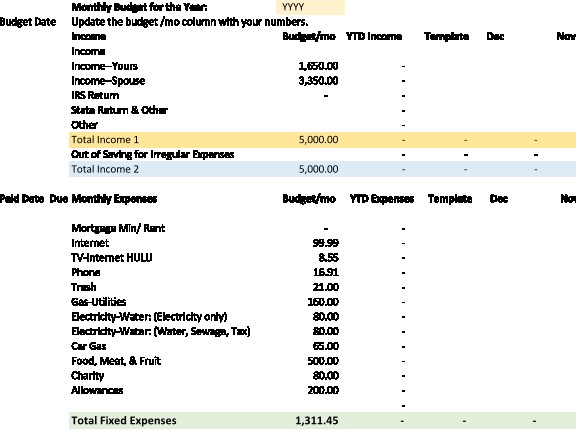

To create your monthly budget, you estimate your household monthly income, your household monthly fixed expenses, and your household monthly irregular expenses you need to save for. With the amount you allocate for groceries, you can create a monthly grocery list to see if you can fit your groceries within the budget you set for it.

You can create your monthly budget using Excel spreadsheet or Google sheet.

What is the best way to plan for known but irregular expenses?

For the irregular expenses, you estimate the annual expenses of these expenses you pay for times to times during the year. Then you total all the annual irregular expenses and divide by 12 to determine the monthly irregular expenses to save for every month.

How do you do your finances every month?

Every month, after you get paid you and your spouse do your finances. You copy the monthly budget and paste in the column of the month.

You leave your estimated fixed expenses amount in the checking account to cover your fixed expenses for the month.

You move the estimated monthly irregular amount in your saving account.

At the end of the month, you do your finances, and you replace the budget amounts with the actual income and expenses for the month. If you make purchases using credit card, you enter your expenses in your budget spreadsheet to track your actual expenses by category.

You review your credit card transactions to make sure you acknowledge every expense and pay your card in full.

In your budget spreadsheet, you have a column for your household monthly budget, and you track the actual monthly expenses and income every month. When creating your monthly budget, underestimate your household income and have an amount lower than your actual income. Overestimate your expenses. You want to make sure in your monthly budget, you allocate enough to cover your monthly expenses.

If you have debts, you can include rows to allocate some of your income toward making extra debts payments to pay them off early.

If you do not have debts, you can have rows to allocate a portion of your income to investment. You can invest some of your income in the stock market or to support a side business or both.

How much of my salary should I save and invest?

If you do not have debts, you can divide your household monthly income by 3 and allocate 1/3 of your income to your monthly fixed expenses by leaving that amount in your checking account. You allocate another 1/3 of your income to irregular expenses to save for and move that amount to your saving account. You allocate the remaining 1/3 of your income to investment and transfer it to your investment account to invest in the stock market.

What percentage of my income should I invest?

Alternatively, to the option above, depending on your income, you can divide your household income by 4. You leave 25% of your monthly income in your checking account for your monthly fixed expenses.

You move 25% of your income to your saving account to save for your irregular expenses.

You transfer 50% of your monthly income to your investment account to invest in the stock market.

With this option, with every portion of your income you live on a month, you invest the same amount a month for your future self.

How to create your monthly grocery list?

Based on what you cook, list the different ingredients you need to make these dishes. Estimate the quantity you need a week and time by 4 for the month.

Add to the list your cleaning products.

Have a column for the name of the ingredients. In another column have the quantities. In the 3rd column you enter the unit price. In the 4th column you insert a formula to calculate the total cost for each ingredient row.

Go to the store or check online and write down your unit price for these ingredients. In the total column, you calculate the cost by multiplying the quantity of each ingredient by its unit price. Then you total the total column to determine the total estimated grocery list. Make adjustments to quantity to stay within your monthly grocery budget.

Conclusion: How do I create a simple monthly budget in Excel?

The video explains how you can create your monthly budget and create a monthly grocery list as well.

Resources

Related article categories

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” I am not a CPA. Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Ads Disclaimer:

Ads are displayed in our contents. These ads do not influence the content we create and publish. We do not endorse them either.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Vision

Nina’s Soap was created to help you live a healthy lifestyle within your budget while increasing your net worth.

Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you will find information about living a quality life within budget and increasing your net worth. Topics covered include personal finance, investment, business management, cooking from scratch, and growing some vegetables and fruit to save money and eat healthy.

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel), https://www.pinterest.com/ninassoap/ (Pinterest), https://ninasoap.com/affiliate-products/ (Our resource page)”.