Every year, you must choose a deposit schedule to make your payroll tax deposits.

The rules are different if you file Form 944 Employer’s annual federal tax return or if you file Form 941 Employer’s quarterly federal tax return.

IRS Publication 15 Employer’s Tax Guide section 11 Depositing tax explains it in detail.

We are going to focus on Form 944 fillers.

Form 941 fillers can refer to this article here.

How to choose payroll tax deposit schedule for Form 944 filers?

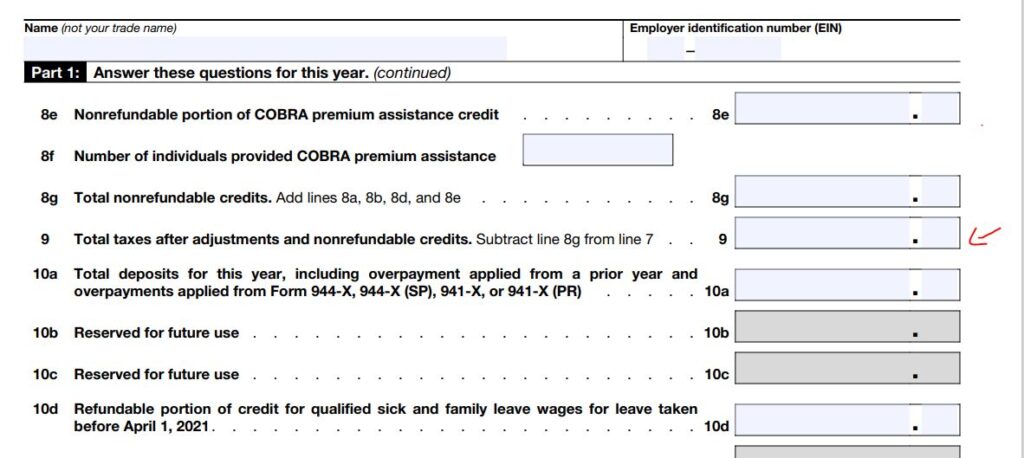

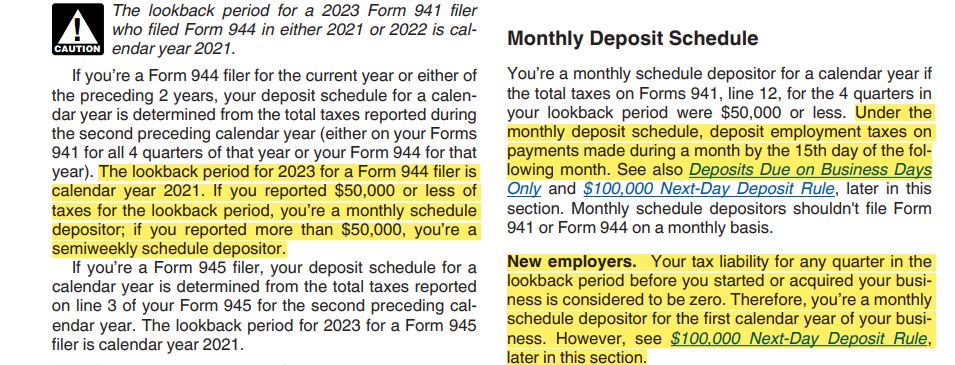

If you are an employer, meaning you pay wages to employees and you file Form 944 Employer’s annual federal tax return, you need to lookback at your form 944 from 2 years ago. To choose your deposit schedule for 2023, you will look at your 2021 Form 944 Line 9 total tax after adjustments and nonrefundable credits.

If your 2021 Form 944 line 9 is $50,000 or less, you choose monthly deposit for 2023.

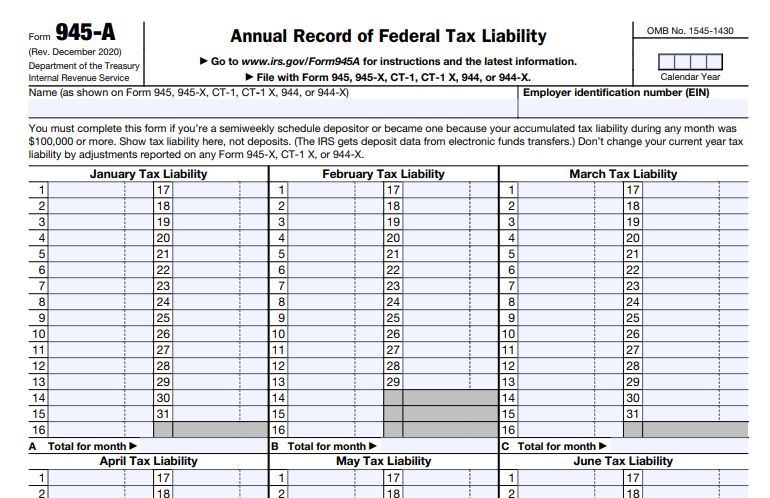

If it is more than $50,000 for that year, you choose semiweekly deposit schedule for 2023. For semiweekly deposit schedule, you will complete Form 945-A Annual Record of Federal Tax Liability to report your daily tax liability and attach it to Form 944. Therefore, it might be a good idea to track your payroll taxes in a way to be able to report the daily tax liability for the whole year.

On any day during the year if you incurred $100,000 in employment tax liability, you make a deposit the next day regardless of whether you are a monthly depositor or semiweekly depositor. From that point you become a semiweekly schedule depositor and make semiweekly deposits for the rest of the year.

2023 IRS publication 15 Section 11

How to make monthly tax deposit?

You submit your tax deposit by EFT using EFTPS system. You deposit your prior month tax liability by the 15th of the current month.

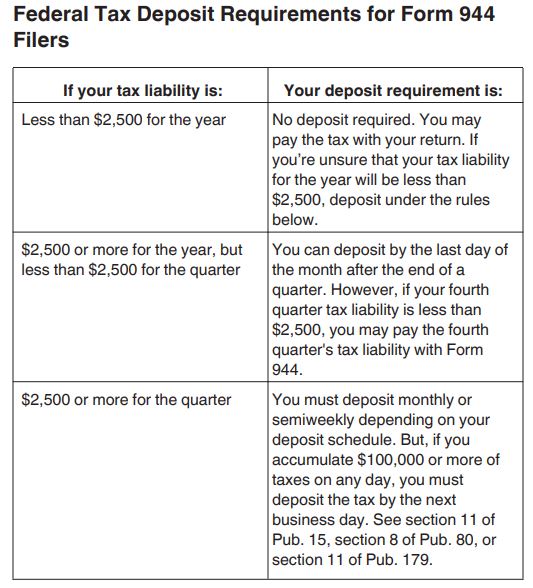

If you expect your tax liability to be less than $2,500 for the whole year, you can deposit it when you incurred it following the due date of your deposit schedule or you can choose to pay it when you file Form 944. However, if it is $2,500 or more, you should make deposit using EFT (Electronic Funds Transfer) via EFTPS (Electronic Federal Tax Payment System) based on your deposit schedule.

How to estimate your tax liability for the year

To determine if you need to make a monthly deposit or pay your tax liability at the end of the year when you file Form 944, you need to determine if your tax liability will be less than $2,500.

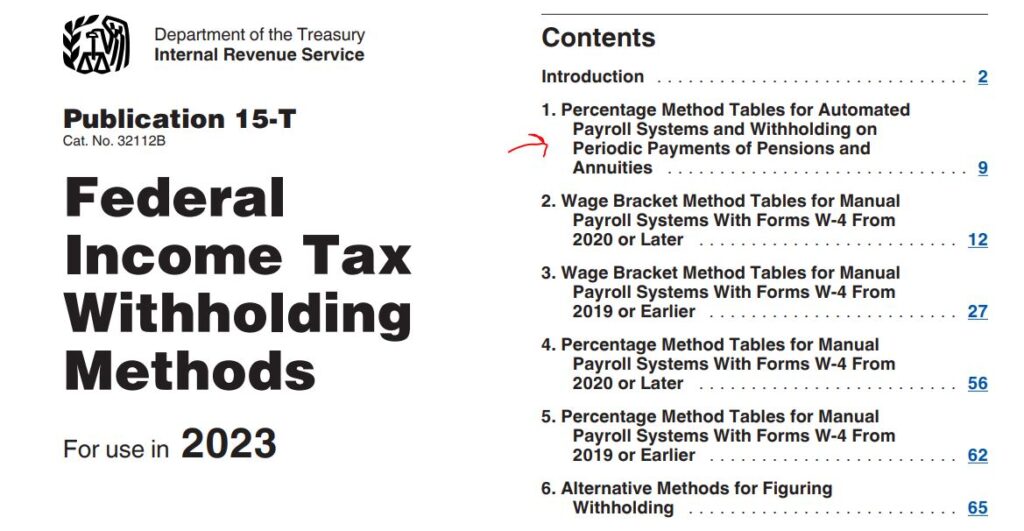

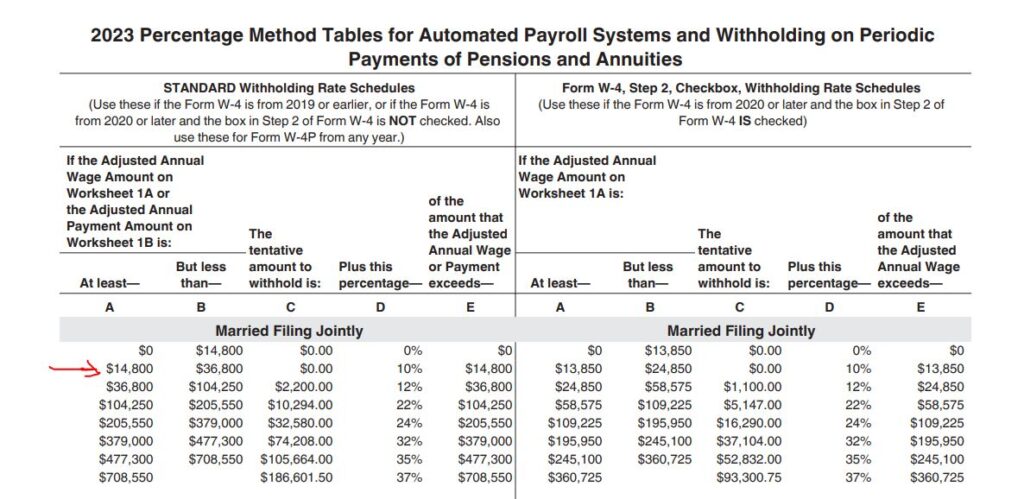

If your business is LLC taxed as S corporation and you work in your business, you are an employee (an officer). Therefore, if you estimate your business will generate profit and you will pay yourself salary, you can estimate how much you intend to pay yourself. Using Publication 15-T you can locate your annual salary and its corresponding tax amount to withhold. Then Social security tax is 6.2% of that salary to withhold from the salary and 6.2% is to be paid by the business. Next Medicare tax is 1.45% to withhold from the salary and 1.45% for the business to pay. If the total of all these employment taxes are $2,500 or more, you might want to make monthly deposit each time you collect salary. If you don’t pay yourself regularly, then each time you pay yourself, you could make your employment tax deposit.

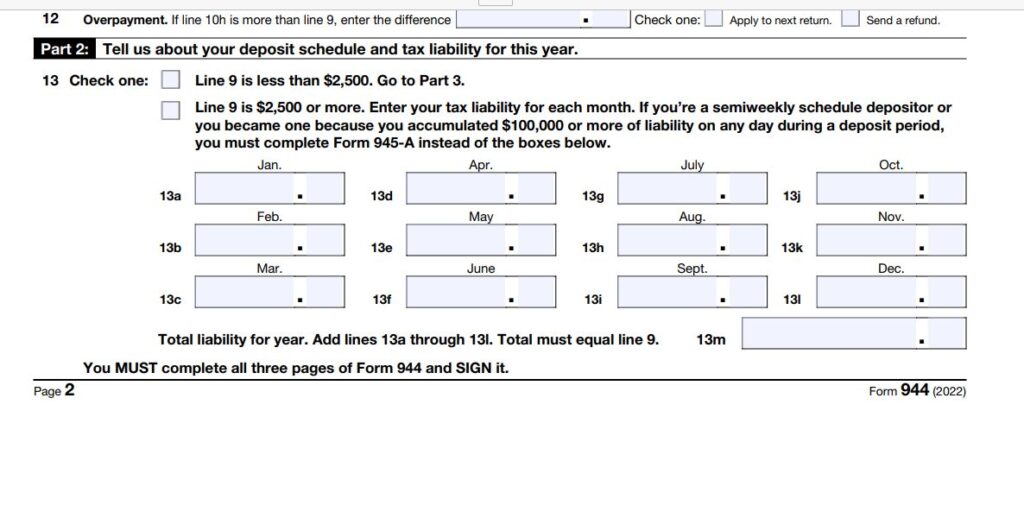

If your annual tax liability on Form 944 Line 9 Total tax after adjustment and nonrefundable credits is $2,500 or more, you are required to provide your monthly tax liability on Form 944 Line 13. If you didn’t make your monthly tax deposits, you could be charged a penalty or interest for late payment.

If you are the only employee of your S Corporation, and you pay yourself periodically, it might be a good idea to make your tax liability deposit based on the deposit schedule you chose at the start of the year. If you know how much you intend to pay yourself during the year, you could estimate what your payroll tax will be and compare it to $2,500.

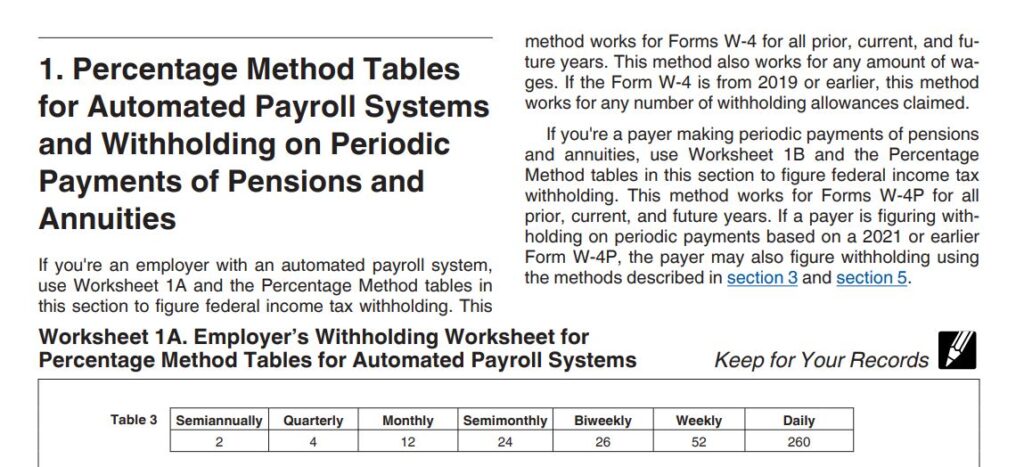

For instance, if you estimate to pay yourself $20,000 a year. A look at the recent IRS Publication 15-T Federal Income Withhold Methods using the Percentage Method for automated payroll systems Section 1, you will withhold 10% if you are filling out joint tax return. 10% of $20,000 is $2,000.

Social security of 12.4% is $2,480 ($20,000*12.4%) for both employee and employer.

Medicare tax of 2.9% is $580 ($20,000*2.9%) for both employee and employer.

The total estimate employment tax liability is $5,060.

It is better you make monthly deposit if that is your default deposit schedule, and you collect salary every month.

In our business, we pay ourselves toward the end of the year and since our tax liability is less than $2,500, you pay our tax when we file Form 944.

You can find the link to the IRS Publication 15-T Federal Income Tax Withholding Methods here.

When do you make a monthly deposit?

If you choose monthly deposit schedule, you deposit the prior month tax liability by the 15th of the current month.

Make your payroll tax deposit by EFT (Electronic Funds Transfers) using EFTPS (Electronic Federal Tax Payment System). https://www.irs.gov/payments/eftps-the-electronic-federal-tax-payment-system

When to make semiweekly deposit?

More detail can be found in the IRS Publication 15 Employer Tax Guide Section 11 or page 28.

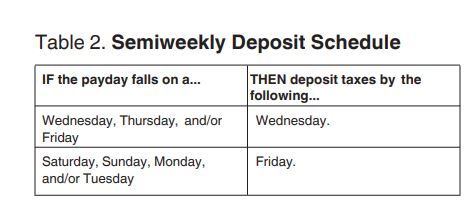

If you pay wages on Saturday, Sunday, Monday, Tuesday, make your employment tax deposit by Friday.

If you pay wages on Wednesday, Thursday, Friday, make your employment tax deposit by Wednesday.

You make semiweekly payroll tax deposit Wednesdays and Fridays of the week.

If you choose a monthly deposit schedule and don’t have payroll software, you could design a payroll spreadsheet to record and track your payrolls. If you are looking for a free payroll spreadsheet, there are a few under for our Free Downloads. The one named “Free Payroll Spreadsheet-Form 940-B22F2” might be useful.

The article “How do I manually calculate payroll taxes Free Payroll Spreadsheet 2023” explains how to use Free Payroll Spreadsheet-Form 940-B22F2.

Conclusion: How to choose your payroll tax deposit schedule for 2023 if you file IRS Form 944?

Article categories

Related articles

Resources

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you will find information about living a quality life within budget and increase your net worth. Topics covered include personal finance, investment, business management, cooking from scratch, and growing some vegetables and fruit to save money and eat healthy.

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

“Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.”

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel) , https://ninasoap.com/affiliate-products/ (Our resource page)”.