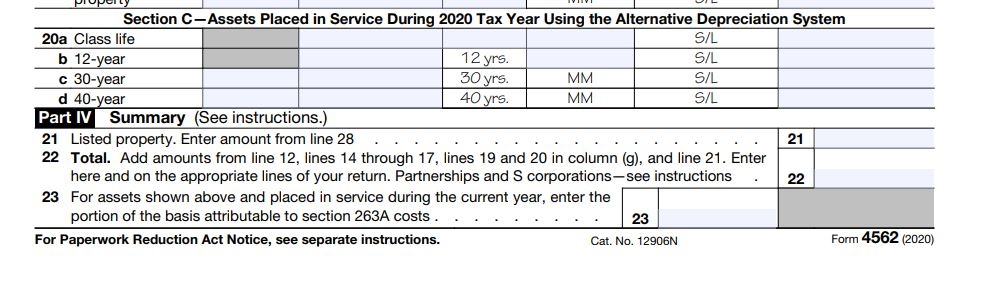

Part 3 to Part VI Form 4562 Depreciation and Amortization

If you choose or are required to use the alternative depreciation system ADS, use section C line 20 a to line 20 d from column a to g to depreciate your asset. Unless it is required, you should depreciate your business asset under the General Depreciation System.

Part IV Summary

Line 21: enter the depreciated amount from line 28 for listed property.

Line 22: for partnerships and S corporation, do not include amount from line 12 section 179 here. Add it to appropriate line on schedule k-1 for the partners. It is a past through entity.

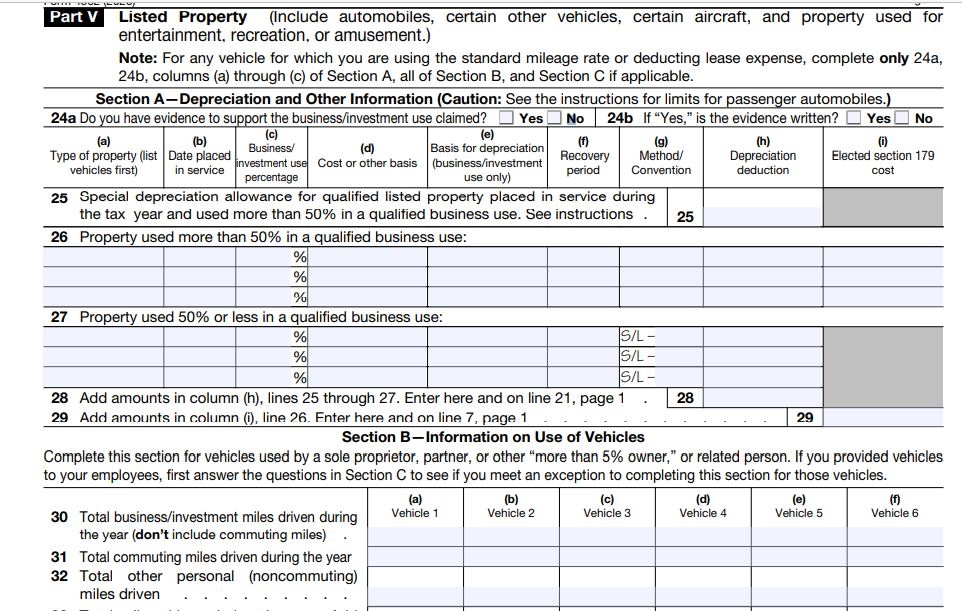

Part V Listed Property

A listed property is a property used for personal and business purposes.

Line 24 a: check the box Yes if you have support document on how you use the property for personal and business

Line 24 b: click yes if you have written record

Line 26 is for listed property used more than 50% in your business while Line 27 is for listed property used for business 50% or less.

Column d is for the cost or the basis of the property at the time you started to use it in your business

Column e is column d * column c

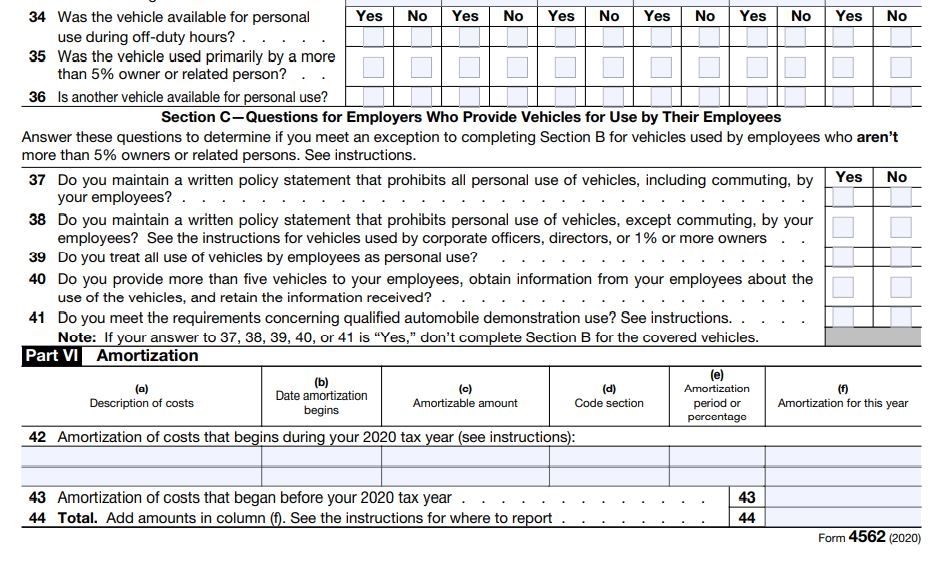

Part VI Intangible Assets Amortization

Which intangible assets are amortized?

How many years amortize intangible assets?

Certain Section 197 intangible properties are to be amortized over 180 months:

Business books and records

Patents

Copyright

Formula, pattern

Process

Permit, license, or right issued by a government

Franchise, trademark, trade name including renewal fees

Business startup cost

Organizational cost to create a corporation or a partnership

It is important you read page 15-16 of Instructions to Form 4562 Depreciation and Amortization if you need to amortize an intangible property. You would find the section code the intangible asset belongs to and how many months you should amortize it.

The code section is entered in column D for the intangible property you placed in service during the tax year.

Line 42 is for intangible property placed in service in the year you are filing for.

Line 43 is for intangible properties placed in service in prior years

Line 44 is the total amortization deduction for the year for line 42 and 43.

You only complete form 4562 Depreciation and Amortization for the first year you placed an intangible property in your business. For the remaining years, you would claim the amortization deduction directly on your business tax return. You don’t need to complete Form 4562 Part VI. But if you placed an asset in service for the first time, you would complete Form 4562 for that year and any amortization for intangible asset placed in service in prior years, would go on line 43.

If you have a C Corporation, you would submit Form 4562 every year along with your business tax return Form 1120 for all depreciation deduction whether a new asset is placed in service for the first time or not.