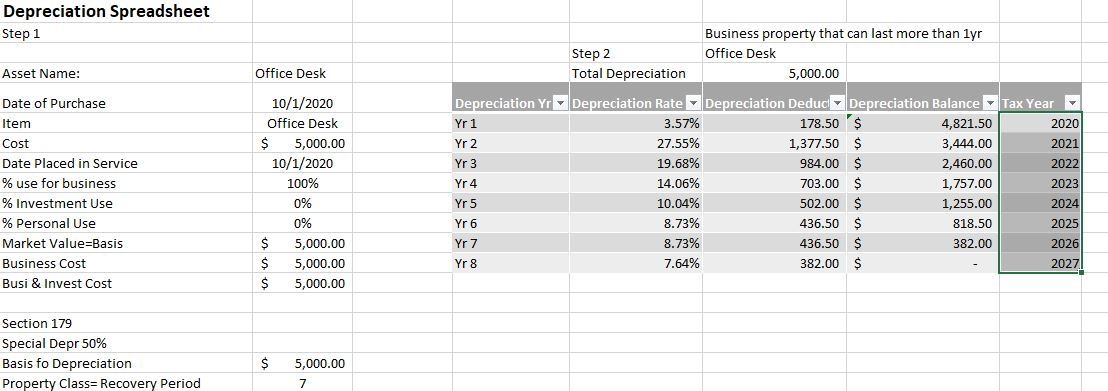

Form 4562 allows you to depreciation the cost of properties used in your business over the course of their lives in your business and to amortize.

If qualified, you could also claim Section 179 expense to deduct the full cost of a depreciable item in the year you started to use it in your business. You could amortize the cost of starting your business. You amortize over a certain number of years and deduct the same amount every year.

Free Downloads

Would you please check the “Free Downloads” in the side bar section on our website for budget spreadsheet, budget planner PDF, tax forms, motivational quotes, checklists, and more for you do download. You don’t need to subscribe to access them. We would like to have you in our community where we interact and encourage each other to reach our goals. We invite you to join our email list. However it is not a required to access our Free Downloads. Thank you!