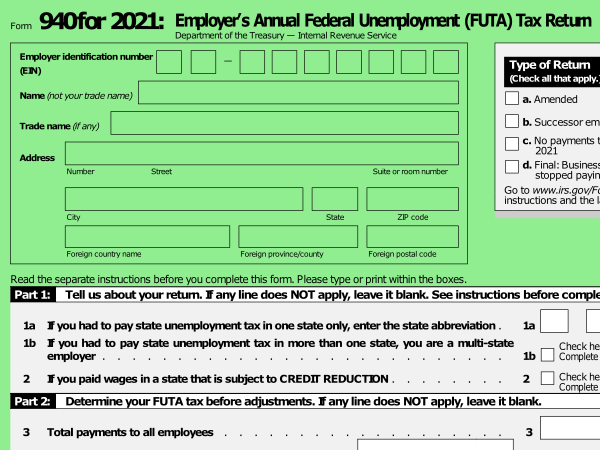

Enter your business Employer Identification Number EIN

Name: Enter your name as the business owner whether it is a sole proprietor, LLC, or S Corporation.

Trade name: Enter your business name exactly the way you entered it to apply for EIN. It should be in the letter you received from IRS when you applied for EIN for your business.

Put your first and last name and your business EIN on the top of page 2

Enter your business address.

To the right of your business information on form 940 is the type of Return

If you didn’t make any payment to any employee in 2020 check box C

If it is your final return, check box d

If none applied to your business don’t check anything.

Your business pays FUTA tax on the first $7,000 you paid to each employee during the year.

When do you file Form 940?

File and submit Form 940 for your business by January 31st.

Form 940 is an annual tax return filled once a year with IRS.

Form 940 Mailing Address

On IRS Instructions for Form 940 page 4, there is a table for Form 940 mailing address.

If you add payment to Form 940

Locate your state. Next if you would add payment to your form in one envelope, Locate the address with payment that corresponds to your state. That is the address to write on the envelope.

If you don’t add payment to Form 940

If you made deposit or didn’t have any tax to pay, you would mail your Form 940 without a payment.

Under the state column, locate your state in the mailing address table and locate the address under “without payment “column that corresponds to your state.

Should you deposit or add your payment to your Form 940?

If your FUTA tax is more than $500 for any quarter, you are required to make a deposit for that quarter.

You make your tax deposit via EFT (Electronic Funds Transfer) using EFTPS (Electronic Funds Transfer Payment System).

EFTPS is a free account you setup with IRS to make tax deposit to the IRS by EFT.

Although Form 940 is annual tax return, you need to track your unemployment tax each time you pay wages. If you unemployment tax is less than $500 in a quarter, you are not required to make deposit. If the cumulative of your unemployment tax is over $500, make a deposit the month that followed the quarter your tax liability went over $500. BY the end of the fourth quarter, if your total undeposited tax including the last quarter is more than $500, you are required to deposit it by January 31. If it is less than $500, you can either deposit it or add your payment to your Form 940.

FUTA deposit schedule

Deposit quarter 1 FUTA tax by April 30,

Q2 by July 31,

Q3 by October 31,

And Q4 deposit by January 31.

How to calculate your FUTA tax?

Do not withhold unemployment tax from your employee’s wages.

Only you the employer pays unemployment tax.

Track how much you pay each one of your staff members.

You pay unemployment tax (FUTA tax) on the first $7,000 you pay to each employee in your business.

Your federal unemployment tax is 6% if you are not paying state unemployment tax.

Should you round your numbers on Form 940?

You can round your numbers to the nearest dollars. But you have to round every number if you choose to round.

You can enter full dollar amount including cents as well. Then you should enter the whole amount throughout he form.

If a line is $0, leave it blank.

2-How to Complete Form 940 for 2021 Employer’s Annual Federal Unemployment Tax Return FUTA

Leave a Comment

You must be logged in to post a comment.