You can increase your credit score using these few strategies:

- Paying your credit card and other debts on time every month: It is very important not to miss payment: Some like auto pay. I like to pay all my bills at the start of the month and avoid missing a deadline.

- Negotiate a higher credit limit on your cards: Having a higher credit line would lower your debts to credit ratio.

Check your credit report for free once a year from the 3 credit bureaus.

- Negotiate a lower interest rate on your cards: Whether you have an outstanding balance or not it is a good idea to call your credit card companies and request lower interest rates.

- Pay off your credit card debts: That would lower your overall debts compared to your available credit line and improve your score.

- Pay off your other debts: If you have a student loan and car loan, have a plan to pay them off as well.

- Keep your credit cards open but check your account every month to make sure they are not being charged fraudulently: Closing a credit card could lower your score for a certain period of time. If you plan on applying for a loan or getting a mortgage, don’t close your credit cards around that same time.

- Use your best credit card to pay online purchases and pay it off within days: It is easier to dispute a fraudulent activity with a credit card company than with your bank.

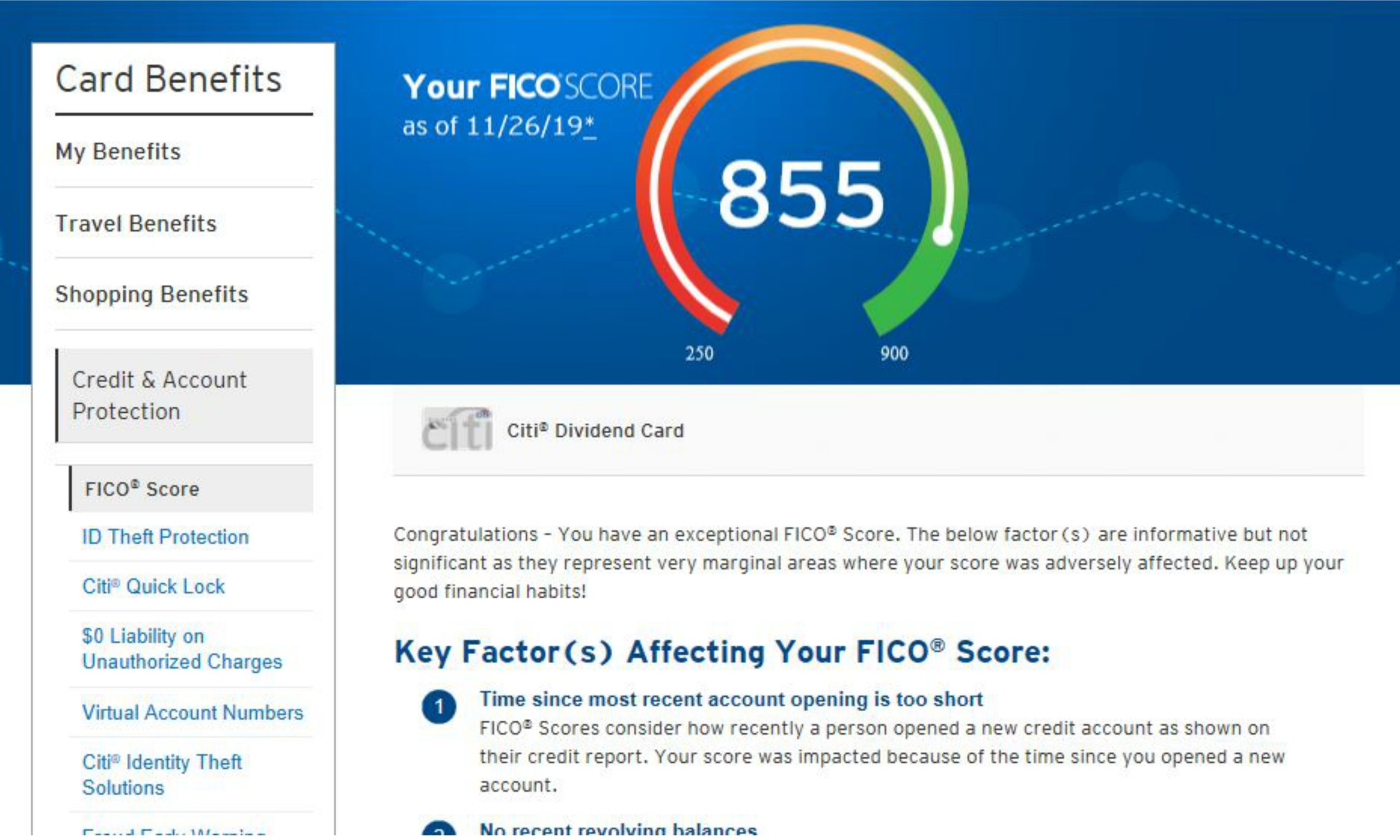

Access your credit score for free from your credit cards account.

I built my credit using only 3 credit cards for 7 years until we purchased our first home in 2014. My credit score based on Equifax but pulled by Citi was 855 as of end of 2019.

You can improve your credit score to the exceptional range as well. Just make sure you pay your bills on time and thrive to pay your debts off early.

Access your credit report for free once a year from the 3 credit bureaus: https://www.annualcreditreport.com/index.action