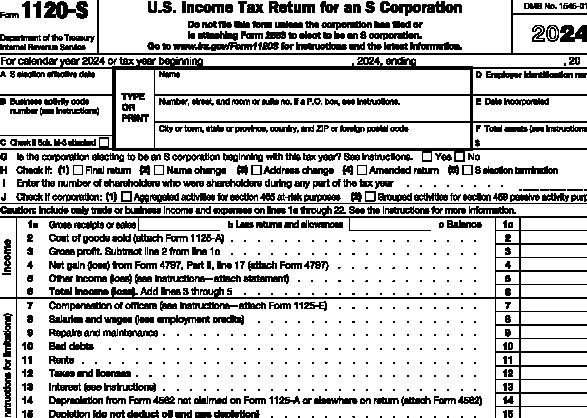

To keep your business expenses low, you can file Form 1120S for your LLC taxed as an S Corporation, yourself. You can fill out form 1120S and Schedule K-1 first, to have an idea what documents you need to pull data from and then, you use a tax software to file the Form 1120S to save time.

Before you file your S corporation tax return using a tax software you can fill out Form 1120S to have an idea whether you gathered all the financial documents needed to file your business tax return.

You can download Form 1120S and Schedule K-1 (Form 1120S) from irs.gov.

To file Form 1120S you will need to have the following financial documents on hand to pull your numbers from:

Balance sheet:

From the balance sheet you will find your business total asset value to enter on Form 1120S page 1 Box F: Total Assets.

Inventory and Sales record or Income Statement:

You will need your business annual gross revenues.

If you sell physical products and carry inventory, you should have inventory management record to complete Form 1125A Cost of Goods Sold. You will need:

Inventory at the start of the year,

Purchases or addition to the inventory during the year including finished goods,

Value of your inventory at the end of the year,

And the cost of goods sold during the year.

The business gross revenue and cost of goods sold will go on Form 1120S page 1 “Income” section if your business is an active business activity.

Payroll record:

You will need:

Wages paid during the year,

Your business portion of employment taxes,

And unemployment tax paid.

Long term asset record:

If you depreciate business assets or purchase assets during the year, you will need the purchase price and when you placed it in business during the year. If you want to depreciate the new asset, the depreciation deduction for the year will go on Form 4562 Depreciation and Amortization and on Form 1120S page 1. If the new asset placed in service during the year qualified for Section 179 deduction to expense it in full in the year you placed it in service, the Section 179 deduction will be entered on Schedule K of Form 1120S and will flow to Schedule K-1 Form 1120S for the partners to claim their portion of the deduction on their Form 1040 Individual income tax return.

Bookkeeping journal or business expenses record:

Your business expense record allows you to complete the expense section of form 1120S.

For expenses you do not find line for, you enter them on Line 20 Other Deductions on Form 1120S page 1 and add an attachment that detail the different cost components of that line.

If you have revenues related to rental real estate, you will complete Form 8825 for rental real estate income and expense and put the profit or loss on Schedule K form 1120S.

Royalties’ income and expenses will go on Schedule K Form 1120S.

You will complete:

Form 1120S page 1,

Schedule B (Form 1120S),

Schedule K,

Schedule M-2.

Depending on your business income level, you may not need to complete Schedule M-1 and schedule L.

Schedule K-1 (Form 1120S):

You will complete Schedule K-1 for each partner. You will need each partner’s information and his or her ownership percentage.

If your Schedule K-1s are well completed they all should total to Schedule K Form 1120S line by line.

QBI

If you qualify for QBI deduction, the software you use to file Form 1120S, will complete the appropriate forms and add the QBI deduction to each partner Schedule K-1 based on their ownership percentage.

Conclusion: How to fill out 1120S tax form for 2024?

The video explains how to complete Form 1120S, Schedule B, Schedule K, Schedule M-2, and Schedule K-1 for 2024.

Using a tax software to file your Form 1120S allows you to save time as the software will enter your numbers on all forms that they should be entered on as well as completing the state tax return for you.

You review all the entries and e file.

You will be able to print the Form 1120S and Schedule K-1s for your business record and give a copy of Schedule K-1 to each partner.

Form 1120 S is due by March 15, and you are required to give business partners their Schedule K-1 by that date as well so that they have time to file their Form 1040 Individual income tax return on time.

Resources

Related article categories

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” I am not a CPA. Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Ads Disclaimer:

Ads are displayed in our contents. These ads do not influence the content we create and publish. We do not endorse them either.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Vision

Nina’s Soap was created to help you live a healthy lifestyle within your budget while increasing your net worth.

Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you will find information about living a quality life within budget and increasing your net worth. Topics covered include personal finance, investment, business management, cooking from scratch, and growing some vegetables and fruit to save money and eat healthy.

Our content categories:

Personal Finance: Saving money, budgeting, investing, swing trading stocks

Cooking from scratch to eat healthy and save money: Grocery list, meal plan, sourdough starter, simple dishes.

Sustainable Perennial Food Garden Zone 5A: Low maintenance vegetables to grow to save money and eat healthy

Business management: Business tax, inventory management, business bookkeeping, making money online, IT.

Production: Sew to sell, YouTube content to make money online and to market your online store.

Self-Improvement: Work life balance, productivity.

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel), https://www.pinterest.com/ninassoap/ (Pinterest), https://ninasoap.com/affiliate-products/ (Our resource page)”.