Use a limit price to place a swing trade purchase order. The limit price allows the brokerage firm to purchase the stock for you at a price lower or equal to the price you set.

A limit price set to sell a stock allows the brokerage firm to sell the stock at a price higher or equal to the price you set.

How do I place an order for swing trading

To place a swing trade order to purchase stock before the market opens,

You analyze the daily chart and if you see the 1st green price bar after a pull back on an uptrend line, you can place the order to buy some shares.

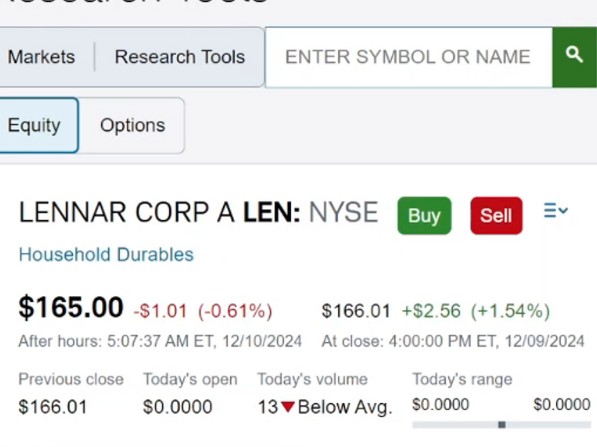

You can set a limit price to equal the lesser of the current premarket price or the price at the closing of the market the day prior.

When the market opens, if the stock price goes down to that price, the brokerage firm will buy the stock for you.

Around noon after the stock market is open, you can review your swing trading portfolio.

If there are stocks that have unrealized gains that exceeded the minimum profit per trade goal you set, you analyze their charts to decide whether to sell them.

If you decide to sell them to lock in the profit, place an order to sell each one of these stocks.

Set a limit price to be the same as the current stock market price. Review your request and place the swing trade order.

Analyze the stock chart of the stocks you picked from your stock watchlist to swing trade that day.

If they started to go up and display their 1st green price bar after a previous day pull bar (red bar), place the order to buy them.

During your purchase requests, set a limit price to equal the current stock price for each one of these stocks.

If the price reaches that level, your brokerage firm will purchase them for you.

At the end of the day, after the market closed, pull your account daily transaction from your account history, to review stocks that were purchased and the ones that were sold.

Record them in your swing trading worksheet.

Analyze the chart and pick stocks for the next day when the stock market opens.

How much to spend per trade in swing trading

To buy stocks for swing trading, you can set an amount to allocate per swing trade. The amount will determine the number of shares to purchase.

Alternatively, in addition to allocating an amount per swing trade, you can also use the minimum profit target to determine the number of shares to purchase to reach the profit target.

Conclusion: How to buy stock for swing trading-How do I place a swing trade order-How many shares to buy?

Resources

Related article categories

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” I am not a CPA. Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Ads Disclaimer:

Ads are displayed in our contents. These ads do not influence the content we create and publish. We do not endorse them either.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Vision

Nina’s Soap was created to help you live a healthy lifestyle within your budget while increasing your net worth.

Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you will find information about living a quality life within budget and increasing your net worth. Topics covered include personal finance, investment, business management, cooking from scratch, and growing some vegetables and fruit to save money and eat healthy.

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel), https://www.pinterest.com/ninassoap/ (Pinterest), https://ninasoap.com/affiliate-products/ (Our resource page)”.