If you have 401k at work, contribute to the maximum your employer would match and open a Roth IRA and a brokerage account with a reputable investment firm like TRowe Price or Charles Schwab. Whether you invest in your 401K, Roth IRA, or brokerage account, it is important you select a mutual fund that would give you a great return. Mutual funds are generally for long term investment. Therefore, you want to choose a mutual fund by considering the inception date, the annual returns, the average annual return since the inception date, and the management fee.

- Use a Google sheet, or Excel spreadsheet, or a note book. Have a column for each one of the categories including the fund symbol, the inception date, 1-year return, 3-year return, 5-year return, 10-year return, average annual return since inception date, gross expense ratio, and the growth of $10,000 invested in that fund.

- In your investment account, open the list of mutual funds available to you to invest in

- Go through the list and locate the average annual return since the inception date and record the funds symbols that have a return above 10% on your sheet. You just narrowed down your search to these funds.

- Click on each one of the symbols you wrote down. Record on your spreadsheet:

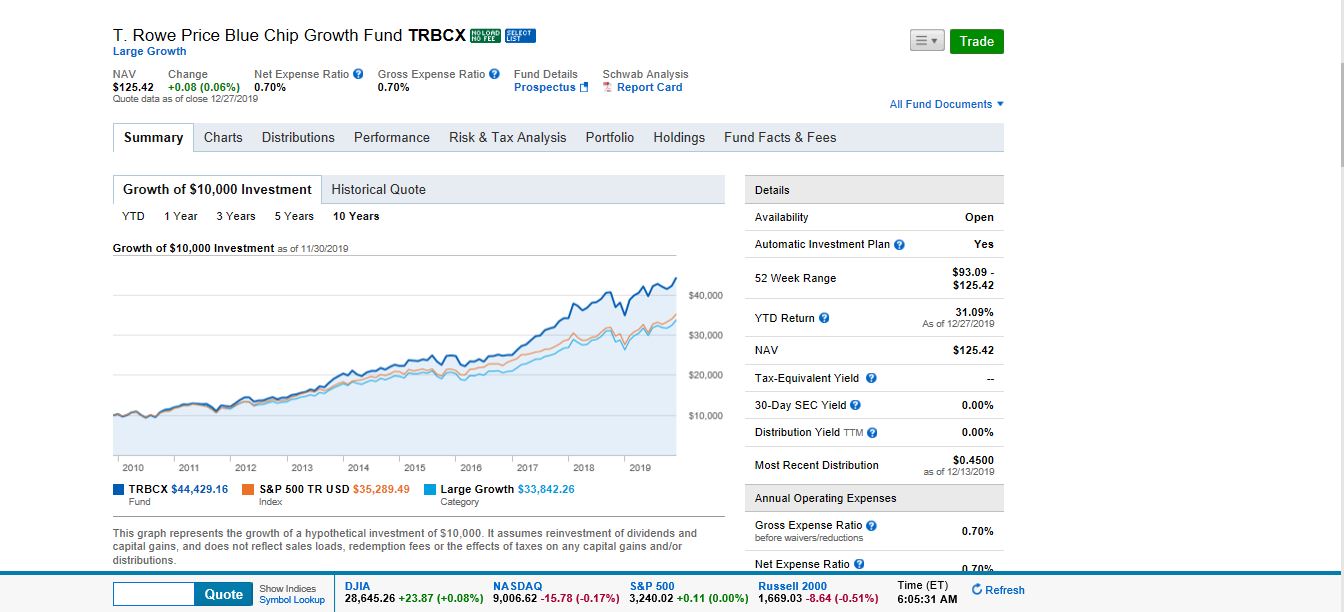

a-The growth of $10,000 investment amount,

b-The gross expense ratio,

c-The returns for 1-year, 3-year, 5-year, 10-year,

d-And update the average annual return since inception date as some of them might be different from what you first spotted on the previous page.

- Compare the funds on your sheet:

- Look at the inception date and locate the oldest fund and the youngest one.

- Look at the 1-year return for all the funds on your sheet and see the ones that are negative.

- Look at the 3-year return and see if the ones that are negative in year 1 recovered and produced a high return. If not highlight them. They are out.

- Look at the 5-year return for the remaining funds. Eliminate by highlighting the ones that didn’t perform well up to then even if they have low positive returns.

- By the 10-year return, you should be left with few funds to compare. Look at their 10-year return and eliminate the one or ones that didn’t perform well from 1-year return to 10-year return.

- Look at the average annual return since the inception date of the remaining funds. Look at their respective inception date. Keep 2 funds with the highest returns from that column and older than 10 years. They are your 2 winners.

- Look at the management fee or the gross expense ratio or net ratio.

The mutual fund that has the highest average annual return since the inception date and the lowest management fee, and is the oldest fund is the winner. If out of the last two winners none of the funds has met all 3 criteria move to the next step.

- Look at the column where you recorded how much an initial $10,000 investment would have increased to. Compare the last 2 winners.

- If the youngest fund has the highest average annual return since the inception date and the highest management fee, if the amount $10,000 invested in that funds would have increased to an amount higher than the other fund, the youngest fund is the winner. In the contrary, if the $10k grew to an amount less than the 2nd fund, the 2nd fund is the winner. This means that the high management fee has decreased the investment.

- If the oldest fund has the highest average annual return rate since the inception and the lowest fee, it is the winner. Chances are the $10K invest in it would have increased to an amount higher than the other or younger fund.

- In any case you have two winners and can do well if you choose to invest in both in your investment accounts.

Comparing mutual funds using this analysis would help you decrease the probability of you investing in a mutual fund that would perform poorly in your portfolio. Periodically, use the same strategy and compare the mutual funds you are eligible to invest in and select a winner to compare to the funds you have in your portfolio to see if you still want to keep what you have in your portfolio or exchange them or add more winners to them. Once you are satisfied and know that the mutual funds in your investment account are good picks, you just keep investing in them and watch your money grow.

To learn more tips on how to live below your income without sacrificing the quality of your life and start building wealth, please join our community by subscribing below. By subscribing to our email list you agree to be notified on our latest post. Thank you!

Registration

Leave a Comment