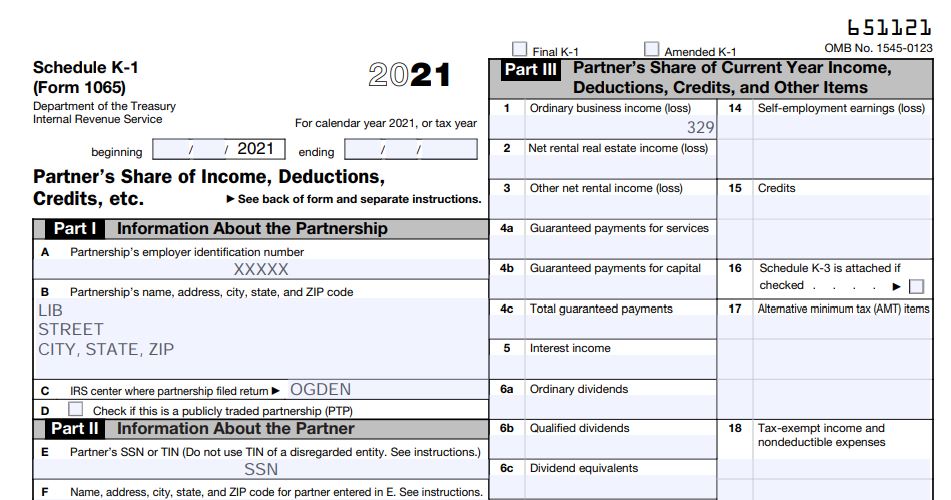

If you have an LLC or a partnership you would file Form 1065 U.S. Return of Partnership Income.

When do you file Form 1065?

You should file your Form 1065 by March 15.

What is passive activity?

If your LLC is a business or a trade and you do not materially participate in your business, the business is a passive activity for you the partner not the partnership. The passive activity is related to the partners engagement in the LLC activities. A rental real estate is a passive activity.

Activities that are not passive activities to the partners

If your Company is engaged in a business or trade in which you the partner materially participate.

Your company is a rental real estate business in which you materially participated: if more than half of personal services your performed in all trades and business are related to the rental real estate business including managing, operating, leasing, or renting; and you work more than 750 hours in your rental activities. You can include services you performed as an employee if you own more than 5% of shares.

If your partnership is a trade or business, you would report income and expenses on page 1 of Form 1065.

Report rental real estate income or loss on Schedule K.

Attach a statement to Form 1065 to show income or loss for each trade conducted under your company.

Also add an attachment to schedule K-1 to show the share of income or loss for each partner.

This allows the partners to properly classify each activity they materially participate in and which on that are passive activities for them.

Where to report rental real estate income or loss?

Rental real properties income or loss are reported on Form 8825, and on schedule K of Form 1065 not on page 1 of form 1065.

Portfolio income is income from interest, dividends, and royalties unless it is your trade.

They are reported on schedule K of Form 1065.

Item J: Schedule M-3

You are not required to file schedule M-3 if your partnership total asset is less than $ 10 million.

Item F: Total asset: are you required to enter the total asset of your partnership?

If you answer Yes to the Schedule B of Form 1065 question 4, you are not required to enter the total asset of your business.

How to complete IRS Form 1065 and Schedule K-1 For your LLC with no Revenue

If you started a trade or business and the first year you worked at it and didn’t generate any revenue, the cost would go on page 1. The loss would go on schedule K of Form 1065 line 1.

How to complete IRS form 1065 for a business activity you didn’t participate in?

If you have a trade or business and you didn’t materially participate in it, the expenses will go on page 1 as well as the revenue. The activity income or loss would go on schedule K line 1 and distributed on schedule K-1s for partners. A partner that didn’t materially participate in the trade or business conducted by the partnership, has a passive activity income or loss.

How to report portfolio income on form 1065?

If you generate income that didn’t come from a trade or a business, report that income on schedule K. Income produced that is not a trade or a business include: interest, dividends, royalties. They are called portfolio income.

Where do you report expenses related to portfolio income on Form 1065?

Expenses you incurred to produce income that didn’t come from a trade or business should be reported on schedule K and schedules K-1 for the partners.

How to report income and expense from a Business activity on Form 1065?

A trade or a business conducted by the partnership is a business activity for the partnership. Income and expenses from a trade or business conducted by the partnership are reported on page 1 of Form 1065 regardless on whether the partners materially participate or not. A partnership business activity could be a passive activity to its partners if they did not materially participate in it. The income and expenses of such business activities would be reported on page 1 of Form 1065 and the income or loss would go on line 1 of schedule K. The income or loss would be reported as ordinary income or loss on schedule K-1s. The partners could not offset loss from passive activities with income from active activities.

If you have multiple business activities conducted by the partnership, attach a statement to Form 1065 and to Schedule K-1s to specify income or loss from each activity for the partners to accurately report them on their personal tax return.

Where to report income and expenses from passive activities on form 1065?

A rental real estate is a passive activity to the partnership as well as to the partners even if the partners materially participate in it.

Income or loss from rental real estate is reported on Form 8825 and on schedule K of Form 1065.

Portfolio income is a passive activity to the partnership and the partners.

Income and expenses from portfolio income are reported on schedule K of Form 1065.

Self-Employment Net Earnings (Loss) Schedule K Line 14

If your LLC is a trade or business activity, The income or loss should be put on schedule K Line 14 self-employment net earnings or loss. Complete the self-employment worksheet in form 1065 instructions. Do not include rental income from rental properties on the worksheet. These are passive income. Enter rental income for selling rentals to customers. Enter rental income for performing substantial services to dwellers. These are active incomes. Any activity that you materially participate in would go on it. Do not include dividends, interest income. These are passive income.

Are conventions and seminar deductibles expenses?

You cannot deduct business expenses related to conventions and seminars. They are reported on Form 1065 Schedule K Line 18c non deductibles expenses. Report them on Schedule K-1 (Form 1065) in Box 18 with code C.

Form 1065 Page 5: Analysis of net Income

Check instructions for form 1065 page 55 on how to report your net income of loss between the partners whether they are active or passive.

If your LLC is a member-managed LLC, consider the line of General Partners for the LLC member-managers and the line Limited partners for the LLC members that don’t work in the business. Or choose if you feel fit for your business.

Paid Preparer

Leave it blank if the return is completed by a partner or an employee. If you paid someone to complete form 1065, the person should complete the paid preparer section.

If you check yes for IRS to discuss the return with someone, you authorized IRS to discuss the return filed with the paid preparer that filed it not his/her firm.

How to organize Form 1065 and its forms?

After you completed form 1065, Schedule K-1 and its supplements,

Print them out.

Sign Form 1065 page 1

Make copy for your business and your state tax return.

Make a copy of Schedule K-1 for partners.

How to assemble Form 1065 before sending to IRS?

Have Form 1065 page 1-5 together.

Put form 8825 behind it

Followed by Form 1125A-Cost of goods Sold if you complete it

Followed by Schedule K-1s

Followed by Schedule B-1 Form 1065

Followed by supplement to Schedule K

Followed by supplement to Schedule K-1

Followed by Form 4562 Depreciation and Amortization if you are required to complete it.

If you have completed other forms not listed here, check instructions for form 1065 page 10 “Assembling the Return” for more detail.

Once all the forms are in order, you could staple them together and put in an envelope.

Write the address that is in the same row where your state is listed that corresponds to the total asset of the business reported on Item F of Form 1065 Page 1. The address can be found in the Instructions for Form 1065 page 10 “Where to File”.

When is the due date for Form 1065?

Mail your Form 1065 via USPS Certified by its due date March 15.

Leave a Comment