How to calculate wage for W2 line 1 if your business paid the employee’s share of taxes?

If you didn’t withhold social security and Medicare tax from your employee’s wage and decided to pay them yourself, you need to include that amount in the wages reported on W2.

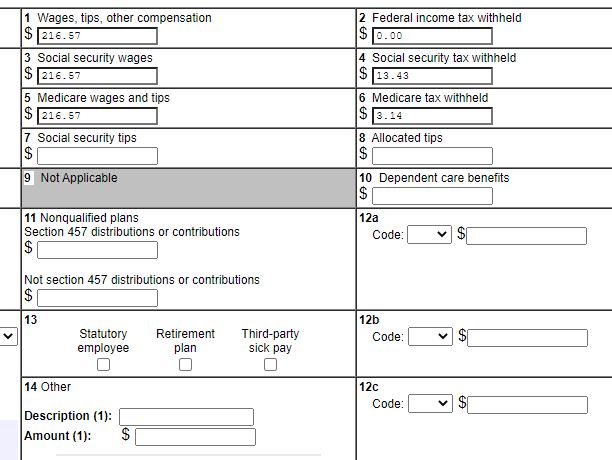

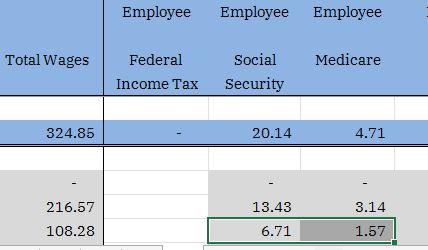

For instance, if you pay $200 to your employee and decided to pay his share of social security (6.2%) and Medicare tax (1.45%), on your payroll spreadsheet you need to calculate the wages and include the taxes in the gross wages.

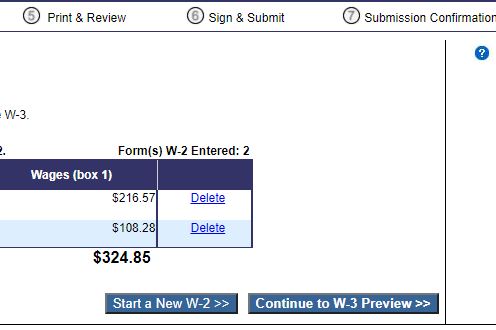

To figure out the amount, do $200/ (1-0.062-0.0145) =$216.57. That is the wages to report of W2 line 1,3, and 5, Form 944, and Form 940 (FUTA).

You would use $216.57 to calculate the employee social security tax and Medicare withheld and report them of Form 941 or Form 944 as if you withheld them from your employee’s salary. You would report the employer’s share of taxes as well on Form 941 or Form 944 but not on W2 Form.

For more information, read IRS Publication 15-A page 21-22 (Employee’s Portion of Taxes Paid by

Employer).

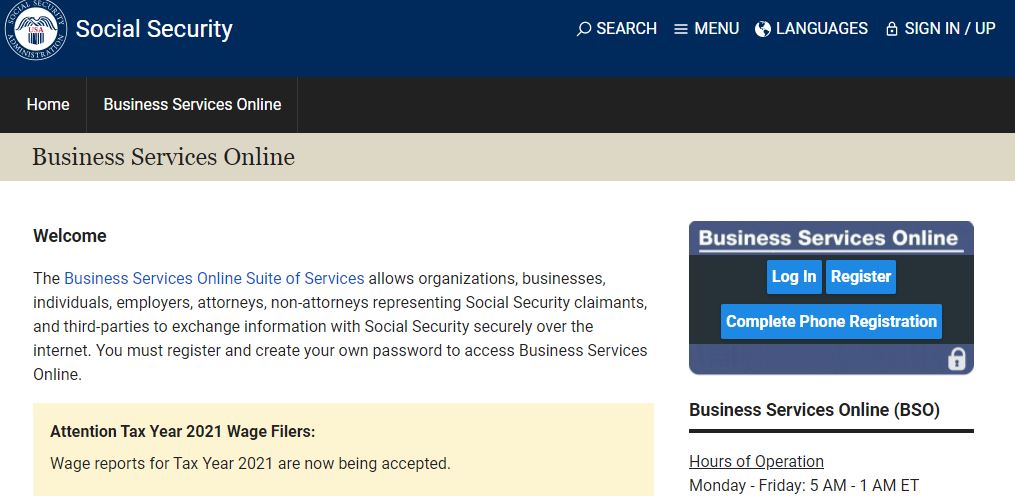

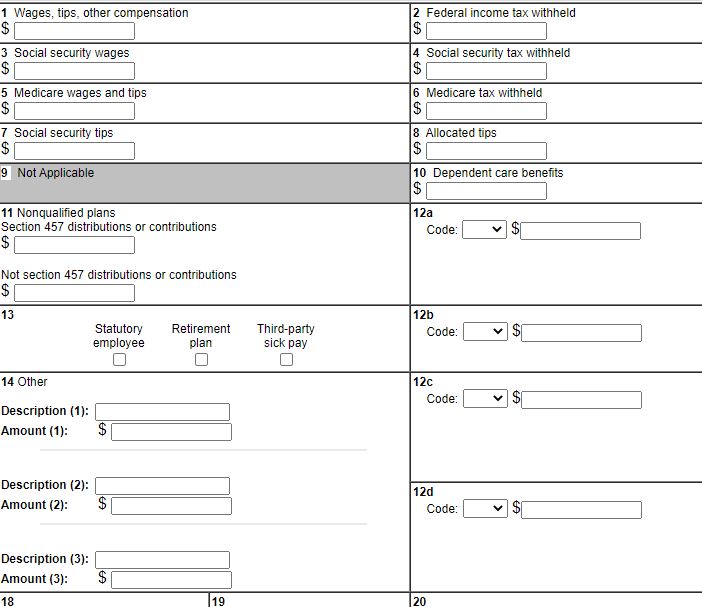

E filing with SSA

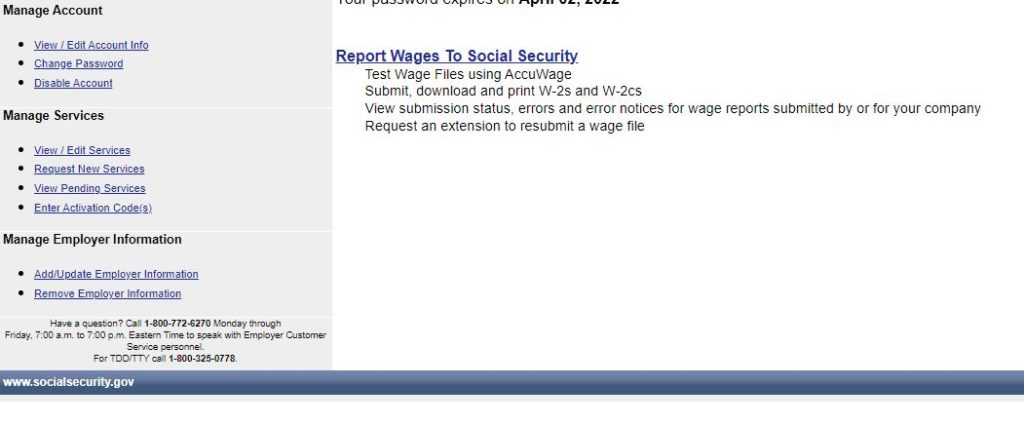

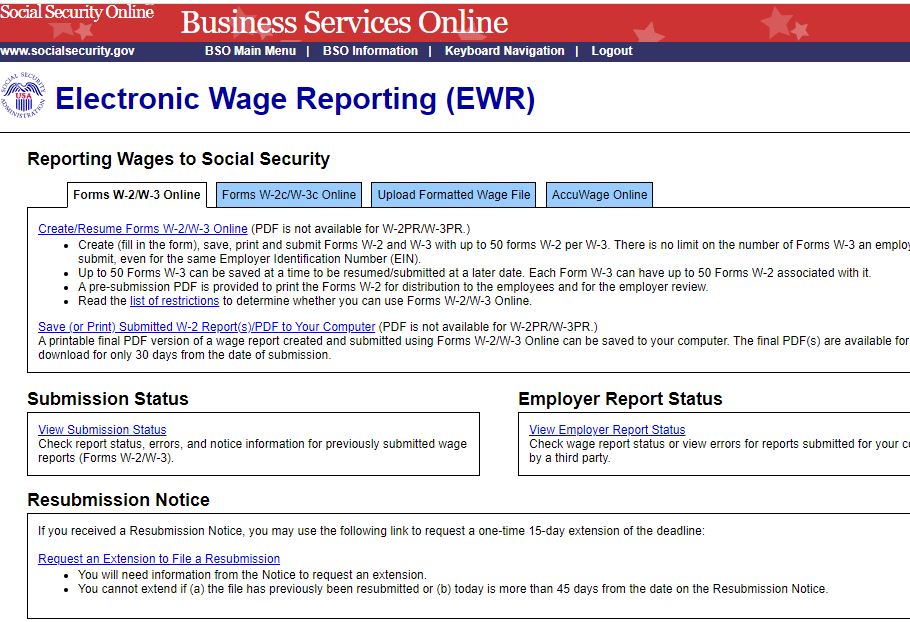

click on Business Services Online

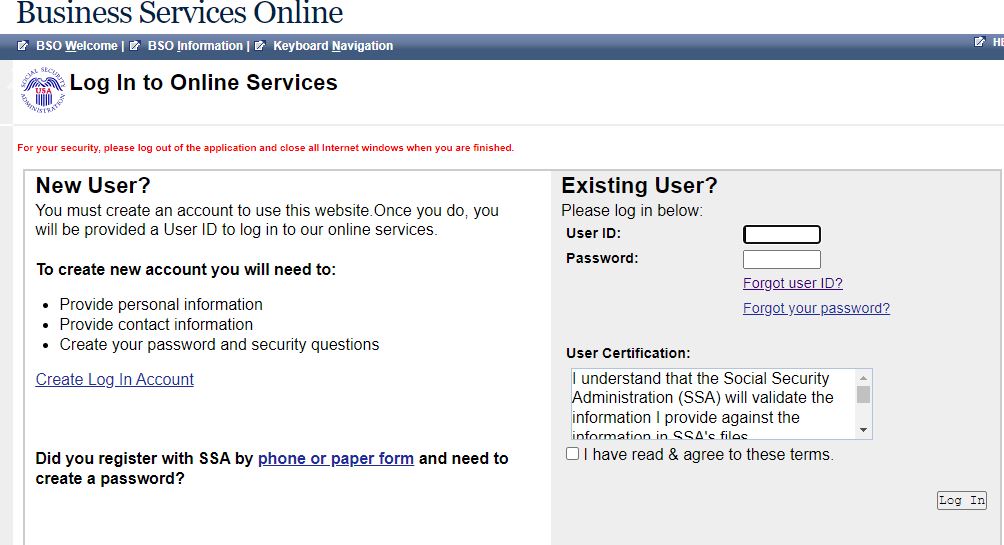

Click on Login if you have signed up already otherwise, register.

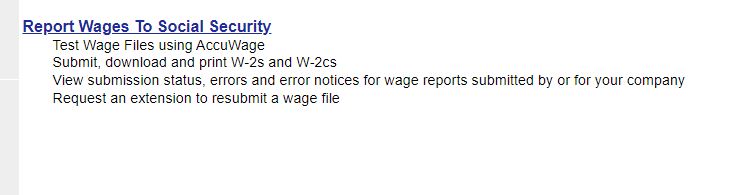

Click on Report Wages to Social Security.

Click on Create/Resume Forms W2/W2 online.

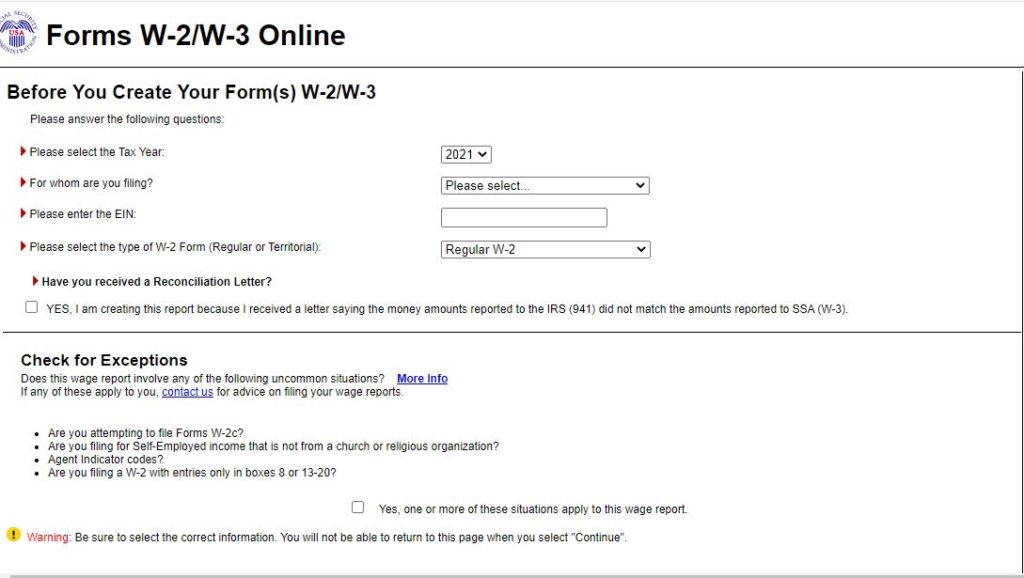

Enter the year

Enter your business name or select it from the menu

Enter the EIN or it should appear

Select Regular W-2

Click Continue

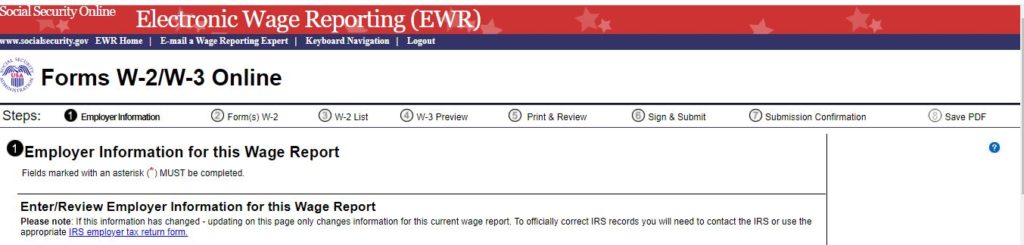

Add contact info.

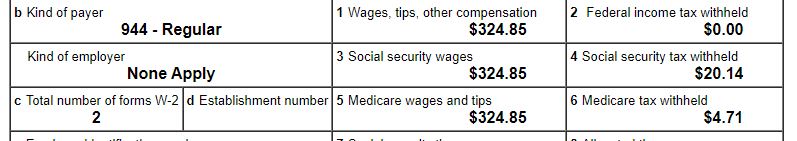

Kind of Payer

Check to box for the type of tax you would pay related to the W2 like Form 944 or 941.

Kind of Employer

Select None Apply.

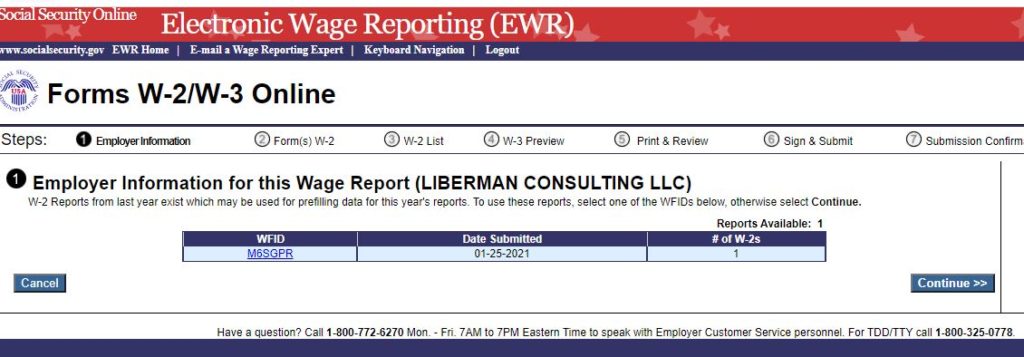

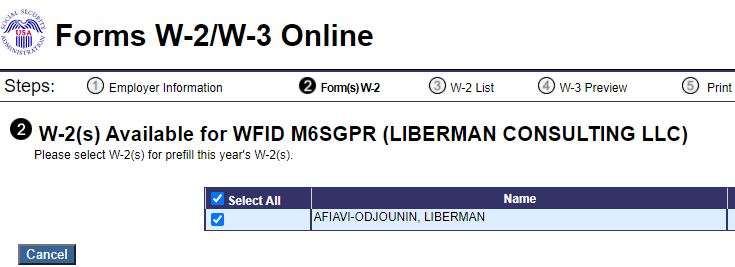

Click on one of the previous year WFID if you have entered information for a w2 last year otherwise click Continue.

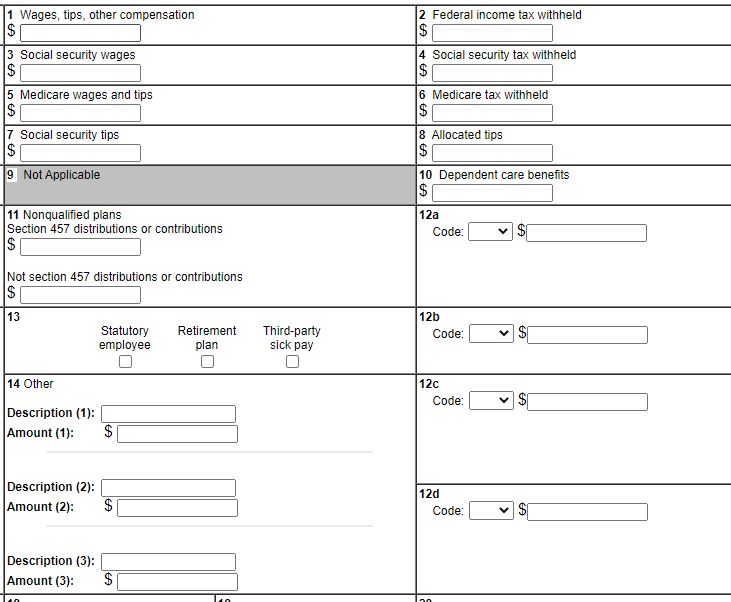

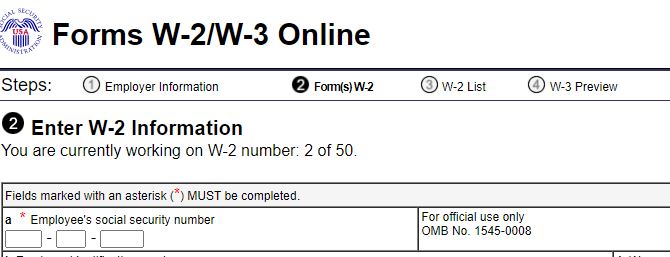

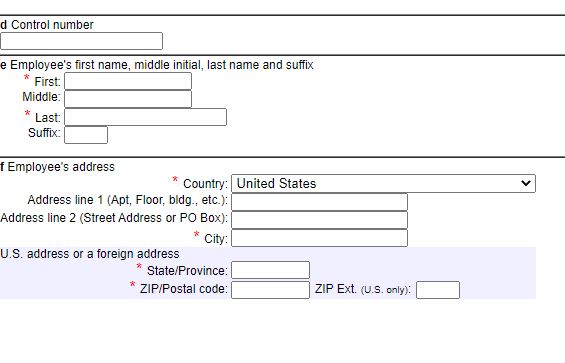

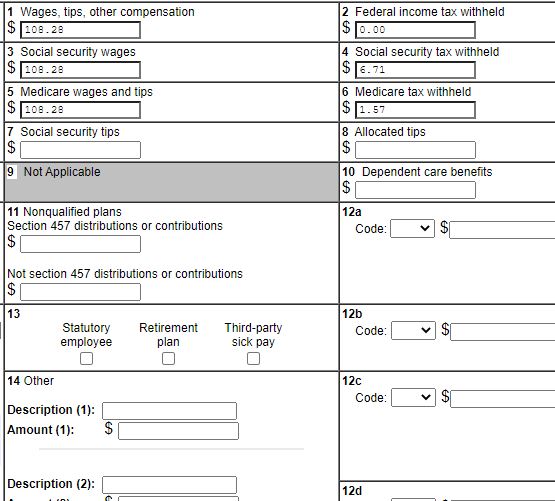

Complete the W2.

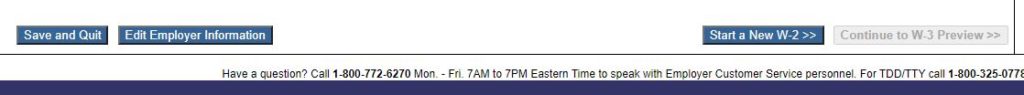

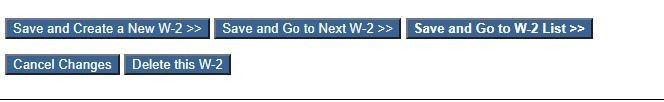

At the bottom click on save and create a new w2 or the appropriate button.

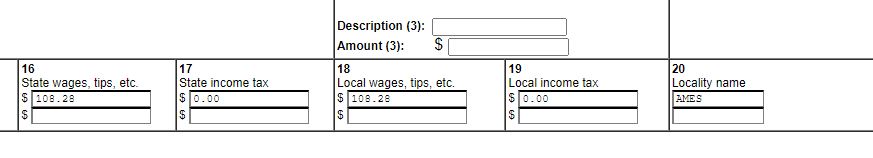

When done with the last w2, click on Save and go to W2 list.

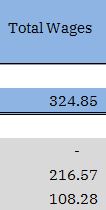

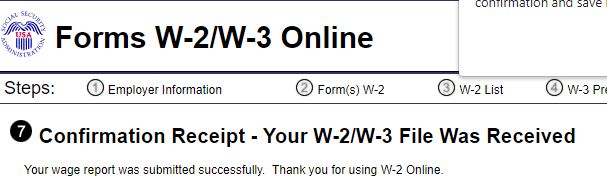

W3 should be the total of payroll spreadsheet gross wages and total of employee share of tax withheld.

Once you verified the W3 is accurate, click on Continue.

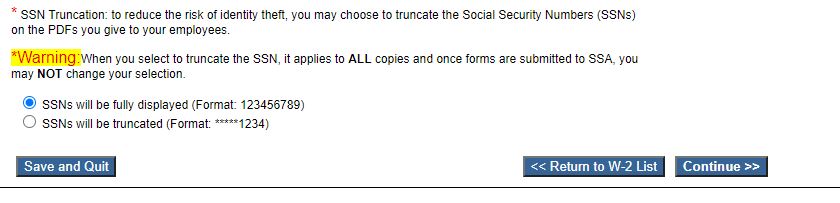

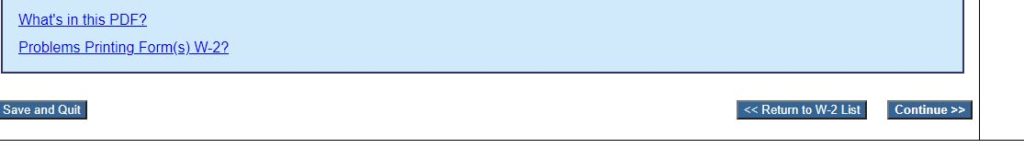

Follow the instructions to save a copy of W-2/W-3 and review. Print them out of your business record and to give to your staff for review as well.

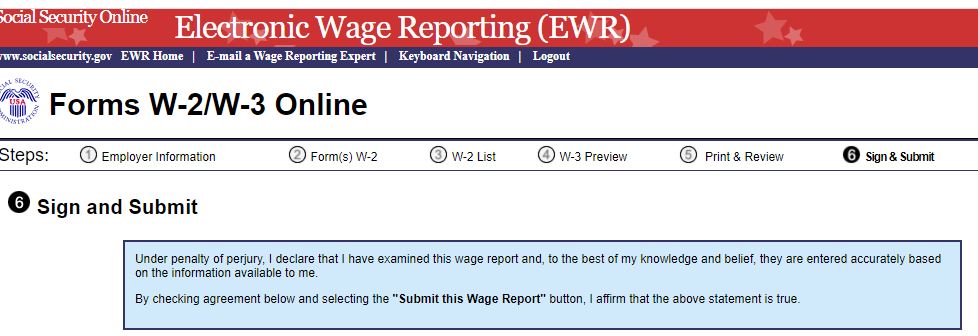

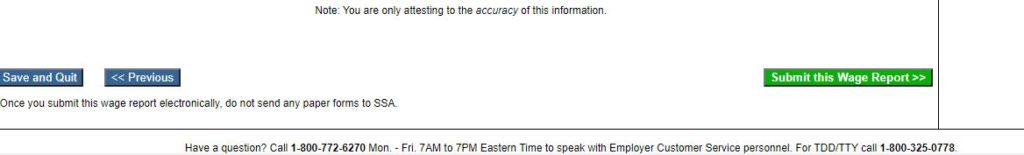

Later sign back in and sign and submit the W-2/W-3 to the Social Security Administration (SSA).

When you e-file W-2/W-3 with SSA, don’t mail them a copy.

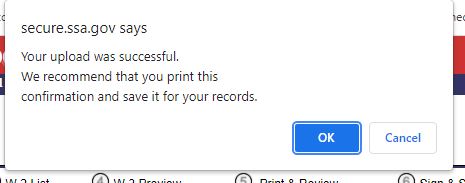

Make sure to save and print the confirmation receipts.

The confirmation receipts should be kept for around 7 years.

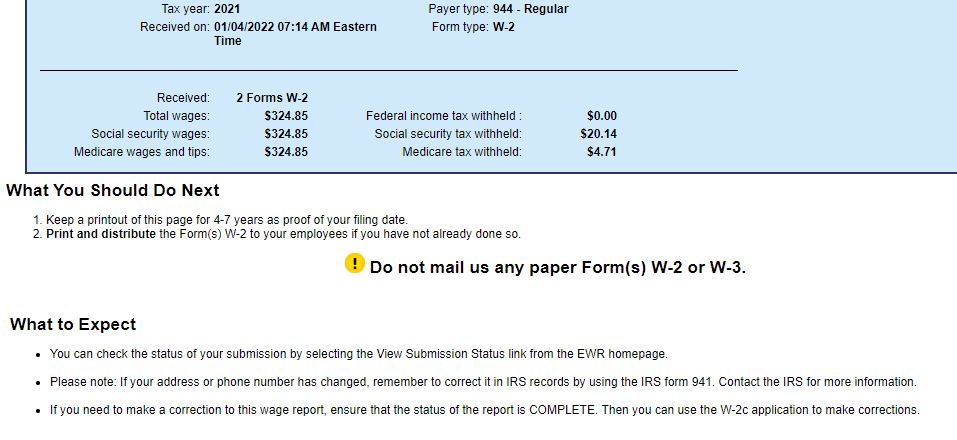

Click on Go to Save PDF

Save the final PDF and print it out as well.

Give your staff their copies and file the business copies.

Click on EWR Home when done.

Click logout.

What is the difference between a w2 and a w3?

A W-2 is the total wages you paid during the year by employer and social security and Medicare taxes you withheld from each employee’s wages.

W-3 is the total by category of all the W-2s you filed for all your employees for the year.

Free Payroll Spreadsheet

If you don’t have a payroll software, we have free payroll spreadsheets in our Free Download you could download and track your payroll to be able to file your payroll taxes at the end of the year accurately.

Leave a Comment