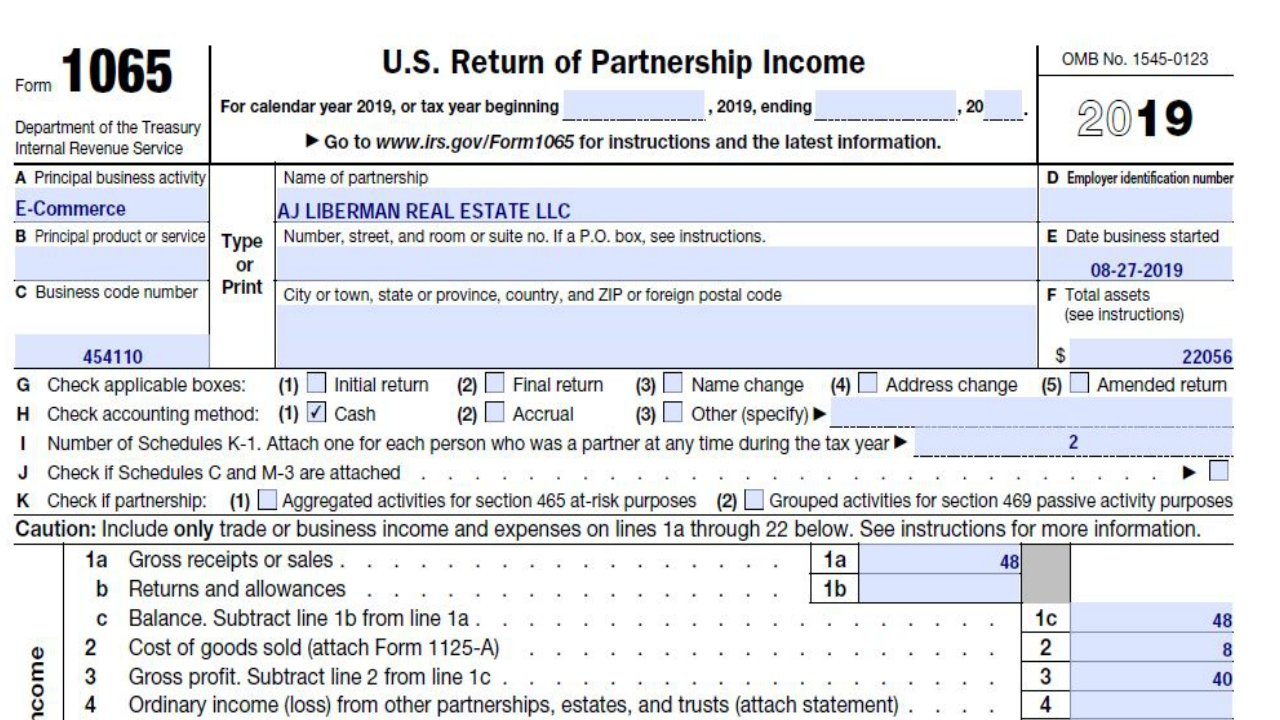

If you have a Limited Liability Company (LLC) or a Partnership that is in the business of producing, manufacturing, or reselling physical products, you might carry inventory even if you use a third party to drop ship or fulfill your customers orders. You would fill out Part 1 of Form 1065 for income and deductions. The balance between both would go on line 22 of Part 1 and you would put it on line 1 of Schedule K. You would fill out Form 1125-A for your inventory and Schedule B-1 if you own more than 50% of your business.

When you fill out page 1 you may not have much to fill out on schedule K as most of your costs related to the products would go on Part1 or Page 1 of form 1065.

If you have inventory, you would need to fill out Form 1125-A. That is where you would determine the cost of goods sold during the year.

Income

You would need to fill out line 1 and 2 in most cases.

Deductions

In most cases you might have deductions to claim under line 14 for taxes and licenses and line 17 for depreciations

Your office supplies and packaging cost or mailing cost would go under line20.

Use employee reimbursement deductions for business mileage and include in line 20

Schedule K-1 is a portion of Schedule K for each partner based on their ownership percentage or their share of profit and loss. The total Schedule K-1s for each line you filled out should match the amount on Schedule K or the corresponding lines.

Please watch our 2 videos on how to fill out the form 1065 for your LLC in more detail.

https://youtu.be/NQs7UBf1gLU How to Fill Out Form 1065 for a Trade or Business Carrying Inventory-Pt 1-Form 1125-A & Schedule B-1

How to Fill Out Form 1065 for a Trade or Business Carrying Inventory – Part 2- Schedule K & K-1: https://youtu.be/iyakRDMNKEs

To learn more tips on how to live below your income without sacrificing the quality of your life and start building wealth, please join our community by subscribing here: https://ninasoap.com/membership-join/

Leave a Comment