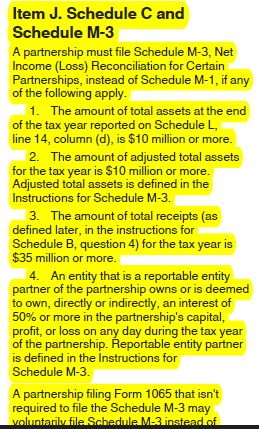

- You are required to fill out Schedule M-3 instead of Schedule M-1 and you would fill out Schedule C (form 1065) if ANY one of the3 conditions below applies to your LLC or partnership.

- If your business total asset is $10 million or more in your balance sheet,

- Your revenues in 2019 is $35 million or more in your income statement,

- You have a business as a partner in your company with 50% or more of ownership to your company’s capital, profit, or loss,

- But there is an exception: If you are required to file Schedule M-3 but have less than 50 million in asset, you could choose to file Schedule M-3 part I and Schedule M -1. In that case you don’t fill out part 2 and 3 of Schedule M-3. You also don’t need to fill out Schedule C (form 1065) or Form 8916-A –See 2019 Instruction for Form 1065 page 18.

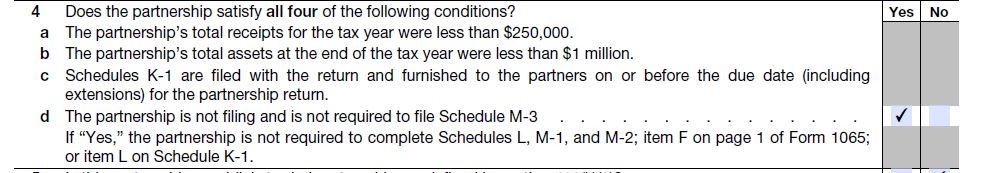

Fill out Schedule B Form 1065 – When to Answer Yes to Question 4 – Are Required to File Schedule M-3

If your answer is Yes to ALL 4 questions under Question 4 of Schedule B Form 1065,

- Your revenue for 2019 is less than $250,000

- Your total asset is less than $1 million

- You plan on filing Schedule K-1 by the due date or the extension date if you would file extension

- You are not required to file Schedule M-3

If you answer yes for ALL 4 questions, you do not need to file

Schedule L (balance sheet) at the end of form 1065

Schedule M-1—Income Statement at the end of form 1065

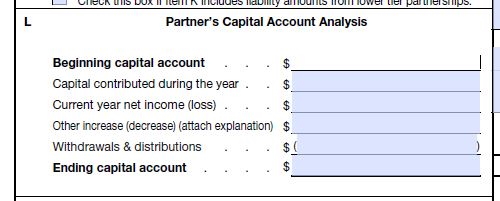

Schedule M-2—Partner’s capital account analysis at the end of form 1065

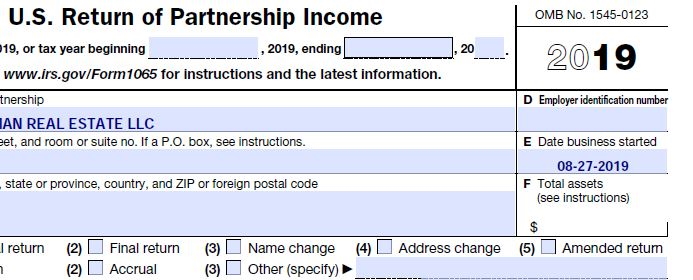

Item F on form 1065 page 1 “total asset”

Item L on schedule K-1 Form 1065 “Partner’s Capital Account Analysis”