What report shows total assets?

You can locate the total assets on your balance sheet assets section.

The total assets on page 1 of the 1120S is the total assets from your balance sheet.

How do I make a balance sheet for my business?

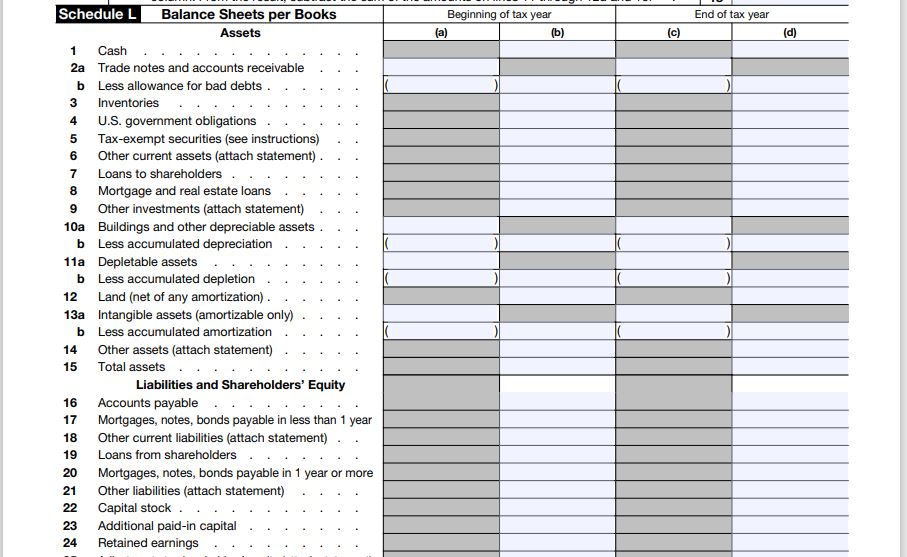

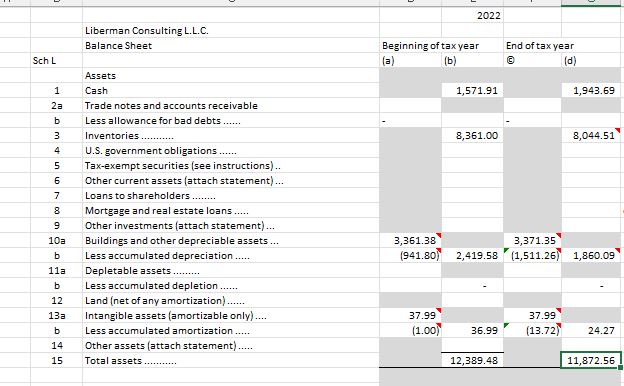

S Corp balance sheet

How to complete your business balance sheet, also call Schedule L for S Corp?

If your business started in the current year, your beginning of year column will be $0.

If your business is not new, your beginning year numbers will be the previous year end numbers,

You copy the previous year end column number to the current year beginning column.

In the balance sheet in the assets section, you might need to complete:

Cash

Account receivable if your clients pay you after later

Inventories if you sell physical products and carry inventory

Depreciation if you have business assets

Amortization if you amortize some intangible assets

In the balance sheet liability and equity section, you might need to complete:

Account payable if you own short term debts to vendor or credit card companies.

Capital stock if you contributed to your business

Retaining earnings for profit or loss from the business activities.

Total assets = Total Liability + Equity (Capital stock + Retained Earnings)

Balance sheet total asset calculation

Cash: the year end cash is the cash in the business bank account at the end of the year.

You can go through your bank accounts periodically to know your cash available.

Inventories:

The year end column inventory value will come from your inventory management workbook. It is the inventory at the end of the year.

Depreciation:

If you depreciate business assets, you will complete the inventory rows.

You have a row for assets purchased during the year.

Depreciation you deduct or claim on your tax return during the year will go on the line Less accumulated depreciation. That row tracks previous years and current year depreciation.

In the year end column, you put depreciation you will deduct for the year.

The beginning year column will have previous years depreciation.

Amortization

The 1st amortization row has total amortizable assets value.

The 2nd row is the amortization amount for previous year and current.

The column b and column d for that row will have remaining amortization to take.

When your total year end column assets amounts, you will have the total assets for the business.

That total asset is reported on S Corp tax return Form 1120S page 1.

Liability and Equity

Account payable: if you have a credit card remaining balance, you can include that. At the end of December, you can check your balance on your credit card. That will go on the year end column.

When you use your business credit card to make a purchase, the purchase could have been included in the assets. Therefore, it is good to add the credit card balance in the liability section. If you have not paid a vendor yet, it will go there.

Capital stock is the section to include the business owner’s capital contribution to the business.

The retaining earning will be the difference between total assets and liability.

If the assets are higher than the liability, you have a profit that year. The profit will be added to the retaining earning for total liability and equity to match total assets.

If the assets are lower than the liability, you have a loss that year. The loss will be added to the retaining earnings as a negative number for the total liability and equity to match total assets.

Conclusion: How do I calculate total assets on page 1 of the 1120S?

Resources

Related article categories

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” I am not a CPA. Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Ads Disclaimer:

Ads are displayed in our contents. These ads do not influence the content we create and publish. We do not endorse them either.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Vision

Nina’s Soap was created to help you live a healthy lifestyle within your budget while increasing your net worth.

Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you will find information about living a quality life within budget and increasing your net worth. Topics covered include personal finance, investment, business management, cooking from scratch, and growing some vegetables and fruit to save money and eat healthy.

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel), https://www.pinterest.com/ninassoap/ (Pinterest), https://ninasoap.com/affiliate-products/ (Our resource page)”.