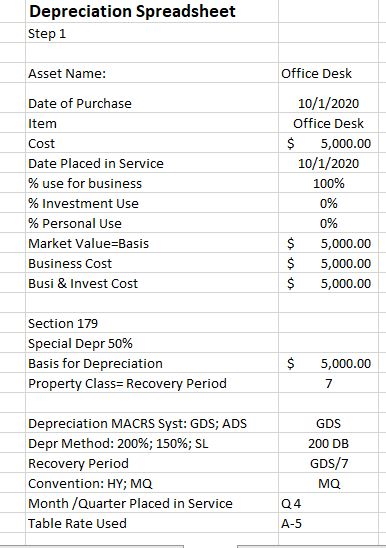

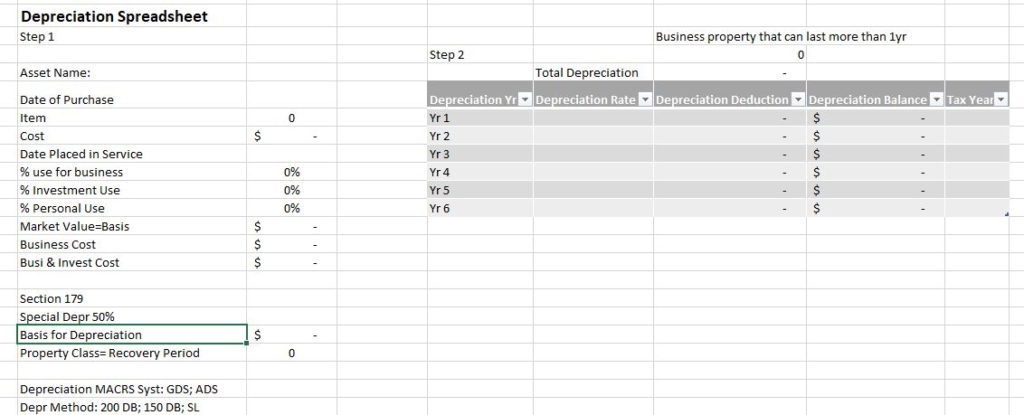

Depreciation spreadsheet allows you to keep records of depreciable assets you placed in your business.

You would be able to calculate the depreciation deduction to claim on each asset you placed in service.

You would need IRS Publications 946 How to depreciate property to find the rate table in Appendix A and to locate the recovery period using Appendix B.

The link to the Publication 946 can be found in Free Downloads under Federal Tax Forms and Instructions.

No email is required to access free downloads.

Get your Depreciation Spreadsheet for free.