How to find property class and recovery period for your asset?

To depreciate a business asset, it is important to look for the rate table name in Appendix A of IRS Publication 946 (current year) that corresponds to the depreciation system, the depreciation method, the convention, and the recovery period of your asset.

How to locate the recovery period and the class life of your asset?

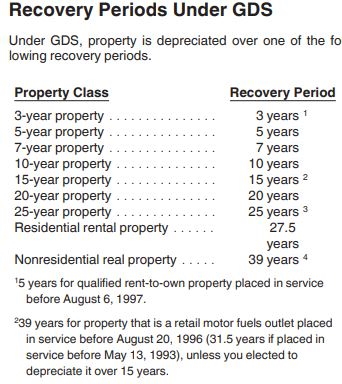

There is a general description of different property class and recovery period under GDS (General Depreciation Systems under MACRS (Modified Accelerated Cost Recovery System).

However, you could have an asset that is not listed.

Step1: Know the activity in your business that uses the asset

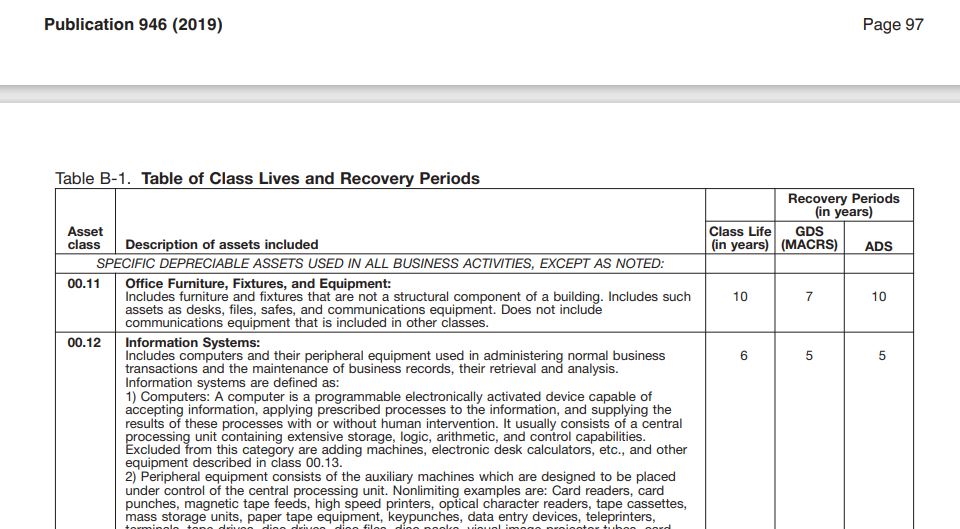

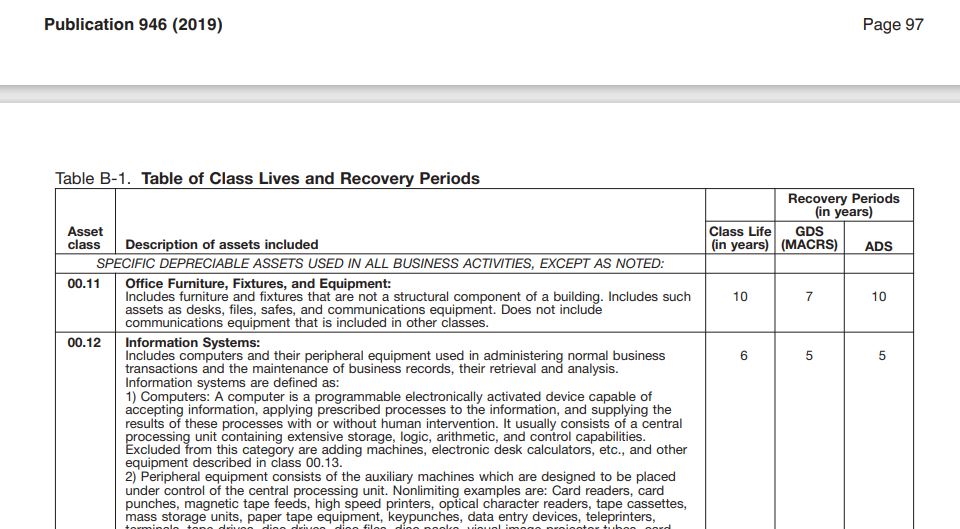

Step 2: Scroll to the end of the IRS Publication 946 Current year version to Table B-1 Table of class lives and recovery periods.

Step 3: look for the asset to depreciate in the list

Step 4: If you find it take note of the class life and recovery period

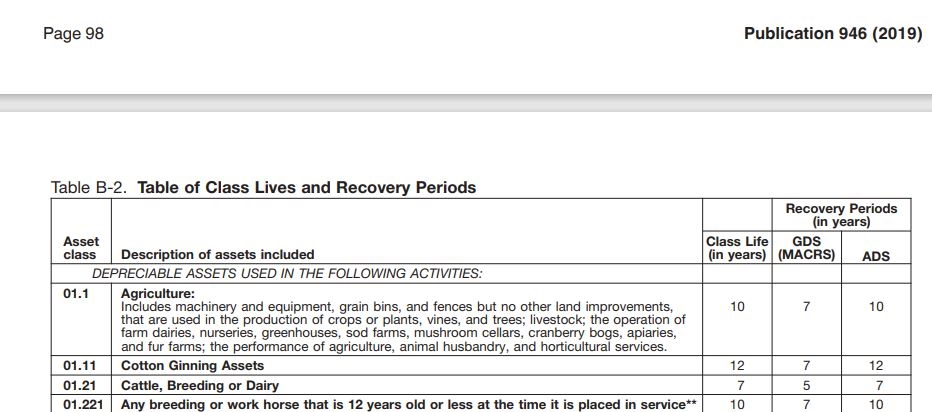

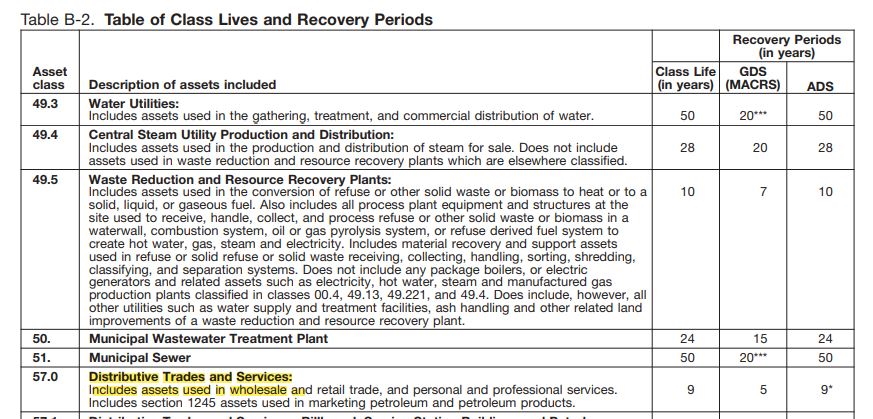

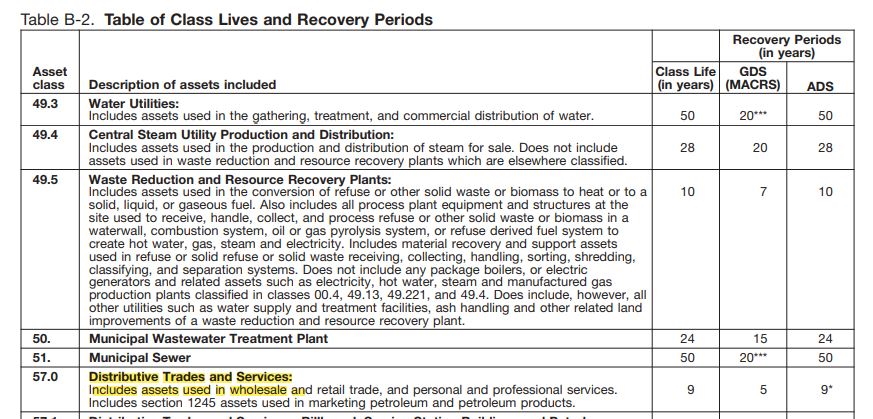

Step 5: Scroll down to Table B-2 Table of class lives and recovery periods.

Table B-2 list business activities in which the assets are used.

Search for your business activity.

Asset is listed in table B-1 and business Activity is listed in table-2 and asset is listed under that activity in table B-2

Check to see if the asset is listed under that activity. If you find it, use the class life and recovery period of table B-2 under your business activity to depreciate the asset. If the asset is specified in the list of assets under that activity, use the recovery period of table B-2, as recovery period could differ from activity to activity for the same asset.

Asset is listed in Table B-1 but Business activity is not listed in TableB-2

Use the class life and recovery period of Table B-1 to depreciate the asset.

Asset is listed in table B-1 and business Activity is listed in table B-2 but asset in not listed under that activity

If your asset is listed in Table B-1, your business activity is listed in Table B-2 but your asset is not in the list of assets under that business activity or is excluded, use the class life and recovery period of Table B-1.

For instance, an office desk you placed in service during the year in your retail store is listed in Table B-1. Your retail store is listed in Table B-2 57.0 but office desk is not in the list there. Therefore, you would use class life and recovery period of table B-1 for the office desk.

10-year Class life and Recovery period: GDS/7

Asset is not listed in Table B-1, Business Activity is listed in Table B-2, but asset is not listed under that activity

Use the class life and recovery period of Table B-2 of that business activity.

Or example a cash register used in your retail store is not specified in table B-1. Retail business is listed in Table B-2. Cash register is not specified under that activity. You will use the recovery period and class life of the activity:

9-year class life

Recovery period: GDS/5 or ADS/9

Once you find the recovery period for the asset go back to Appendix A to locate the name of the rate table to use based on the depreciation system, the depreciation method, the convention, and the recovery period.

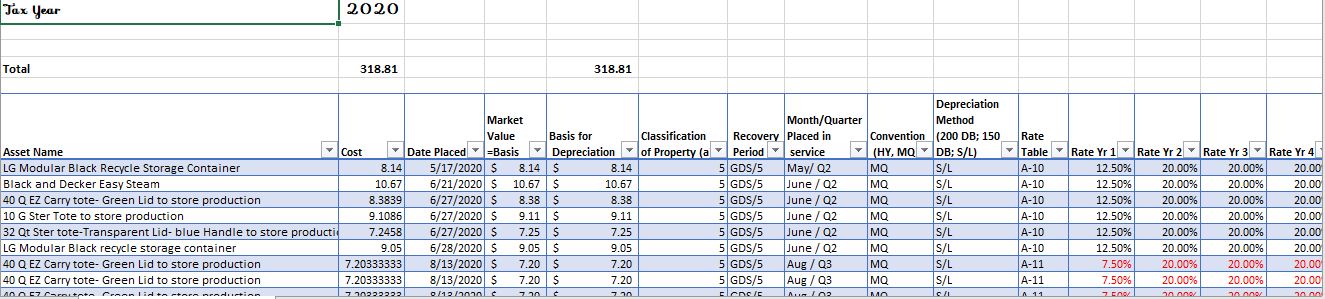

For instance, I purchased totes to store goods and placed them in service in 2020.

I wanted to depreciate them as 7-year property class with 7 years recovery period.

They are not listed in Table B-1. The activity is listed in Table B-2 Asset class 57.0 (retail) but the totes are not mentioned among the assets. Therefore, I would use the recovery period in Table B-2 of the asset class that is related to the activities the totes are used in. The recovery period is 5 years under GDS. The tote would be in 5-property class with 5 years recovery period.

Another example is the office desk I use in my home office.

It is mentioned in the list in Table B-1 with a recovery period of 7 years.

A look at table B-2 at my business activity Asset class 57.0 (professional services, retail) didn’t have desk in the list). Therefore, I would use the recovery period in Table B-1.

When you purchased an asset to use in your business, Look for the asset in Table B-1. Locate your business activity in Table B-2. Carefully choose the appropriate recovery period or the number of years you would recover the cost of your business asset.

Video: 2020 Form 4562 Depreciation and Amortization-25