Should you select line J-1 or Line J-2 for your S Corp tax return?

Section J (1) Aggregated activities for section 465 at risk purposes:

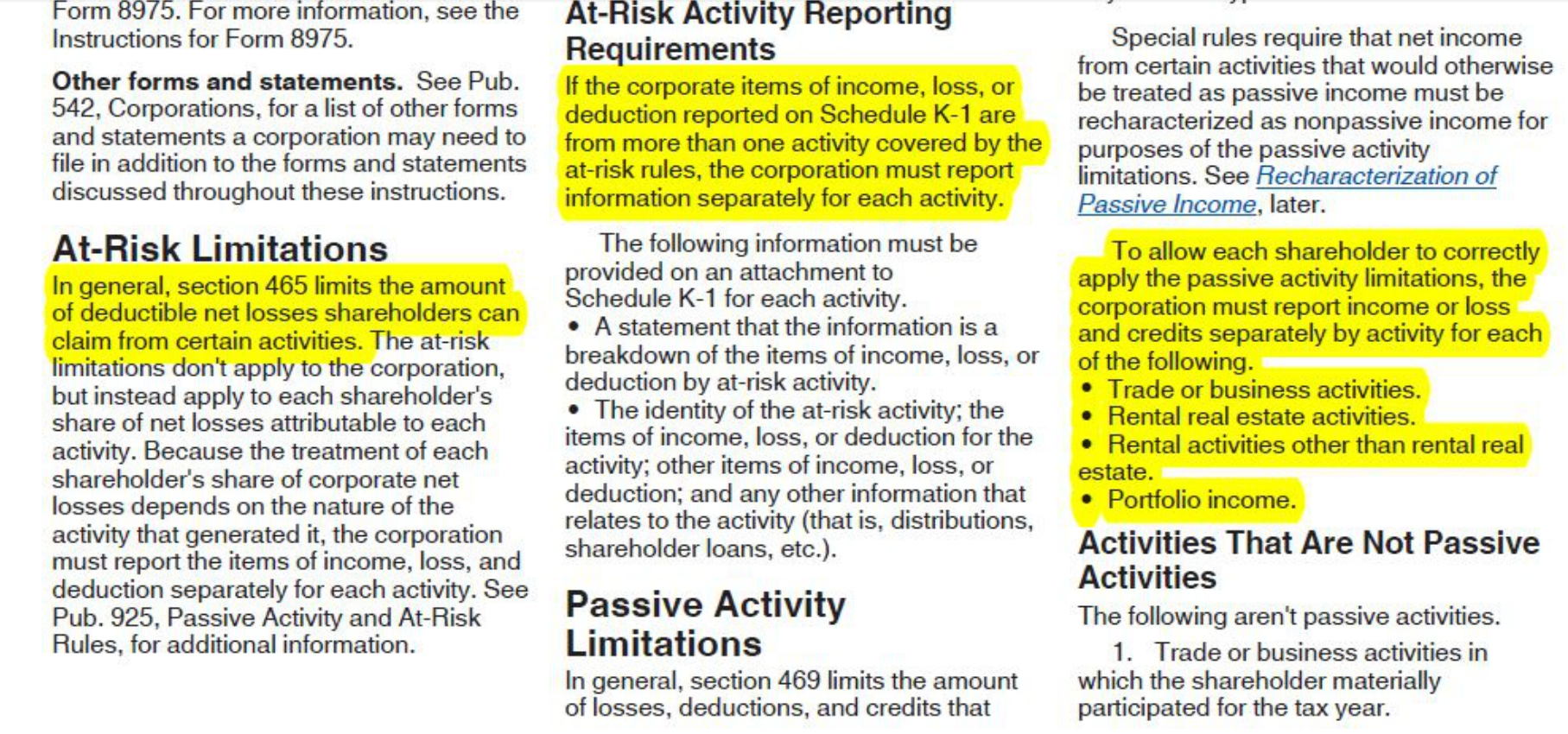

If your S Corp has multiple activities that meet the rules to be a business or active activities (producer, manufacturer, reseller of products, consultant…) they are active activities and partners could claim loss against their salaries or wages or other types of active incomes if they materially participate in the activities. If the S Corp wants to group active activities together, they have to be similar activities, or you have the same level of ownership in all the activities, and you don’t combine passive activities with active activities. So if your S Corporation has multiple active activities you can combine their financial on 1120S Tax return but would provide an attachment to schedule K and to K-1 partners for each activities separating income and loss on the attachment. That way each partner would know what loss to claim against his/her other active income because he or she materially participated in that activity. And the activity he/she didn’t participate in, she /he won’t be able to claim the loss against an active income. That is the At-Risk rule limitation.

J (2) Grouped activities for section 469 passive activity purposes:

You select this one for the S Corp if you have passive activities type of business like rental real estate and you want to group all rental real estate revenues and losses together on one return. Or you have active activities under your S Corporation but none partner materially participate in any one of them. You hired managers on payroll to perform activities and management roles, you can group these activities on one tax return 1120S but attachments would be provided for Schedule K an K-1 to specify what activities are rental and what activities are business or trade and would be classified as active if you have materially participated in them.

In my case, I didn’t need to select any as I didn’t group any activity for 2019. But 2020 tax return would be different and I might need to select J-1 as I would group multiple activities (manufacturing, reselling, blogging, you Tubing, financial consulting, tax consulting) that I and my husband participate in and own 88% shares of the S Corp. For 2019 everything has been kept separate. But my attorney suggested I moved all these activities under one entity this year.

Leave a Comment