To depreciate a business asset:

- Choose the MACRS System.

- Locate the asset Class Life.

- Locate the asset Recovery Period.

- Locate the asset Classification of Property.

- Choose the Depreciation Method.

- Find the right Convention.

- Know which month and quarter the asset was placed in service.

- Locate the rate table.

- Locate the right rate column.

- Calculate your asset depreciation deduction for each year.

- Complete Form 4562 to report the depreciation.

The tutorial will demonstrate how to calculate depreciation deduction for assets and how to complete Form 4562 Depreciation Amortization for 2023.

Open IRS Publication 946 How to Depreciate Property. Scroll down to “Which Property Class Applies Under GDS?”. Look for your depreciable asset in the list of assets under the property classes. Your asset might be listed or may not.

Scroll down to Appendix B-Table of Class Lives and Recovery Periods. It is toward the end of the publication.

Look at table B-1 and search for your business asset.

Table B-1 is a list of business assets that are used in all types of businesses and the number of years to depreciate them.

Table B-2 is the list of businesses and some specific business assets used within these businesses and how many years to depreciate these assets.

If you didn’t find your asset in the short list of assets under the property classes, you will need to use both Appendix B Table B-1 and Table B-2 to identify how to depreciate your business asset.

1st look in Appendix B Table B-1 list of assets used in all businesses. If you find your business asset in table B-1 note the recovery period.

Case 1:

Go to Table B-2 Assets Class and look for your business activity. If you locate it, check is your asset is listed under your business activity. If your asset is clearly named in the list, note the recovery period for assets listed under that business activity in table B-2. That is the recovery period to use to depreciate your asset.

Case 2:

If your asset is not listed under your business activity in table B-2, go back to Table B-1 where you find your asset is listed, and use the corresponding recovery period.

Case 3:

Your asset is not listed in table B-1. Your business activity is listed in Table B-2. Your asset is not listed under your business activity in table B-2. Use the business activity’s recovery period in table B-2 to depreciate your asset.

Case 4:

Your asset is listed in Table B-1. Your business activity is not listed in Table B-2. Use the recovery period from Table B-1 corresponding to your asset to depreciate it.

After you locate your asset in Appendix B, you will find the following information to note on your depreciation spreadsheet:

Asset Class

Years of Class Life

Recovery Period under GDS

You will use the information you noted from Appendix B to correspond to the right rate table name in Appendix A.

Go to Appendix A in the same IRS Publication 946.

Knowing the MACRS System you will use (GDS), choose the Depreciation Method you want to use that correspond to the Recovery Period assigned to your asset that you found from Appendix B. Usually you have the choice between 200%, 150%, and Straight Line (SL) as depreciation method for GDS.

With these last 2 information, locate the right Convention that applies to you. Without including residential rental properties and non-residential real properties, you have the choice between Mid Quarter (MQ) and Half Year(HY).

When to use Mid Quarter Convention?

If in Q4, the cost of assets you purchased and placed in service in Q4 are 40% or more than the total cost of all assets you placed in service during the year (without including the cost of residential rental properties and nonresidential real properties placed in service that year), you must used MQ Convention. It means any asset you will depreciate; you start their depreciation mid quarter in the quarter it was placed in service.

When to use Half Year Convention?

If you didn’t purchase and placed assets in service in the last quarter (assuming calendar year) that are 40% or more that the total of assets placed in service during the year excluding residential rental properties and nonresidential real properties, you use HY Convention. Each asset is depreciated taking half year depreciation deduction the first year and the other half at the end of the depreciation year.

Asset Class Life

If you didn’t know your asset recovery period from Appendix B, the asset class life in years located in Appendix B will help you locate the recovery period in Appendix A table.

When did you place your asset in service in your business?

In your depreciation spreadsheet, you should have a record of when you placed your asset in service. That date would be useful when using Appendix A. It is another criterion to apply to narrow your choices toward the type of rate you should use in your depreciation.

Depreciation Rate

In Appendix A, when you choose the MACRS System, the Depreciation Method, locate the Recovery Period based on the asset Class Life, locate the right Convention applied to your asset, based on the month or quarter you placed the asset in service, you will be able to determine in the Rate Table column the title of the depreciation rate to use in your asset depreciation.

Once you locate the rate title, you note it in your depreciation spreadsheet.

You scroll down pass Appendix A to locate the rate.

You record the appropriate column rate in your depreciation spreadsheet and calculate the depreciation deduction for each year.

These deductions will remain the same. It is recommended to keep a good record of your business assets depreciation to be able to refer to it every year to pull the depreciation deduction for assets placed in services in prior years.

Once your depreciation spreadsheet is updated for the current tax year you want to file for, you are ready to complete Form 4562 if it is required of your business.

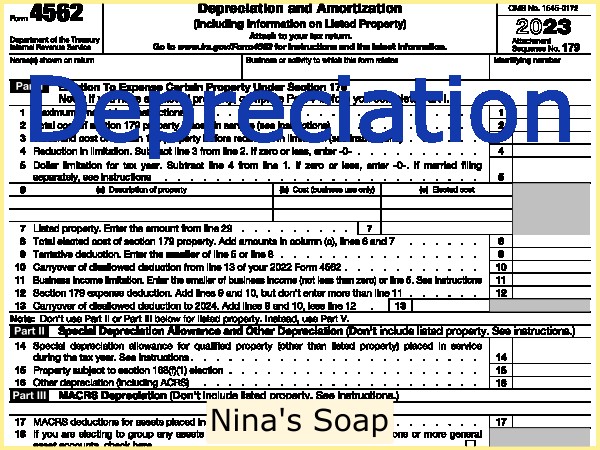

In the example below, we will explain how to depreciate a business asset and complete form 4562 Depreciation and Amortization.

How to depreciate a business asset?

We can take an example of iron purchased for business use and depreciate it. Iron is not listed in the general list of assets in the property class section of IRS Publication 946 nor in the IRS Instructions for Form 4562.

We need to visit Appendix B.

How to find asset recovery period?

The iron was placed in service in March 2023 in a retail business. What is its recovery period?

Iron is not listed among the assets list in Appendix B Table B-1.

Table B-2 revealed our retail business is Asset class 57.0 Distributive Trades and Services. The Asset Class 23.0 “Manufacture of Apparel and Other Finished Products” qualified as well as it is a sub activity of our retail business, and the iron is used in sewing woven fabric. In both classes 57.0 and 23.0, iron is not specifically listed among the assets used in these business activities.

Our iron is not listed in Table B-1. The business activity the iron is used in, is listed in Table B-2. However, iron is not specifically named in the list of assets under the business activity in the Table B-2 either. Therefore, we will use the recovery period listed under the business activity in Table B-2 for the iron. In this case, for retail business in Table B-2 Asset Class 57.0 the iron has 9 years class life and 5 years recovery period under the General Depreciation System GDS (MACRS).

When using sewing business under asset class 23.0, the iron class life is 9 years also and the recovery period is 5 years under GDS.

With the recovery period located, we will update our depreciation and amortization workbook. Then we go back to IRS Publication 946 How to Depreciate Property Appendix A to locate the right depreciation method and the right depreciation rate table to use in our iron depreciation.

How to choose the Depreciation Method?

In Appendix A, there are multiple options to choose from for 5-year recovery period for the iron. Under GDS, you have 200%, 150%, and SL (straight line) depreciations methods.

In the case of iron, Using GDS system, we will choose the straight Line (SL) Depreciation Method as we do not want to take higher depreciation in early years but spread it throughout the life of the asset. Next, we need to know the right convention to choose.

Choose Convention

To choose the convention for your asset, you need to know the total of asset placed in service during the year. You also need to know when they were placed in service. You need to calculate the proportion of assets placed in service in the last quarter compared to all year. If you placed 40% of your business assets in service during the last quarter of the year, you are required to choose mid quarter convention (MQ). In the mid-quarter convention, you placed each asset in service during the year halfway through its quarter.

If you didn’t purchase and place 40% or more of assets in your business during the last quarter of the year, you use Half-Year Convention for the assets. In the iron example, it was the only asset purchased and placed in service in 2023. It was placed in service in March or the 1st quarter. Our convention is Half-Year.

Knowing the depreciation method (SL), the recovery period (5 years), convention (Half Year), you look at the corresponding rate table number. All these conditions need to be on the same row in the Appendix A Table to locate the title of the rate to use.

How find the depreciation rate table?

With the depreciation method (SL), the recovery period (5 years), convention (Half Year), the corresponding rate table number is A-8.

You scroll down looking for table A-8.

A look at A-8, you will find the 5-year rate column. It has 6 rates.

The iron will be depreciated in 6 years. With the half year convention, the 1st and last year (year 6) will claim half year depreciation amount. The remaining years between will claim 1 full year amount. The asset will be depreciated in full in 6 years.

Depreciation spreadsheet

Update your depreciation workbook with the convention, depreciation method chosen and the recovery period.

Then add the rate in your depreciation spreadsheet for it to calculate the depreciation amount for every year.

The depreciation amount for the year the asset is placed in service will be reported on Form 4562 Depreciation and Amortization as it is required to complete that form for the first year an asset is placed in service. The 1st year depreciation deduction will go on Line 19 Section B on Form 4562 Depreciation and Amortization as we elect not to claim Section 179 and special depreciation.

How to complete Form 4562 Depreciation and Amortization?

Download Form 4562 Depreciation and Amortization from IRS website: www.irs.gov.

You can also access the link to some IRS forms and instructions here under Federal Tax Forms and Instructions https://ninasoap.com/federal-tax-forms-and-instructions.

Business Information

Add your business name on top.

Add the business activity that used the assets been depreciated on this form.

Use a separate Form 4562 for each business activity or business. Complete Part I Section 179 on one Form 4562. IRS Instructions for Form 4562 for 2022 page 1.

I like to complete Part IV Summary on one Form 4562 as well.

In our example, add your business EIN number on Form 4562.

Part I Section 179

We are not claiming Section 179. In our attachments, we will add we elect not to claim Section 179, and Special Depreciation. We elect Straight Line depreciation method for our assets’ classes.

Leave Part I Line 1-13 blank.

Part II Special Depreciation

Leave Line 14-16 blank.

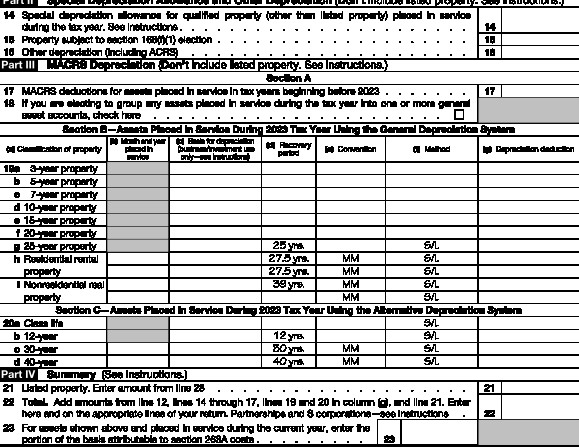

Part III MACRS Depreciation Section A

Line 17 Prior years assets:

If you have placed assets in service in prior years and have been depreciating them, the current year depreciation deduction will go on line 17. Find your depreciation spreadsheet for these assets.

If you don’t use an accounting software or need a tool to record your asset depreciation, you can design your own in Google sheet or Excel spreadsheet, or you could purchase our Depreciation and Amortization Worksheet at https://liberdownload.com. There are few for you to choose from. You can access them here.

In our example prior year assets depreciation record show the current year depreciation deduction amount to report on Line 17.

Make a PDF record of your asset depreciation for your business tax record.

Line 18 Box: Leave it blank if you do not want to group assets. I don’t like to group asset because if an asset in the group is disposed of, at some point before the end of its depreciation years, you do not change the basis cost of the grouped assets. You file Form 4797 to report the remaining years of depreciation as income. You continue depreciating the grouped assets as if no assets were removed out of the group. If you want to group assets, you group assets that have the same property class and have the same recovery period. You can read more about it on IRS Publication 946 How to Depreciate Property in section “How do you use General Asset Account GAA”.

Form 4562 Part III Section B: Assets placed in service during the year

Report information from your depreciation spreadsheet on the appropriate line for each asset.

How to locate your asset classification of property?

For the iron example, in Appendix B we found out the class life is 9 years, and the recovery period is 5 years under GDS. You go to IRS Instructions for Form 4562 to see what classification of property corresponds to 9 years. It is 5-year property. That means you will report our iron depreciation information on Line 19b “5-year property”.

You complete the row for Line 19 that is related to your business assets.

Part IV Summary

Line 22 Total: That will be Line 17 + Line 19b in our example.

If you depreciated listed properties, they total will go on Line 21 Listed property.

Line 22 should not include total form Line 12 section 179 if your business is partnership or S Corporation. The section 179 deduction will go on Schedule K and partner’s Schedule K-1 for them to report them on appropriate form when filing their 1040.

Line 22 is the total of your depreciation deduction for the year, amortization not included and also not included is Section 179 deduction for partnerships and S Corporations. You will report amortization separately on your business tax return under other deduction and add an attachment.

Part V Listed property

If you didn’t depreciate a listed property, leave Part V blank.

You can read more about listed properties and exceptions on IRS instructions for Form 4562 page 2.

Part VI Amortization

If you amortized an intangible asset during the year, the asset amortization information from your amortization spreadsheet should go on Part VI line 42. In the column d of Line 42, you will enter the code which can be found in the IRS Instructions for Form 4562 on page 14-15. You will also locate how long to amortize your intangible asset. There are some exceptions.

Should you depreciate or amortize computer software?

If you purchase a computer software and paid 1 time fee, IRS recommends you depreciation it for 36 months using Straight Line depreciation method as it is intangible asset other than 197 intangibles. You can read more on it in the IRS Instructions Form 4562 on page 6 or IRS Publication 946 page 9 or so.

Line 43: you enter the amortization deduction for intangible assets placed in service in prior years.

Line 44: You total both line 42 and line 43 column f deduction amount for the year.

You are done completing Form 4562 for the year. Total from line 22 and line 44 will go on your business tax return.

How to depreciate a business asset Form 4562 for 2023

The video explains step by step how to depreciate a business asset.

Resources

Related article categories

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” I am not a CPA. Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Ads Disclaimer:

Ads are displayed in our contents. These ads do not influence the content we create and publish. We do not endorse them either.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Vision

Nina’s Soap was created to help you live a healthy lifestyle within your budget while increasing your net worth.

Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you will find information about living a quality life within budget and increasing your net worth. Topics covered include personal finance, investment, business management, cooking from scratch, and growing some vegetables and fruit to save money and eat healthy.

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel), https://www.pinterest.com/ninassoap/ (Pinterest), https://ninasoap.com/affiliate-products/ (Our resource page)”.