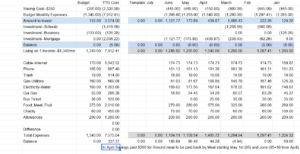

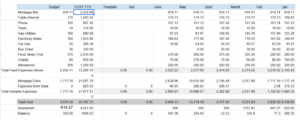

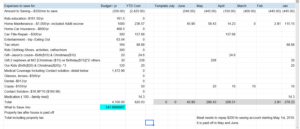

Before my husband and I decided to live on one income, he pulled up few months of utilities bills and wrote down the average cost a month for gas and electricity. Then he added his monthly cost of cable and internet, phone, and our allowances. We estimated what we would like to spend on fruit, meat, and food. We found out these needs of ours could fit within one of our income if we didn’t have debts. Without an emergency funds, we decided to estimate what other expenses we pay for few times a year. These include birthday gift, Christmas gift, home maintenance, medical expenses (copay, dental extra expenses, medicines, contact lenses, and glasses), Kids school expenses (registration fee, clothing), car repair and car insurance, vacation (car gas for travel to visit my in-laws). We just set numbers we think are appropriate based on past experience or as new goals. For instance, we decided not to give gifts to adults for birthday or Christmas any longer. For our kids, we set a number to give them and decided to give them money so that they can invest instead of buying them toys. This free worries around Christmas as I don’t bother buying toys and I don’t need to go to black Friday. For little cousins and nephews, we set an amount to send them for either birthday or Christmas gifts. We set estimates for car based on past experience and made the decision to drive less when it is not necessary. I decided to either take the bus or walk to work and let my husband take the car to work as he needs it more than I do. In spring, summer and fall, I walk to work. It is 2 miles from our house. My husband’s work is at 4.6 miles from our house. In winter I take the bus. For medical expenses, we estimate an average cost of contact lenses, copay for checkups. At work I chose basic dental coverage for my family as the comprehensive is more expensive and was not needed for us. The difference from the basic and the comprehensive, I added to our medical expenses. We estimate about 1% of our house cost as annual expenses. All the cost per year totaled to $4,000 and we divided by 12 to see the amount we should save a month. It is $333. We added that to our monthly expenses and found that all that can be supported by one of our income. We added the mortgage we pay every month which was higher than the minimum and remarked that our highest income could support all our expenses but we could only afford to save $250 for these expenses we budgeted at $333/ month.

We decided to live on our highest income and used the other income to pay off our debts starting with the credit cards. We paid the minimum on all our debts and used the remaining income to pay the credit card with the lowest balance. Once that was paid off, we moved to the second credit card and repeat the process until all the credit cards are paid off. We repeated the same process and paid the car loan and tuition loan. After all the debts are paid, we switched to live on the lowest income and used the highest income to pay the mortgage. Beside the mortgage, $500 of that income is set in a saving account to finance our businesses. Once we moved to live on the lowest income, we started to save every month $350 for the expenses we budgeted at $333 a month. We made the switch from one income to the other around July 2018.

We paid off the debt around June 2018. Because one of us is paid at the end of the month and the other is paid every two weeks, we saved two biweekly paychecks in our saving. And the end of the month of July, we moved the amount that was needed for the following month expenses to the checking account. We kept in the saving the $350 and moved any expenses that should be paid from the saving account to the checking as well.

From that point, we moved the biweekly paychecks to our saving account and at the end of the month, we sit down to calculate how much to move to the checking account for irregular expenses in addition to the $1,340 needed for our monthly expenses.

My husband is in charge of moving funds between checking and saving and pay utilities, cable, trash, and phone. I on the other hand, track our expenses on paper and paid the mortgage. Even when we live on our lowest income, we still have some excess and we decide every month whether to invest it or add it to the mortgage payment. Most of the time we added to the mortgage. Since July 2018 that we dedicated one income to our mortgage payment, by May 2019, we paid more than $30,000 additional in principal.

Budget your Living Expenses

Budget your expenses is important for your financial health. You cannot achieve a goal without a plan. The plan is your budget. The goal is to spend less than you earn and put the rest to work so that even when you are not working, you are making money.

First, pull some of your past bills and just estimate what your utilities cost you in average.

Then list all other costs. Estimate what much you spend in average for each one of them.

Most of our cost are fixed. The varied cost we have is groceries. How much do you spend on groceries?

If you don’t know, that is fine. Ask yourself, how much you want to spend on groceries and write it down.

If you have debts, write them down and the minimum required or the amount you pay every month.

What your minimum debts payments are? What is the total of your living expenses without debts included or mortgage included?

If all your debts are paid off, how much would you have free in your budget? This is the question you should have in mind and start to pay off the debts.

Every month, write what you paid for your bills and what you spend on groceries. After 6 months, compare your budget to every month cost. Have you overestimated or underestimated your cost? Adjust the budget accordingly.

Below is an example of our budget spreadsheet and how we track our cost.

You can download our budget template to your computer and start taking control on your finances.

If you are in a relationship, it is helpful if you and your partner are on the same page.

Leave a Comment