[vc_row][vc_column][vc_column_text]Schedule K-1 (Form 1065) comes with codes for boxes 11 to 20

Schedule K-1s should total to your schedule K.

How to Complete 2020 Form 1065 Schedule K-1?

To complete Schedule K-1 of Form 1065 for 2020, it is a good idea to download the Instructions for Form 1065 for 2020.

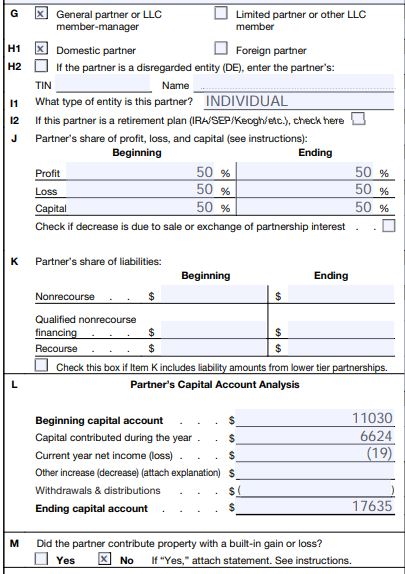

Part 2 Partner’s Information

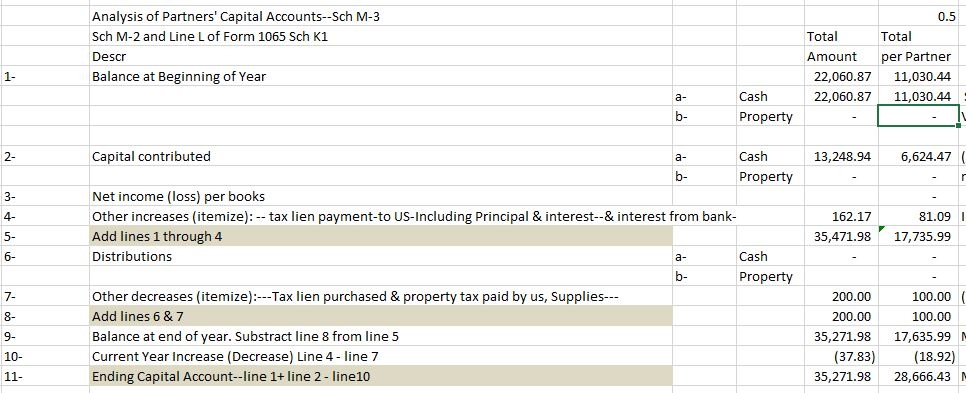

Item L Partner’s Account Analysis: You are not required to complete Item L if you answer Yes to Schedule B question 4 of form 1065. However, if you would like to enter it, it is good to draft schedule M-2 spreadsheet to record the balance of the partnership at the start of the year followed by any capital contribution during the year, any increases due to income, any decreases, and the balance at the end of the year. Calculate for the partnership and calculate the portion that should be allocated to each partner’s. Enter each partner account analysis on their schedule K-1.

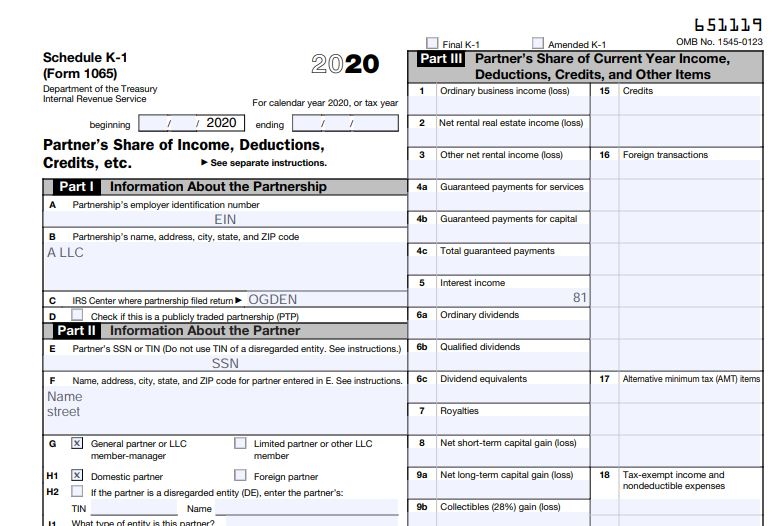

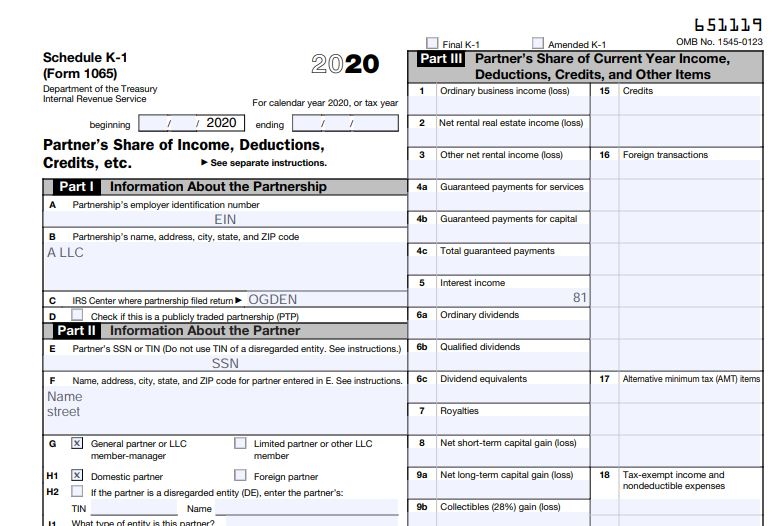

Part 3: Partner’s share of income and deductions

Have the instructions for Form 1065 available to read how you should report every line of Schedule K to its corresponding box number on Schedule K-1, the appropriate code to enter, and whether you should attach a statement to describe the type of deduction claimed.

Read the instructions for each line of Schedule K to see how to enter it on Schedule K-1 and the appropriate code to use.

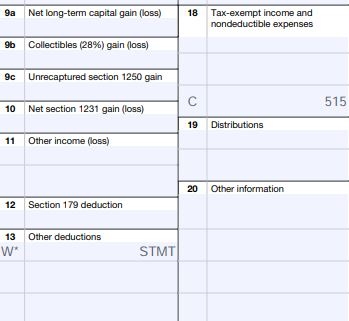

For instance, line 13d: If the 13 code W has an amount that is related to multiple activities or more than one type of expenses, add code W* in the left side of the amount column. In the amount column, write STMT. Add an attachment. List all the expenses that total to the amount that should go on that line. Mention the box number and the code. If necessary, include every portion of the expense that is related to each activity conducted by the partnership. On Schedule K the space next to the dollar amount, could have the type of deductions, and the total amount can be added in the amount column. An attachment detailing the deduction should be added to Form 1065. Below are images of 2 different Schedules K-1 from 2 businesses to illustrate how to complete Part 3

The video shows hot to complete 2020 Form 1065 Schedule K-1

[/vc_column_text][/vc_column][/vc_row][vc_row css=”.vc_custom_1614606452172{margin-top: 10px !important;margin-bottom: 10px !important;}”][vc_column][vc_row_inner][vc_column_inner][vc_video link=”https://youtu.be/gqNc9Bl4vvQ” el_width=”50″ el_aspect=”43″][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row][vc_row css=”.vc_custom_1614606452172{margin-top: 10px !important;margin-bottom: 10px !important;}”][vc_column][vc_row_inner][vc_column_inner][tagline_box call_text=”2020 Federal Tax Forms and Instructions” call_text_small=”Save time and find the links to the right IRS Tax Form and Instructions for your business.” title=”Links to Tax Forms” target=”_blank” color=”custom” custom_bg_color=”#ebf3fb” custom_title_color=”#000000″ custom_description_color=”#000000″ button_text_color=”#000000″ button_border_color=”#c2ccf7″ button_bg_color=”#c2ccf7″ href=”https://ninasoap.com/categories/2020-federal-tax-forms-and-instructions/”][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row][vc_row css=”.vc_custom_1614606452172{margin-top: 10px !important;margin-bottom: 10px !important;}”][vc_column][vc_row_inner][vc_column_inner][vc_video link=”https://youtu.be/xAM695waDBY” el_width=”50″ el_aspect=”43″][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row][vc_row css=”.vc_custom_1614606452172{margin-top: 10px !important;margin-bottom: 10px !important;}”][vc_column][vc_row_inner][vc_column_inner][vc_cta h2=”How do I File my Business Taxes” h2_font_container=”color:%23000000″ h2_google_fonts=”font_family:Sofia%3Aregular|font_style:400%20regular%3A400%3Anormal” h4=”Previous articles in this category” h4_font_container=”color:%23000000″ txt_align=”center” style=”custom” add_button=”right” btn_title=”File It Yourself” btn_style=”custom” btn_custom_background=”#f4f8f9″ btn_custom_text=”#000000″ use_custom_fonts_h2=”true” use_custom_fonts_h4=”true” btn_link=”url:https%3A%2F%2Fninasoap.com%2Fhow-do-i-file-my-business-taxes%2F|title:How%20do%20I%20File%20my%20Business%20Taxes||” custom_background=”#cfd3df” custom_text=”#000000″ h2_link=”url:https%3A%2F%2Fninasoap.com%2Fhow-do-i-file-my-business-taxes%2F|title:How%20do%20I%20File%20my%20Business%20Taxes||” h4_link=”url:https%3A%2F%2Fninasoap.com%2Fhow-do-i-file-my-business-taxes%2F|title:How%20do%20I%20File%20my%20Business%20Taxes||”]

Do you want to know the business deductions to claim on your taxes and how to record them throughout the year?

[/vc_cta][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row][vc_row css=”.vc_custom_1614606452172{margin-top: 10px !important;margin-bottom: 10px !important;}”][vc_column][vc_row_inner][vc_column_inner][tagline_box call_text=”Depreciation Spreadsheet-DS22821″ call_text_small=”You can claim as business expense, the depreciation of your assets every year on your business tax return. Use the depreciation spreadsheet to keep the proper record that allows you to claim yours!” title=”Get yours now!” target=”_blank” color=”custom” custom_bg_color=”#008000″ custom_title_color=”#000000″ custom_description_color=”#000000″ button_text_color=”#000000″ button_border_color=”#00ff00″ button_bg_color=”#00ff00″ href=”https://liberdownload.com/downloads/depreciation-spreadsheet-ds22821/”][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row][vc_row css=”.vc_custom_1614606452172{margin-top: 10px !important;margin-bottom: 10px !important;}”][vc_column][vc_row_inner][vc_column_inner][tagline_box call_text=”Instant Digital Products” call_text_small=”Downloads you need to successfully manage your finances and your business” title=”Get What You Need When You Need It!” target=”_blank” color=”custom” custom_bg_color=”#008000″ custom_title_color=”#ffffff” custom_description_color=”#ffffff” button_text_color=”#000000″ button_border_color=”#ffd700″ button_bg_color=”#ffd700″ href=”https://liberdownload.com”][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row][vc_row css=”.vc_custom_1614606452172{margin-top: 10px !important;margin-bottom: 10px !important;}”][vc_column][vc_row_inner][vc_column_inner][vc_wp_text]

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” Our articles are informative and based on our knowledge and experience. Use them at your own discretion.

Affiliate Links Disclaimer:

Our articles contain affiliate links. When you click on one of our affiliate links and make a purchase, we will receive a commission. We thank you very much for your support!

Please Find About our Products and Links Below

Free Download

Would you please check the “Free Download” section on our website for budget spreadsheet, budget planner PDF, tax forms, motivational quotes, checklists, and more for you do download. You don’t need to subscribe to access them. We would like to have you in our community where we interact and encourage each other to reach our goals. We invite you to join our email list.

https://ninasoap.com/free-downloads/

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you would find information to live a quality life within budget and increase your net worth. Topics covered include personal finance, investment, business management, cooking from scratch and growing some vegetables and fruit to save money and eat healthy.

For more, would you please check our blog:

Contact Information: care@ninasoap.com

You Tube Channel:

https://www.youtube.com/c/LibermanConsultingLLC

Liberman Consulting L.L.C. Podcast:

Liberman Consulting L.L.C. Podcast (buzzsprout.com)

Join Us for Free

You are invited to join us where you could ask questions, stay motivated and work toward reaching your financial goals.

How to Find Previous Articles

To make it easy to navigate our website, would you please check the side bar? Under “Post Archives”, are our “categories”. The links to our prior articles are saved under their appropriate categories. Would you please click on any category under “Post Archives” to read the titles of previous articles and click on the link of your interest to open the article.

Welcome to Our Financial Success Group!

To learn more tips on how to live below your income without sacrificing the quality of your life and start building wealth, would you please join our community for FREE by subscribing here:

https://ninasoap.com/membership-join/

Our Online Stores

Welcome to Nina’s Soap our Natural Products Store

Our lye soaps are handmade with quality grade natural oils and butters, food grade sodium hydroxide, and herbs grown in our garden without pesticide or chemical fertilizer—- no additives, no fragrance, no dye.

Our towels, washcloths, and napkins are natural and eco-friendly alternatives of paper towels, paper napkins, and tissue papers for you to enjoy in the comfort of your home while saving money and the environment.

Welcome to Liber Label our Apparel Store

Customs design clothing, home décor, accessories, and stationery with motivational quotes to lift your mood every day.

Welcome to LiberOutlet.com our Resale Store

New and used toys, small kitchen appliances, household products, office supplies, packaging supplies at a bargain price.

Welcome to Liberdownload.com, Digital Products Store

Budget and Monthly Expense Tracker, Checklist to create your online store, Inventory and Sales Excel Template…tools you need to manage your money, start and run your business successfully, and reach your financial success.

Affiliate Links:

Bluehost: We host our websites at Bluehost and like their service. They take the time over the phone to help solve website issues

https://www.bluehost.com/track/ninasoap/

Please Register for Free

Registration

[/vc_wp_text][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row]