To file Form 941 for a quarter, you need to have up to date your payroll record including:

- A record of wages paid during that quarter of the year to employees and business officers that worked in the business during that quarter.

- A record of the social security withheld from employees and officers’ wages for that quarter.

- Have on hand the Medicare withheld from employees and officers’ wages for that quarter.

- A record of income tax withheld from employees and officers’ wages for that quarter.

- Have a record of social security and Medicare tax your business needs to pay on employees and officers’ wages for that quarter.

- Have a record of social security, Medicare tax, income tax deposited for that quarter.

- Know the number of employees that worked and received wages during that quarter of the year.

- If you plan to paper file Form 941, download a copy from www.irs.gov and save in your file to fill out.

- Download the instructions to Form 941 where you can locate the address where to mail the form 941 when it is completed and signed.

The video explains Instructions for form 941.

How do I fill out form 941 for 2024 Quarter?

To file Form 941 Employer Quarterly Federal Tax Return for a quarter you do the following:

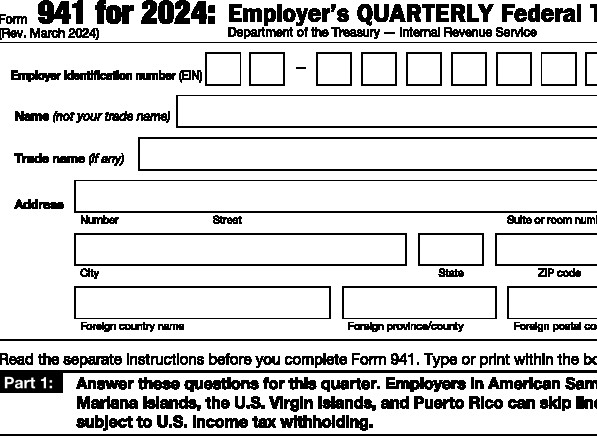

Open Form 941 and its instructions that you downloaded from the IRS website.

Enter your business information including EIN, business legal name and business address.

Check the quarter in the box on the right side of the form.

For any line that is 0-dollar amount, leave is blank except Line 1, 2, and 12.

Enter your decimal numbers or cents even if it 0. Don’t round your numbers to whole dollar.

Complete form 941 with the payroll data pertaining to the quarter.

Print the form out.

Review and sign if you are one of the owners of the business.

Make a copy to keep for your business record.

Mail the Form 941 for that quarter via USPS certified mail to the address found in the IRS instructions for Form 941 in the column “Without Payment” that corresponds to the row your state is located on if you made your payroll tax deposit following your chosen payroll tax deposit schedule and you do not have any balance due on the form 941 you are filling or intend to deposit your balance due by the due date of the tax return.

If you are eligible to make a payment of your balance due with the form 941, and you choose to do so, you complete Form 941-V at the end of Form 941 and complete a check as instructed. Mail all 3 pieces including Form 941 for the quarter, Form 941-V, and the check (in one envelope but NOT stapled to each other) to the address found in the IRS instructions for Form 941 in the column “With Payment” that corresponds to the row your state is located on.

In general, if you are required to file Form 941 Employer Quarterly Federal Employment Tax Return, you are expected to file it every quarter even if you don’t have payroll tax to report. It is a quarterly tax return filed at the end of every quarter. However, IRS has some exceptions. One exception is for seasonal employers.

If you are a seasonal employer and hire employees some parts of the year only, you could check box 18 on Form 941 every quarter you file Form 941 to let the IRS know you are not going to file that form for quarters you don’t have employees. You will also check the box next to the quarter you are filling for, in the right-side corner of page 1.

You can read more in the IRS instructions for 2024 Form 941 page 4.

Where to find Form 941?

On the IRS website, search Form 941 from their search bar.

www.irs.gov

Download Form 941 and IRS Instructions for Form 941.

You can also access the links to both forms from our blog page “Federal Tax Forms and Instructions Links” or here:

How to assemble your form 941?

Staple your first 2 pages of Form 941.

Add form 941-V if completed but don’t staple it to Form 941.

Write the check as instructed in the Form 941-V Instructions under the Form 941.

Enclosed in an envelope the following:

Form 941 for the quarter.

Form 941-V if completed.

And the check if Form 941-V is completed.

Mail to IRS.

Where to mail Form 941 with payment for 2024?

On the IRS instructions for form 941 for 2024 page 7, locate your state in the address table.

The address in the column “with payment” that corresponds to the row your state is, is the address to mail your Form 941, Form 941-V, and the check payment for 2024.

Mail your return via USPS certified mail and keep the receipt and tracking number with your business copy of the tax return.

Where to mail Form 941 without payment for 2024?

On the IRS instructions for form 941 for 2024 page 7, locate your state in the address table.

The address in the column “without payment” that corresponds to the row your state is, is the address to mail your Form 941 for 2024.

Mail your return via USPS certified mail and keep the receipt and tracking number with your business copy of the tax return.

When is Form 941 due?

The 1st quarter Form 941 is due by April 30 and includes January, February, and March payroll tax reports.

The 2nd quarter Form 941 is due by July 31 and includes April, May, and June payroll tax reports.

The 3rd quarter Form 941 is due by October 31 and includes July, August, and September payroll tax reports.

The 4th quarter Form 941 is due by January 31 and includes October, November, and December payroll tax reports.

Track your payroll.

When you start paying wages and would like to track your payroll manually, you could design a payroll spreadsheet in a layout that will help you gather your payroll to file Form 941, Form 940 FUTA tax, and W2/W3 with SSA. If you do not have time to design your own, you can download a payroll spreadsheet for free from our blog under “Free Download”. There are few to choose from but the “Free Payroll Spreadsheet-Form 940-B22F2” could be a good one to give it a try. We have a video and an article on how to use it. Just make sure no formula is broken. You are responsible of tracking your business data accurately.

Conclusion: Instructions for Form 941 Explained

Resources

Related article categories

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” I am not a CPA. Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Ads Disclaimer:

Ads are displayed in our contents. These ads do not influence the content we create and publish. We do not endorse them either.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Vision

Nina’s Soap was created to help you live a healthy lifestyle within your budget while increasing your net worth.

Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you will find information about living a quality life within budget and increasing your net worth. Topics covered include personal finance, investment, business management, cooking from scratch, and growing some vegetables and fruit to save money and eat healthy.

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel), https://www.pinterest.com/ninassoap/ (Pinterest), https://ninasoap.com/affiliate-products/ (Our resource page)”.