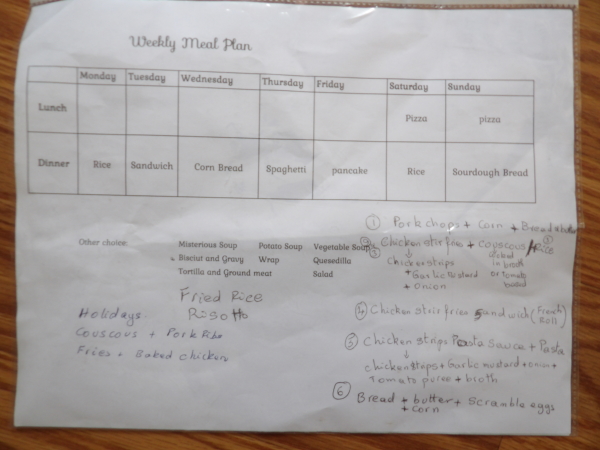

- List 7 -10 different meals you like to cook and your family like to eat.

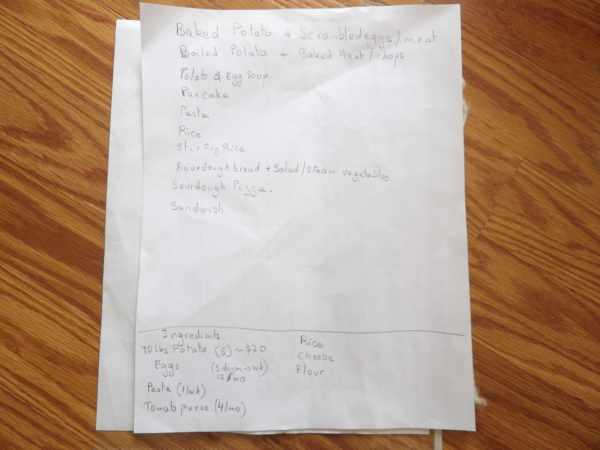

- List the ingredients or grocery staples needed to make these dishes.

- List the quantities you need to have on hand a month.

- Multiply the monthly quantities by 12 to determine the quantities of each staple you might use in a year

- Add your cleaning supplies.

- Estimate how many of household cleaning products you need in a year.

- Use a Google sheet or a spreadsheet to list your grocery staples and their number of quantities estimated for the year.

- Go to your grocery stores where you shop and record the unit price for each one of your grocery staples.

- Your spreadsheet will calculate the estimate annual cost for each staple and the total annual grocery cost.

- Divide that amount by 12 and you have your estimated monthly grocery budget.

- If that number is more than what you plan on setting as monthly grocery budget, set a lower number for your grocery budget.

- Set a grocery budget for your family for the month.

- Take cash out for your groceries.

- You will need to note staples on your list that go on sales during the year.

- Save some of your grocery budget every month to stock up on these staples when they are on sale will be the key to spend a low grocery budget.

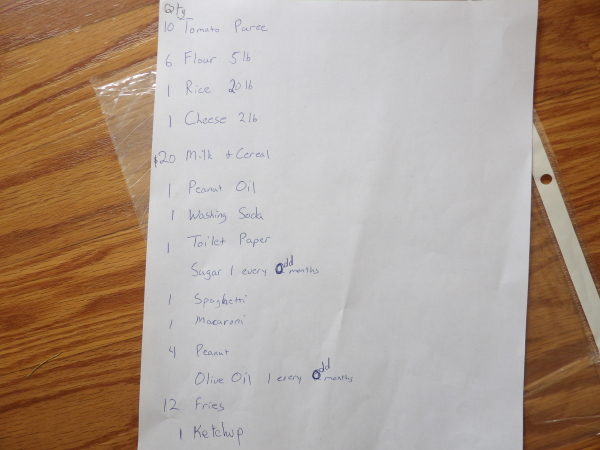

- Every month draft the list of the grocery staples you want to purchase for the month that fit within your grocery budget.

- Whenever possible, add few extra quantities of staples you don’t find on sale and just estimate the quantity you need for the month for staples that go on sale during the year.

- Adjust the quantities on your grocery list to purchase, to spend less than your grocery budget and save some money to stock up when some staples are on sale.

- Slowly purchase extra staples that do not go on sale, while you save some money from your grocery budget to stock up on the ones that go on sale.

- Little by little, you will build few months of food supply within your budget. You shop your pantry and freezer to cook and do grocery shopping to replenish your stock every month or when there are sales.

In this third video, we addressed how to create a grocery budget for your family with the goal to lower your grocery expenses.

For our family of 5, our July 2022 monthly grocery budget was $300 including $150 for general groceries, $60 for fruit, and $90 for meat.

Our grocery budget used to be $375 a month until 2019 when I changed it to $300 a month.

How to create a grocery budget

To set your grocery budget, you can pull your previous months grocery expenses from your bank transactions or credit card statements back to see how much you spent in average a month.

Then you set an average budget to work with. Alternatively, you could set a dollar amount you judge good for your finance, as your monthly grocery budget. Then you can track your purchases to see if you stay within that budget.

Grocery budget for family of 5

Before our kids were born, we spent around $300 to $350 a month on groceries. However, I didn’t track the grocery purchases until around 2015 when I set $375 a month for groceries. In 2019 I looked at our average actual grocery purchases. They were around $300. Therefore, I set $300 a month for our grocery budget for our family of 5.

To create a grocery budget for your family of 5, you can set a dollar amount you want to spend on groceries. Then track your monthly groceries purchases for few months. If you struggle to spend within that set budget, adjust the amount. If you spent far less reduce your budget.

Make changes until you are comfortable with your grocery budget and keep it fixed for every month. It is a good idea to take cash out for your groceries. Any unspent amount could be put aside to stock up when some grocery staples go on sales.

A little by little you will build few months of food supply on hand where you can shop from, for your cooking. And you do grocery shopping every month to replenish your stock.

Groceries for a family of 5 on a budget

First draft a list of what you cook often for our family or what your family like to eat.

Have a list of:

- Meals that you don’t want to spend a long time to prep, and they cook fast.

- Meals that you can prep quickly but they take long time to cook.

- Meals that can take you time to prep and take time to cook.

- After you have your meals list, think on ingredients needed to cook them and list them down.

That is your grocery list. You can add your household cleaning products to your grocery list as well.

You don’t need to purchase all the grocery staples on your grocery list every month, but you can purchase what you need for that month and purchase few extra staples you don’t usually see on sale. Overtime, you will have all the ingredients you need for your cooking, and you just need to shop your pantry, your fridge, and your freezer before cooking. Then every month, you draft a monthly grocery list of staples you want to replenish your stock of.

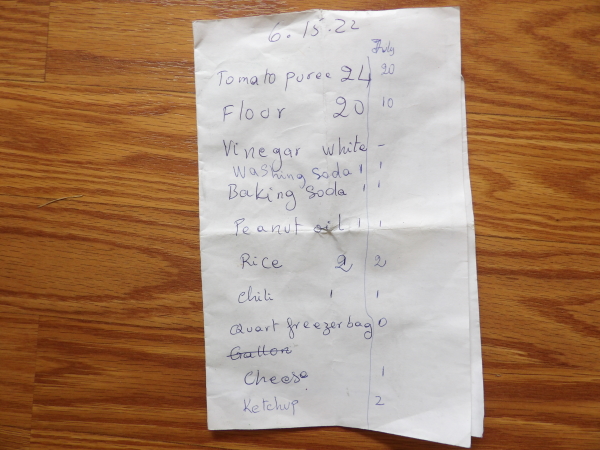

For our July 2022 grocery shopping, I adjusted the number and quantities of grocery staples to purchase.

Out of $150 for grocery, my husband took $100 for the shopping and $20 from $90 meat budget to purchased breaded chicken.

Our monthly shopping was to replenish our food pantry.

Every month, I scan our pantry to see what we are low in and add to my grocery list to purchase.

I started my grocery list with a budget below the $150 food budget. That way if I forgot a staple, I could add it later. In this instance, we didn’t purchase pasta. My husband took $20 to purchase frozen fries. He didn’t purchase the quantity of tomato puree and flour and could use that change to purchase pasta.

$300 a month grocery list

We purchased the following as of 7-17-22:

Unbleached all-purpose flour 5lbs: 8 Bags

29 oz. Tomato Puree

2 Ketchup

Washing Soda

Baking Soda

French Bread

2 Lbs. Cheese

Peanut oil

My husband spent about $70 on general groceries.

He also spent $21 on protein including breaded frozen chicken and eggs.

Throughout the month, if we are low in a grocery supply or forgot an ingredient on our list, we will stock up. Any remaining not spent in the grocery budget will be saved for when some grocery staples go on sale, we would be able to stock up. This could include corn, butter, chocolate chips…

Meat is expensive. We look in weekly ads to see if meat is on sale. Then we stock up if that is a cut we cook with.

We also stock up on fruit when fruit is on sale in the weekly ads.

When we didn’t spend all fruit and meat budget during a month, we save the remaining budget and when fruit or meat goes on sale, we can stock up.

Grocery staples that do not go on sale, we purchase a little extra every month, over time they build up.

An example is toilet paper. When you want to know how long it will take you to use one bag of toilet paper, you can write the date you opened the bag. After the bag is empty, you can calculate how many months it took you to use it all.

From there, you can calculate how many bags you need in a year. Based on our calculations, we need 6 bags a year. Some months, I add 1 bag on the grocery list just to build the supply back up. We have 4 bags on hand.

That strategy works to build your food supply on budget. You don’t purchase more than needed of some items. For instance, if you need 4 cans of 29 oz. of tomato puree a month, that is 48 (4*12) cans needed for the year. You know how many of an item to have on hand if you want 1 year of food supply at home. You know if you have enough supply for the year and not to have an oversupply of some grocery staples while you are low on other staples.

We have a free monthly budget template in Free Download and the workbook include a tab for grocery list. You could use it to calculate how many groceries staples you might need a year. You could find the monthly budget spreadsheet here.

Sometimes when we go shopping, the store is out of some of our grocery staples. For the month of July shopping, my husband didn’t find rice. We have 2 bags of 20 lbs. rice on the list to purchase and the store didn’t have any. Not having supply at home, you could be out of a main cooking ingredient when the store is out. If the grocery staple is an important staple used in your house, you might have to purchase it from another store and pay more than what you usually pay for it at your regular grocery store where you shop at. Luckily, we have rice in stock. We added it to the grocery list to just build our rice stock up slowly.

How to build your food supply on budget part 3

When you cook from scratch, you don’t need many varieties of salad dressings. You may not need salad dressing at all. This saves you shelve space and refrigerator space when you can make many dishes from your grocery staples. For instance, with flour, you can make sourdough pizza, sourdough bread, egg roll wrapper, flour tortilla…

With tomato puree, you can make pizza sauce, pasta sauce…

With kefir culture and milk, you can make milk kefir drink and kefir salad dressing. Both are probiotic.

The video series explains how we build our food supply on budget while cooking from scratch.

We share different ways to save money and different ways to make money to reach for financial independence where you do not depend on your employer to provide for your needs.

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you would find information to live a quality life within budget and increase your net worth. Topics covered include personal finance, investment, business management, cooking from scratch and growing some vegetables and fruit to save money and eat healthy.

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

“Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.”

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel)”.