We fit our monthly expenses within one of our incomes. We use the other income to invest in our businesses and pay down our mortgage.

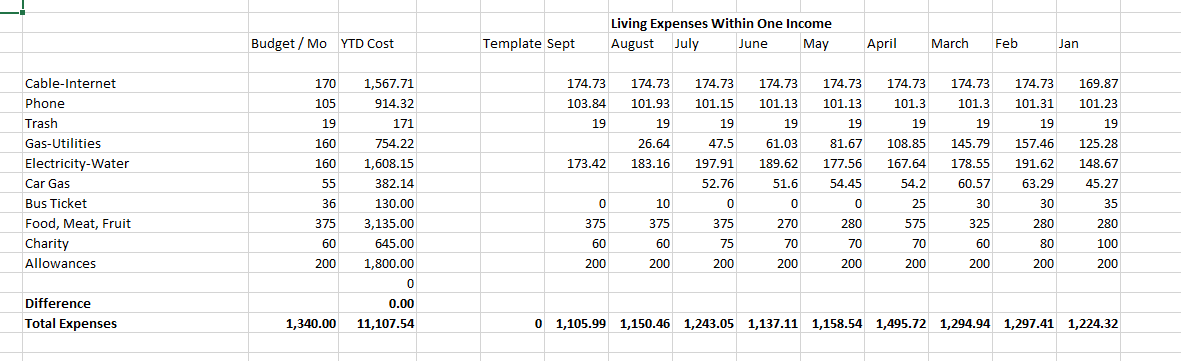

The table named “Living Expenses Within One Income” reflects our monthly costs. It helps us analyze our spending trend.

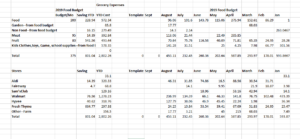

The way we budget is we set fixed amount in the second column (Budget/mo.) for what we think our monthly expenses should be. Then once we start a month we record bills we paid. We took cash out for food, meat, and fruit. I record receipts of my groceries but my cash envelops set the limit on how much I could spend in any given month. Recording my receipts helps me analyze our expenses after they incurred not before. Below is my Food Budget table.

After inputting all the receipts of August, you can see that we spent over $375 in August. However, I didn’t spend much on food. We stocked up on meat. We purchased pork (75 lbs. roast) and around 19 dozen of eggs. Even though we spent more than our grocery budget, we didn’t take anything extra from our checking or saving accounts. The extra came from what I didn’t spend in groceries from prior months. Food budget paid for food, non-food, garden, and kids’ clothes. In August that was $269.41 (96.06+17.77+14.3+141.23). That was $69 over August budget. I have about $100 from prior months which made it possible for me to pay for the kids’ supplies. Now I have about $38 in the food envelop which I tucked away. I would start September with $200 for food.

Fruit is below budget but in reality only has $1 left. That means fruit must have paid for food items at one point for about $20. I didn’t have enough food cash on hand and purchased few clothes for next year for the kids. I didn’t move that money from food to fruit when I got home.

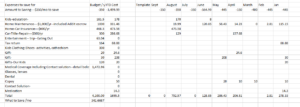

We also saved $350 from the income we live on, for expenses we pay for, few times a year. We called it “expenses saved for”. Please see the table below to see what cost so far this year. We are in the process of replacing the garage door. The professional collected half the cost and would collect the rest after installation. The cost is not listed yet in our budget. The full cost is a little over $700 and we paid half.

In case you don’t have few months of your living expenses saved for, It is a good idea to budget for those expenses you might expect few times a year and saved for them. You could total them all and divide the total by 12 to find the amount to save every month.

Leave a Comment