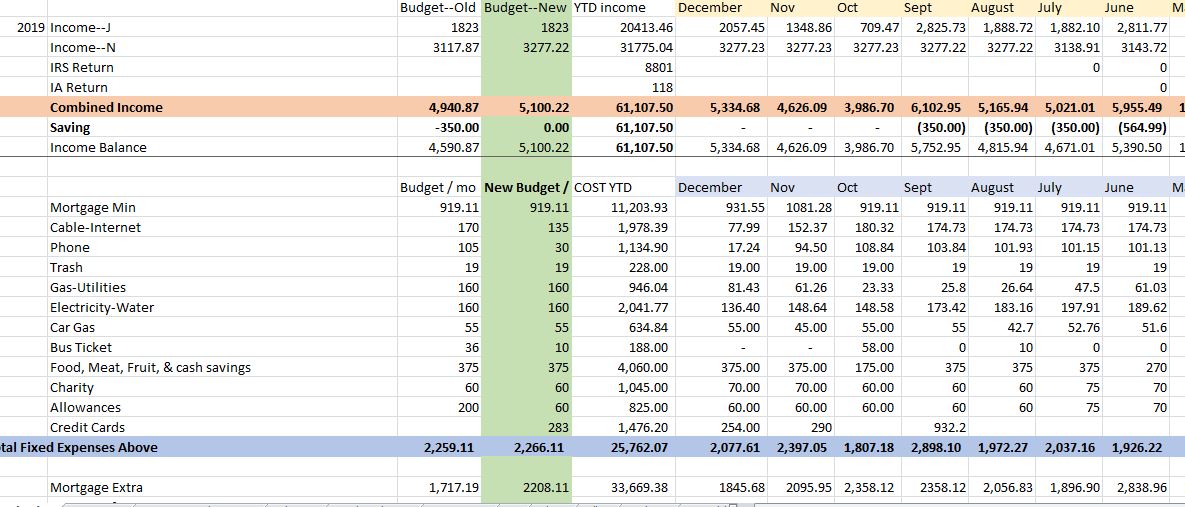

Total Expenses in December including our minimum mortgage and minimum credit card was $2,077. Our income was $5,718. We spent below our income. We spent the remaining income to pay additional principal and made extra credit card payment.

Our spending was as follow:

Our basic living expenses in December totaled to $892. That was about 16% of our income. Our budget for this type of expenses is set at $1,064.

Our minimum mortgage was $931 and our minimum credit card was $254. That totaled to $1,185. Our debt to income ratio is 22%. As you can see our debts is more than our living expense.

If you don’t do budget, you should start this year 2020. Budgeting is not a bad thing. It just helps you know where your money is going. If you have debts you could easily notice that most of your income is going toward paying your debts. You may not be spending much on your basic needs. That means if you are able to pay off your debts you would free a big chunk of money and start planning on ways to put it to work. Right now you might be the one working for money and trading your time for money. You want to get to a point where it is your money working for you.

With the extra income we paid $799 toward extra credit card payment and $1,845 toward our house principal. We paid $478 from our saving toward irregular expense we saved for. In this case it was in the house maintenance category. A pipe broke in one wall and we have to pay a plumber and a dry wall professional to open the wall, fix the pipe, and patch the wall.

If you don’t save for irregular expenses, I have a spreadsheet on the website in the left side bar under free Download and under Budget spreadsheet. The file name is “Monthly Budget-Irregular Expense.” I talked about it on my YouTube Channel as well. Saving for these expenses you don’t pay for every month helps you not seeing these expenses as emergency. To locate these videos, it would be good to type my name “Marie-Ninette Liberman” in the search bar of YouTube. You could then easily select a playlist related to Monthly Budget to watch the video that best suit your need.

In the same month of December we contributed $150 to one of our businesses. We spent over $2,640 toward extra debts payment (additional mortgage principal and credit card). That was 50% of our income. We spent all we earned in December in the way I described above.

Please check our video to see how our actual expenses are for the month of December.

We recently launched our You Tube Channel called Marie-Ninette Liberman. You can type that name in YouTube search bar to find us. Most of our videos are classified inside Playlists. Please feel free to click on any playlist of your interest and select a video to watch. Our YouTube provides the visual to help complement what we explain through our articles. Please take advantage of all the free tools you can get your hands on to help you reach your financial goal this year 2020.

There is a post coming on how my husband and I spent half of the past decade accumulating over $100,000 debts and how we spent the next half of the decade to pay most of it off. It is not easy to have a retrospective of your finances if you don’t keep a written budget. We just started a new decade. Let’s budget and keep track of how much we make and how much we spend. Stay tune.

Would you please leave us your comment to help us improve our articles and YouTube videos to provide you more to help you in your financial journey? I thank you very much for visiting our website and our YouTube Channel.

Please don’t hesitate to join us by registering on our website to be added to our contact list. I want to interact more with you this year. Therefore, I am manually adding my subscribers to my contact list. Please join us and let’s make our financial goals come true together!

Registration Form

Leave a Comment