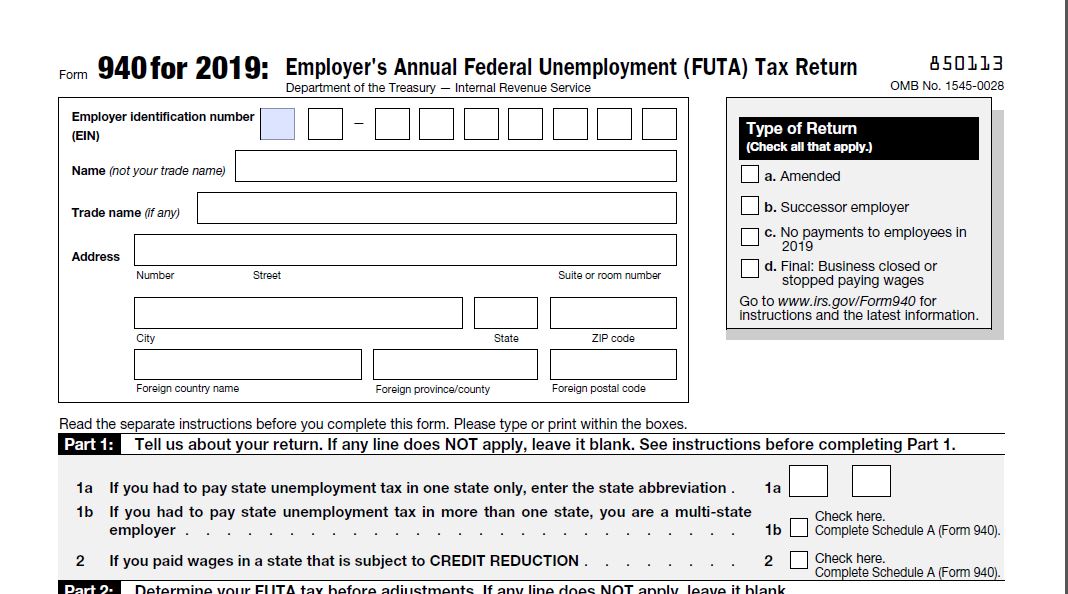

If you are a small business owner and paid salary to employees or yourself during the year, you might be required to file Annual Unemployment Tax form 940. You can file it up yourself if your business is small and you didn’t generate enough to hire a professional to file it for you.

FUTA tax is 6% on the first $7,000 you paid to each employee during the year.

Read instruction for Form 940 page 3 to see if you are eligible to pay unemployment tax for 2019. Either way you need to file the Form 940 whether you own unemployment tax or not. Make sure you file your FUTA by January 31st.

You need to contact your state to see if you are required to pay unemployment tax also called contribution.

If you are, it is good to get that form filled up and send in the amount.

Then you continue the Federal form 940.

Please don’t hesitate to join us by registering on our website to be added to our contact list. I want to interact more with you this year. Therefore, I am manually adding my subscribers to my contact list. Please join us and let’s make our financial goals come true together! https://ninasoap.com/membership-join/

On FUTA form 940, you can claim the amount you paid to the state for unemployment up to 5.4%.

On form 940 FUTA, you would first calculate 0.6% tax on your total that is subject to unemployment tax (every first $7,000 paid to each employee totaled together).

The form would require you enter the total wage you paid on line 3. On instruction 940, page 8, you would see a list of benefits you paid to your employees you can deduct from the total payroll to come down to the first up to $7,000 paid to each employee totaled together. The benefits exempt from FUTA would go on line 4.

Then you would deduct the amount above $7,000 you paid to each employee on line 5. It is good to have a spreadsheet to track the salary of each employee and do this calculation if you don’t use payroll software or accounting software. Don’t fill the need to invest in a software if your business is just growing and you can do without a software. Remember, people were doing this by hands before software came along to facilitate the process. Not only the software saves us time, it makes us little lazy in a sense that we rely solely on the software and don’t know the process.

If you pay less than $7,000 to an employee, the whole amount is taxed and if you paid $10,000 to another employee, only $7,000 is taxed.

Only you the employer pays the unemployment tax.

You would be asked on the form to calculate the tax at 0.6% first on line 8.

Then you would be asked to enter the credit you want to claim if your pay unemployment to the state on part 3.

If you didn’t you would be required to apply another 5.4% to your total subject to the unemployment tax on part 3 line 9.

That brings the total unemployment tax to 6%.

When you enter your numbers on the form 940, you can round to the nearest dollar or you can keep the cents.

You type the dollar amount to the left of the amount cell and the cents to the right side of the dot.

Do not include dollar sign or decimal point.

There is a worksheet for line 10 to help you calculate the credit to claim for paying the state. The worksheet is mostly helpful if your state has different type of rates throughout the year. Page 12 of instruction 940 shows an example of how to fill up the worksheet found on page 11. If you are one-person business at the moment and didn’t generate a lot to pay yourself a high salary, you can fill your form 940 without the worksheet. Or if you didn’t pay your state unemployment tax, you can fill the form 940 without the worksheet.

Part 4 line 12 is the total FUTA after credit is claimed.

Line 13 is the amount you deposited during the year for unemployment tax. You are required to make deposit using ETFPS.

Line 14 is the difference between line 12 and 13. If the amount on line 12 is more than line 13, that is the amount to send it.

Do not fill part 5 if it is not necessary. It is more required if your FUTA is more than $500 for the year and you didn’t make any deposit during the year.

Part 6: you could select “no”.

Part 7: Type in your name, title, phone number and leave the “paid preparer ese only” blank if you filled your own form.

Don’t forget to fill the Voucher form on page 3 of the form 940 and print it out. You would sent it in with your payment and the form 940. Do not staple the voucher to the payment. Do not staple the form to the voucher or to the payment.

On the money order, make sure you write payable to “United States Treasury”., your EIN, “Form 940”, and the year “2019”. You would find that information on page 3 of the form 940 right above the voucher.

Mail your envelop to the address that is assigned when you send your form with payment on instruction 940 page4.

To learn more tips on how to live below your income without sacrificing the quality of your life and start building wealth, please join our community by subscribing here. By subscribing to our email list you agree to be notified on our latest post. Thank you!

If you are not required to make quarterly deposit which would requires you to use ETFPS (federal electronic deposit system), you could mail in your form with your payment.

I would suggest if you choose to mail your payment, you could purchase a money gram. It might be more expensive to go that route, but don’t make your account number to easy for the IRS to access. They can get it if they want but don’t hand it over to them if you can help it. Otherwise it is ok to send it a check as well.

It is the same idea behind mail in paper form instead of e-filing.

You are required to keep your tax documents for at least 3 years. IRS keep paper files for 3 years before destroying them it is believed. With the e-file system, documents can be kept definitively. If your company is still young and you have the choice to e-file or mail in paper form, it is a good idea to mail in your documents. Make sure you request receipt confirmation or certified mail. I have mailed my tax documents simply in the past with success but if you enclose a payment using money order, there is no way to tell if it is received. If you mail in a check, you can simply mail the envelop and you can track your bank account and once the amount is withdrawn then you have the confirmation. Keep in mind that the mail is deposited in a PO Box. You don’t need the post office to send you a copy of the certified mail by mail. It is more expensive. You can track it online that you mailed it and it got deposited. You can copy it and save it on your computer. When you decided to simply mail for form, ask at the post office if the receipt can show the address where the envelop is going. That is a proof that you mailed your form as well.

You can download Form 940 and its instructions here on our website: https://ninasoap.com/tax-forms-and-instructions/

For how to File FICA, please watch our YouTube: Marie-Ninette Liberman

.

We recently launched our You Tube Channel called Marie-Ninette Liberman. You can type that name in YouTube search bar to find us. Most of our videos are classified inside Playlists. Please feel free to click on any playlist of your interest and select a video to watch. Our YouTube provides the visual to help complement what we explain through our articles. Please take advantage of all the free tools you can get your hands on to help you reach your financial goal this year 2020.

We have a playlist on taxes to show you to file some forms.

Would you please leave us your comment to help us improve our articles and YouTube videos to provide you more to help you in your financial journey? I thank you very much for visiting our website and our YouTube Channel.

We invite you to visit our website at www.ninasoap.com for more information.

To make it easy to navigate our website, would you please check the left side bar? Under “Post Archives, are our categories” I manually saved the links of my articles under their appropriate categories. Please click on any category under Post Archives to read the titles of previous articles and click on the link of your interest to open the article.

Please don’t hesitate to join us by registering on our website to be added to our contact list. I want to interact more with you this year. Therefore, I am manually adding my subscribers to my contact list. Please join us and let’s make our financial goals come true together!

Please join us by registering Below:

To learn more tips on how to live below your income without sacrificing the quality of your life and start building wealth, please join our community by subscribing here. By subscribing to our email list you agree to be notified on our latest post. Thank you!

Registration Form