If you are required to file IRS Form 941 Employer Quarterly Federal Tax Return and you have no employee in 2023, or you are an employee of your own LLC taxed as an S corporation and you didn’t collect any salary, you still need to file form 941. It is a quarterly return filed at the end of every quarter.

In general, if you are required to file Form 941, you are expected to file it every quarter even if you don’t have payroll tax to report. However, IRS has some exceptions. One exception is for seasonal employers.

If you are a seasonal employer and hire employees some part of the year only, you could check box 18 on Form 941 every quarter you file Form 941 to let the IRS know you are not going to file that form for quarters you don’t have employees. IRS Instructions for 2023 Form 941 page 5 for more detail.

Where to find Form 941?

On the IRS website, search Form 941 from their search bar.

Download Form 941 and IRS Instructions for Form 941.

On the IRS website, search Form 941 from their search bar.

You can also access the links to both form from our page “page “Federal Tax Forms and Instructions Links” or here:

How do I fill out form 941 if I have no employees 2023 Q2

For any line that is 0, leave is blank except Line 1, 2, and 12. IRS Instructions for Form 941 page 7.

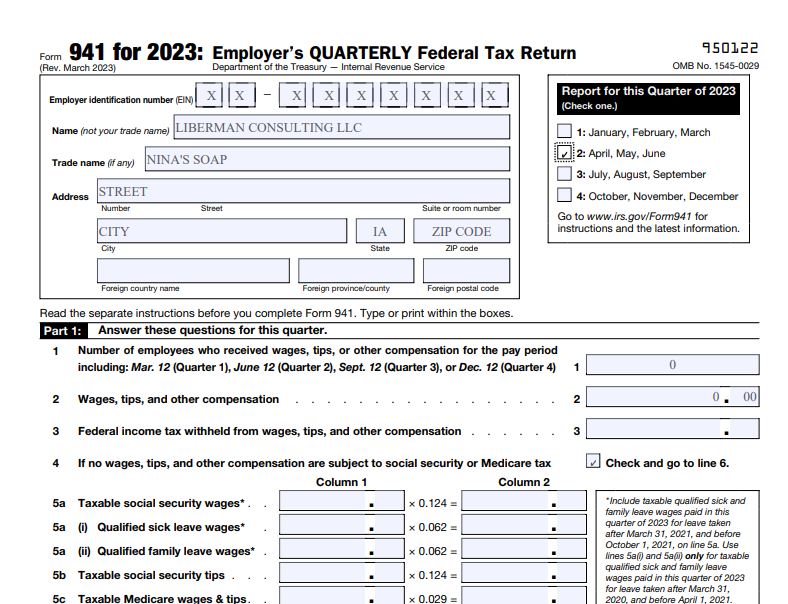

Form 941 Business information.

EIN: Enter your business EIN number.

Name: Enter your business legal name as entered on your EIN application form or on Form SS-4 Application for Employer Identification Number.

Trade name: If you have a DBA (Doing Business As) name enter if here otherwise, leave it blank.

Address: Enter your business address.

Which quarter of 2023 are you filling for?

In the right table next to your business information, check the quarter your Form 941 is for. In this example that will be Q2. You check the box next to 2: April, May, June.

If you are a seasonal employer, you need to check the quarter you are filling for and you check box 18 as well to let IRS know you will not file form 941 every quarter.

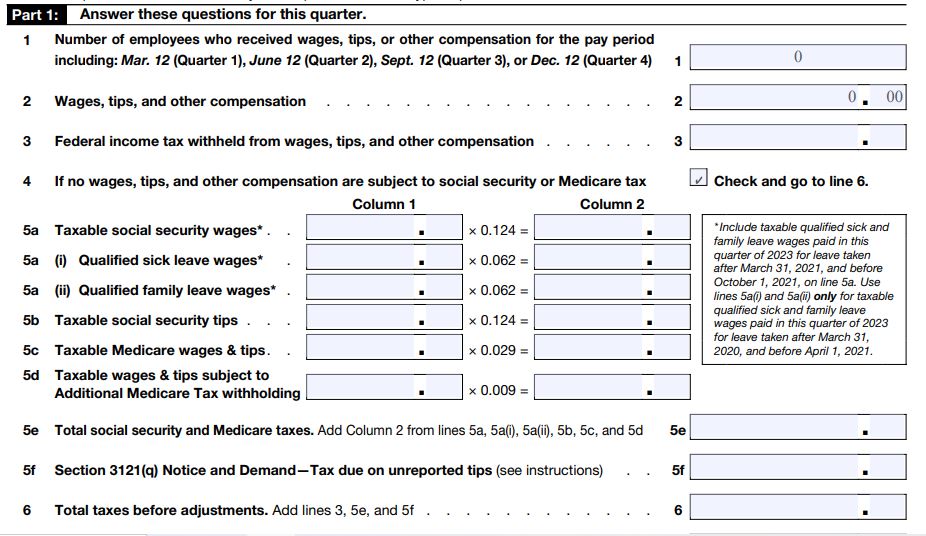

Form 941 Part 1

Line 1 Number of employees who received wages: enter 0 as you have no employees or your business paid $0 in salary for that quarter.

Line 2: Total Wages paid: It is the total gross payroll for the quarter. Enter 0.

Line 3 Federal income tax withheld: leave it blank.

Line 4 If no wages are subject to social security tax and Medicaid tax: check box 4 and go to line 6. You check that box and skip line 5s to go to line 6.

Line 6 total taxes before adjustments: leave it blank.

Line 7 quarterly adjustments for fractions of cents: leave it blank.

Line 8 quarterly adjustment for sick pay: leave it blank.

Line 9 quarterly adjustments for tips and insurance: leave it blank.

Line 10 Total taxes after adjustments: leave it blank.

Line 11a and Line 11b: leave them blank.

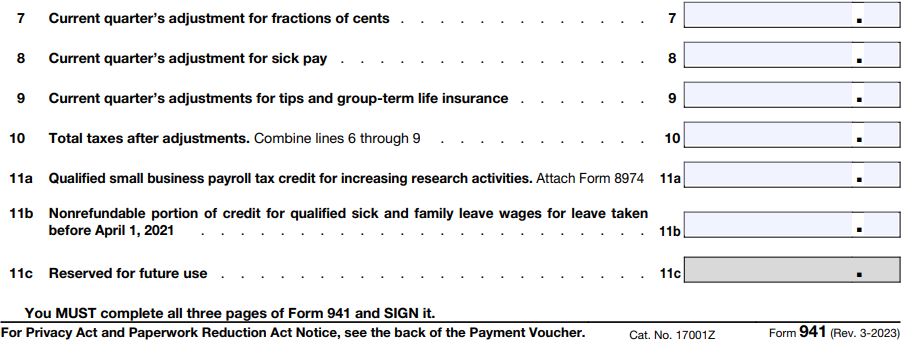

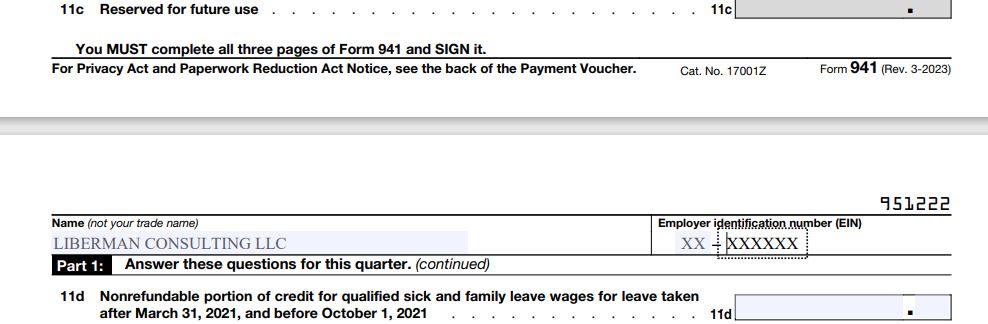

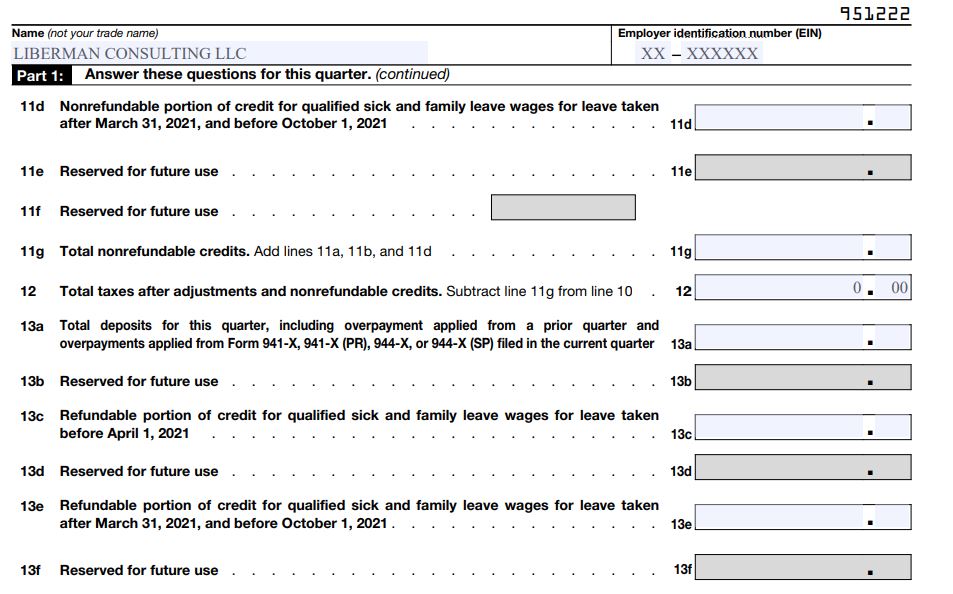

Form 941 Part 1 Page 2

Name and EIN: enter your business legal name and EIN at the top of Form 941 page 2.

Line 11d: Nonrefundable credit: Leave it blank.

Line 11g: Total nonrefundable credits: leave it blank.

Line 12 Total taxes after adjustments and nonrefundable credits: if it is $0, enter 0.

Line 13a: total deposits for this quarter or any overpayment you want to use: If you didn’t make any payroll tax deposit for that quarter, leave it blank.

Line 13b to Line 13f Refundable credits: leave them blank.

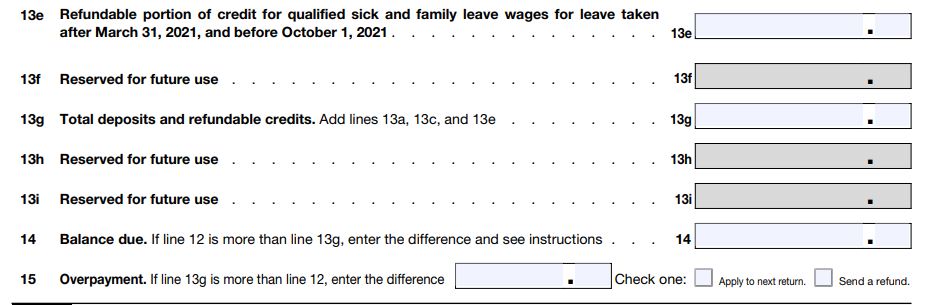

Line 13g: Total deposits and refundable credits: leave it blank.

Line 14: leave it blank as that will be $0 since your line 12 payroll tax is $0 and your line 13a is blank.

Line 15 overpayment: Leave it blank if your line 13a is blank and your line 12 is $0.

Having Line 14 blank and line 15 Blank means you didn’t owe tax and you didn’t overpay either.

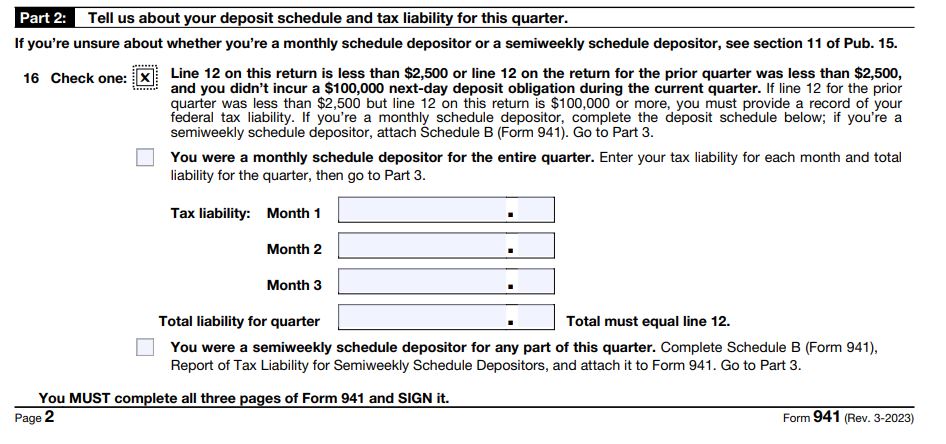

Form 941 Part 2 Your deposit schedule.

Line 16: Line 12 total tax is $0 therefore, it is less than $2,500, check the 1st box and go to Line 17.

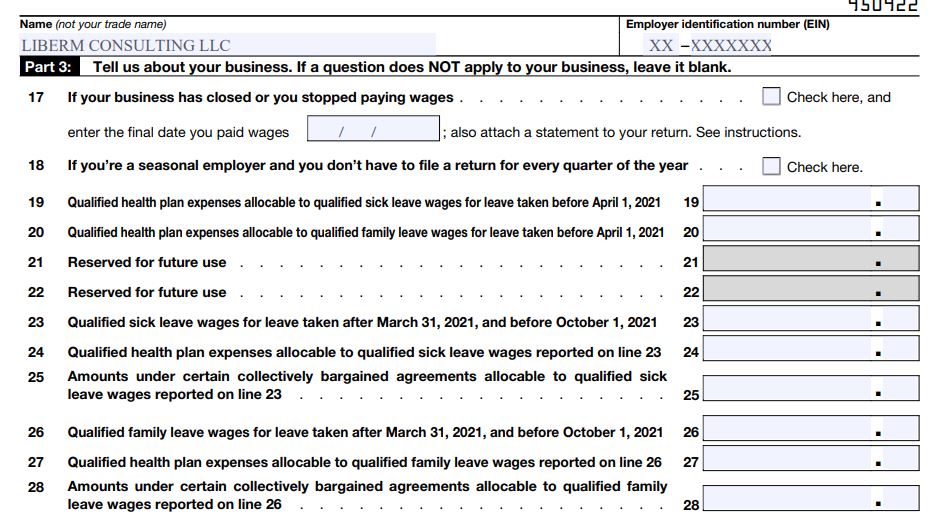

Form 941 Part 3 Page 3

Name and EIN: enter your business legal name and EIN on the top of Form 941 page 3.

Line 17: If your business is not closed, leave that line blank.

Line 18: If your business is not a seasonal employer, leave it blank.

Line 19 to Line 28: If they are not related to your business, leave them blank.

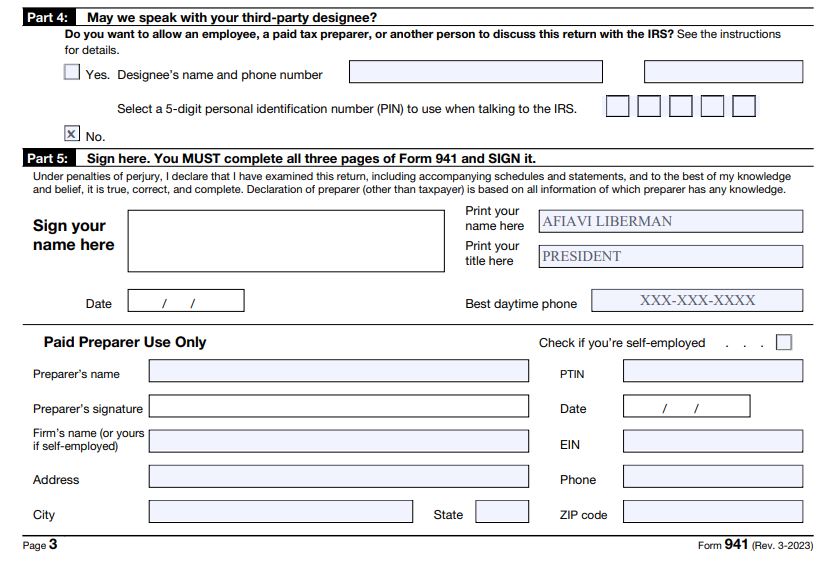

Form 941 Part 4 Page 3

You can check “No” if you want IRS to contact you in case, they have a question.

Form 941 Part 5 Page 3

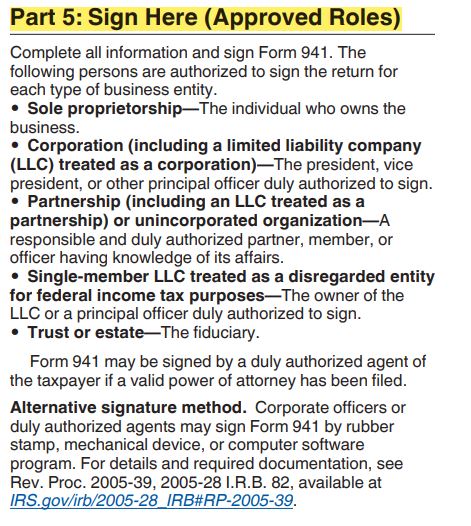

Who must sign Form 941?

If you are the sole proprietor, you the owner of the business will sign.

If the business is LLC taxed as an S corporation, the president, vice president, or any officer can sign.

If your business is an LLC that files Form 1065 partnership tax return, any member of the business that is acknowledgeable of the business activities can sign.

You read more in the IRS instructions form 941 for 2023 page 20.

Type your name and your title.

After you print Form 941, you sign and date. Then you make a copy of the return for your business record.

Paid preparers use only.

Leave the paid preparer use only section blank if you are filling form 941 for your own business.

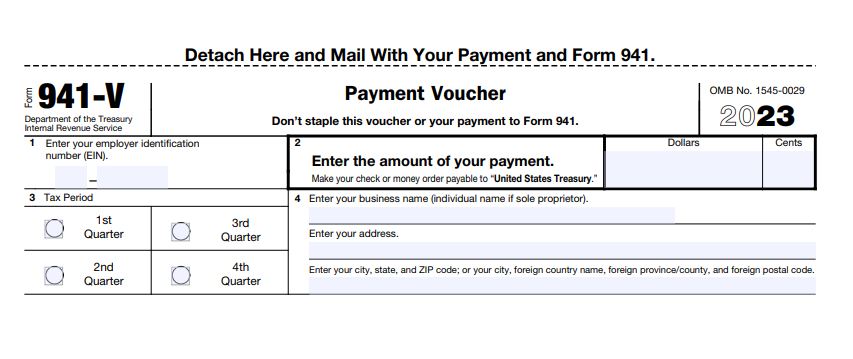

Form 941-V Payment voucher.

If you have no employee or didn’t pay any wages, and your Form 941 line 12 is $0, do not complete form 941-V.

Review your return and print it out. Sign and date.

Make a copy of the tax return for your business record.

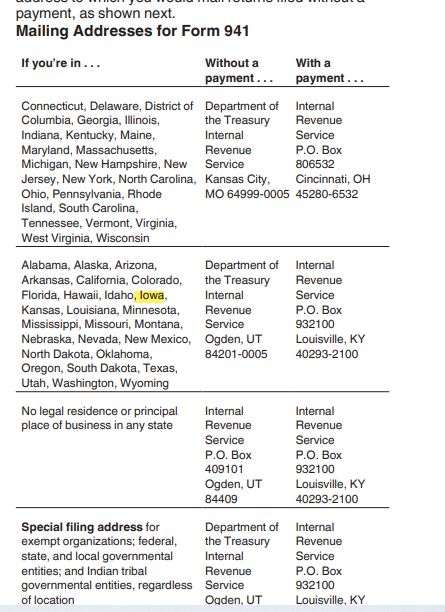

Where to mail Form 941 for 2023?

On the IRS instructions for form 941 for 2023 page 7, locate your state in the address table.

The address in the column “without payment” that corresponds to the row your state is, is the address to mail your Form 941 for 2023.

Mail your return via USPS certified mail and keep the receipt and tracking number receipt with your business copy of the tax return.

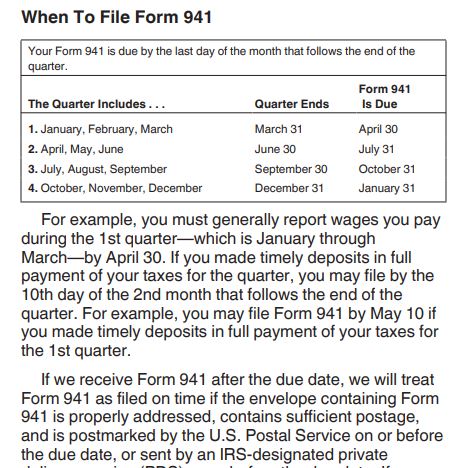

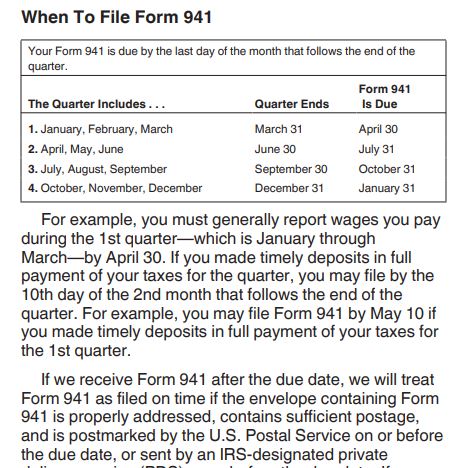

When is Form 941 due?

The 2nd quarter Form 941 is due by July 31 and includes April, May, and June payroll tax reports.

Conclusion: How do I fill out form 941 if I have no employees 2023 Q2

The video explains step by step how to fill out Form 941 for the 2nd quarter of 2023.

Federal Tax Forms and Instructions Links: https://ninasoap.com/federal-tax-forms-and-instructions/federal-tax-forms-and-instructions-links/

Previous related articles:

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you will find information to live a quality life within budget and increase your net worth. Topics covered include personal finance, investment, business management, cooking from scratch, and growing some vegetables and fruit to save money and eat healthy.

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

“Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.”

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel) , https://ninasoap.com/affiliate-products/ (Our resource page)”.