How to estimate federal income tax to withhold?

Remind your employees to complete the new W-4 form and sign it.

Use the Form W-4 to complete the worksheet in IRS publication 15-T Federal income tax withholding methods based on the withholding method you chose to use.

Publication 15-T Federal Income Tax Withholding Methods:

https://www.irs.gov/pub/irs-pdf/p15t.pdf

You will be able to determine the tax bracket or percentage to apply to each employee wages and determine the federal income tax to withhold.

Record the payroll and the income tax withheld in your payroll spreadsheet to be able to file federal employment tax return as well as unemployment tax return for your business and file W-2 with Social Security Administration.

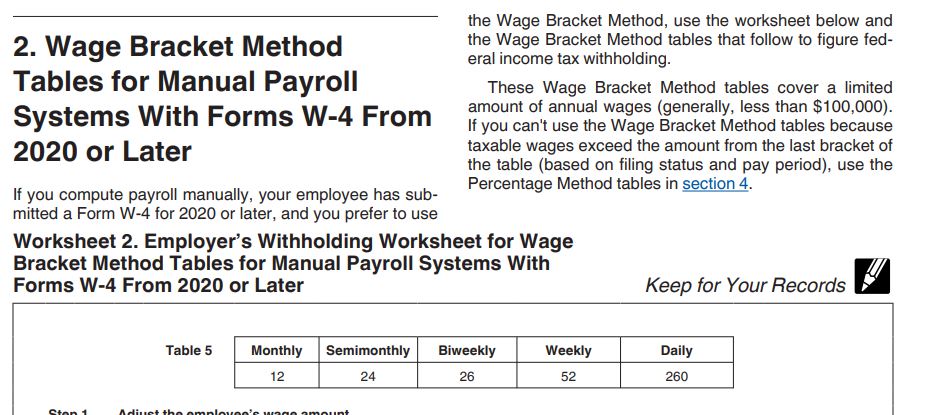

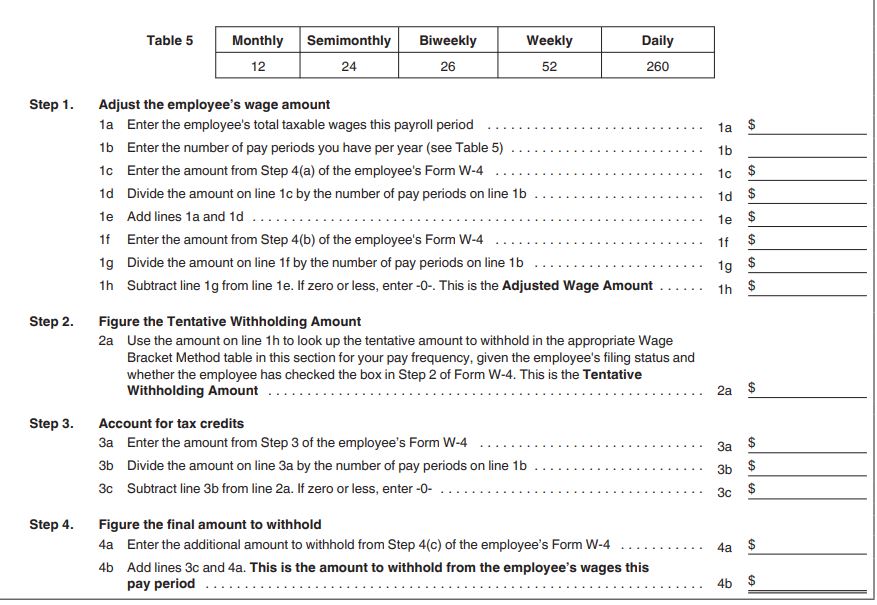

There are 2 income tax withholding methods. The percentage method and the tax bracket method.

The tax bracket method is used if you manually calculate payroll.

If you have LLC taxed as an S corporation and you work in your business, you are an employee of your company.

If you collect salary from your company and your company makes profits, you could revise your W-4 and check the box 2 to withhold more tax from your payroll to also cover your tax from your share of profit.

Even if you don’t make distribution from the business earnings, you will still pay tax on your share of profit. If you know your share of profit might cause you tax liability, you can adjust your W-4 to withhold more tax from your salary. If you know you might owe more than $1,000 in taxes, instead of making estimated tax, you could let your business withhold more income tax from your salary to cover taxes you might owe on your share of profit from the business.

If you decide to use the tax bracket withholding method, you can complete the worksheet 2 after you completed your W-4 to be able to determine how to locate your tax bracket.

How to locate your tax bracket?

Complete W-4.

Complete Worksheet 2 in the IRS publication 15-T Federal income tax withholding methods.

How to complete worksheet 2 for tax bracket method?

Table5: choose your pay frequency.

Step 1:

Line 1a: enter your payroll amount for the pay period.

Line 1b: Enter your pay frequency chosen in table 5.

Line 1c: Look at the employee’s W-4 and if there is an income from other job on Line 4a, enter it here.

Line 1d: divide line 1c by line 1b.

Line 1e: total line 1a and line 1d. That is the wage for the pay period and the other income from other jobs reported by the employee on the W-4.

Line 1f: if there is a deduction on the W-4 step4 4b, enter it here.

Line 1g: divide the deduction on line 1f by line 1b the number of pay frequency.

Line 1h: subtract line 1g from line 1e.

If it is less than 0 enter 0. That is the adjusted wage amount for the pay period.

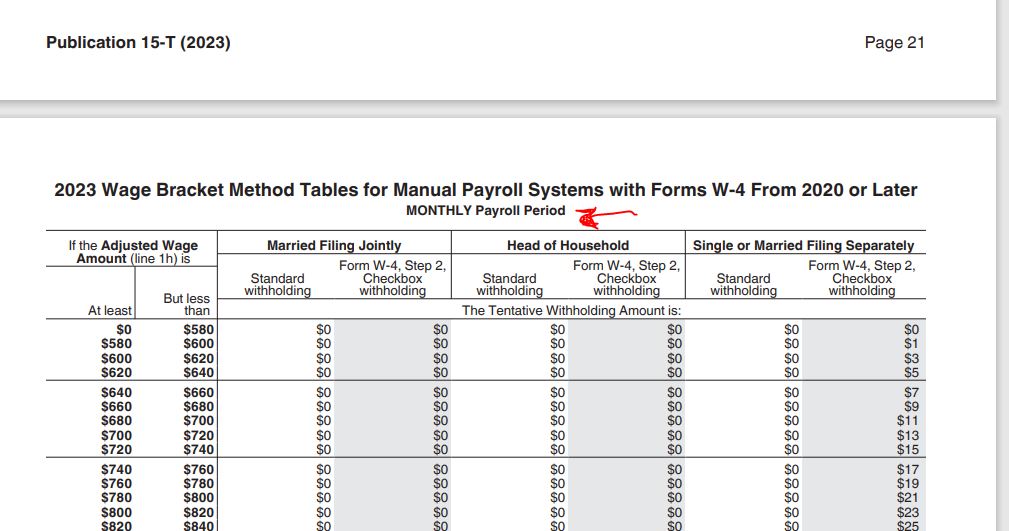

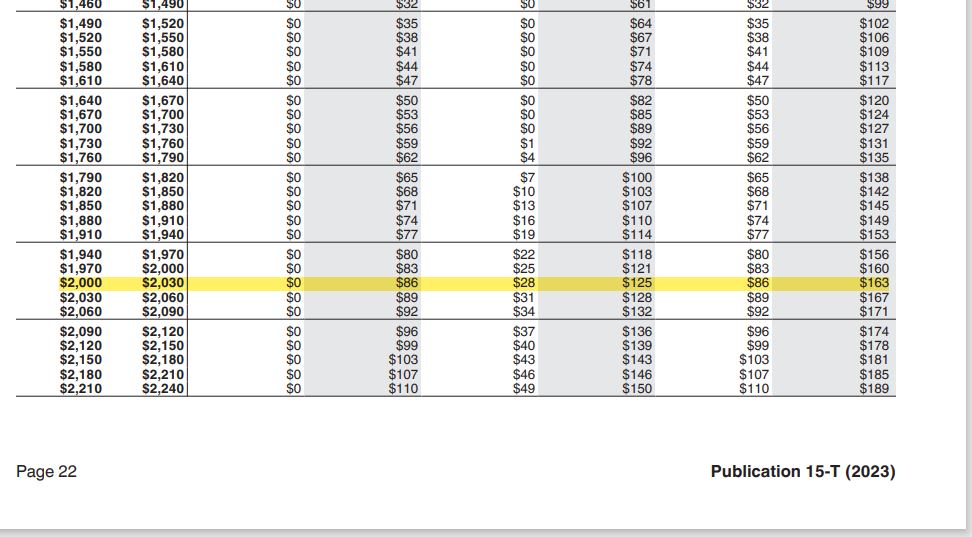

After you calculate the adjusted wage, you use that to determine the estimate tax to withhold.

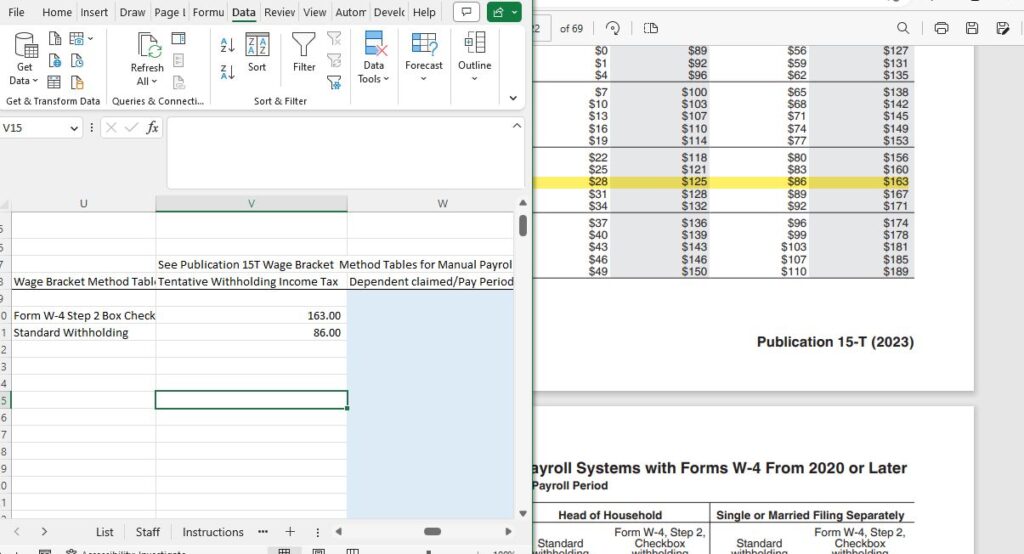

Step 2 Tentative withholding amount

Use the adjusted wage amount and use the tax bracket table of manual withholding method.

With the adjusted wage amount, use the employee marriage status and whether Step2 box was checked on W-4 to locate the withholding amount. That is the tentative amount to withhold.

Step2 Line 2 a: Enter the tentative withholding amount.

Step3 Account tax credits

Step 3 on the W-4 is for the employee to reduce tax to withhold from the paycheck.

Line 3a: if there is an amount on W-4 step3, enter it here.

Line 3b: Divide line 3a by the number of pay frequency on line 1b.

Line 3c: subtract line 3b the credit to take during the pay period from line 2a the tentative tax.

Step 4 Tax to withhold.

Line 4a: Look at W-4 Step 4b. If there is an amount the employee wants to be withheld as extra from the income, enter on this line. That is another way to allow more to be withheld from your paycheck if you are engaged in other income activities and you don’t want to deposit estimated taxes.

Line 4b: Total line 3c and line 4a for the total tax to withhold.

That is the federal income tax to withhold.

You can transfer the Worksheet 2 in a spreadsheet to be able to compute the adjusted wage amount and once you locate the tentative tax to withhold, and enter in your payroll spreadsheet, you can easily calculate the income tax to withhold as well as the FICA and the net wage to pay to the employee.

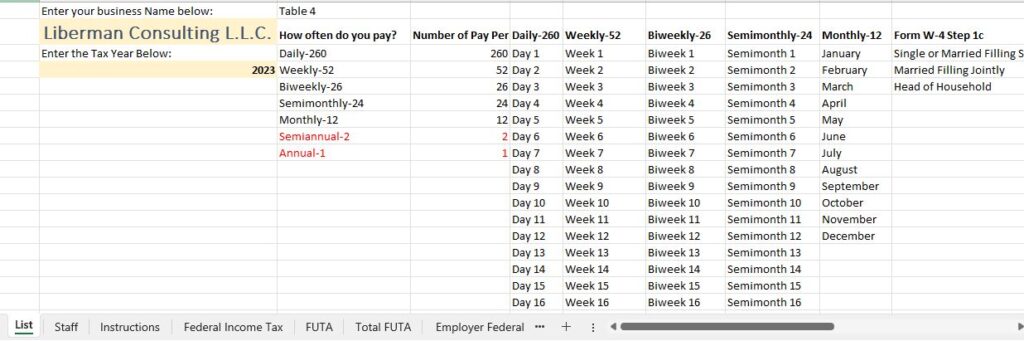

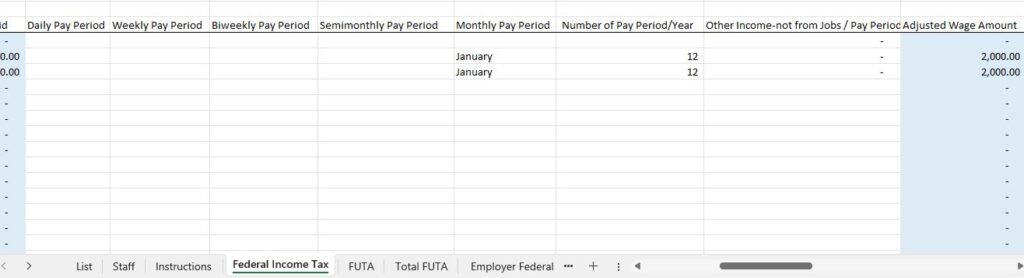

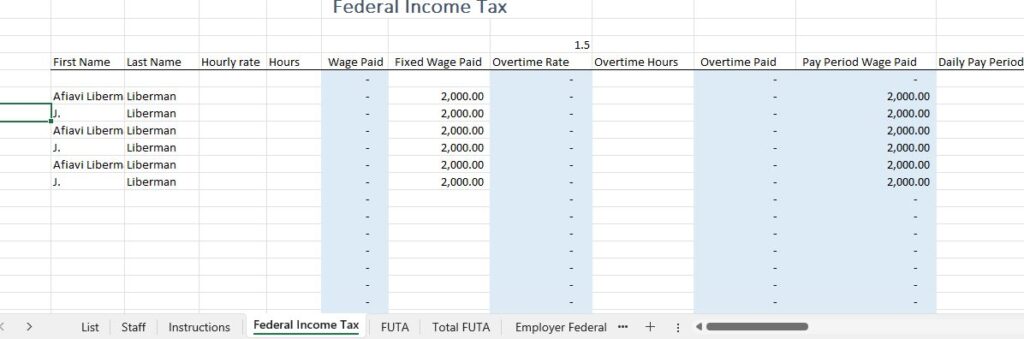

How do I manually calculate payroll taxes using a payroll spreadsheet?

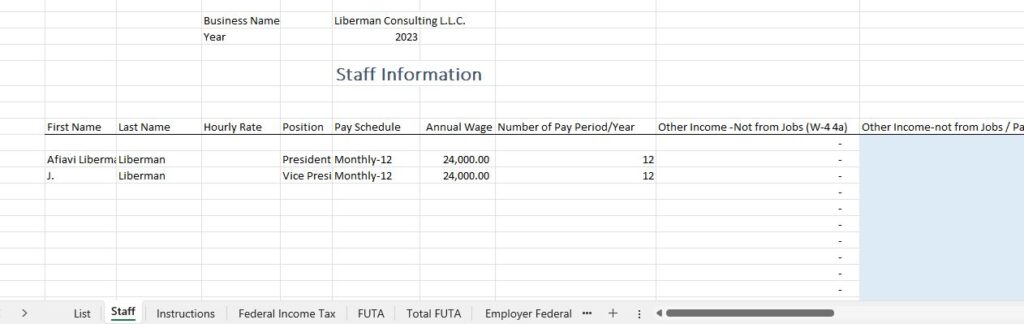

Enter the name of the business officer or any employee you may have.

In our payroll spreadsheet, on the List tab, enter your business name and the year.

In the staff tab, you enter the name of the staff members.

If there is an hourly rate, enter it.

Choose the position from the dropdown menu.

Pay Schedule: Choose the payroll frequency.

Annual Wage: if no hourly rate is entered, enter the annual wage for the officer.

Number of Pay Period/Year: choose the number of payrolls in a year based on your payroll frequency.

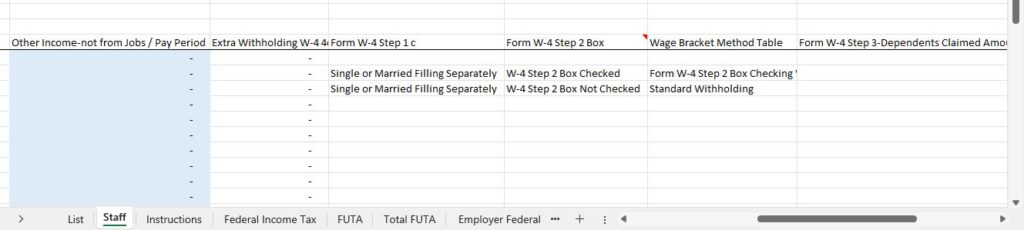

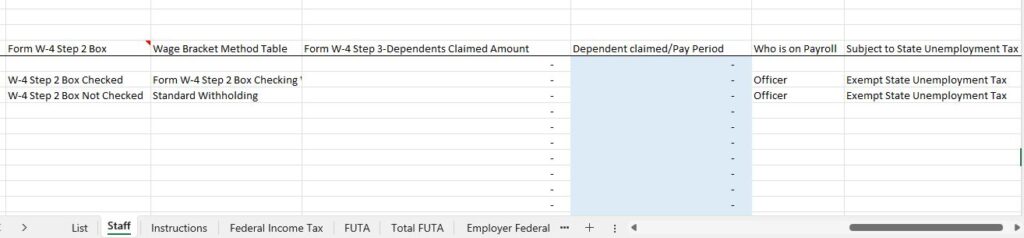

Other Income – Not from Jobs (W-4 4a): if there is an amount on W-4 step 4-line 4a, enter it.

Other Income-not from Jobs / Pay Period: The formula will calculate the portion of other job income to income in your payroll tax calculation at each pay.

Extra Withholding W-4 4c: If W-4 has an amount on Step 4 Line 4c, enter it here.

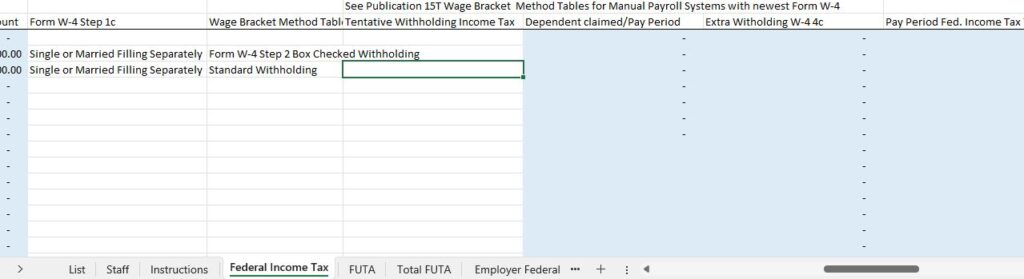

Form W-4 Step 1 c: Select from the drop-down menu to match the W-4 Step 1c.

Form W-4 Step 2 Box: Select from the drop-down menu to match the W-4 Step 2.

Wage Bracket Method Table: Select from the drop-down menu the column of the bracket table you will use for the officer based on whether W-4 step 2 box is checked or not checked.

Form W-4 Step 3-Dependents Claimed Amount: If W-4 has an amount claimed for dependents, enter it.

Who is on Payroll: choose from the selection.

Subject to State Unemployment Tax: Some states don’t charge unemployment tax on business officers. The selection under who is on payroll is related to this column.

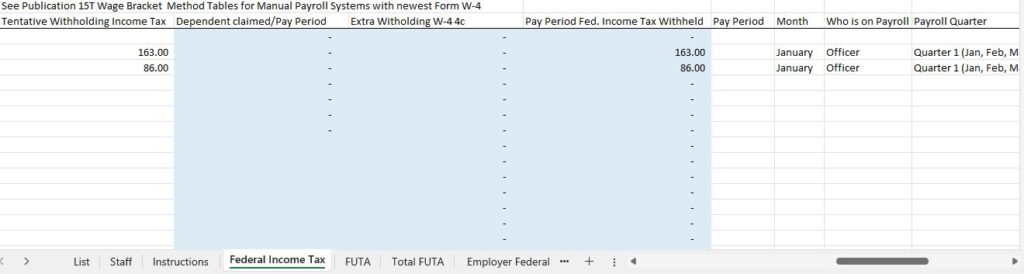

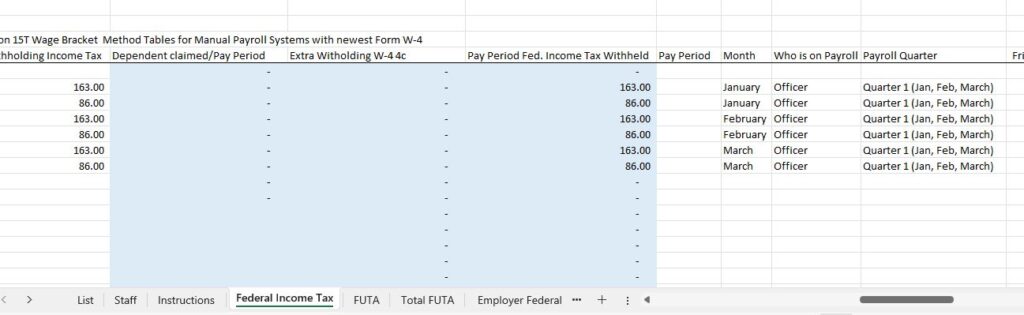

Federal income tax tab

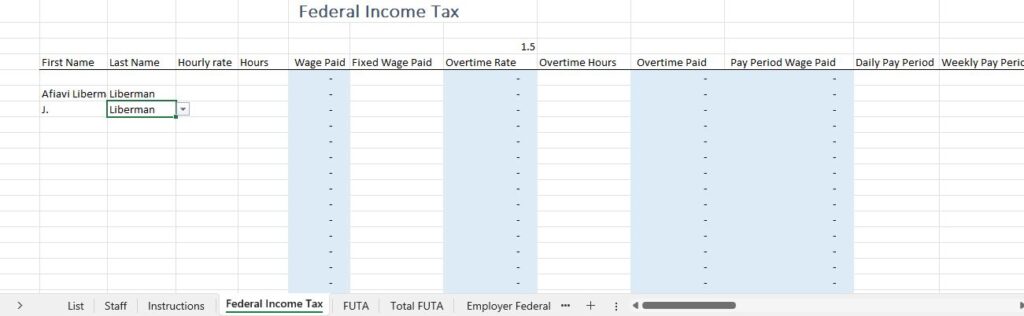

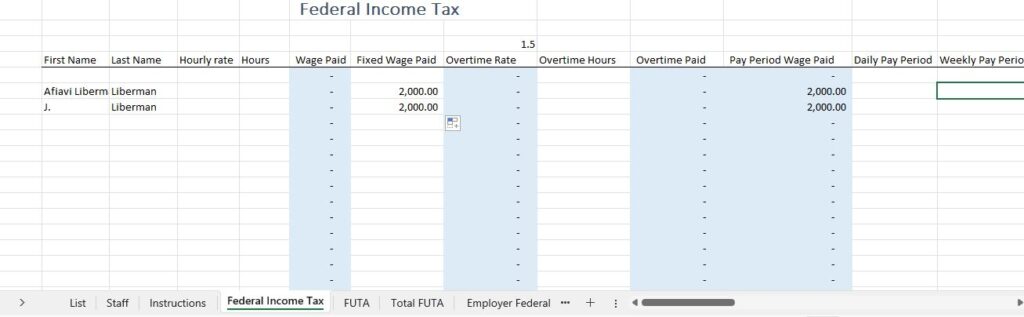

Select the officers’ names in the federal income tax tab.

Complete the columns without formula that are relevant for your business to enter the wage paid.

If you pay a fixed wage, you enter it. If you paid hourly, enter the hourly rate and the hours worked.

Choose the pay period from the drop-down menu. The selection will be reduced as you will choose from the pay period you entered on the staff tab.

Enter the marriage status.

Tentative Withholding Income Tax:

Open IRS publication 15-T Federal Income Tax Withholding Methods to Section 2 the tax bracket method for manual payroll system. Go to the table for wage bracket method. Scroll to the table that corresponds to your pay period.

Locate the wage bracket the wage paid fits in and corresponds it to income tax to withhold from the column of marriage status the employee checked in the W-4 and the sub column of step 2 checkbox if it is checked on the W-4 otherwise the standard withholding.

If there is amount claimed for dependent on the staff tab you choose it from the drop-down menu.

Enter the pay period, the month, and the quarter the wage paid belongs to.

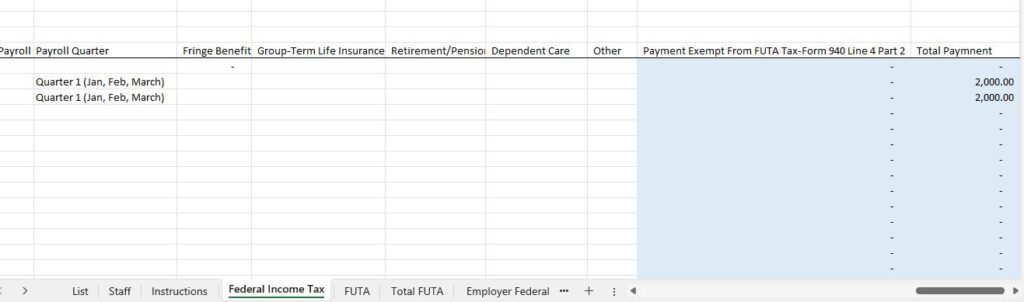

Some benefits are exempt from FUTA federal unemployment tax. You can enter them if your business qualifies for them and pays for them. Otherwise, leave these columns blank.

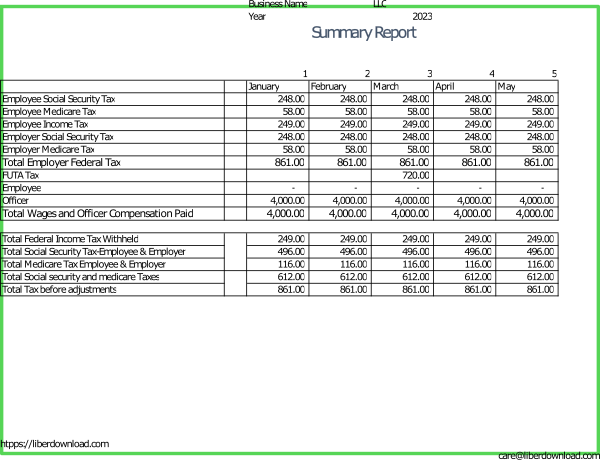

The summary tabs are useful to file Form 941 Employer quarterly federal employment tax return or Form 944 Employer annual federal employment tax return.

The Free Payroll Spreadsheet-Form 940-B22F2 Rev1 is designed to help you track your payroll for you to be able to file for 944 or Form 941, and for 940 FUTA, and W2/W3 with Social Security Administration.

The 2023 revision is named “Free Payroll Spreadsheet-Form 940-B22F2 Rev1”. You can access the download under Free Downloads on the page “Free Payroll Spreadsheet-Form 940-B22F2“.

Note of Caution:

You are responsible for filing accurate payroll tax returns. The spreadsheet is just a tool to help you organize your costs. Would you please make sure no formula is broken and the spreadsheet is doing what you expect from it.

Use it at your own discretion.

Conclusion: How do I manually calculate payroll taxes Free Payroll Spreadsheet 2023

Step by step we explained how to use information from W-4 to help estimate Federal income tax to withhold using IRS Publication 15-T and a free payroll spreadsheet.

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you would find information to live a quality life within budget and increase your net worth. Topics covered include personal finance, investment, business management, cooking from scratch and growing some vegetables and fruit to save money and eat healthy.

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

“Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.”

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel) , https://ninasoap.com/affiliate-products/ (Our resource page)”.