Few days ago I wrote about how my husband has been a victim of a scam that put us back in credit card debts for over $15,000 within 6 hours.

Few days after the incident, we discussed how to pay the debt off.

Option 1: Pay it off with our investments

He sold his employer’s stock a month earlier and I suggested we save more to add it or add our tax return to it to invest in a rental property. We put the check in a saving account and I created an LLC for our rental property.

One option would be to take the investment money and pay off the debts. If we do so, my priority to pay the mortgage would come next even before we invest in a rental property as it would take us few years to save enough for a down payment in a rental property. I didn’t feel comfortable using many years of investments that were set aside for our future and spend it to pay today expenses. It would be like robbing from our future.

How to Build a Net Worth More than $1 Million within 15 Years

As much as it is important to pay off debts, it is equally important to save and invest for our retirement or to have other sources of income other than our paychecks. It is not just for retirement. Having a rental property that generates cash flow, overtime could easily replace income in case of a loss of job. It would be risky at first to have a mortgage on our house and a mortgage on our rental property. But over time the mortgages would be paid off. It all depends on how much risk everyone is willing to take. Would you be willing to focus on paying off all your debts to minimize your monthly expenses, or are you willing to put a cap on my monthly expenses through budgeting and use the excess income to create a cash flow income that doesn’t involve your employer? You could still do that after all your debts are paid off but it would just take longer. Every decision involves some level of risk and the higher the risk, the higher the reward. Not taking any risk is a risk on its own. Investments need capital and time to grow with the power of compounding interest. Keep paying present debts first to invest later would keep delaying your investment goals. In any case, you need to trim your spending to free as much as possible of your income to either pay your debts or invest depending on what you are comfortable with.

Keeping the cash investment in a saving account until we save enough to purchase a rental property which would take longer because of this debts is not a good investment strategy either. The money would lose value. Putting it back into the stock market is risky as investing in the stock market is a long term goal not a short term one. Investing in CD would tie it up and when we are ready to put it to work, we might get charged a fee that might be more than the interest it earned. Putting in the money market account may not be a good option with the Federal Reserve lowering the interest rate. So I prefer we leave it in the saving account as we keep thinking about how to pay off this debt.

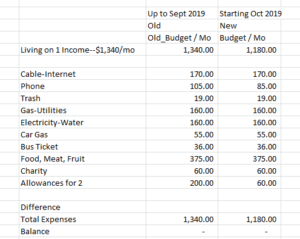

Option 2: Live on one income and use the other to pay off the scam debt

Another option is to move all our expenses and mortgage to our highest income and use the lowest income to pay the credit card debts. We used to live on the smallest income and use the highest income to pay the mortgage. The objective was to invest that income after the mortgage is paid off and continue living on one income. A year ago, we lived on the highest income and paid off consumer debts with the lowest income. The highest income paid the mortgage as well. After the debts were paid, we lived on the lowest income and use the highest income to pay our mortgage and to maintain an investment property. The investment property might require a lot more than we need to come up for a down payment for a rental property for its renovation. We would renovate it before it is rented out. We plan on saving for the renovation after our mortgage is paid off. The investment property doesn’t have mortgage.

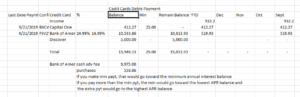

I decided to move our monthly expenses and the mortgage to the highest income and use the lowest income the pay the scam debts. I asked my husband to call Bank of America and ask the interest rate on cash advance. They said 24.99% variable annual APR on his cash advance and 13.99% on his purchases. My original plan was to pay the minimum on all the credit cards and pay the excess toward the lowest balance. However, with 24.99% annual interest on over $9,500, I suggested we pay the highest interest rate first. I asked him to find out from Bank of America how they would apply his payments? Bank of America would apply the minimum payments to the lowest interest rate balance and any excess payments would go toward the higher interest rate balance. I suggested he paid off Capital one which has the lowest balance of $400. The second to target is Bank of America of $10,500 and the third would be Discover. With Capital one paid off, my husband would paid the minimum on Discover and apply the remaining income to Bank of America. Discover has 0 minimum payment at the moment. So he paid the rest of two weeks income to Bank of America. The lowest income is paid twice a week. I suggested we pay the credit cards every two weeks instead of once a month. The reason is credit cards calculate interest on a daily basis not on monthly basis like it is on mortgages.

My husband suggested we balance transfer the remaining balance to Discover after he made the first payment. I asked him to run the numbers. The first month Bank of America would charge him $200 or more and over $150 the second month. If he does the balance transfer to Discover at 0% for 12 month with balance transfer fee of 3%, the fee would be $300. It makes sense to transfer the cash advance from Bank of America to Discover.

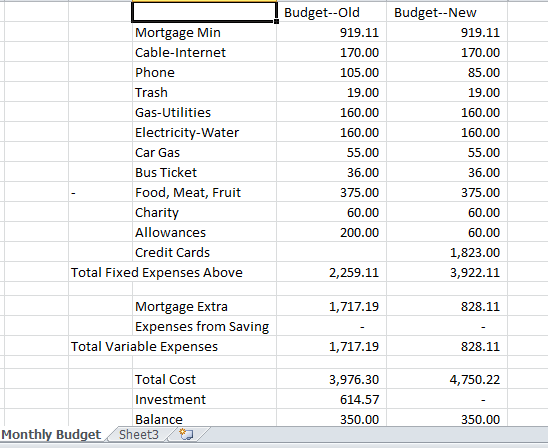

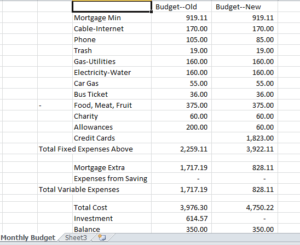

I reevaluated our monthly expenses and decreased our allowances. We won’t be able to pay mortgage with the whole income but little more than the minimum mortgage.

I just want us to handle the situation as if we didn’t have the investments money on hand.

Either option would get us to the target. One option is lowering the amount of interest to pay on debts and mortgage while that would cause a setback in our investments goal. The second option would cause us to pay more in interest as there will be a delay in paying off debts and mortgage but the investments goal will be on track. It all depends on what level of risk everyone is comfortable with.

If you have any suggestion, please do share. How do you handle your finances?

Living Expenses Update:

Monthly Expenses Updated:

Debts Payment Record before the balance transfer:

Check how we budget and live well on less here.