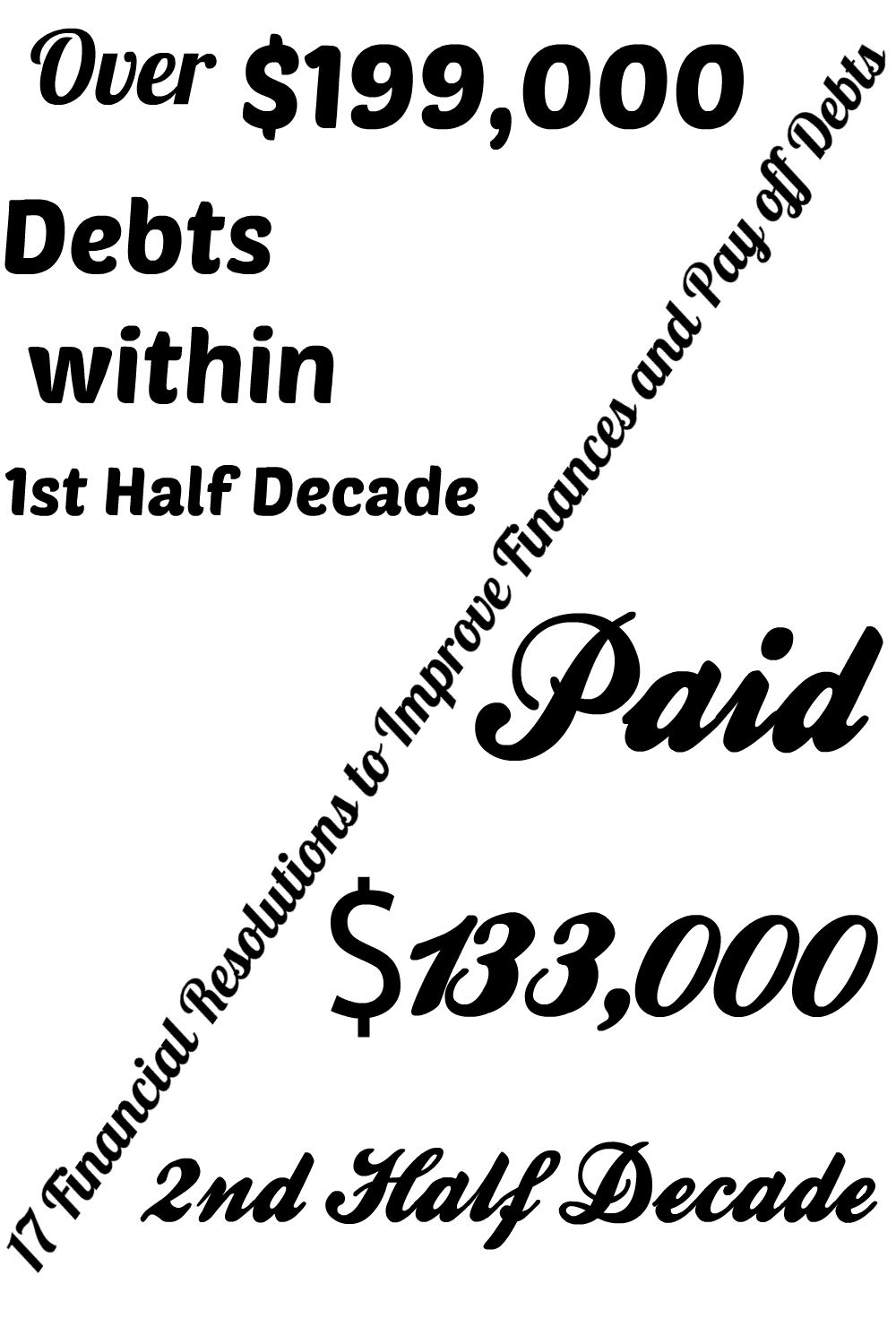

Within the past 10 years we accumulated over $199,000 of debts and paid over $133,000 during the past 5 years. My husband and I made poor financial decisions during the first 5 years of the past decade. We spent the second 5 years to clean up our financial mess. Below is how we did it:

2010 – 2013

From 2010 to 2013, we accumulated over $67,000 of debts including $30,000 of credit card debt, $22,000 of car debt, and $15,000 of student loan. Our gross combined income ranged from $35,000 to $38,000 a year.

2014

I found a full-time job mid-2014 and our gross combined annual income went up to about $62,000.

We purchased our first home at the end of 2014 and had a mortgage loan little over $117,000.

2010 – 2014

For the first 5 years from 2010 to 2014 we accumulated over $184,000 of debts including $67,000 of consumer debts and $117,000 of mortgage loan. Our annual gross combined income went from $35,000 to $62,000.

2019

Due to a scam that happened few months before the end of 2019, my husband has over $15,000 of credit card debt.

2010 – 2019 Debts

From 2010 to 2019 we accumulated a total debt of $199,757 ($67K of consumer debts, $117K mortgage, and $15.5K of credit card debt). Our annual combined income went from $35,000 to $90,000 annual gross or from $30,000 to $61,000 annual take home pay).

As you can see, we accumulated most of $199,000 debts during the first 5 years of this past decade.

Debts Payment

From 2013 to 2019 we paid well over $120,000 or around $133,000 (over $51k in consumer debts from 2013 to2017, over 30K in 2018, and over 39K in 2019).

From 2013 to 2019, our combined annual income went from $35,000 to $90,000 and our take home pay went from $30,000 to $61,000 a year).

At the end of 2019 we have a total debt a little over $66,000 which includes $14,274.25 of credit card debt and $52,280.75 of mortgage loan.

What methods did we use to pay most of our debts? 17 Financial Resolutions to Improve Finances and Pay Off Debts

1. Stopped using credit card for purchases

2. Set fixed amount to apply to our credit cards payment every month

3. Paid minimum on all debts and paid the extra toward credit cards

4. Paid extra on mortgage from the start. Every year we increased the payment by $50 extra a month.

5. Called credit card companies and requested a lower interest rate.

6. Transferred what we could pay within a year to a 0% credit card and paid it off in less than 12 months.

7. Stopped giving gifts to adults’ family members

8. Stopped purchasing toys gifts to kids. We gave them money on birthdays and Christmas.

9. Stopped eating out. In 2017 we went to a restaurant once. We have not gone to a restaurant in 2018 and 2019.

10. Live on one income: We used our highest income to pay for our monthly expenses and mortgage and we used the lowest income to pay debts.

11. Once the consumer debts were paid off, we saved one month on our lowest income and we made the switch to live on that income.

12. We lived on our lowest income and used our highest income to pay the mortgage. We paid half of our mortgage in less than 2 years.

13. Stopped paying ourselves first. We stopped investing in our brokerage accounts and Roth IRA unless we saved our own allowances to invest. We contributed to our employers 401Ks to the maximum they matched.

14. Cash envelops were used to purchase groceries. This helped us shopping within our groceries budget. Anything we didn’t spend in a month was saved in an envelope and used to stock up and build 1 year of food supply.

15. Recently cut cable. Cable used to cost us over $100 a month.

16. Recently decreased our phone bills by changing carrier. We decreased our cellphone bills from $110 a month to $17 a month.

You can make an impact in your debts this 2020 if you reduce your expenses and increase the amount you pay toward your debts.

Track your income to allow you to go back in time and compare your debts to your income.

Budget and record your income and expenses to allow you to track over time the amount of money you paid toward your debts. I wouldn’t be able to reflect on our past financial life if I didn’t track our annual income, our monthly income and expenses. You can find the spreadsheet we use to track our budget and monthly expense on www.ninasoap.com under Free Download.

You could also download our budget and monthly expense tracker and start budgeting in 2020.

Leave a Comment