How to choose payroll tax deposit schedule for Form 941 filers?

If you file Form 941 Employer Quarterly Federal Tax Return for your business, at the beginning of the calendar year, you need to determine which payroll tax deposit schedule you will choose for the whole year.

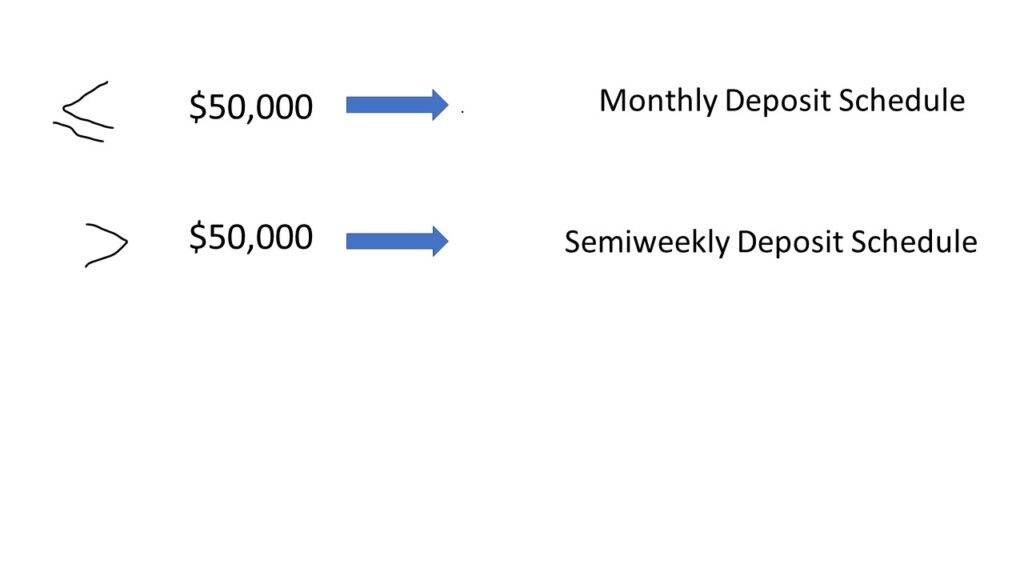

There are two deposit schedules: monthly deposit schedule and semiweekly deposit schedule.

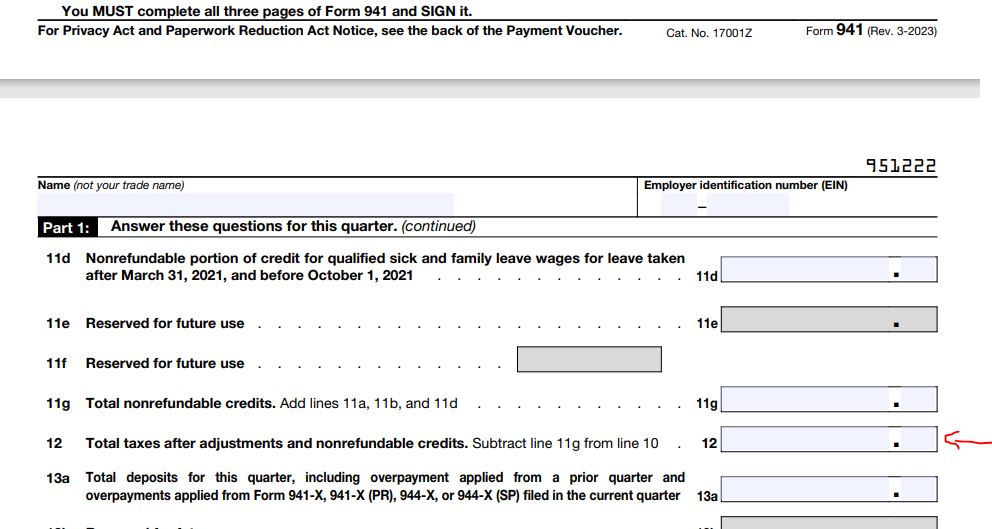

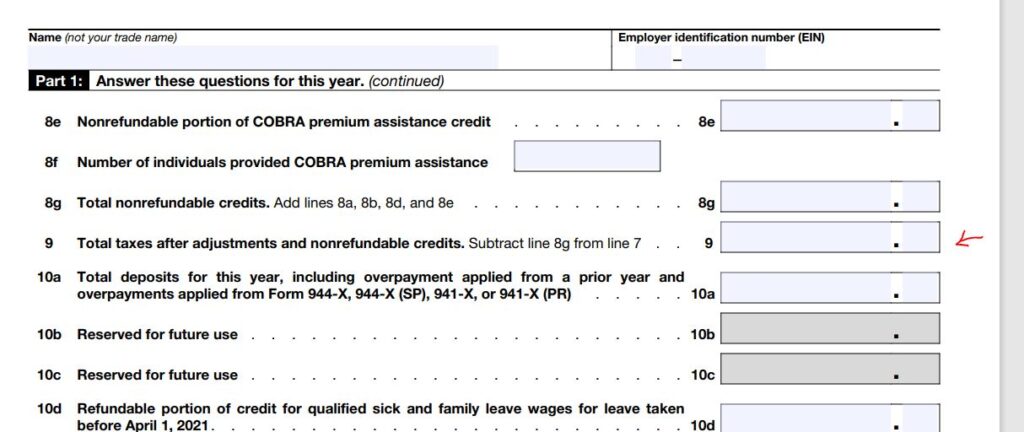

If you incur a tax liability on Form 941 (Line 12 total tax after adjustment and nonrefundable credits) including social security tax withheld from employees salary, Medicare tax withheld from employees salary, federal income tax withheld from employees salary, social security tax paid by the employer, and Medicare tax paid by the employer that is less than $2,500 for the quarter, you can deposit the tax liability or pay it with your form 941 for that quarter.

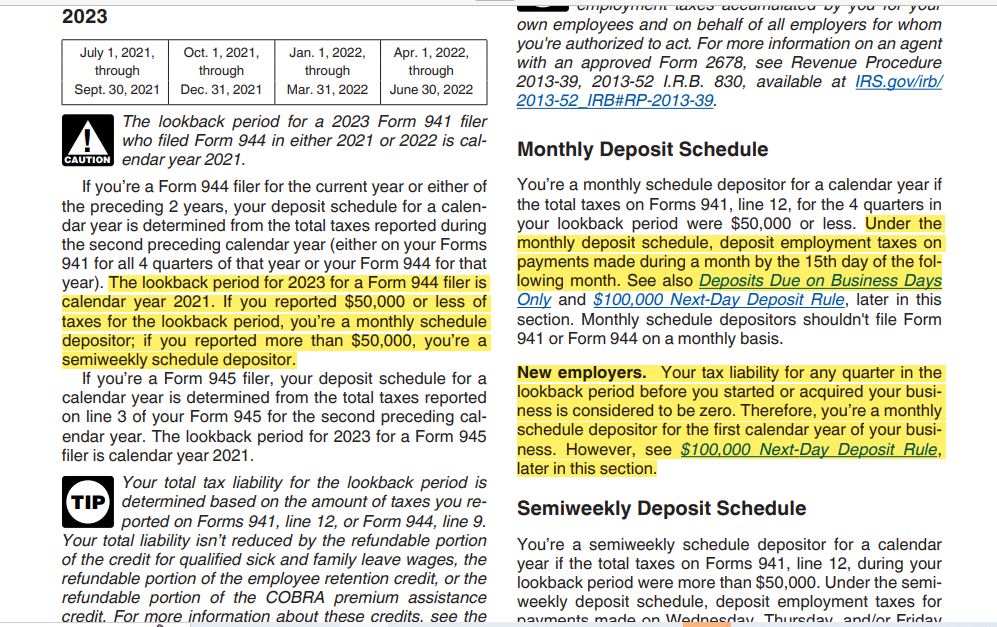

How to choose your payroll tax deposit schedule for 2023 if you file IRS Form 941?

To choose your payroll tax deposit schedule, you total your Forms 941 Line 12 total tax after adjustment and nonrefundable credits for 4 quarters from July 1st, 2021, to June 30, 2022. That will include:

2021 Form 941 Q3 Line 12 (July, August, September)

2021 Form 941 Q4 Line 12 (October, November, December)

2022 Form 941 Q1 Line 12 (January, February, March)

2022 Form 941 Q2 Line 12 (April, May, June)

Monthly deposit schedule

If the total liability on Forms 941 Line 12 Total tax after adjustments and nonrefundable credits for the 4 quarters cited above is $50,000 or less, you choose monthly deposit schedule.

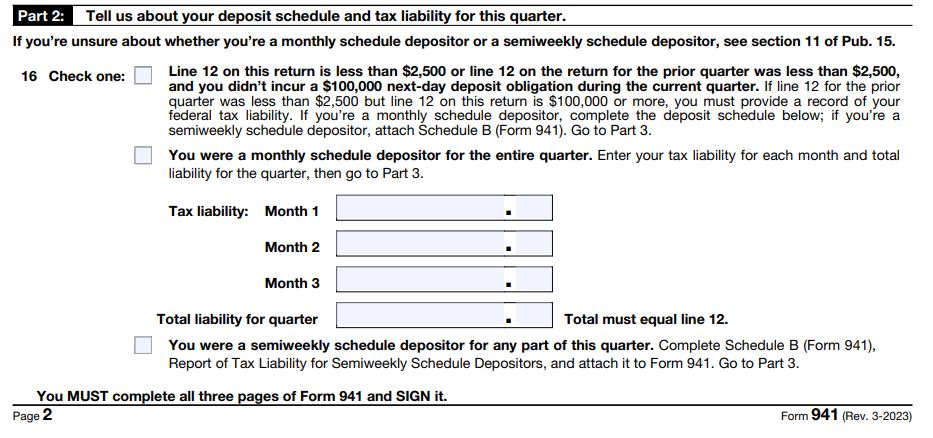

If you choose monthly deposit schedule, you should track your payroll tax monthly as Form 941 Line 16 requires you enter your quarter tax liability broken down by month.

If you are looking for a free payroll spreadsheet to track your payroll tax liability by month and by quarter, there is “Free Payroll Spreadsheet-Form 940-B22F2 Rev1” in the free download section you can download.

Semiweekly deposit schedule

If the total liability on Forms 941 Line 12 Total tax after adjustments and nonrefundable credits for the 4 quarters cited above is more than $50,000, you choose biweekly deposit schedule.

More detail can be found on IRS Instructions for Form 941 2023 page 8 or IRS Publication 15 Employer Tax Guide Section 11.

If at any day of the year you incur $100,000 tax liability, you make the deposit the next day and switch to semiweekly deposit schedule if you are a monthly schedule depositor and remain semiweekly schedule depositor for the rest of the year.

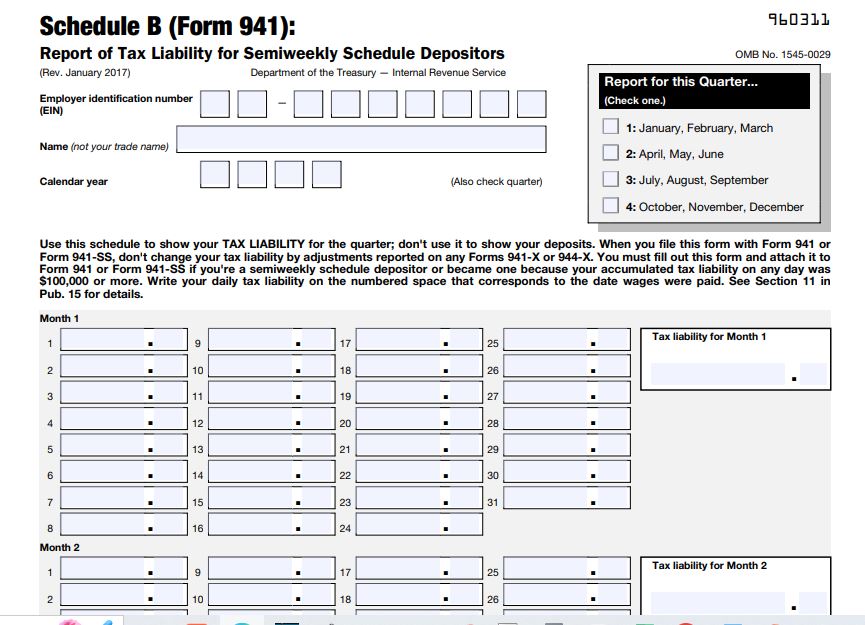

Semiweekly schedule depositor should track payroll and payroll taxes daily. There is Schedule B Form 941 that is required to attach to Form 941 if you are a semiweekly schedule depositor.

How to make your monthly deposit?

If you are a monthly schedule depositor, deposit your employment tax liability incurred the prior month by the 15th of the current month. For instance, you deposit January employment tax by February 15th.

Make your tax deposit via EFT (Electronic Funds Transfer) using EFTPS.

You can sign up with EFTPS (Electronic Federal Tax Payment System) to make tax deposits.

https://www.irs.gov/payments/eftps-the-electronic-federal-tax-payment-system

Deposit Schedule for New Employers

As a new employer, your lookback July 1st, 2021, to June 30th, 2022, employment tax liability will be $0. Therefore, you could choose a monthly deposit schedule.

How to figure out your deposit schedule if you file Form 944 the past 2 years?

If you are required Form 941 in 2023 but were required to file and filed Form 944 Employer Annual Federal Tax Return in 2021 and in 2022, your lookback is Form 944 for 2021-line 9 Total Tax.

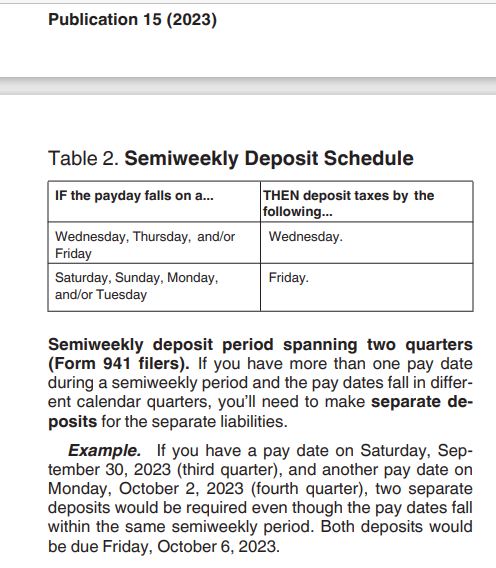

When to make semiweekly deposit?

More detail can be found in the IRS Publication 15 Employer Tax Guide Section 11 or page 28.

If you pay wages on Saturday, Sunday, Monday, Tuesday, make your employment tax deposit by Friday.

If you pay wages on Wednesday, Thursday, Friday, make your employment tax deposit by Wednesday.

You make semiweekly payroll tax deposit Wednesdays and Fridays of the week.

Conclusion: How to choose your payroll tax deposit schedule for 2023 if you file IRS Form 941?

Whether you choose to deposit your employment tax liability monthly or semiweekly, depends on whether your lookback to your 2nd preceding year Form 941 last 2 quarters and preceding year Form 941 for the 1st 2 quarters tax liabilities total amount is $50,000 or less or more than $50,000.

Related article categories

Previous related articles:

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you will find information to live a quality life within budget and increase your net worth. Topics covered include personal finance, investment, business management, cooking from scratch, and growing some vegetables and fruit to save money and eat healthy.

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

“Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.”

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel) , https://ninasoap.com/affiliate-products/ (Our resource page)”.