Listed property includes property originally designed for personal use that could be used for personal and business purposes. (passenger vehicles under 6,000 lbs., entertainment devices like camera for instance, and laptops).

If you use a property that is considered a listed property solely for business, and it stays in your business office, it is not a listed property.

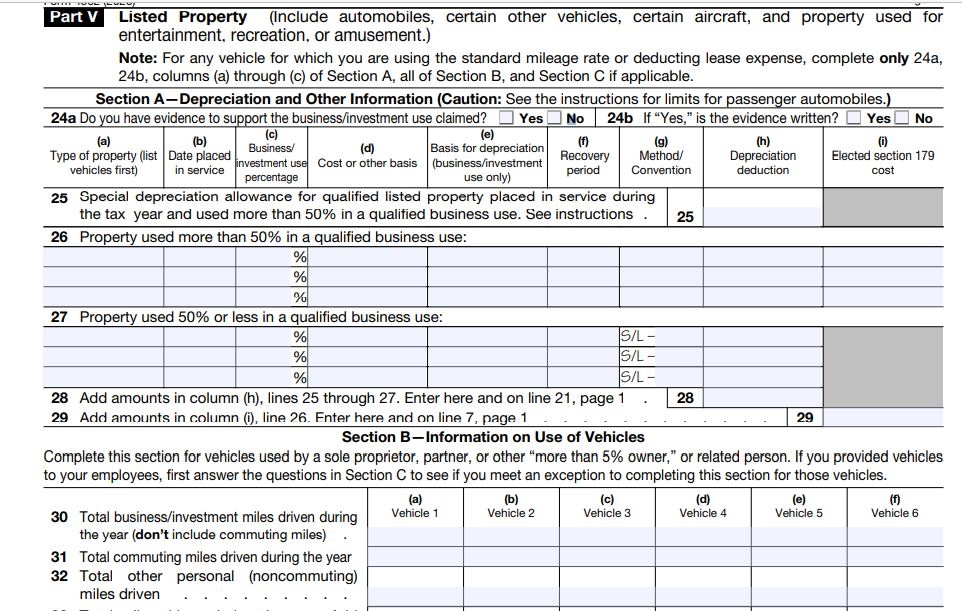

Form 4562 Part 5 Line 26

If you use a property in the category of listed property for personal, investment, and business purposes, you have to track how many hours you use it.

Step1: How many hours you used it during the year

Step 2: How many hours you used it for investment? %investment use is Investment use hours/ total hours for the year

Step3: how many hours of business use? % business use = business use hours/total use hours for the year

Step 4: how many hours for personal use? % personal use = personal use hours/ total use hours for the year

Step5: If business use% is more than 50%, you could claim Section 179. You could claim special depreciation if qualified for the property. You could choose to depreciate the property using 200% declining balance over GDS.

Step 6: The basis for depreciation would be (business use% + investment use%) * the cost or market value of the property whichever is less.

You use business use percentage to figure out if you use it more than 50% for business to qualify for the above depreciation but you use both business and investment use percentages to calculate the basis for depreciation deduction.

If one year, your business use falls below 50%, you would have a recapture to include on your 1040 as an income using Form 4797 Part 4. Also, you must recalculate the basis for depreciation.

Form 4562 Part 5 Line 26 is where you enter the property you use for more than 50% in your business.

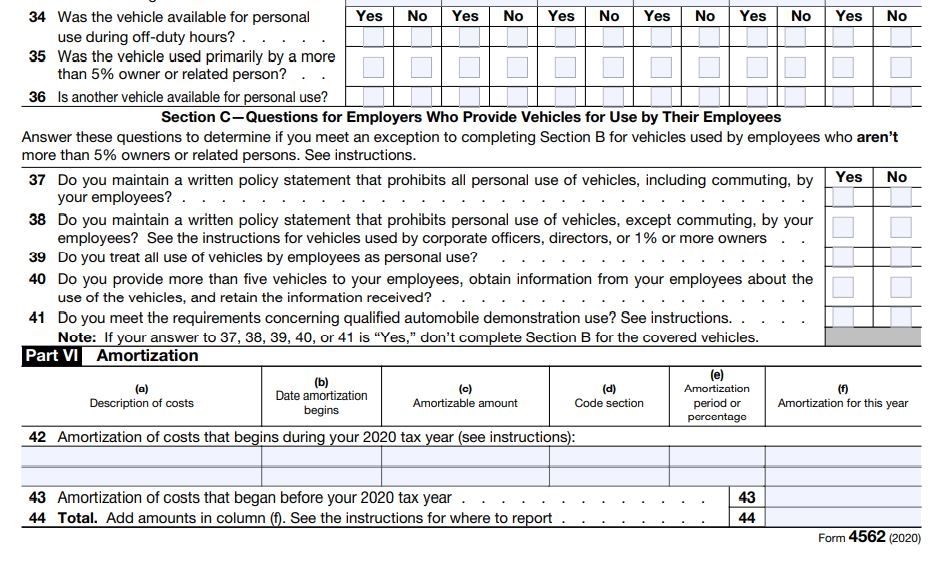

Form 4562 Part 5 line 27

If you use a property for business, investment, and personal use and use it is used 50% or less in your business list it in part 5 line 27.

You cannot not claim Section 179 or special depreciation on it.

You could depreciate it using Straight-line method under the General Depreciation System GDS.

If you depreciate a property on line 26 and in later years your business use is 50% or less, you have to calculate the depreciation using Straight-line rate for the same number of years you depreciated. The total of the new depreciation calculated would be compared to the total depreciation you took for that property for the prior years including Section 179, special depreciation, and 200% or 150% declining balance under GDS used. If the depreciation you took is more than the new depreciation calculated, the difference is the recapture to include in your income.

If you use standard mileage

Check the boxes on line 24a and line 24b

Complete a; b; c for Section A part 5 listed property for line 26 or 27.

Complete Section B and C if applied to your case.

The video is about how to complete 2020 Form 4562 Part 5 Listed Property