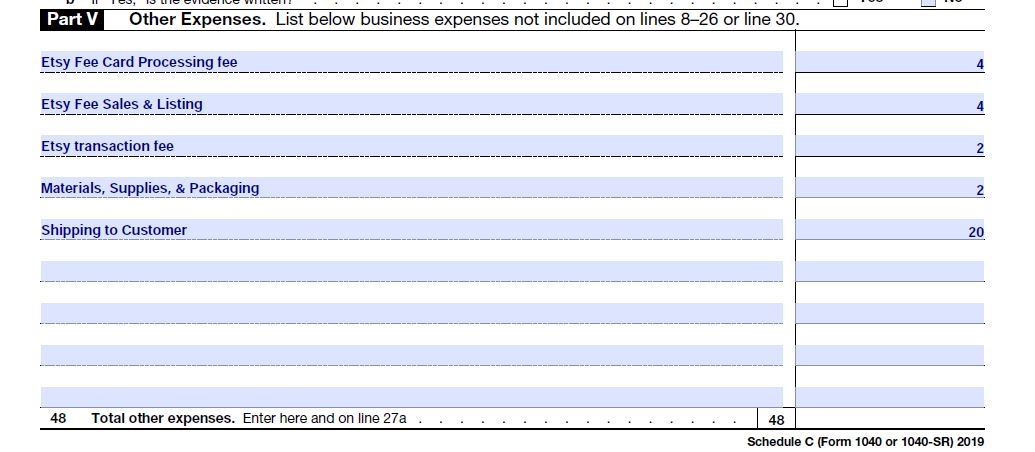

Amortization, Business Startup Cost, Bad Debts, Ordinary and Necessary Business Expenses, Carryover Loss, De Minimis Safe Harbor Deductions, cost to remove barriers to individuals with disabilities could be reported on your business Schedule C Form 1040 Part 5 – Other Expenses

Ordinary and necessary business expenses

If they are not included elsewhere on the schedule

Do not include improvement cost to a property

Do not include personal living expenses

Do not include charitable contribution

Amortization

Fill out Form 4562 if the amortization begins in the tax year you are filing for.

Include amortization cost on Schedule C on Part V “Other Expenses”. Amortize the following expenses:

- Research and experimental

- Expenses incurred related to trademarks and trade names to acquire, protect, defend, register or expand them

- Goodwill, intangibles

At-risk loss deduction

Any loss not deducted in prior year due to at risk limitation can be carried over and entered it here

Bad debts

- Any sale entered as income but is now worthless can be entered here as bad debts. If in later years it is paid, enter the bad debt amount paid as income in the year it was paid.

Business startup cost

- If your business started in the tax year, you can deduct up to $5,000 if your total business start up cost is than $50,000 or less. The remaining cost would be amortized over 180 months.

Cost to remove architectural or transportation barrier for individuals with disabilities

- You can claim a credit on Form 8826 or deduct the expense up to $15,000 here but not both.

De Minimis safe harbor for tangible personal property

- They should be capitalized but you can claim de Minimis safe harbor for expense you incurred to purchase or produce buildings, equipment, or furniture for your business up to $5,000 per item if you have a financial statement that met

- IRS regulation or that uses standard accounting method. If not, you can claim up to $2,500 per item or invoice. On how to make this election, read IRS Publication 535.

For the complete list of deductions for Part V read IRS Instructions to Schedule C Form 1040 page 15 to 16.

Free Download

Check the Free Download section on our website for budget spreadsheet, budget planner PDF, tax forms, motivational quotes, checklists, and more for you do download.

Our Objectives

At Nina’s Soap, we thrive to live a quality life within our budget and increase our net worth. We share many aspects of our lifestyle including personal finance, investment, business management, cooking from scratch and growing some vegetables and fruit to save money and eat healthy.

For more, would you please visit us on our website www.ninasoap.com.

Would you please like, comment, share, and subscribe to our website and YouTube channel? We share tips on how to make natural products including our lye soap recipes. If you don’t have the time to make your own natural products, please check our website. We thank you very much!

Website: www.ninasoap.com

Join Us for Free

How to Find Previous Articles

To make it easy to navigate our website, would you please check the side bar? Under “Post Archives, are our categories”. The links to our prior articles are saved under their appropriate categories. Please click on any category under “Post Archives” to read the titles of previous articles and click on the link of your interest to open the article.

Welcome to Our Financial Success Group!

To learn more tips on how to live below your income without sacrificing the quality of your life and start building wealth, please join our community for FREE by subscribing here: https://ninasoap.com/membership-join/

Welcome to our Online Store

Our Handmade Natural Products:

Our lye soaps are hand-made with quality grade oils, food grade sodium hydroxide, and herbs grown in our garden without pesticide or chemical fertilizer—- no additives, no fragrance.

Please visit our Digital Store

Our Digital Products:

Liberman Consulting L.L.C. produces and sells printable to help you keep track of your personal finances and manage successfully your business. You share a FREE sample of our printable under our Free Download section for you to try before you purchase from our store.