To report your cost of goods sold on Schedule C, you need the following:

- Have your inventory and sales report up to date for the year.

- Know the cost of your inventory at the beginning of the year.

- Know the cost of raw material, resale products, or private labeled products purchased during the year.

- Know the cost of products made during the year as well as the cost of raw material taken out of inventory to make the finished products.

- Know the cost of products sold during the year.

- Know the cost of your inventory remaining at the end of the year.

- Use tax software to file your Form 1040. During the filling process you will complete Schedule C and enter your cost of goods sold during the year if your business carries inventory.

How to calculate the cost of goods sold during the year?

Your cost of goods sold during the year = cost of inventory at the beginning of the year + purchases or raw materials, resale products, private labeled products, – out of inventory of raw materials for production + finished products made using these raw materials taken out of inventory – cost of inventory at the end of the year.

As you sell products, it is a good idea to update your inventory level and estimate the cost of goods sold as you sell them. By the end of the year, you will be able to determine the cost of your inventory at the end of the year.

How to calculate the cost of inventory at the end of the year?

The cost of inventory at the end of the year = cost of inventory at the beginning of the year + purchases or raw materials, resale products, private labeled products, – out of inventory of raw materials for production + finished products made using these raw materials taken out of inventory – cost of goods sold during the year.

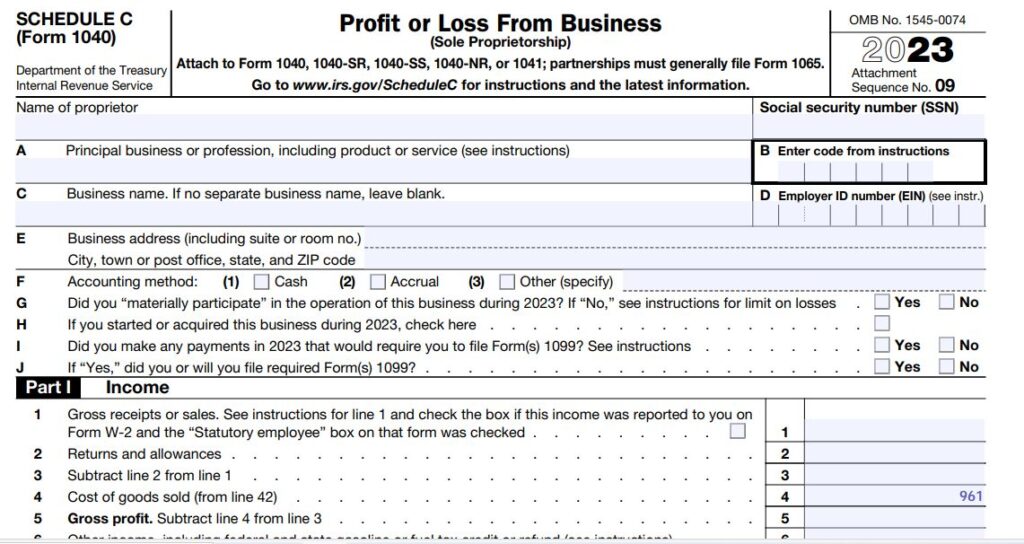

How to report cost of goods sold on schedule C Form 1040?

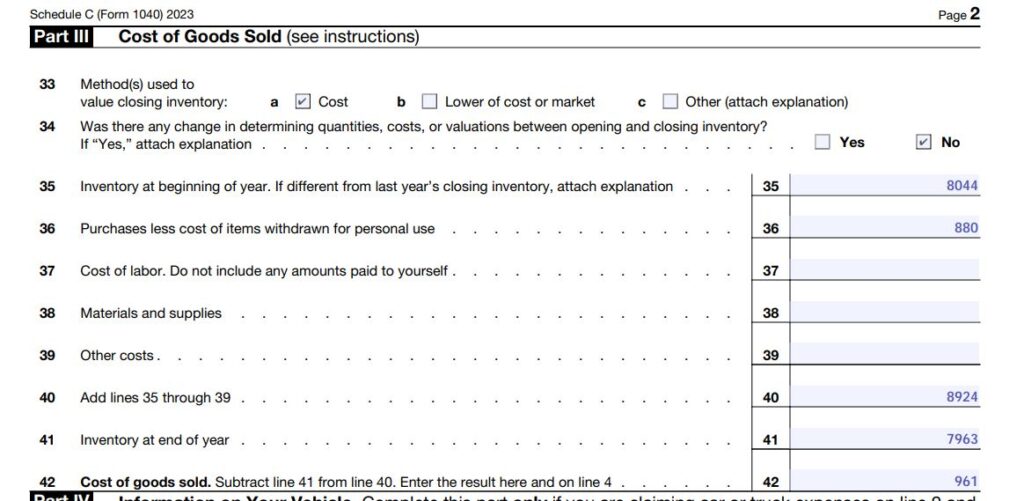

The cost of goods sold is reported on Schedule C (Form 1040) Part III Line 42. The amount on that line 42 is then reported on Schedule C (Form 1040) Part I Income Line 4 Cost of goods sold.

How to complete Schedule C (Form 1040) Part III Cost of goods sold?

Line 33 Method used to value closing inventory: You choose the right one. It could be a) cost.

Line 34 Was there any change in determining quantities, costs between opening and closing of inventory? You check No if your inventory at the end of the year December 31 is equal to inventory at the beginning of the year January 1st.

Line 35 Inventory at beginning of the year: If your business is new, chances are your inventory at the beginning of the year will be $0. Otherwise, enter the cost of your inventory at the end of the previous year.

Line 36: Purchases less cost of items withdrawn for personal use: enter the cost of raw materials, or products purchased to resell, or private labeled products. Deducts raw material taken out of inventory to make finished products. Add finished products made during the year.

If you took some products to use and didn’t pay for them, take the cost associated with these products out or reduce your total for Line 36 by that amount.

If you took raw material out of inventory to make finished products, to avoid duplicating cost, you need to subtract the cost of out of inventory raw material and then add the cost of finished products. The cost of these finished products will be at least the same as the cost of raw material taken of inventory. Otherwise, the cost of your inventory level will be out of balance.

Line 37 Cost of labor. You do not include any amounts paid yourself: You leave this line blank if it is not applicable to your business.

Line 38 Material and supplies purchased during the year:

Line 39 Other costs: You leave this line blank if it is not applicable to your business.

Line 40 Total inventory level during the year: Add line 35 + Line 36 + Line 37 + Line 38

Line 41 Inventory at the end of the year: enter the cost of your inventory at the end of the year.

Line 42 Cost of goods sold: That is line 40 (the cost of the inventory at the beginning of the end + purchases during the year) – Line 41 (cost of inventory at the end of the year).

The cost of goods sold is not the price you sold the products for, but how much it cost you to buy them or to make these products you sold.

The amount on line 42 cost of goods sold will be then reported on Schedule C (Form 1040) Part I Income Line 4 Cost of goods sold to determine your gross profit.

Schedule C (Form 1040) is a part of Form 1040 Individual income tax return and is completed if you are the sole proprietor. Schedule C is not a stand-alone tax return. You file it as you file your form 1040. It is recommended to use software to complete your form 1040 and Schedule C to save time. Once you enter your business financial data on your tax return, the software will put the numbers on the different forms they should be reported on, including your state tax return, saving you time. You review your return when you are done, to make sure your numbers are reported as you expected.

How to report cost of goods sold on schedule C Form 1040 for 2023?

This video explains step by step how to complete Schedule C (Form 1040) Part III Cost of goods sold for 2023 tax return.

Resources

https://ninasoap.com/free-downloads/

https://ninasoap.com/federal-tax-forms-and-instructions/federal-tax-forms-and-instructions-links/

Related article categories

https://ninasoap.com/categories/how-to-fill-out-irs-form-941/

https://ninasoap.com/categories/how-to-complete-form-940/

https://ninasoap.com/categories/how-to-fill-out-form-944/

https://ninasoap.com/categories/how-to-file-form-1065-partnership-income-tax-return/

https://ninasoap.com/categories/how-to-file-form-1120s-s-corporation-income-tax-return/

https://ninasoap.com/categories/how-to-e-file-w2-and-w3/

https://ninasoap.com/manage-your-business-yourself/

https://ninasoap.com/categories/estimated-tax-payments/

https://ninasoap.com/categories/how-do-you-keep-track-of-business-expenses-and-income-in-excel/

https://ninasoap.com/categories/how-do-you-depreciate-a-business-asset/

https://ninasoap.com/categories/file-your-own-taxes/

https://ninasoap.com/categories/how-do-you-calculate-cost-of-goods-sold-for-taxes/

Previous related articles:

https://ninasoap.com/2023/08/how-do-you-record-mileage-for-business-use-2022/

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Ads Disclaimer:

Ads are displayed in our contents. These ads do not influence the content we create and publish. We do not endorse them either.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Vision

Nina’s Soap was created to help you live a healthy lifestyle within your budget while increasing your net worth.

Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you will find information about living a quality life within budget and increasing your net worth. Topics covered include personal finance, investment, business management, cooking from scratch, and growing some vegetables and fruit to save money and eat healthy.

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel), https://www.pinterest.com/ninassoap/ (Pinterest), https://ninasoap.com/affiliate-products/ (Our resource page)”.