To fill out Form 940 for 2024, you should have the following documents on hand:

- Your payroll record for 2024

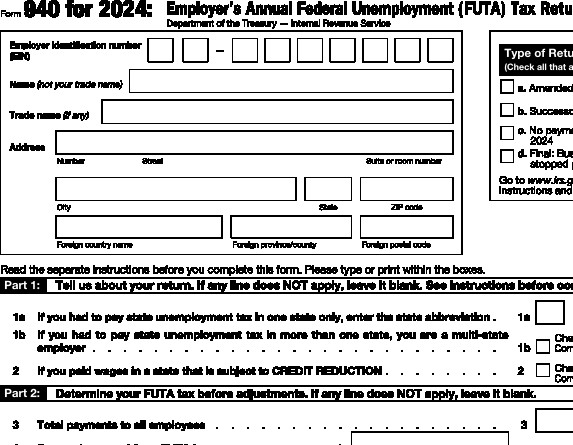

- Download Form 940 for 2024

- Download the IRS Instructions for form 940.

- Download Schedule A (Form 940) if you paid wages in more than one state or paid wages in a credit reduction state.

You can access the link to IRS Form 940 for 2024 on the IRS website. You could also access the link to these URL on our website or here.

How to track wages for unemployment tax?

Your payroll spreadsheet should track payroll for each employee by month as well as the cumulative payroll for each employee for FUTA purposes.

Your payroll worksheet should also calculate FUTA on each employee payroll for you to know when your business pays FUTA tax on the first $7,000 you paid an employee after you excluded wages exempt from FUTA like fringe benefits.

Is FUTA calculated on gross or net wages?

FUTA (Federal Unemployment Tax Act) is calculated on the gross wages up to the first $7,000 paid to each employee during the year after wages exempt from FUTA are excluded.

Is FUTA paid quarterly or annually?

FUTA tax is paid annually or deposited quarterly. If FUTA is more than $500 during a quarter, you are required to make FUTA deposit for that quarter. If your FUTA tax is less than $500 for a quarter, you don’t need to deposit it. You carry it to the next quarter until the cumulative exceeds $500 for a quarter and you deposit the full amount.

If your FUTA in quarter 4 is more than $500, you are required to deposit it by the end of January.

If your FUTA tax in quarter 4 is $500 or less, you can deposit it or make payment with your Form 940.

Form 940 is filed once a year. FUTA payment is made once a year with FUTA Form 940 if the payment is less than $500. FUTA tax is deposited quarterly when the amount is more than $500 for the quarter.

FUTA tax rate for 2024

FUTA tax is 0.6% if you can claim the maximum credit. Otherwise, it is 6% of the $7,000 paid to each employee a year.

If you paid FUTA tax to your state by the due date of IRS Form 940 (January 31st), you could get a credit on FUTA up to 5.4%.

Your business pays 0.6% on the first $7,000 wages paid to each employee during the year after you exclude payments not subject to FUTA from the wages. Every quarter, determine the portion of the first $7,000 paid to each employee during that quarter to pay FUTA tax on it. Once you pay FUTA tax on the $7,000 wages for an employee, you don’t continue paying FUTA tax on that employee for that year.

You can check with your state department of labor or your state workforce for unemployment insurance rules and whether your business is required to contribute to your state unemployment tax.

https://oui.doleta.gov/unemploy/agencies.asp

You can also search on Google.com for your state unemployment.

If you are required to pay unemployment tax to your state, you should register with your state labor department and file and pay your unemployment taxes.

Conclusion: How to Fill out IRS Form 940 for 2024 Employer’s Annual Federal Unemployment Tax Return FUTA

The video explains how to file Form 940 for 2024.

Resources

Related article categories

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” I am not a CPA. Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Ads Disclaimer:

Ads are displayed in our contents. These ads do not influence the content we create and publish. We do not endorse them either.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Vision

Nina’s Soap was created to help you live a healthy lifestyle within your budget while increasing your net worth.

Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you will find information about living a quality life within budget and increasing your net worth. Topics covered include personal finance, investment, business management, cooking from scratch, and growing some vegetables and fruit to save money and eat healthy.

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel), https://www.pinterest.com/ninassoap/ (Pinterest), https://ninasoap.com/affiliate-products/ (Our resource page)”.