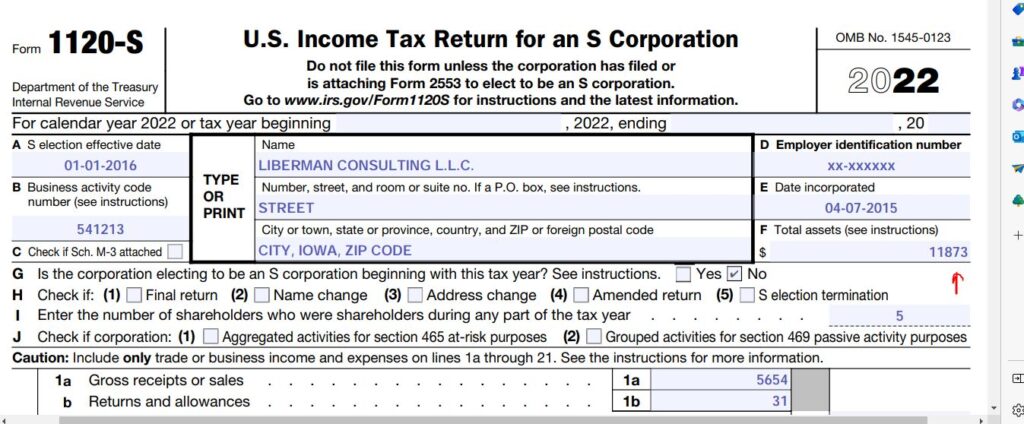

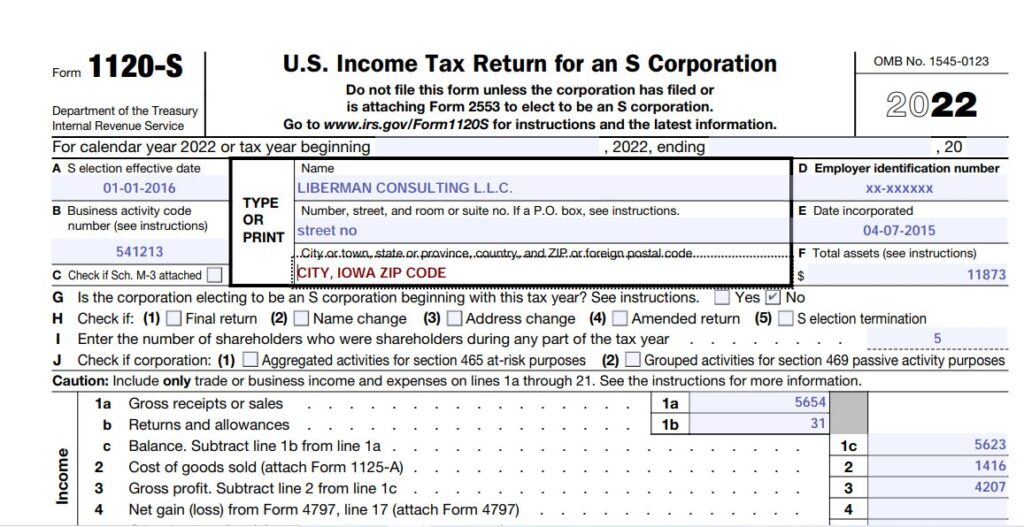

To file Form 1120S, download IRS Instructions for Form 1120S from IRS.gov.

Have your business financial data ready including:

Your business expenses.

Total gross revenues

Capital contribution during the year.

Business balance sheet

Have partner’s information ready.

Pick an online tax software to file your tax return.

File your Form 1120S and Schedules K-1 and your state Form 1120S.

Review your return and submit electronically and mail if you met the requirement.

Give the partners their Schedules K-1.

Keep a copy of Form 1120S and its Schedules for your business record.

It can save you time to use a tax software to file your tax return. The tax software will transfer your data to any other tax forms required including your state business tax return.

If you decide to fill out Form 1120S, you download Form 1120S, Schedule K-1(Form 1120S), and you download any other forms you might be required to complete.

If you have rental real estate properties, you will need Form 8825. If you sell physical products and carry inventory, you will need Form 1125-A Cost of Goods Sold. If you have depreciable assets, you will need Form 4562 Depreciation and Amortization.

It is a good idea you use a tax software to file your business tax return to save time.