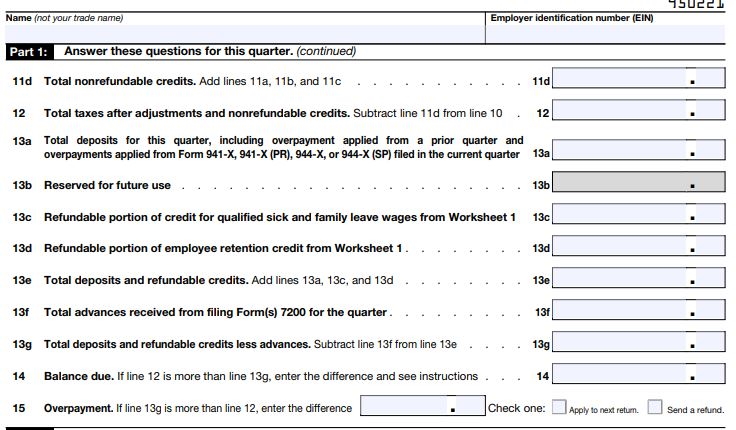

Line 12 to Line 15

Enter your first and last name on page 2 of Form 941 on top.

Enter your EIN number on top right

Part 1 Line 12: Total taxes after all adjustment and non-refundable credits: Line 10 – Line 11 d

Line 13 a total deposit for this quarter. Include in the amount the overpayment you want to apply to this quarter.

If you file amended Form 941-X for prior quarter in this quarter and have an overpayment, add it as well.

Leave line 13b blank.

Line 13 c, d: If you have refundable credit from sick pay and or family leave from the Worksheet 1 add the amount on the appropriate line.

Line 13 e: total deposit and refundable credit: Lines 13a+13c+13d

If line 13f applied to you read more in the instruction for form 941 page 15. If you completed Form 7200 but didn’t receive the advance by the time you complete Form 941 for the quarter, do not enter the advance requested on line 13 f.

Line 13g: Line 13 e-Line 13f

Line 14: If line 12 total taxes after adjustments and non-refundable credits is higher than line 13g total deposits, you owe tax. Put the amount from Line 13g – Line 12 on line 14 if it negative.

www.bluehost.com/track/ninasoap

Line 15: Enter the amount from Line 13g – Line 12 if positive. You overpaid tax.

Check the box next to Line 15 to be sent a refund or be applied to the next quarter.

3-How to fill out IRS Form 941 For 2021

Leave a Comment