If you produce goods to sell or purchase goods to resale, you will have inventory. Therefore, we need to have your inventory accounted for at the end of December.

How to complete form 1125-A Cost of goods Sold?

You would complete Form 1125-A cost of goods sold information including

Cost of inventory at the beginning of the year

Cost of Purchases or raw materials during the year

Cost of goods sold

Cost of inventory at the end of the year

How do you treat goods taken out of inventory for personal use?

If you are an LLC or S corporation, you would show the cost of goods pulled out of inventory for personal use on Schedule K line— as distribution to partners and on Schedule K-1 as well for the partners that used them. Reduce purchases by the cost of goods used by shareholders.

Read instructions at the bottom of form 1125-A for details needed to understand the entry lines.

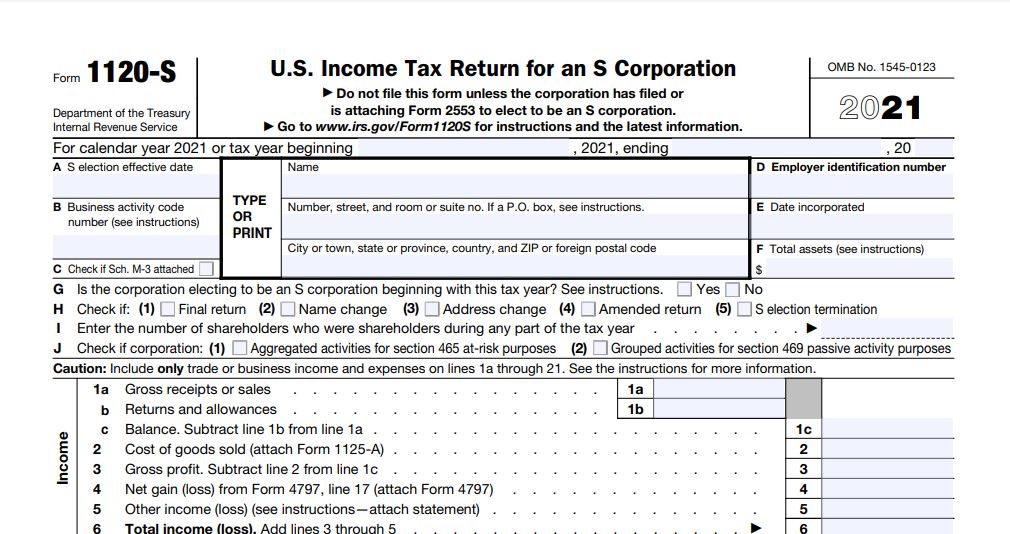

How to complete IRS Form 1120S?

If you have an S corporation or LLC taxed as an S Corporation, you would file IRS Form 1120S for your business.

Line 1a is all your revenues (sale of goods and or services)

Line 1b: returns and refunds

Line 2: Cost of goods sold from line 8 of Form 1125-A

Submit Form 1125-A with your Form 1120S

Line 6: Total income (loss)

How to complete Form 1120S page 1: Deductions?

Do you need to Complete Form 1125-E Compensation of Officers?

If you are an S corporation and file Form 1120S, you would need to complete Form 1125-E if you pay compensation to your officers and your total revenues for the year is $500,000 or more.

Check page 1 of Instructions for form 1125-E Total Receipts to determine the income to factor in the calculation of total receipts.

If you are not required to complete Form 1125-E, you don’t need to attach it either to form 1120S.

Line 7: enter the amount paid to officers as salaries or compensations

Line 8: enter the amount paid to your staff members that are not officers

Changes are a partner or shareholder that works in the business would be an officer. Therefore, the salary would be on line 7.

If you make distribution to your partners that work in the business, these distributions must be treated as salaries or wages for the service they performed in the business up to a certain point that is presumed reasonable amount for the work they performed, before you can treat the remaining distribution as distribution that is not wages and not subject to social security and Medicare Tax.

If it is you the only owner of the business or the only one that works in the business, you could use “Federal Tax Withheld Record Spreadsheet” to track and record your compensation during the year to make your tax completion easier.

Line 12: Taxes and Licenses: See instructions for form 1120S for detail

Line 13: Interest: See instructions for form 1120S for more detail.

Line 14 Depreciation. Do not include Section 179 on this line. It would go on Schedule K and Schedule K-1.

If you placed assets in service during the tax year you are filing for, and would depreciate them, you need to complete Form 4562 Depreciation and Amortization.

Depreciation Spreadsheet-DSS22821:

https://liberdownload.com/downloads/depreciation-summary-spreadsheet-dss22821/

The video is an example of how to complete IRS Form 1120S

Schedule K

Schedule B Form 1120S: Answer the question on schedule B.

Complete Schedule K Form 1120S with the profit or loss from page 1. If you have rental properties, you would enter the profit or loss on Schedule K. Interest income and royalties income would go on schedule K.

Interest expenses and royalties’ expenses would go on schedule K under deductions section.

The video illustrates how to complete Schedule K (Form 1120S).

Schedule K-1

Complete Schedule K-1 (form 1120S) after you completed Form 1120S.

The total schedules K-1 should equal schedule K.

Every line on schedule K would have a corresponding box on schedule K-1. Read IRS Instructions for Form 1120S for every line on schedule K you have entered a number, to see how you should report it on schedule k-1.

Leave a Comment