Daily swing trading stock picks-Easy swing trading strategy-Swing trading chart analysis- Entry and Exit in swing trading

An Easy swing trading strategy could be to set your entry in swing trading to purchase a stock after it pulled back to its main trend line and started to go up. You set your exit from the swing trade by targeting a certain the next recognizable month the stock reaches new high. You write down your entry and exit for each stock you want to hold though multiple swings after you purchase it. Then you analyze the stock chart to track the course of the stock’s price throughout the year.

The video explains how we set a longer trend line swing trading strategy for 2025.

This strategy allows you to trade a few times a week, freeing you some time. You do not make profit daily in your swing trade. You don’t sell your stocks after a few days but could wait weeks or months to sell for a bigger profit.

First, record your swing trades of the day. Then analyze the stock chart using your swing trading stock watchlist to pick stocks you will trade the next day or next time the stock market is open.

Daily transaction history

After the market closes, download the daily transaction history from your brokerage website.

Save it.

Swing trading recordkeeping

Record the swing trades in your swing trading spreadsheet using the daily transaction history you downloaded.

Your swing trading recordkeeping consists of you recording your stock purchases, stocks sold, and dividend earned.

Swing trading stock chart analysis

Analyze your stocks’ charts to mark down stocks you might analyze the next day and purchase some shares if they meet your swing trading criteria.

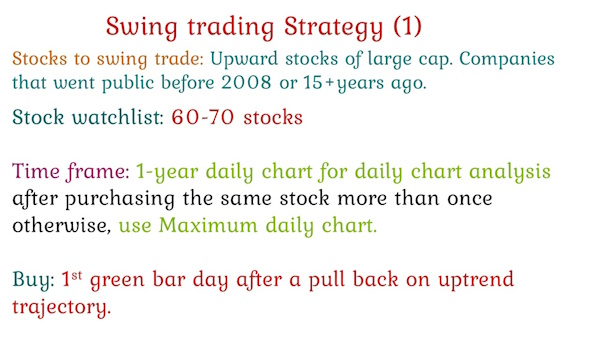

Swing trading strategy

To select stocks to swing trade the next day, analyze the chart of these stocks.

Time frame for swing trading: 1-year daily chart for stocks you swing traded more than once or maximum daily chart for stocks you never traded before.

Swing trading stock watchlist: large capitalization companies’ stocks that went public before 2008 and have upward overall trend to their maximum monthly stock charts.

Stock to pick for swing trading today: Up-trending stocks that pulled back the day before.

Swing trading strategy: Buy up-trending stocks at the 1st green price bar that followed the previous day pull red bar.

Swing trading purchase order: Set a limit price to buy some share of stock at the price it is currently selling.

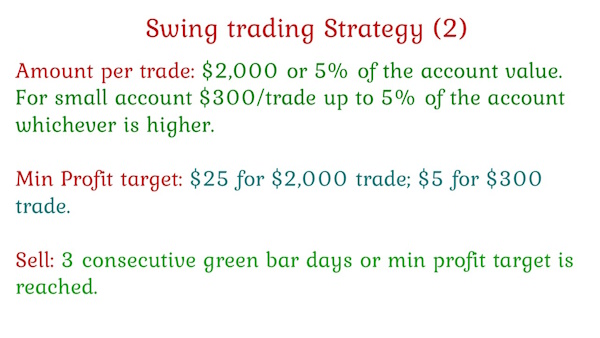

How much to spend per swing trade: allocate $300 per swing trade or up to 5% of your swing trading account value which is higher.

When to exit swing trading: Sell a swing trading stock when your minimum profit target is reached or exceeded.

Swing trading sale order: Set a limit price to sell your stock at the price it is selling at the time of the sale order request.

What time of the day to swing trade: If you have a full-time job, pick a time of the day to swing trade stocks. You can place your swing trades early in the morning before the market opens. At which case you picked stocks to swing trade after you see the 1st green price bar the day before on their up-trending daily chart.

You can swing trade around your lunchtime around noon when the stock market is open and halfway through the day. This allows plenty of time for the stocks to display whether their price will go up that day for you to buy the ones you picked or not.

Conclusion: Daily swing trading stock picks-Swing trading daily routine

This video explains how we record our swing trading transactions of the day and analyze the stocks charts to pick stocks to swing trade the next business day.

Resources

Related article categories

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” I am not a CPA. Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Ads Disclaimer:

Ads are displayed in our contents. These ads do not influence the content we create and publish. We do not endorse them either.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Vision

Nina’s Soap was created to help you live a healthy lifestyle within your budget while increasing your net worth.

Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you will find information about living a quality life within budget and increasing your net worth. Topics covered include personal finance, investment, business management, cooking from scratch, and growing some vegetables and fruit to save money and eat healthy.

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel), https://www.pinterest.com/ninassoap/ (Pinterest), https://ninasoap.com/affiliate-products/ (Our resource page)”.