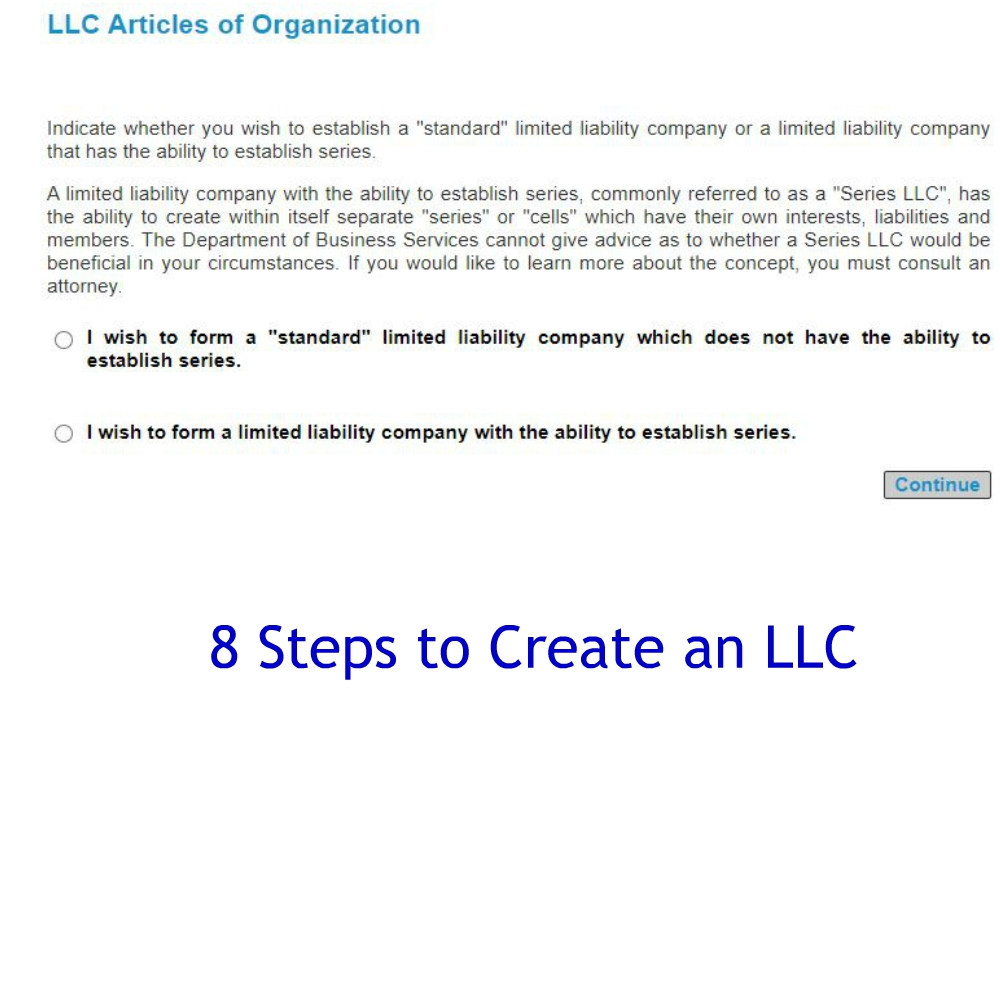

- File the certificate of Organization or the article of organization with your state

- You would get approved within days. Check their site within 24 hrs.

- Register with IRS to request EIN “Employer Identification Number”

- You would get a letter from IRS that would include forms to file and their filling frequency

- Form 940 to file Federal Unemployment Tax by 1-31

- Form 1065 by 4-15

- Form 944 by 1-31 or 941 every quarter to file Federal Withholding Income Tax

- Register with your state department of revenue for business permits online and request the following that applies to your new business

- Consumer’s use tax

- Withholding tax

- Corporation/partnership income tax

- Sales tax

- You would receive a letter from the state with all the permits you requested:

- Your business e-file and pay number “BEN”

- Your state withholding permit number

- Your filling frequency: even if your withholding is 0 you have to respect your filling frequency.

- Your state Sales Tax Permit and its filling frequency

- Home Occupation Permit from your City Planning and Housing Department

- Go to your city website

- Type permit or home occupation permit

- Print the form

- Fill it out

- Drop it at the city hall with the fee

- They would send you their approval in the mail.

If you are going to operate your business from home is it required you do that.

8. Open a business bank account at your local credit union