To fill out IRS Form 1120S for 2022 for your LLC taxed as an S Corporation, go to IRS website and search Form 1120S.

Download Form 1120S for 2022, Schedule K-1 (Form 1120S), and IRS Instructions for Form 1120S.

If you have rental real estate properties, you will need Form 8825. If you sell physical products and carry inventory, you will need Form 1125-A Cost of Goods Sold. If you have depreciable assets, you will need Form 4562 Depreciation and Amortization.

It is a good idea you use a tax software to file your business tax return to save time.

If you want information on how to fill out Form 1125A Cost of Good Sold you can access the article here.

Article on Form 4562 Depreciation and Amortization is here.

Download your tax forms and schedules and save them in your business tax folder for 2022.

How to fill out IRS Form 1120 S for 2022?

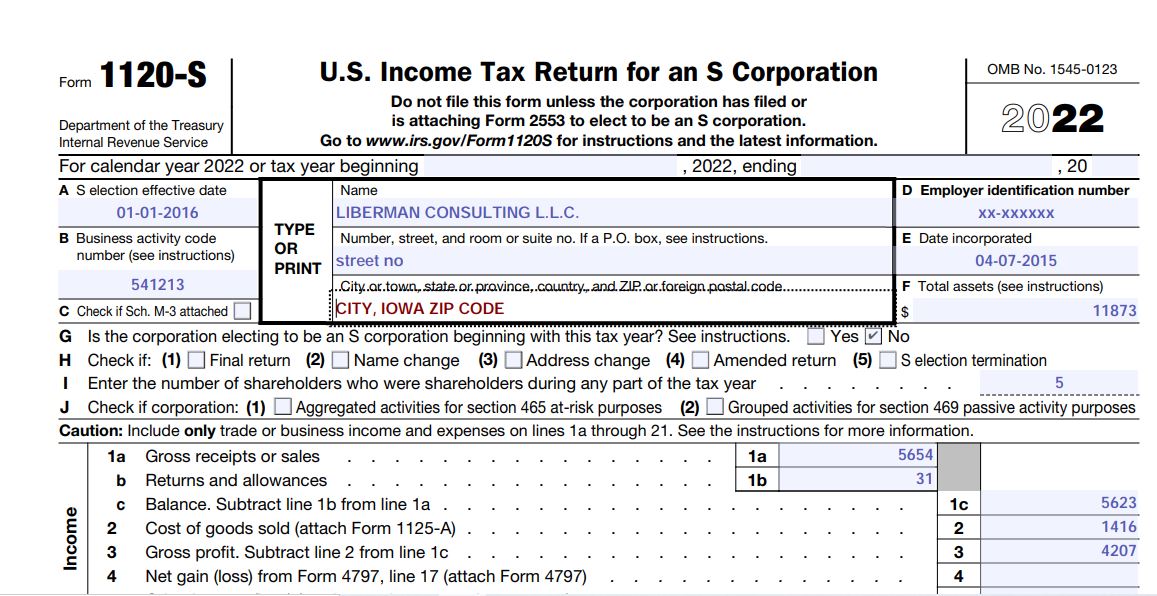

Business Information:

Item A: S election effective date: enter the date IRS approved you to treat your LLC as an S Corporation for tax purposes. The S effective date may not necessary be the same as the date your business was incorporated.

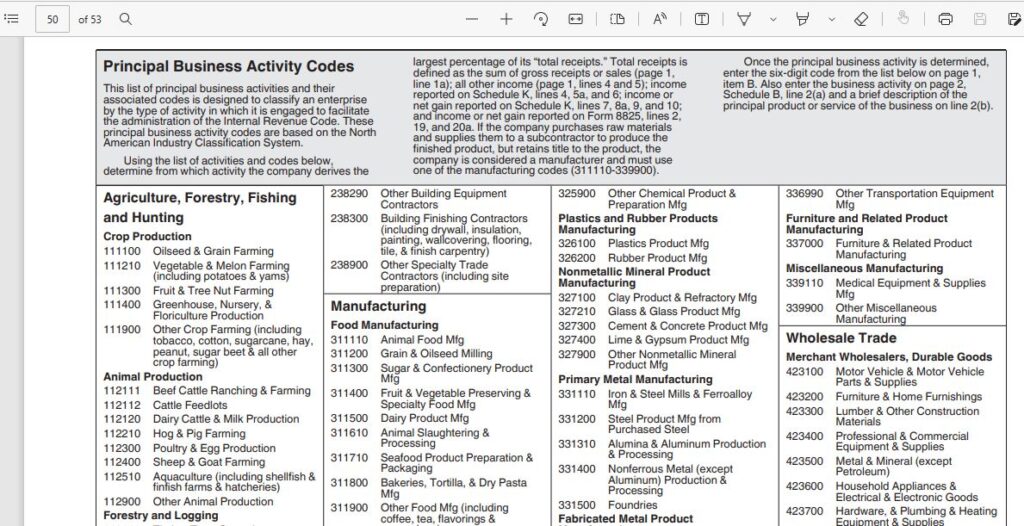

Item B: Business activity code number: You can look for business activity code in the IRS Instructions for Form 1120S page 50. You will choose the business activity code number that corresponds to your principal business activity. If it is not your first-year filling Form 1120S for your business, you might want to use the same business activity code number you used in the past but first check the IRS business activity code t make sure your code didn’t change.

Item C: if you are required to complete Schedule M-3, check that box.

Name: Type your business name the way you filed it with your state. On Form 944 Employer Annual Federal Tax Return or Form 940 Employer Federal Unemployment Tax Return, the business name required was the business legal name as it was on your EIN application Form which can be found on IRS Form SS-4 or EIN approval letter. That business legal name might be different from your business name as filed with your state if the EIN application form didn’t allow you to include dots in your business name for instance while your business name has dots. More in IRS Instructions for Form 1120S Page 13.

Type your business address.

Item D: Enter your business EIN (Employer Identification Number).

Item E: Enter the date your state approved your business to be LLC. The approval document will have the start date of your LLC.

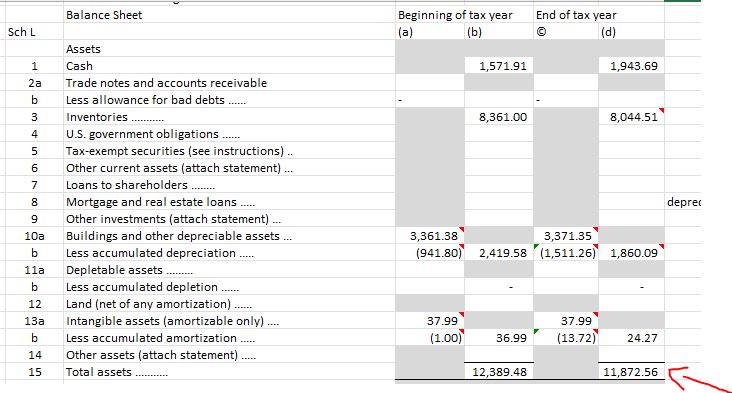

Item F: Enter your business total assets value. You can find the amount in your balance sheet year end 2022 at the bottom on the Line Total Asset.

Check the right box for Line G that corresponds to your business.

Item H: If any box applies to you, check it otherwise, leave them blank.

Item I: Type the number of shareholders or partners, or members, you have Gross Receipts in your business.

Item J: If any applies to you, check it otherwise, leave them blank.

Form 1120S Income

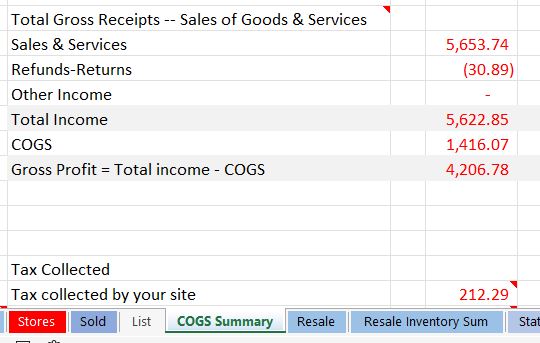

Line 1a Gross Receipts: Enter your business annual gross sales total. It should not include state sales tax.

Line 1b: Enter the total amount of return or refund for the year.

You can find your total sales and refunds in your inventory and sales worksheet. If you need a template to track your inventory and sales, you could download a free inventory and sales worksheet for free under our free downloads.

Line c: Do Line 1a minus Line 1b.

Line 2 Cost of goods Sold: You could pull the cost of products you sold during the year from your inventory and sales record.

If you do not use a software to track your inventory and sales, you can download a copy of Free Inventory and Sales Worksheet from our blog https://ninasoap.com.

If you keep inventory, you could be required to complete Form 1125-A and attach to Form 1120S.

Line 3 is the gross profit.

If you are required to file Form 4797 to recapture depreciation deduction taken for instance or for any other reason, the net gain or loss will go on this line. More information about this line can be found in the IRS Instructions for Form 1120S on page 14.

Line 6: Total income or (loss). Do the calculation as instructed and put the amount on that line for your business annual income or loss.

Form 1120S Deductions

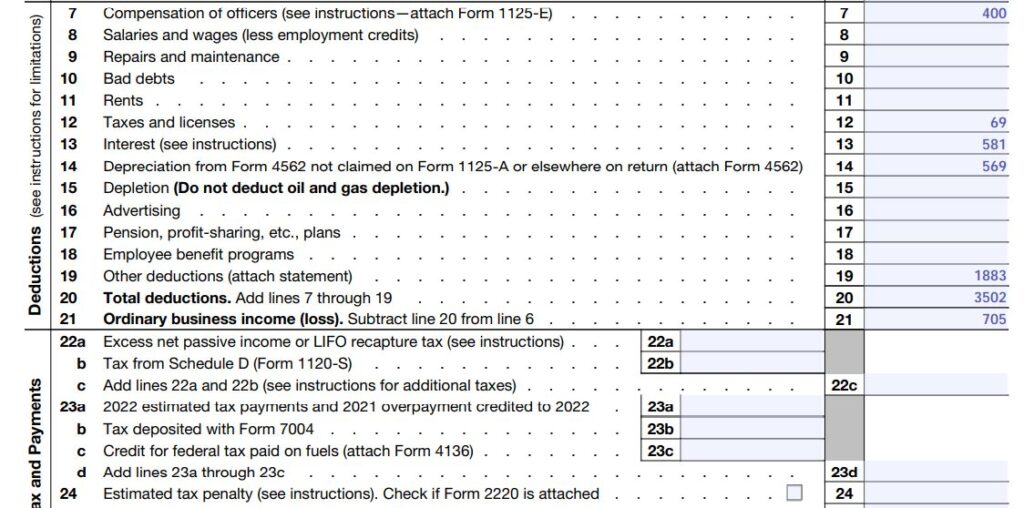

Line 7 Compensation of Officers:

Based on my acknowledge, Line 7 should be the gross payroll paid to officers or business partners that worked in the business during the year and collected salaries. It should be the same as what you reported on their W2 Box 1 and wages. That means it you include the Federal income tax you withheld on their wages, employee social security tax withheld, and employee Medicaid tax withheld. Based on my view, if the business uses cash method, it should not report expenses not actually during the year. For that reason, if employee federal income tax, social security tax, and Medicaid tax withheld by the employer were not deposited to IRS during the year, they should not be included on Line 7. In that case Line 7 might match the net take home payroll for these officers.

Keep in mind that if the business uses accrual method of accounting, the way to report expenses might be different. However, for cash method, I didn’t think I should deduct taxes withheld form officers’ salary during the year I am filling the tax return for if I paid these withholding taxes to IRS the following years as employment and unemployment tax are due by the end of January. With cash method of accounting, we report expenses in the year you paid them not in the year you incurred them.

Line 12: Taxes and Licenses: If you report total wages for officers on Line 7 and total wages for employees on Line 8 and these wages are the same reported on the W-2s, Line 12 should only include employer portion of social security, employer portion of Medicaid, and employer federal unemployment tax. The employee tax withheld are already included in their wages on line 7 and 8 and should not be duplicated.

If the business uses cash method and report the net payroll wages on Line 7 and 8, the total employee and employer employment tax and employer unemployment tax will be reported on Line 12 for these tax liabilities incurred last year but paid in the year the business is filling for.

If the business uses cash method and paid to IRS or deposited to IRS all employee and employer employment tax and employer unemployment tax for the year during the same year, line 7 and 8 would have the wages as on W2 box 1 and the line 12 will have employer portion of employment tax and employer unemployment tax paid.

These are my opinion. You can read more about line 7, 8, and 12 in the IRS Instructions for Form 1120S page 17.

If you paid state consumer use tax or state retailer, use tax, you do not include it on Line 12. These business use tax should be included in the cost of the products used by the business or the assets basis for depreciation.

If there are any licenses paid that fit this category of expenses, you should added.

Line 13 Interest: If you have interest related your business as described in the instructions you report it her. It could include some credit card interest you paid during the year if they are not capitalized in your inventory or in your asset cost of basis.

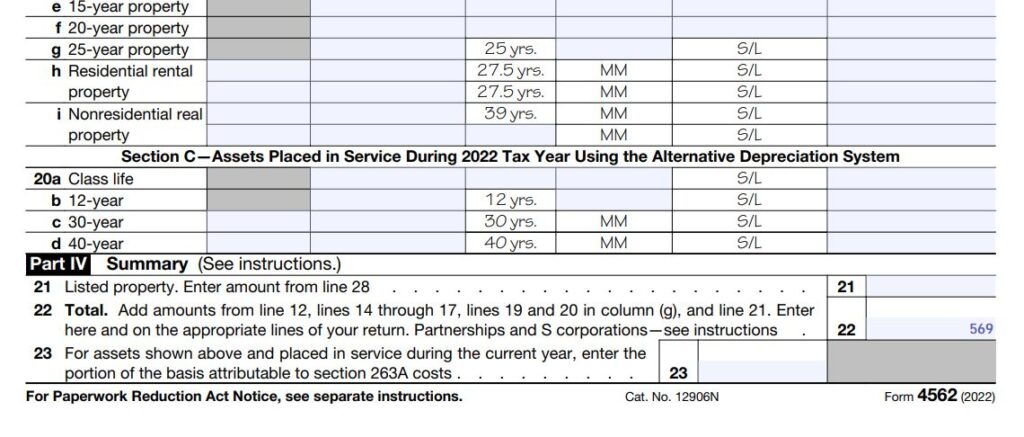

Line 14 Depreciation:

You can find the depreciation amount on Form 4562 Line 22.

Line 16 Advertising cost will go her.

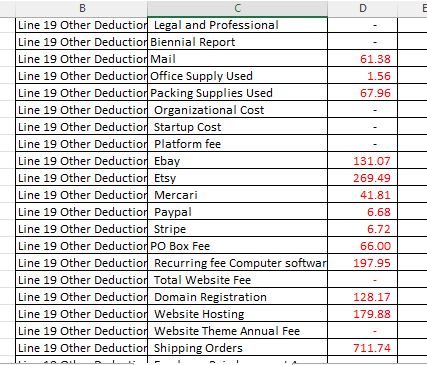

Line 19 Other Deductions: This line will include startup cost and business organization if that is your 1st year in your business and this cost is below threshold limit. If they exceed the threshold, you will amortize the rest over 180 months. You can deduct up to $5,000 of business organization cost and up to $5,000 of business start-up cost in the first year of being in the business. If your startup cost or organizational cost exceeds more than $50,000, you will not be able to amortize all of them. You can find more information on page 27 of 2022 IRS Publication 535 Business Expenses. More information on start-up cost and organizational cost amortization on page 15 of 2022 IRS Instructions for Form 4562 Depreciation and Amortization.

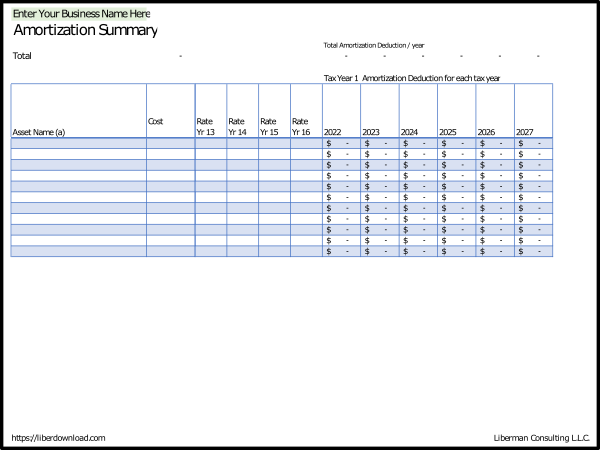

If you have amortization deduction, it will be included on this line 19 Other Deductions.

Other expenses could include employee reimbursed amount under accountable plan, and any other business expenses that are deductible but didn’t have their own dedicated lines on Form 1120S. You will include an attachment to show the detail of the expenses totaled on Line 19. The list on the type of expenses that can fit on Line 19 can be found on page 19 of 2022 IRS Instructions for Form 1120S.

If you need a spreadsheet to track your business expenses for your LLC taxed as an S Corporation, you can download a copy of Bookkeeping worksheet for free under Free Downloads at https://ninasoap.com.

Line 20 Total deductions: you add all the expenses together.

Line 21 Ordinary business income (loss): you subtract your Line 20 total expenses from Line 6 total income to find the profit of loss.

Line 22to Line 27: If you have passive income and could have a tax to pay, you could read the instructions and complete section related to your business. Otherwise, leave these lines blank.

Line Sign here: Enter your business title. Check “no” if you want IRS to discuss your business tax matter with you only.

Leave Paid preparer use only section alone.

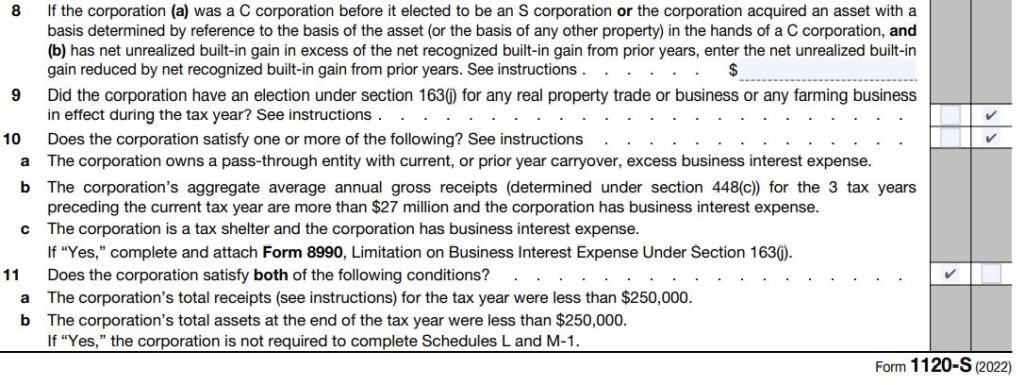

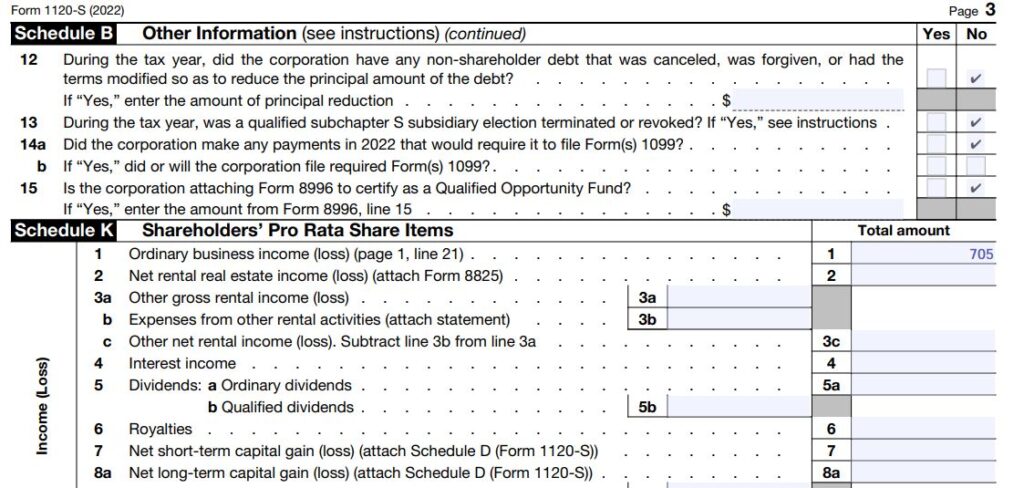

How to complete Schedule B Form 1120S for 2022?

Line 1 Check accounting method: choose the accounting method you chose for your business.

Line 2: Enter your business activity on line 2 and on line b, enter the type of products or services you sell in your business.

Line 3 to Line 10: Read each question and check the right answer. For most young businesses, the answer will be NO.

Line 11: If any of line 11a or line 11b is yes, you are not required to complete Schedule L (balance sheet) or Schedule M-1 at the end of the Form 1120S.

Line 11a: Did your company make a total gross sales less than $250,000 during the year? You can find your total gross receipts or total sales on Form 1120S Line 1.

Line 11b: Is your company total assets at the end of the year less than $250,000? You can find this number on Item F total assets Form 1120S or in your balance sheet total asset.

For most new businesses, the answer will be yes. Check the right box for your answer.

Line 12 to Line 13: Read the questions and answer them.

Line 14a: Do you have to file Form 1099? If the answer is yes check it. If yes, do you plan on filling it on time. Check the right answer.

Line 15: read the question and answer it.

How to fill out Schedule K Form 1120S?

Line 1 Ordinary Business income or loss: Enter the amount from Form 1120S Line 21.

Line 2 Profit or loss from rental real estate: Complete Form 8825 where you report your rents from your properties and your properties expenses. The profit or loss from Form 8825 will be reported on Schedule K Line 2.

Line 3: if you have rental activities that are not real estate, you will use line 3a to line 3c for the expenses.

If you have portfolio income check line 4 down in the income section of Schedule K and put your income on the appropriate line.

Schedule K Deductions:

Line 11 Section 179 deduction: If you claimed section 179 on form 4562 or if you expense depreciable assets you purchased during the year, you need to complete form 4562 Depreciation and Amortization and attach it.

If you have a qualified deductions for Line 12, put it on the right line. You can locate more information on IRS instructions for form 1120S on page 23.

Line 13 is for credits. If any apply to your business, complete them otherwise, leave them blank.

Line 14 is for international business data. Schedule K-2 (Form 1120S) might be required to report any data on this line.

Line 15 Alternative minimum tax: If it applies to you, you complete that part. If it doesn’t apply leave that part blank.

If you made distribution to shareholders or have nondeductible expenses, there are line 16 to 17 for you to complete.

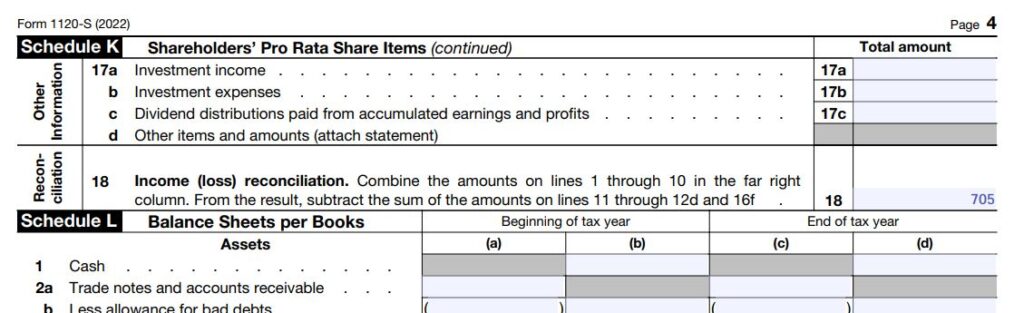

Line 18 Income or loss. Follow the calculation instructions to calculate the profit or loss for Schedule K.

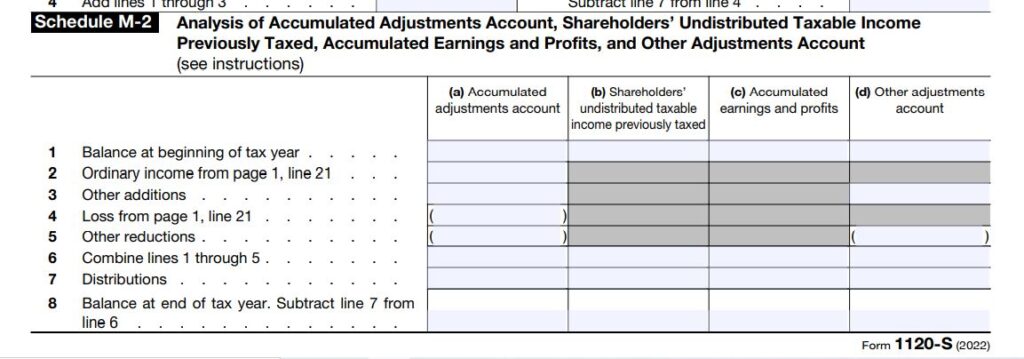

Schedule M-2

The IRS instructions for form 1120S page 4 for more information on how to complete it.

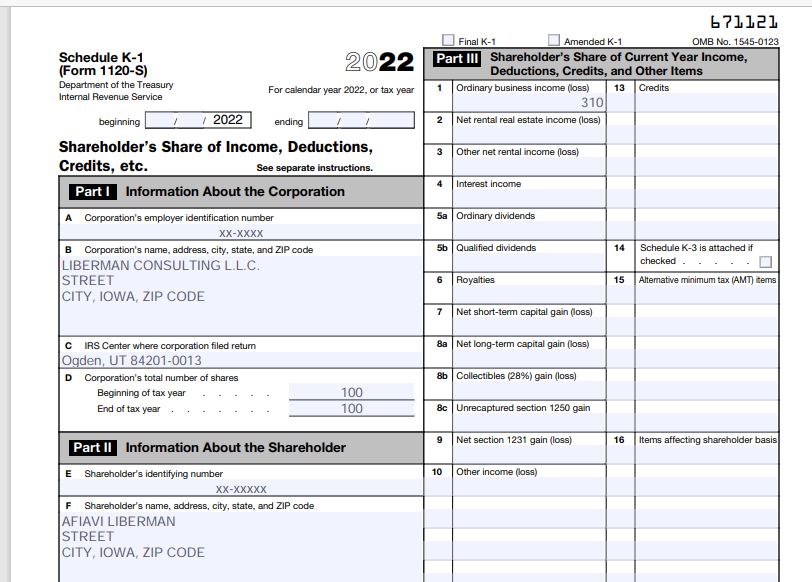

How to fill out Schedule K-1 Form 1120S for 2022?

You need to complete Schedule K-1 (Form 1120S) for each partner.

The numbers on schedule K will be allocated proportionally to the partners based on their ownership interests.

The total of all schedules K-1 will total to Schedule K.

Schedule K-1 Part-1

Item A: enter your business EIN.

Item B: Enter your business name and address.

Item C: Enter the city state, and zip code of the IRS address you will mail the tax return to.

You can find the address in the IRS Instructions for Form 1120S on page 3.

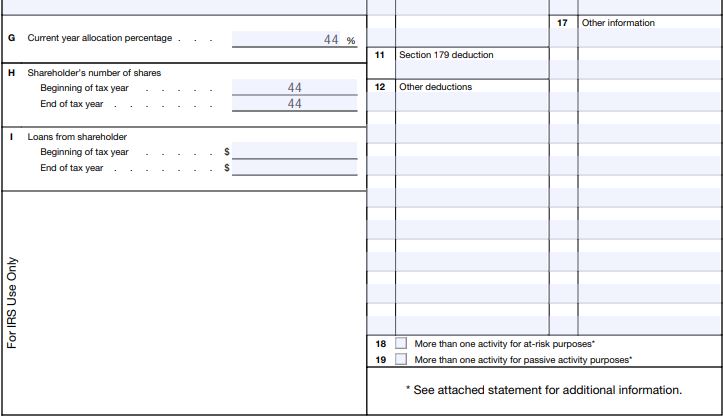

Item D Corporation total number of shares:

LLC doesn’t have shares. But IRS recommends you put some numbers for Item D.

S Corporations have one class of stock when it comes to distribution and liquidation rights but can have voting and nonvoting rights. LLC taxed as an S corporation to keep the S corporation status, is required to have the same members ownership interests when it comes to distribution and liquidation rights.

Because LLC doesn’t have stocks, the member ownership interest could be used as stocks in the case of filling schedule K-1 for Form 1120S. It is my opinion.

You can read more on how to complete item D on IRS instructions for form 1120S page 25.

Part 2

Item E: Enter the partner SSN.

Item F: Enter the partner’s name and address.

Item G: Partner ownership interest: Enter the percentage of the partner ownership interest. You can read more on how to complete item G on IRS instructions for form 1120S page 25.

Item H Shareholder’s shares: It is the same issue as item D. LLCs usually don’t have stocks. But since IRS recommends we use our LLCs equivalent of stocks, you could use the partner ownership interest for this line in my opinion. You can read more on how to complete item D on IRS instructions for form 1120S page 25.

Item I Loan from shareholder: If it doesn’t apply to your business leave it blank.

Part 3 Shareholder incomes and deductions

Using Schedule K look at each line of Schedule K. If a line on Schedule K has a number, its corresponding box on Schedule K-1 should haver the partner’s portion of that number based on the partner’s ownership interest. For instance, if schedule K line 1 has a number, you take that number multiply by the partner’s current year allocation percentage you entered on Item G. You put the result in the box 1 for schedule K-1 for that partner.

By the time you completed K-1 for all your partners, the total of a box for all the K-1s should equal that line on schedule K.

When you are done completing schedules K-1, review your return for accuracy and print them out.

How to assemble your Form 1120S tax return?

If you will mail your return or paper file your return, you print your Form 1120S, and all the forms you completed that are required to attach as well as the schedule K-1s. you also print out supporting documents for Line 19 other deductions Form 1120S and supporting documents for schedules k-1 if needed.

You sign Form 1120s and make a copy for your state tax return and a copy for your business record.

You make a copy of schedule K-1s and their supporting documents for your partners.

You look in IRS instructions for form 1120S page 4 Assembling the return to see the order IRS recommend you organize your forms, schedules, and supporting documents.

You staple them together and mail to the right address.

Where to mail IRS Form 1120S?

Open IRS Instructions for form 1120S for 2022 page 3.

Look for your state in the left column. Based on the total asset threshold in the second column within which your business asset fits in, locate the IRS address in the 3rd column that corresponds to that threshold row and your state. That is the address you should mail your Form 1120S tax return to.

Mail your Form 1120S via USPS with tracking. Keep the receipt with the copy of the tax return for your business record.

When to file Form 1120S?

Form 1120S is due by March 15.

Conclusion: How to fill out Form 1120S and Schedule K-1 for 2022

The video explains step by step how to fill out IRS Form 1120S and Schedules K-1 for 2022.

If you need a checklist of the different financial documents you should keep up to date before you can file Form 1120S for your organization, you could purchase one at https://liberdownload.com.

If you will use a tax software to file Form 1120S, you may not need to calculate your asset depreciation deduction. You still need to record your depreciable business assets and know their class lives. If you need a worksheet to track your business assets, you could get one at https://liberdownload.com.

If you sell physical products and carry inventory, you could try our free inventory and sales worksheet in the free download section.

If you need a worksheet to track your business expenses and for one entry journal, you can download a free bookkeeping worksheet from the free download.

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you would find information to live a quality life within budget and increase your net worth. Topics covered include personal finance, investment, business management, cooking from scratch and growing some vegetables and fruit to save money and eat healthy.

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

“Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.”

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel) , https://ninasoap.com/affiliate-products/ (Our resource page)”.