It is important to track your income and expenses all year around. It is equally important to spend some time reviewing your monthly record to see how you allocated your money.

To better analyze my financial record, I calculated expense to income ratio.

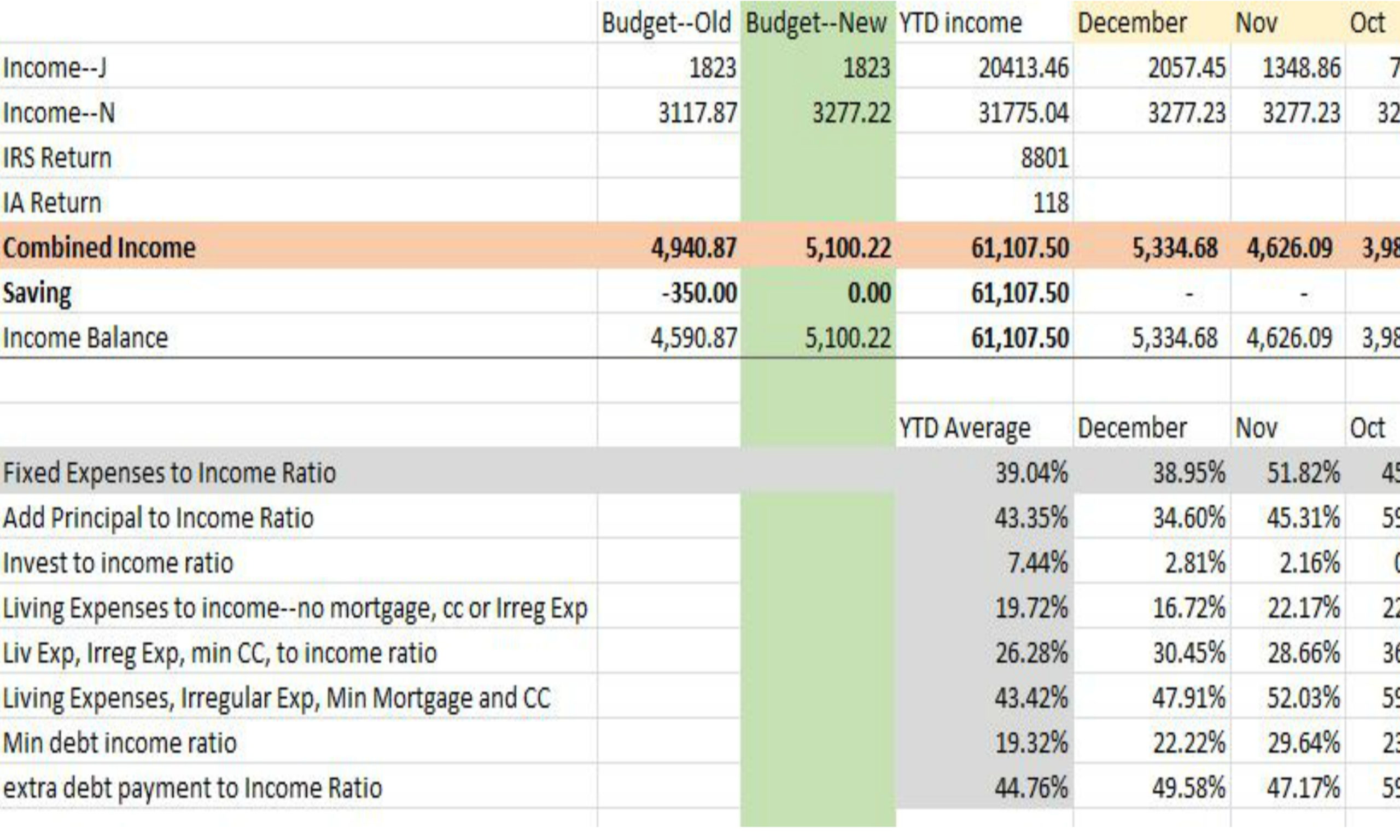

In 2019 we earned about $61,000. We spent 19.72% on our basic living expenses, 19.32% on our debts minimum payment, 4.38% on Irregular Expenses, 7.44% on our businesses, and 44.76% toward extra debts payment.

I use different type of expense divided by the income for every month to better understand how we spent our income in 2019. I then calculated the average for the whole year.

Our annual income was $61,107.50

Basic Living Expense to income ratio: 19.72%

The living expense included our monthly expenses from phone to our allowance and utilities without mortgage or credit card payment.

I like to track my basic expenses without debts included to see if we didn’t have debts how much we would need to provide for our basic needs. The living expense to income ratio was 19.72% in average for the year. Our combined income was $61,107.50 and we spent $13,081.94 on utilities, internet, cable, phone, groceries, donations, allowances, gasoline, & public transportation.

Fixed Expenses to Income Ratio: 39.04%

Our fixed expenses included our minimum mortgage, basic living expenses, and minimum credit card payment for a total of $25,762.07

Living Expense, Irregular Expense, minimum mortgage, and minimum credit card to income ratio: 43.42%

This category of expenses included our fixed expenses from above and our minimum mortgage payment. We spent $28,514.17. We spent $2,752.10 in irregular expenses or unplanned expenses. That was 4.38% of our annual income spent on unexpected and irregular expenses.

Debts Minimum Payment to Income Ratio: 19.32%

Our minimum mortgage and credit card represent 19.32% of our income.

Extra Debts Payment to Income Ratio: 44.76%

We paid $33,669.18 toward the principal part of our mortgage which was 43.35% of our income. We also paid $885.30 extra toward credit card balance.

Investment to Income Ratio: 7.44%

Our investment included capital contributions toward our businesses and investment in the stock market. That was a total of $5,271.83.

As much as it is important to budget for your expenses, it is equally important to track your actual income and expenses to be able to see how much of your income you spent in each one of your expenses category.

Leave a Comment