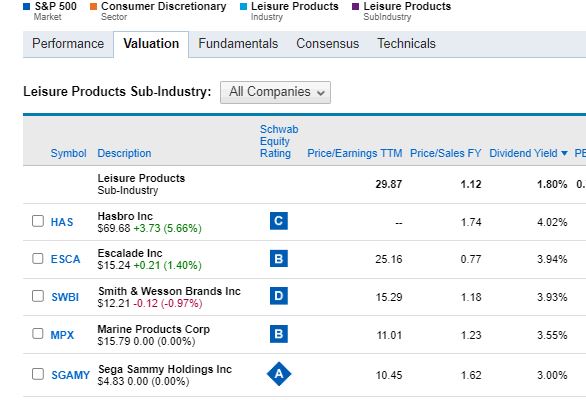

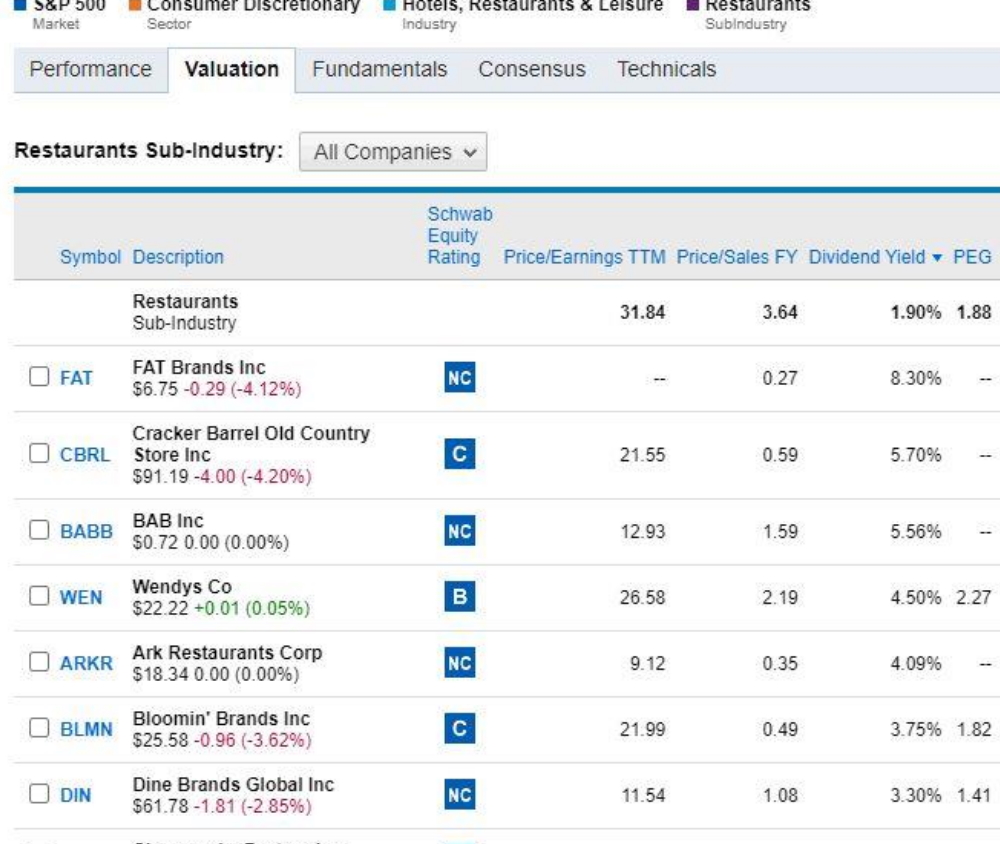

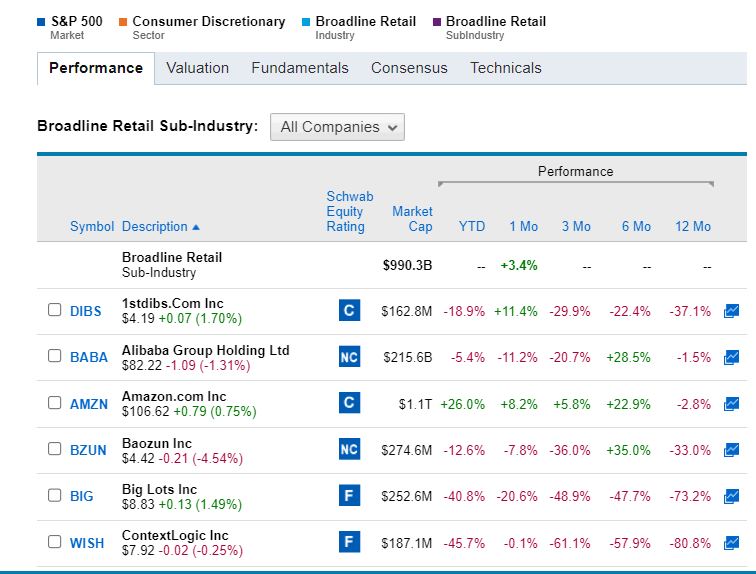

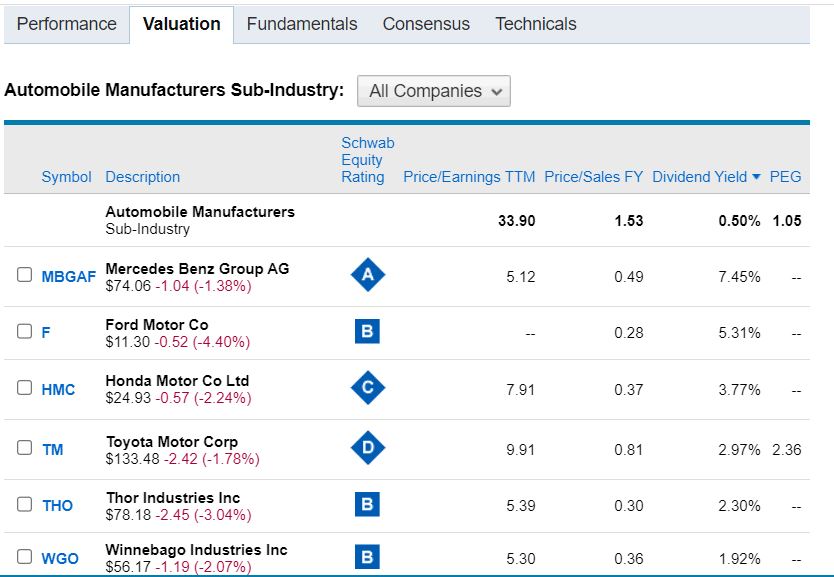

Filter One: Sort stocks by dividends

Filter 2: Eliminate LLC and partnership companies.

Filter 3: Avoid most international companies.

Batch Research Dividend Stocks

Filter 4: Remove OCT market stocks.

Filter 5: Avoid new companies.

Filter 5: Chart Analysis

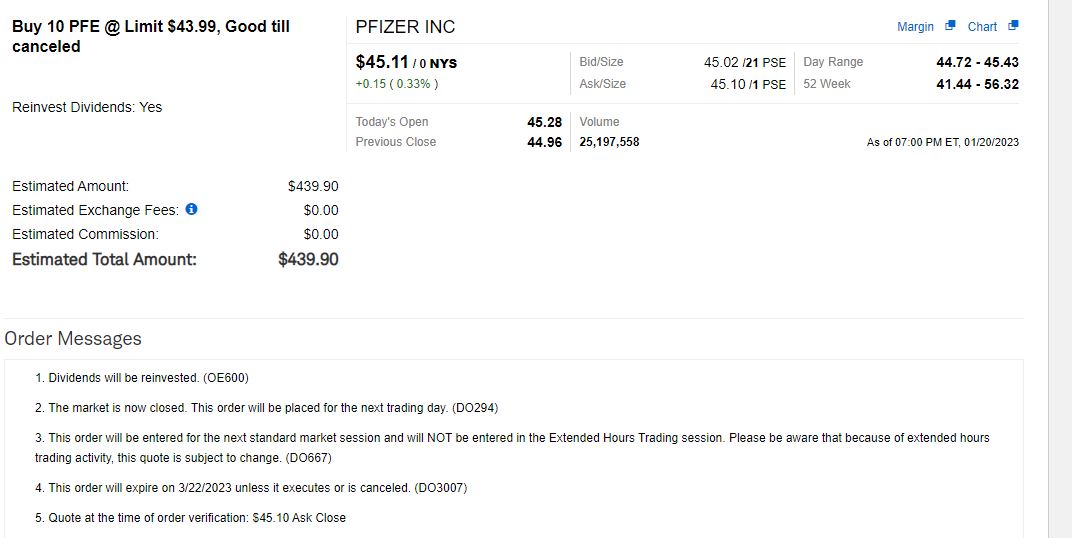

When can you buy stock?

Brokerage account vs Roth IRA account vs IRA account

How much to invest in dividend stock?

Set a minimum dividend annual income.

How to earn $1,000 dividends a year?

Set average dividend rate.

6%

Set minimum amount to invest in a year.

$1,000/0.06=$16,667.

Set monthly amount to invest.

your annual investment amount /12.

$16,667/12= $1,388 to invest a month.

After 10 years, you could generate about $1,000 in dividend income a month.

If you can generate that dividend a year, you can generate it and more monthly after 10 years.

Set monthly amount to invest based on your living expenses.

$12, 000 a year for living expenses and $12,000 a year for irregular expenses to keep in your saving to pay to cover these expenses if or when they incur. That is a total of $24,000 a year no mortgage, rent, tuition loan, or credit card debts included.

At 6% dividend rates from stocks, you need to invest $400,000 ($24,000/0.06) or $200,000 ($12,000/0.06) to generate $24,000 a year in dividend income or $12,000 a year.

If you set a 10 years’ time frame to reach that goal, that is $40,000 ($400,000/10) or $20,000 ($200,000/10) a year to invest.

By month that is $3,333.33 ($40,000/12) or $1,666.67 ($20,000/12) to invest.

Set monthly amount to invest based on specific expense.

$50 a month on your cell phone, is $600 a year.

$10,000 ($600/0.06) to invest in 6% dividend stocks to generate $600 dividend every year.

If you set 10 years to reach that goal, that is $10,000/10 and is $1,000 to invest a year. That is $83.33 a month to invest.

You can also break down your living expenses into expense category and plan on investing enough a year to generate dividend income to cover that expense category. And every year you choose another expense category to invest enough for the dividend income to cover that expense category.

How many dividend stocks do you have in your portfolio?

Purchase stock in every sector and possibly every industry.

100 different stocks in your portfolio are a good average.

Introduce more or keep reinvesting in the ones you have.

Track dividends paid by your stocks by month.

Diversify to generate dividend income every month.

After you have about 100 stocks find tune your selection.

Select stock based on months dividends are paid to ensure you generate dividend income every month.

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you would find information to live a quality life within budget and increase your net worth. Topics covered include personal finance, investment, business management, cooking from scratch and growing some vegetables and fruit to save money and eat healthy.

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

“Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.”

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel) , https://ninasoap.com/affiliate-products/ (Our resource page)”.

[/vc_column_text][/vc_column_inner][/vc_row_inner][/vc_column][/vc_row]