IRS changed the Principal Business Activity code for online business owners. If you are filing your business income tax return for 2022, you should double check the business activity code in the 2022 IRS Instructions for the Form you are going to file whether it is Form 1120S, Form 1065, or Schedule C (Form 1040) to make sure your business activity code number that you put on your business tax return is still accurate.

IRS removed the business activity code numbers for non-Retailers. They recommend online business owners to go through the business activity codes and choose a code number that corresponds to their main business activity.

How to Find the Business Activity Code for Online Business?

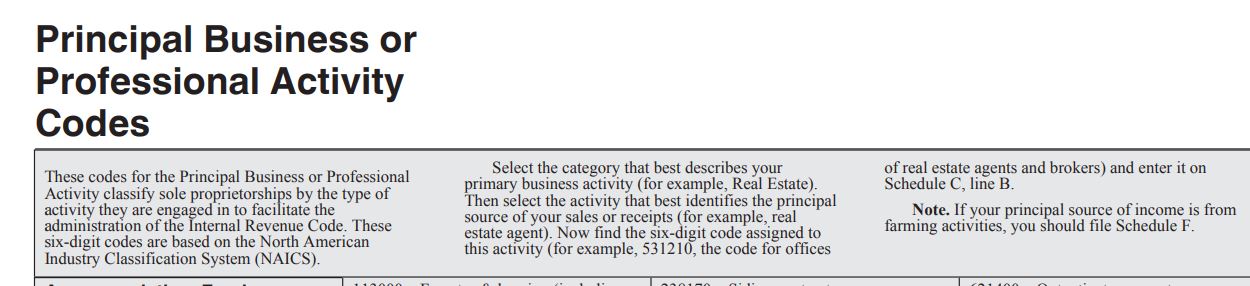

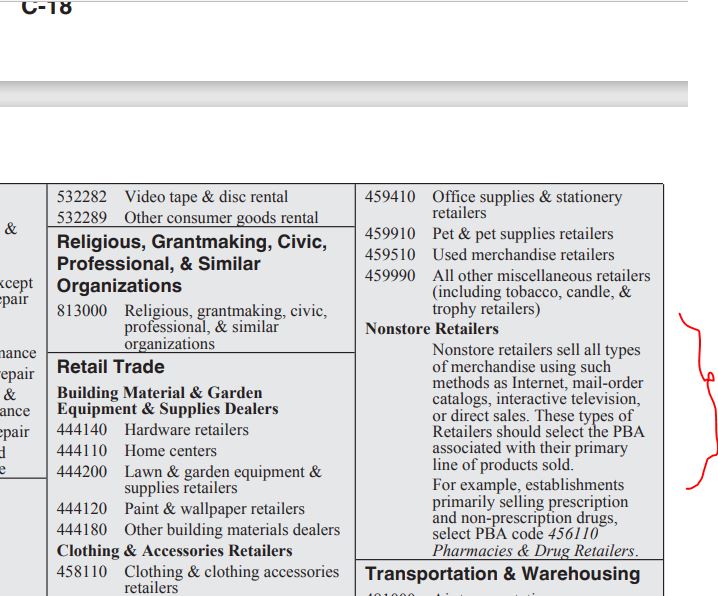

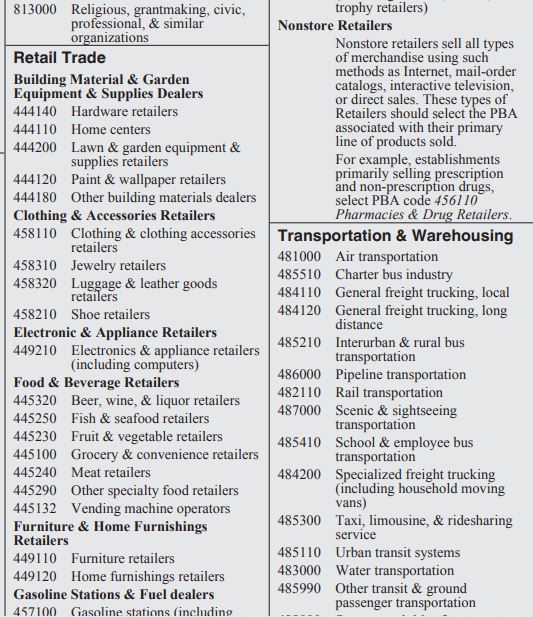

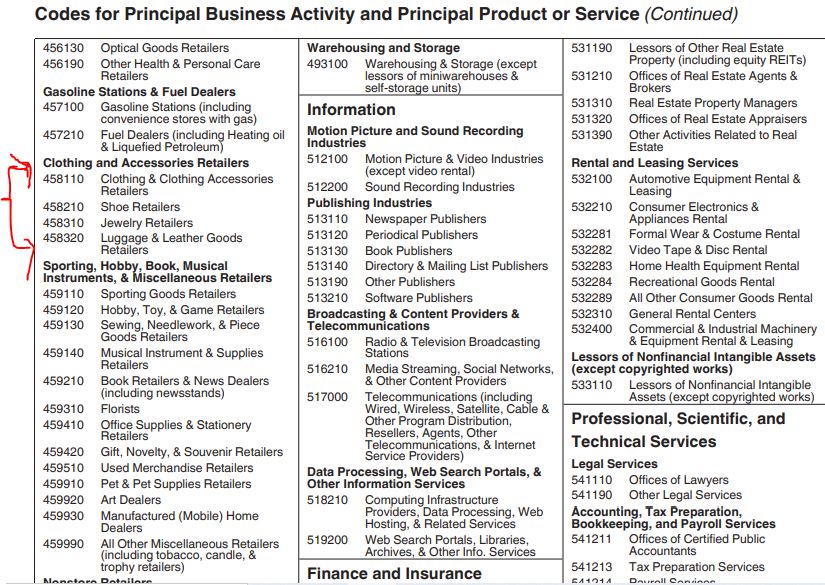

If you are a sole proprietor and will file Schedule C with Form 1040, pull IRS Instructions for 2022 Schedule C (Form 1040) and look at page C18 to C20. Retailers’ codes are on page C19. They removed stores from the end of these business activities. They now apply to all retail businesses whether they have a physical building or sell online.

IRS Instructions For 1040 Schedule C Profit and Loss from Business

https://www.irs.gov/pub/irs-pdf/i1040sc.pdf

If you have LLC and file Form 1065 Partnership Tax Return, look in 2022 IRS Instructions for Form 1065 page 61 to 63. The list of retail trade business activities is on page 61 to 62. You choose a business code number that best describes your main business activity.

IRS Instructions for Form 1065

https://www.irs.gov/pub/irs-pdf/i1065.pdf

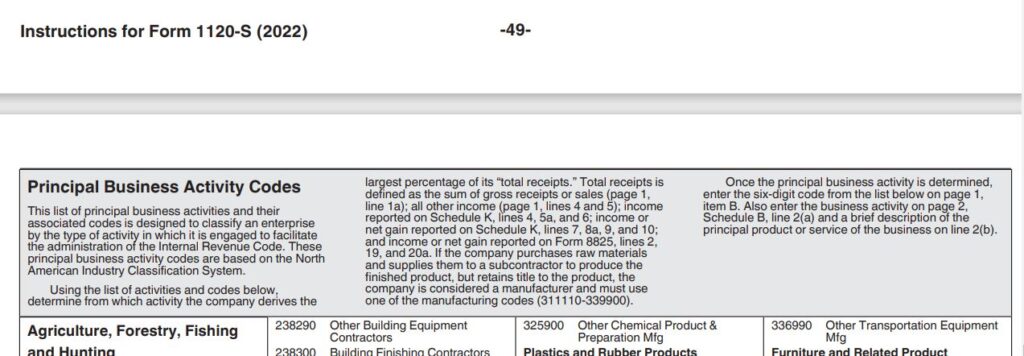

If you have LLC taxes as an S Corporation and file Form 1120S, look in 2022 IRS Instructions for Form 1120S page 50 to 52. The list of retail trade business activities is on page 50 to 51.

IRS Instructions for Form 1120s:

https://www.irs.gov/pub/irs-pdf/i1120s.pdf

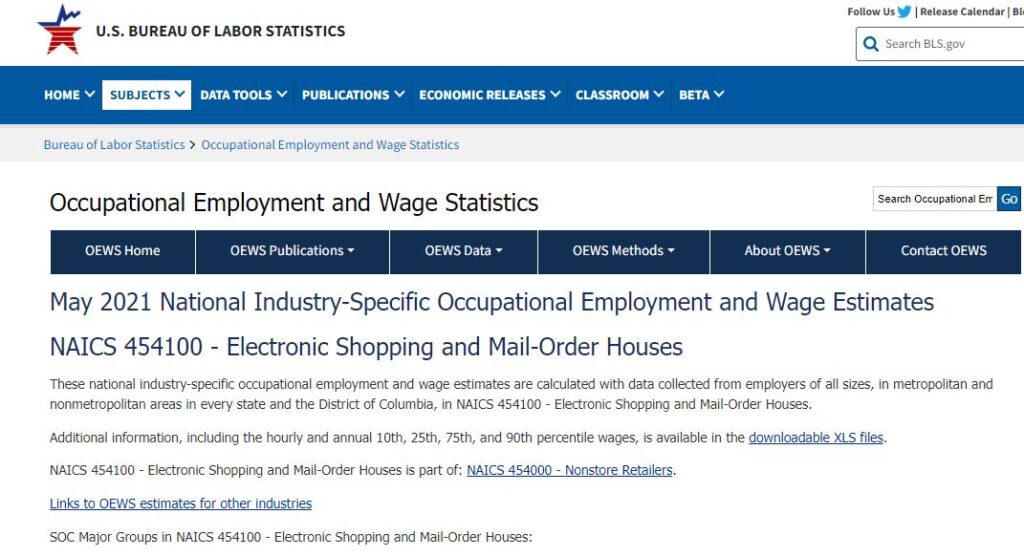

The U.S. Bureau of Labor and Statistic is still using the old business activity code: https://www.bls.gov/oes/current/naics4_454100.htm

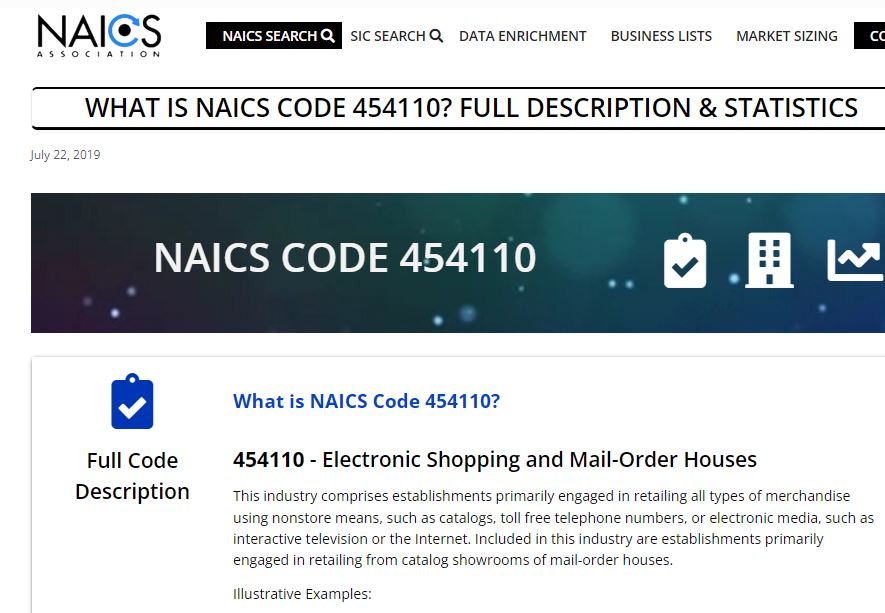

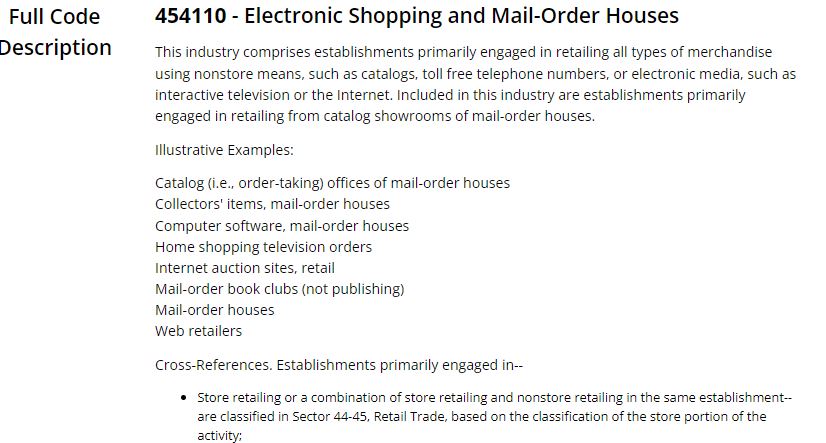

NAICS is still the old business activity code for online retailers: https://www.naics.com/what-is-naics-454110-full-description-and-statistics/

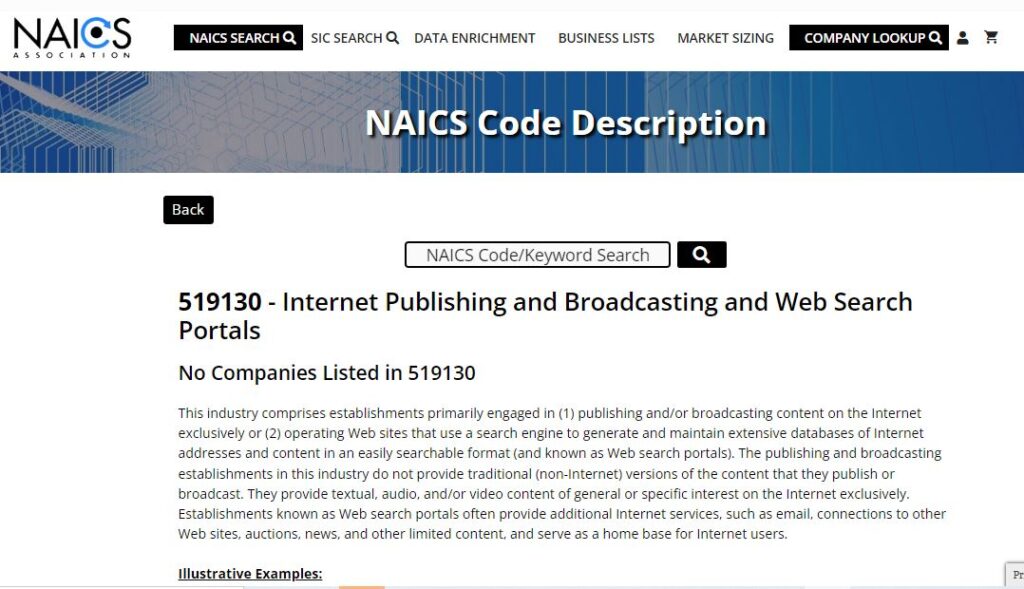

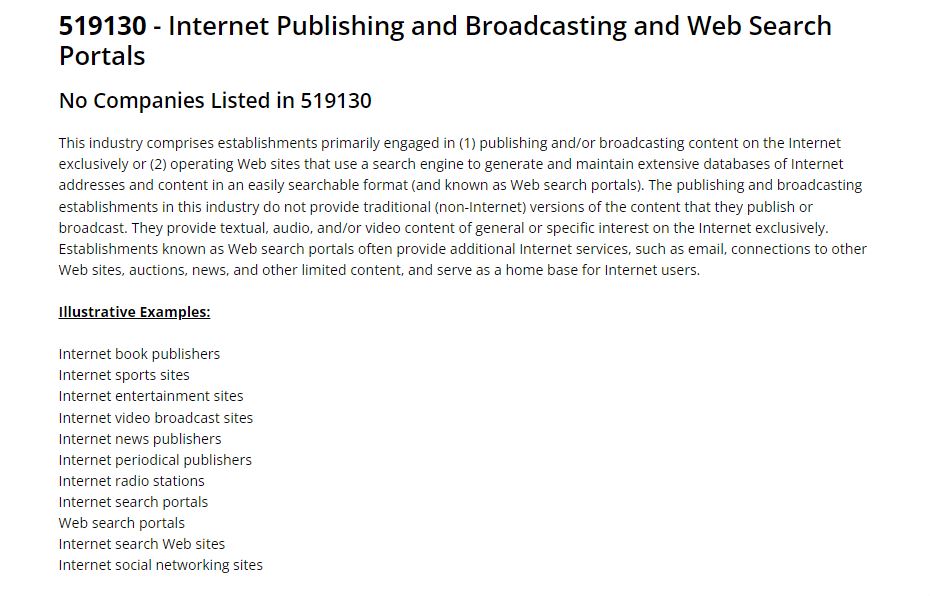

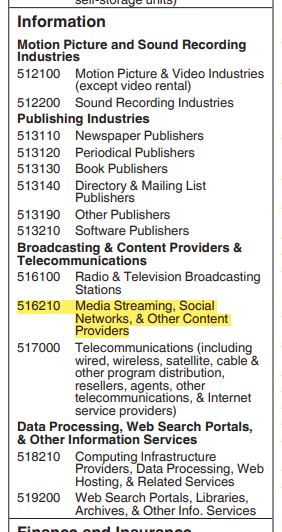

What is the business code for YouTube Content Creator?

The code on NAICS site is different from the code on IRS instructions for 2022 business tax return forms.

Conclusion: How to Find the Business Activity Code for Online Business and Online Content Creators?

If you are looking for your online business activity code for tax purposes, it might be a good idea to choose a business activity code number from the list IRS provided in its latest version of instructions to the business income tax return form you file for your business.

The video explains how to find the list of business activities codes in 2022 IRS instructions for Form 1120S, Form 1065, and Schedule C.

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you would find information to live a quality life within budget and increase your net worth. Topics covered include personal finance, investment, business management, cooking from scratch and growing some vegetables and fruit to save money and eat healthy.

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

“Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.”

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel) , https://ninasoap.com/affiliate-products/ (Our resource page)”.