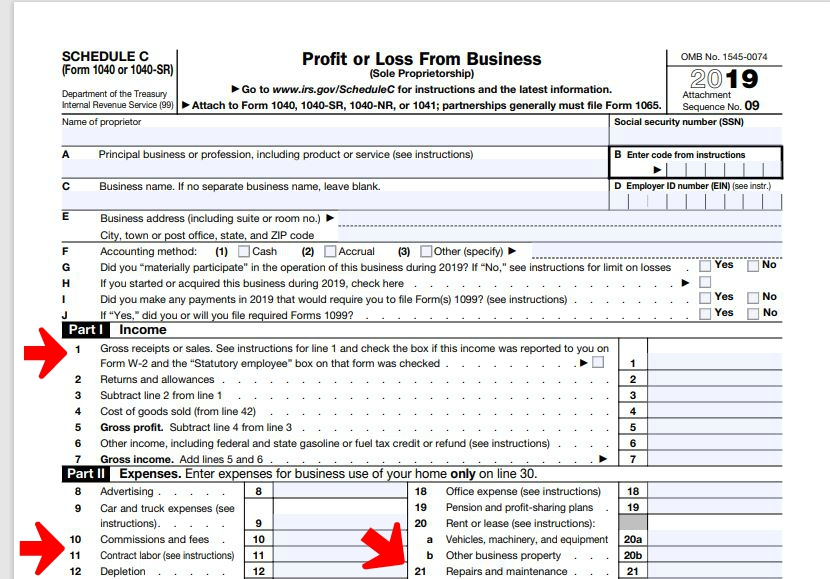

There are 7 ways to report 1099 Miscellaneous on Schedule C.

“Our natural products can be found at https://ninassoap.com

Visit our custom design apparels at https://liberlabel.com’’

If you are a sole proprietor, on one person LLC, you are required to file Schedule C.

How to report Form 1099 Miscellaneous on Schedule C?

Let us view it from 2 angles: revenue and expense.

How to Report 1099 Miscellaneous Revenue on Schedule C

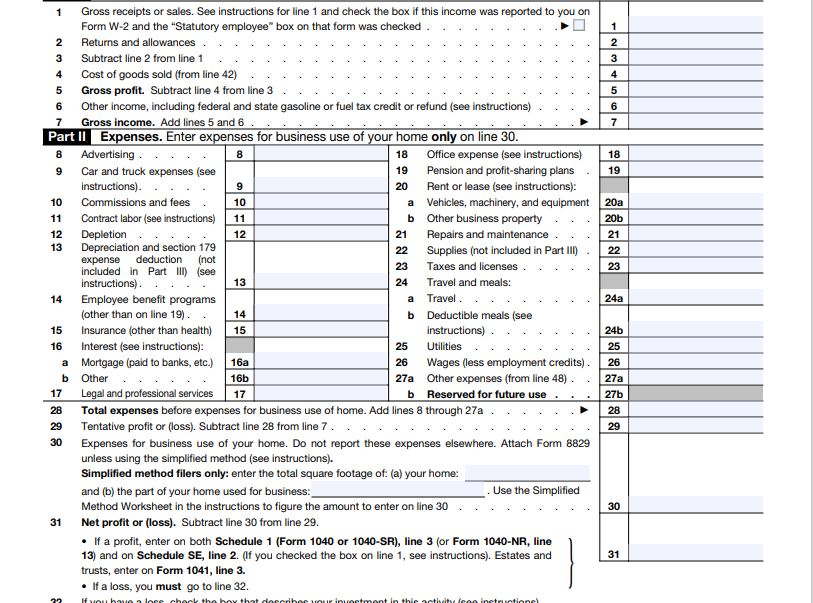

If you received 1099 miscellaneous for your service, the amount is a revenue.

Schedule C Line 1 Gross Revenues or Sales:

Report the amount on the 1099 Miscellaneous you RECEIVED from your clients as an income on Schedule C Part I Income: Line 1 Gross Revenues or Sales.

How to Report 1099 Miscellaneous Expense on Schedule C

If as a sole proprietor, you gave 1099 Miscellaneous forms to your contractors, there are 6 ways to report these 1099 Miscellaneous on Schedule C depending on the nature of the services performed.

Schedule C Line 10 Commission and Fees:

If the commission you paid is not to be capitalized, you could report the 1099 miscellaneous related to that cost on Line 10.

Schedule C Line 11 Contract Labor:

You could report 1099 Miscellaneous given to contractors such as your web designer for maintaining your website and your virtual assistant for managing customers complaint emails and your calendar on Line 11.

Schedule C Line 17 Legal and Professional Services:

You could report your 1099 Miscellaneous you gave to a bookkeeper you paid as a contractor to keep your book during the year.

Schedule C Line 21 Repair and Maintenance:

You could report on Line 21 any 1099 Miscellaneous you gave to an electrician for fixing electricity issue in your office. Keep in mind that if the repair resulted into an improvement of the place and could increase the value of the place, it should not be considered a repair but rather an improvement which should be capitalized and depreciated. Therefore, any labor cost associated with an improvement should be included in the overall improvement cost and depreciated.

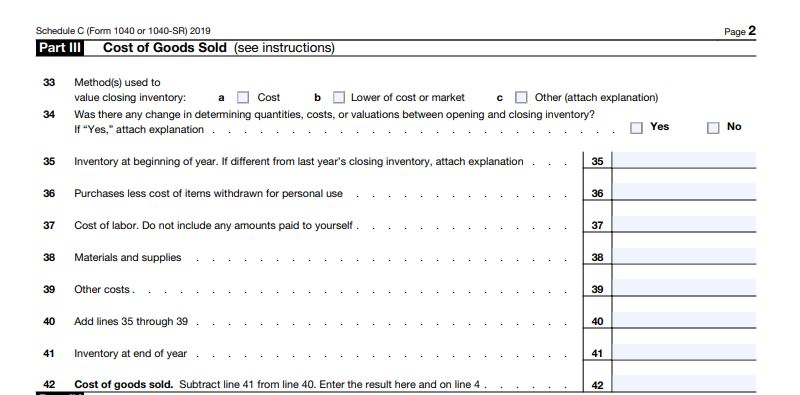

Schedule C Line 37 Cost of Labor:

If you gave 1099 Miscellaneous to a contractor that you paid for his time to produce finished products for you to resale, you should include the cost of the labor to your inventory and deduct proportion of the labor associated with the quantity of products you sold during the year. In that case your 1099 Miscellaneous would go on line 37.

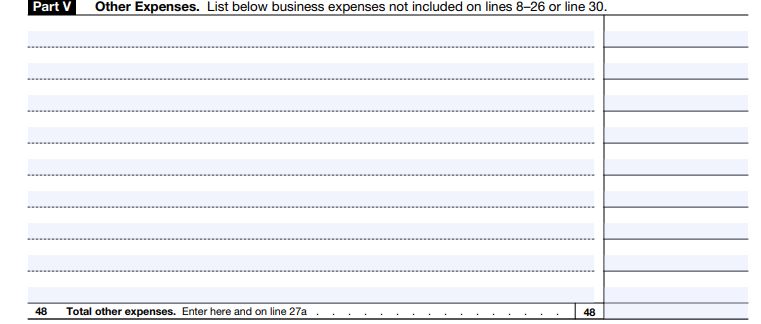

Schedule C Line 27 Other:

If the nature of the service performed doesn’t fall in any of the above category, or if you choose to have all the 1099 miscellaneous you gave out in one place as long as they are not tied to inventory, or improvement to capitalize, you could report them on Schedule C Part V. Put the total of part V on line 48 Total Other Cost and on Line 27 Other.

Make sure you send out 1099 miscellaneous to any contractor you paid $600 or more to during the year to be able to deduct it as an expense on your schedule C.

Please Find About our Products and Links Below

Free Download

Check the Free Download section on our website for budget spreadsheet, budget planner PDF, tax forms, motivational quotes, checklists, and more for you do download. Would you please join our email list to access it.

Our Objectives

At Nina’s Soap, we thrive to live a quality life within our budget and increase our net worth. We share many aspects of our lifestyle including personal finance, investment, business management, cooking from scratch and growing some vegetables and fruit to save money and eat healthy.

For more, would you please visit us on our website www.ninasoap.com.

Would you please like, comment, share, and subscribe to our website and YouTube channel? We share tips on how to make natural products including our lye soap recipes. If you don’t have the time to make your own natural products, please check our website. We thank you very much!

Website: www.ninasoap.com

Join Us for Free

How to Find Previous Articles

To make it easy to navigate our website, would you please check the side bar? Under “Post Archives, are our categories”. The links to our prior articles are saved under their appropriate categories. Please click on any category under “Post Archives” to read the titles of previous articles and click on the link of your interest to open the article.

Welcome to Our Financial Success Group!

To learn more tips on how to live below your income without sacrificing the quality of your life and start building wealth, please join our community for FREE by subscribing here: https://ninasoap.com/membership-join/

Our Online Stores

Welcome to Nina’s Soap our Natural Products Store

Our lye soaps are hand-made with quality grade natural oils and butters, food grade sodium hydroxide, and herbs grown in our garden without pesticide or chemical fertilizer—- no additives, no fragrance, no dye.

Our towels, washcloths, and napkins are natural and eco-friendly alternatives of paper towels, paper napkins, and tissue papers for you to enjoy in the comfort of your home while saving money and the environment.

Welcome to Liber Label our Apparel Store

Customs design clothing, home décor, accessories, and stationery with motivational quotes to lift your mood every day

Leave a Comment