How do you record mileage for business use 2022

Have a home office for your business.

Try to have a place in your house that you keep just for business that you use to do your business administrative work. That place will qualify you for business mileage deduction.

How to track your business mileage.

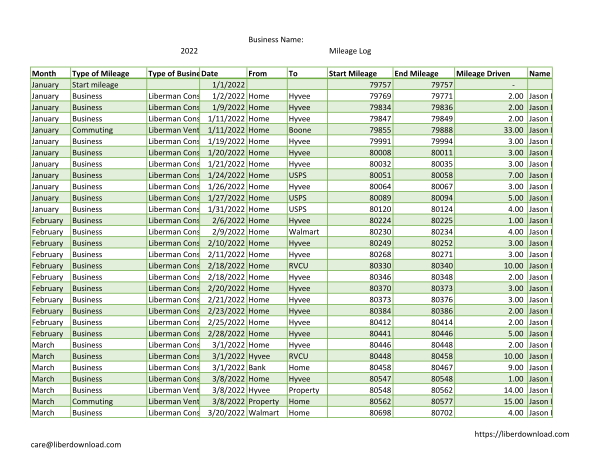

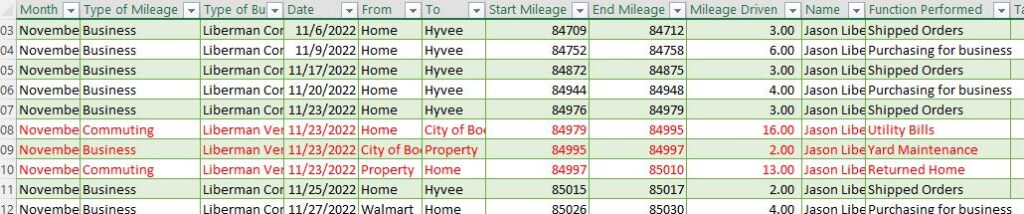

When you have a place at home just for your business, any place you go to when you leave home, if it is for business purposes, record your car mileage when you get in the car. Record the mileage when you get to your destination. Record your mileage when you get home. The difference between the mileage before you left home and the mileage when you got home is business mileage. Record it in a document, or a spreadsheet if possible.

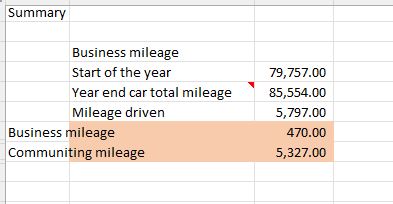

At the end of the year December 31, record your card total mileage.

Know the mileage between your home and your job or workplace. That is commuting. When you know how many days a week you go to work and the mileage round trip from home to work, that is commuting per week multiplied by 52 weeks is the total commuting mileage for the year.

When you know your business mileage by tracking them and total them together, that is your business mileage for the year. At the end of the year, you record the total mileage of your car. The mileage on your car on January 1st, 2023, and the mileage on December 31, 2023, would help you calculate the total mileage driven during the year.

If you use a tax software to file your taxes, you need to know the following:

The total mileage driven during the year,

The total commuting mileage driven during the year,

The total business mileage driven during the year,

The difference between the total mileage driven during the year and business mileage and commuting mileage will give you mileage driven for other purposes like shopping…

You can deduct expenses related to business mileage only.

If you want to deduct actual expenses, you need to track your car gas receipts and record them.

Sometimes a deduction of actuals expenses might give you a higher deduction but requires more record keeping.

Sometimes taking IRS standard mileage deduction is a better deal if the car is old. It doesn’t require keeping your car gas receipts and recording them, but you still need to track your business mileage and other types of mileage driven as described above. The standard mileage deduction per mileage varies every year. The tax software will be up to date to apply the right deduction. Tax software will usually ask you questions and use your answers and data to figure out if claiming the actual business use of your car will result in a higher deduction for you or if the standard mileage is higher.

Conclusion: How do you record mileage for business use 2022?

The video uses 2022 mileage log to explain how to track mileage for taxes.

Resources

Article categories

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Ads Disclaimer:

Ads are displayed in our contents. These ads do not influence the content we create and publish. We do not endorse them either.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Vision

Nina’s Soap was created to help you live a healthy lifestyle within budget while increasing your net worth.

Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you will find information about living a quality life within budget and increasing your net worth. Topics covered include personal finance, investment, business management, cooking from scratch, and growing some vegetables and fruit to save money and eat healthy.

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel) , https://ninasoap.com/affiliate-products/ (Our resource page)”.