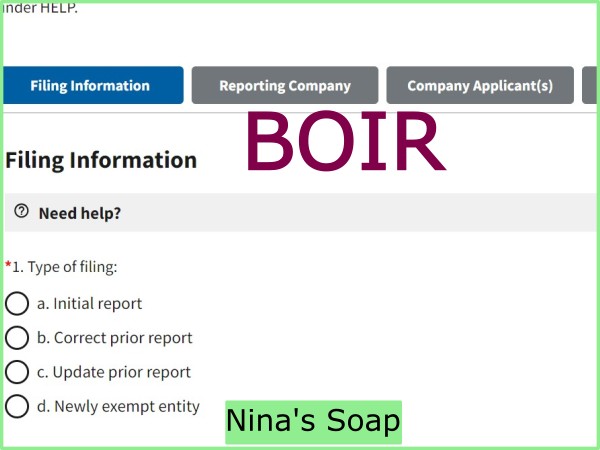

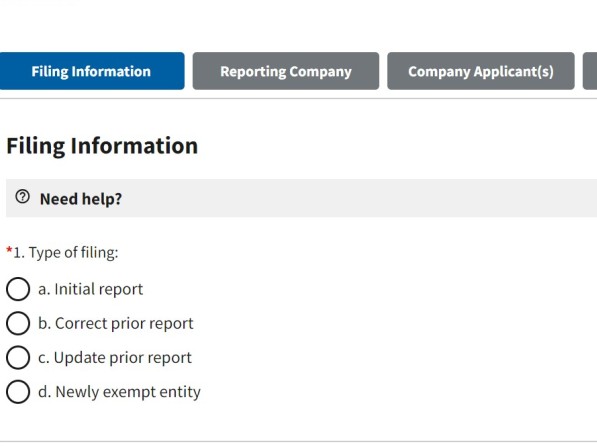

How to report your company?

You report your business information, its beneficial owners’ information, and its filling applicants up to 2 applicants if your business was created on or after January 1, 2024. If it was created before January 1st, 2024, you only report your business information and its beneficial owners’ information.

Who is a beneficial owner?

People in senior management positions that have control in decision making in the business whether they have ownership or not.

Owners that own 25% or more of the business.

When to report company applicants?

You are required to report your company applicants if you created your business or registered it with your state on or after January 1, 2024.

If you are required to report your company applicants, you report at least 1 or no more than 2 people.

Company applicants are the persons that filed the document to register the new company with the state.

If you are required to report company applicants, it must be people you report information on, not companies that represent them.

If more than 1 person was involved in the registration of the business with the state, then 2 people should be reported as the company applicants including the direct filer (who filed with the state like attorney, spouse…) and the controller of the filling action (who prepared the documents, gathered the documents necessary that got filed with the state like the business owner for instance).

What to report for your company?

Company information:

Company legal name as registered.

Trade name if applicable (DBA)

Business location

Business owners’ information

Owners that have control in the business as senior officers even if they have no ownership % in the business.

Owners that own 25% or more of ownership of the business.

Owners that have control in the major decision making in the business and own 25% of the business.

Some beneficial owners are exempt from been reported including minors based on the rule of your state. Instead, you report information of a parent or guardian of the minor. Once the minor becomes adult, you update your registration with BOIR.

Beneficial owner information to report:

Full name

Date of birth

Current address

Driver license / US passport

When to report your company?

If your company was created before January 1, 2024, you are required to report it bebore January 1, 2025.

If your business was created on or after January 1, 2024, but before January 1, 2025, you are required to report it within the first 90 days from its state filling effective date.

If your business is created on or after January 1, 2025, you are required to report it within the first 30 days from its state filling effective date.

When to update your BOI Report?

If an information changed and requires updating, you should update your report within 30 days of occurrence.

Where to report your company?

You can file your report online at the website below:

You can find more information in the Small Entity Compliance Handbook about BOIR Beneficial Ownership Information Reporting.

Business Information Record Template:

It is good to have your business information on hand to use to file tax or submit information related to your business easily.

If you don’t have a time to create a template you can use to gather your business information at your fingertip, you can purchase a Business Information Record spreadsheet from our store:

Conclusion: How to file an LLC Beneficial Ownership Information Report?

Resources

Related article categories

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” I am not a CPA. Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Ads Disclaimer:

Ads are displayed in our contents. These ads do not influence the content we create and publish. We do not endorse them either.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Vision

Nina’s Soap was created to help you live a healthy lifestyle within your budget while increasing your net worth.

Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you will find information about living a quality life within budget and increasing your net worth. Topics covered include personal finance, investment, business management, cooking from scratch, and growing some vegetables and fruit to save money and eat healthy.

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel), https://www.pinterest.com/ninassoap/ (Pinterest), https://ninasoap.com/affiliate-products/ (Our resource page)”.