Who is most likely to pay estimated taxes?

If you are a self-employed including a freelancer, contractor, blogger, reseller, retailer, small business owner with no business entity title for your business, day trader, LLC member, or you are an investor, or you make income through dividends, interests, rents, royalties, prizes, awards, selling products, if no one withheld tax on these sources of income for you, you could be required to make estimated tax payments if you made enough to owe more than $1,000 in taxes at the end of the year.

The video explains 2 ways to estimate your tax payments and 2 ways to pay all your taxes through withholding to avoid the need to make estimated tax payments.

The 2 ways to estimate your tax payments include estimated tax worksheets and finding your income tax rate. The former takes time and results in paying less tax. The latter is easy, saves time, but results in paying more tax and getting a refund back.

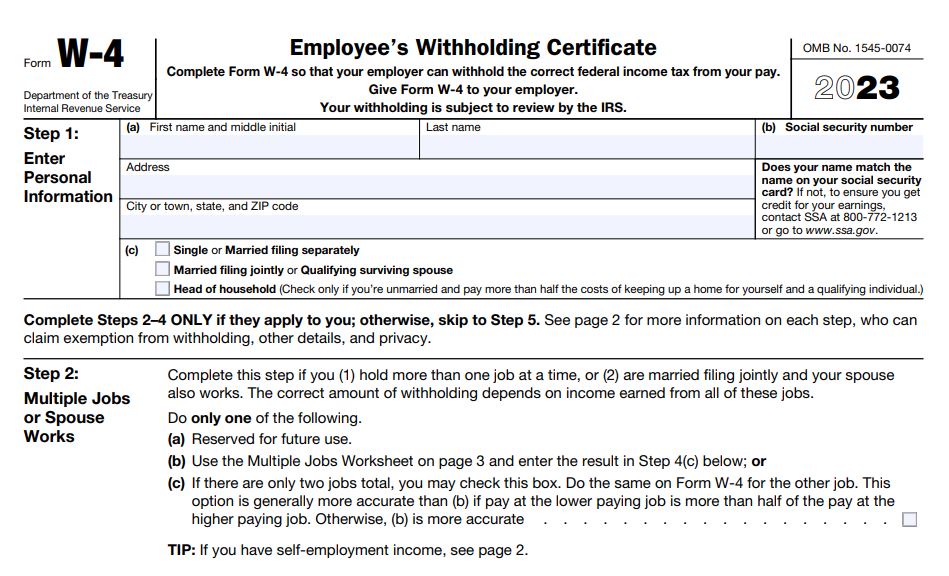

The 2 ways to avoid making estimated tax payments includes updating your W-4 (box 4c) to let your employer increase withholding on your paycheck and if you have an LLC business taxed as an S Corp, let the S Corp withhold more tax to cover the tax you should have made estimated payments for.

Who pays estimated taxes?

If you make income through dividends like from dividend stocks investment, interest from bank saving accounts, capital gains from selling stocks or trading stocks or selling assets, rents from renting real estate or property, royalties, and freelance services, if the company didn’t withhold tax on your income from these sources, if the income is substantial, you should estimate the tax on the income and make quarterly estimated taxes.

Usually, companies paying you these sources of income generally will require you complete Form W-9 Request for taxpayer Identification Number and certification. They will report to the IRS the income they paid you. If you do not complete it, they might withhold 28% and pay it to IRS on your behalf.

You also make estimated tax to pay self-employment tax if you are self-employed or own an LLC.

If you are a partner of a profitable LLC even if you do not expect to receive distribution from the business, you should pay estimated tax on your expected share of the LLC profit.

If you are self-employed, you file Schedule C when you file your individual income tax form 1040 and you pay self-employment tax on the profit made from your self-employment business.

If you have an LLC and file Form 1065 Partnership tax return for your business, you pay self -employment tax on your share of the LLC profit.

The self-employment tax includes both employee and employer Social Security tax, Medicare tax, and the income tax on your share of the profit.

American income tax is pay as you make income type of tax. Therefore, IRS requires you make periodic estimated tax throughout the year.

Estimated Tax for 2023

You can make estimated tax payments for earned incomes not subject to withholding such as:

Self-employment income including freelance income

Interest income

Dividend income

Rent income.

Gains from sales of assets

Prizes

Awards

Salary on which not enough is withheld for tax.

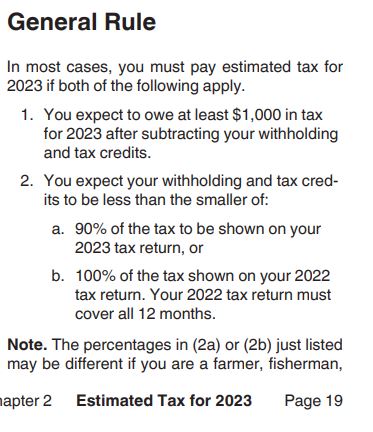

When is an estimated tax required?

If you estimate to owe $1,000 in tax liability when you file Form 1040, you should make an estimated tax payment.

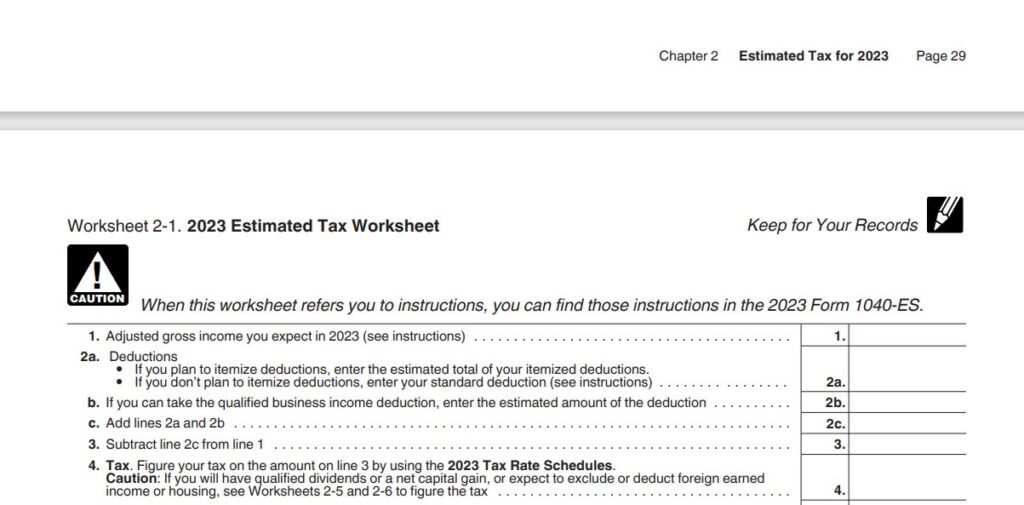

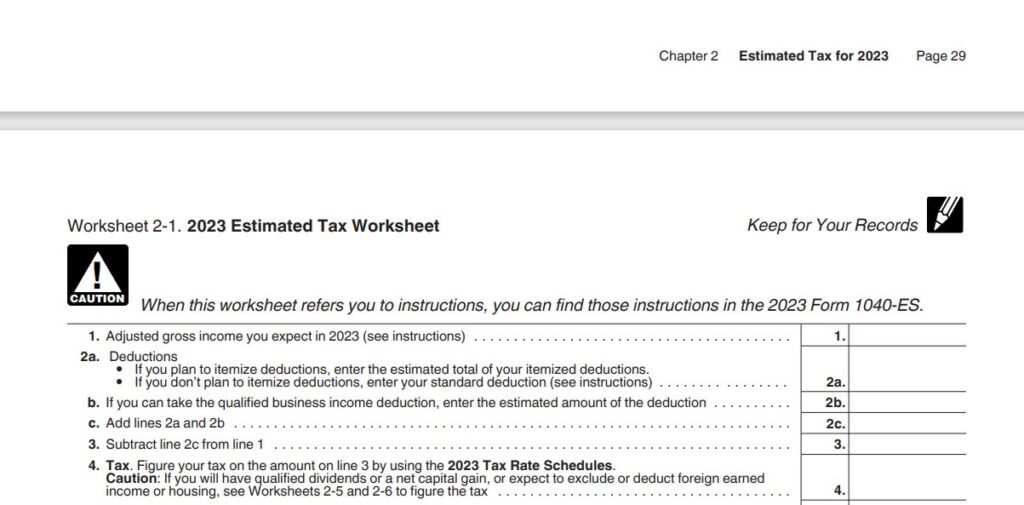

How to determine the estimated tax using estimated tax worksheets?

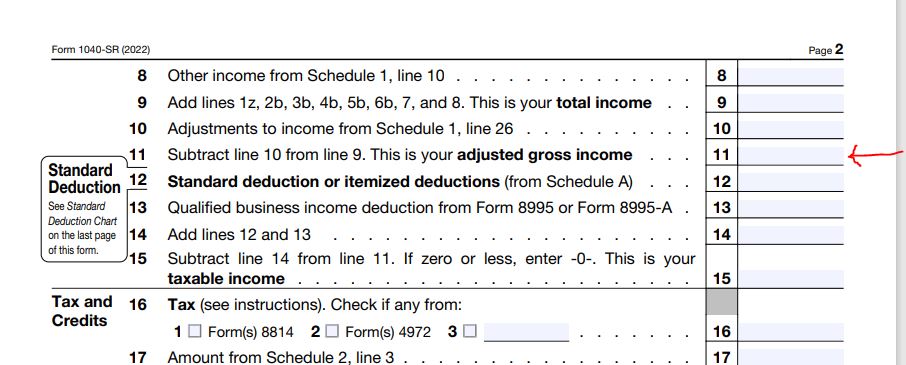

You can start with your previous year adjusted gross income like 2022 AGI on your form 1040.

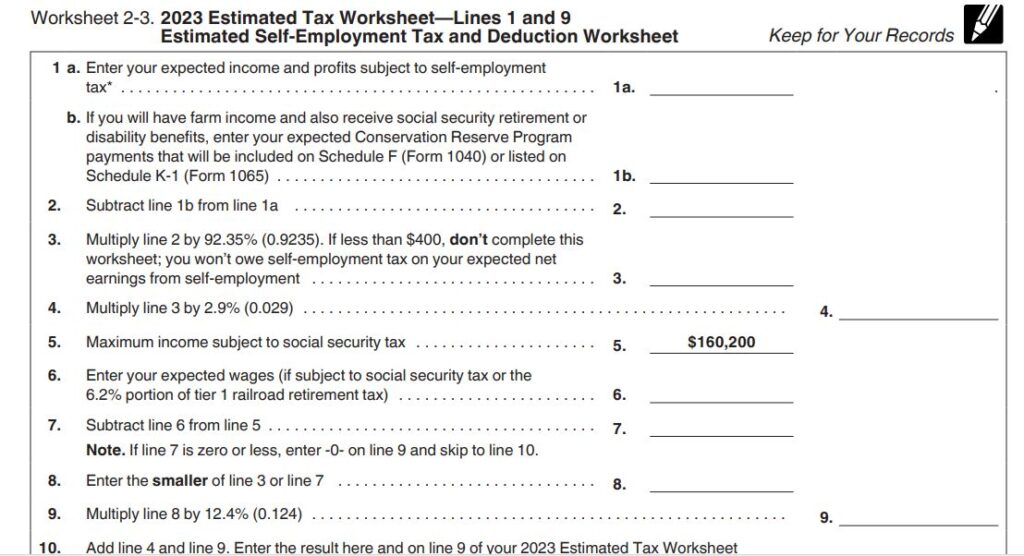

How to figure out estimated tax for Self-employed and LLC members?

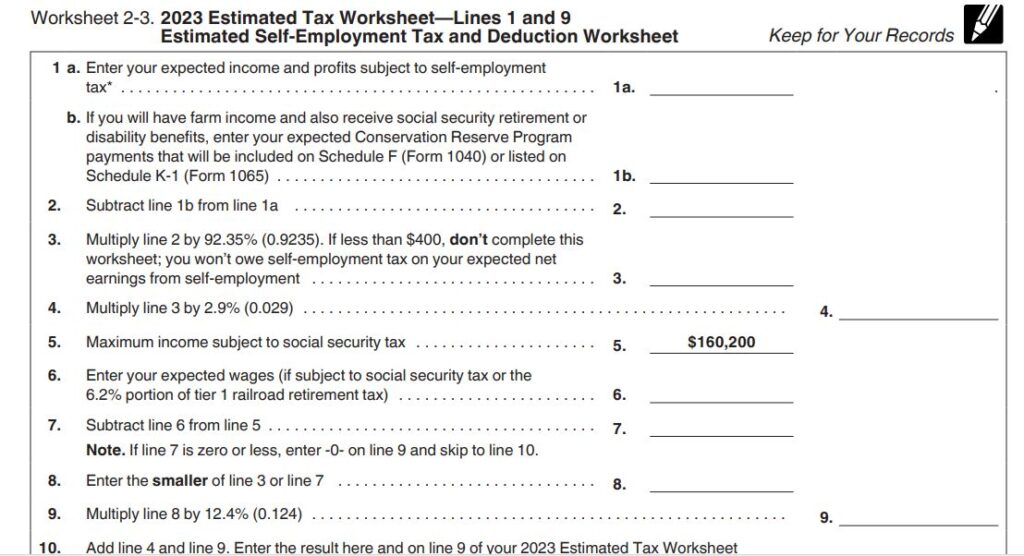

Start completing the Worksheet 2-3: 2023 Estimated tax worksheet Line 1-9 for self -employment tax (page 32).

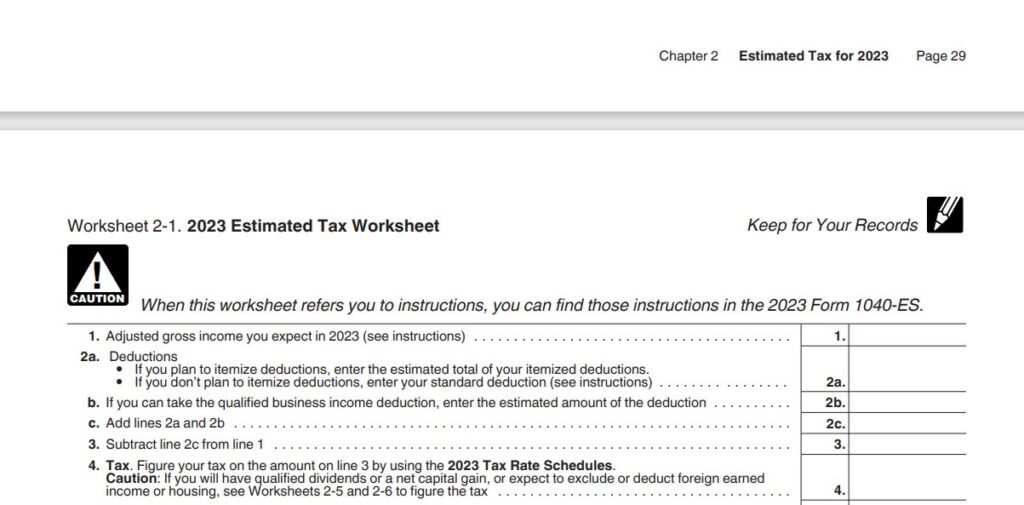

Then complete Worksheet 2-1

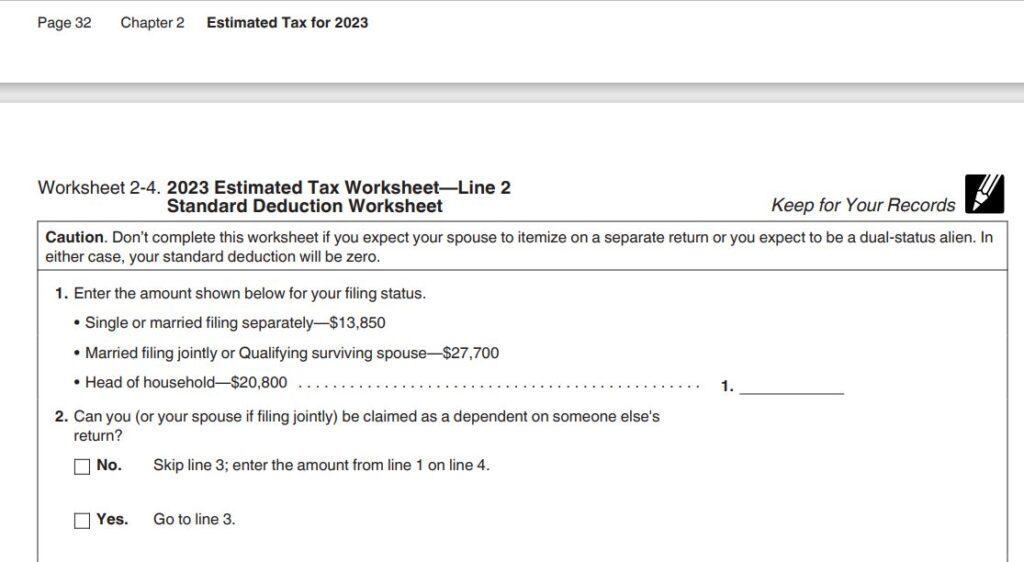

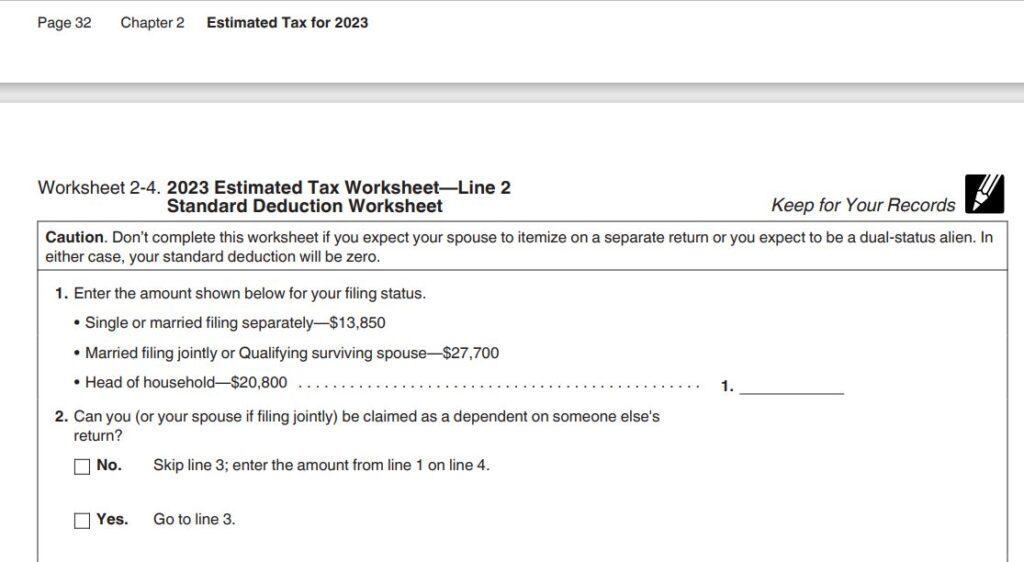

If you will claim the standard deduction on Form 1040, complete worksheet 2-4. The result from this worksheet will go on Line 2 of Worksheet 2-1.

For a self-employed and LLC members that generate income from business activity, you can complete Worksheet 2-3 for the self-employment income, or the portion of the profit allocated to each member, worksheet 2-4 for the standard deduction, and worksheet 2-1 to estimate the tax.

How to figure out estimated tax for stock investors, part time traders, and passive income earners?

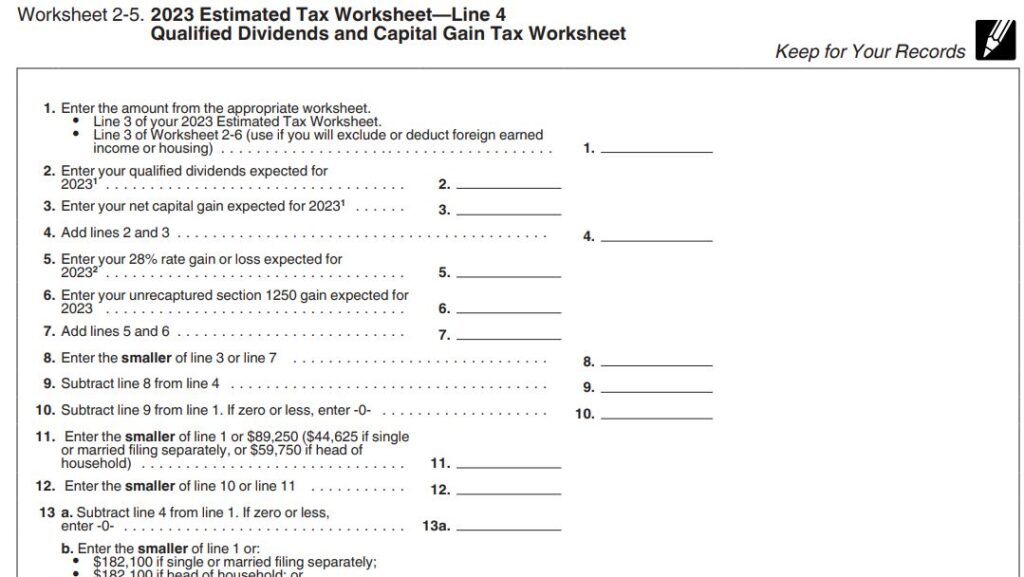

If you invest in dividend stocks in a taxable brokerage account or occasionally trade stocks, or generate passive income, and could owe more than $1,000 in tax, you could estimate your estimated tax using worksheet 2-5 2023 Estimated tax worksheet Line 2 Qualified Dividends and Capital Gain Tax.

Then Use Worksheet 2-4 for the standard deduction, and worksheet 2-1 to estimate the tax.

How to figure out estimated tax for stock traders?

If you day trade in the terms that IRS classifies a trader as a day trader (trading more than 3 times a week), trading stock is a business activity where you spend time. Therefore, you should consider your trading business as a self-employed business and expect to pay social security and Medicare as well as income taxes on the profit from your trades. You will also claim business expenses. As a day trader you might need to use a self-employment worksheet 2-3 for the self-employment income in addition to the worksheet 2-4 for the standard deduction, and worksheet 2-1 to estimate the tax.

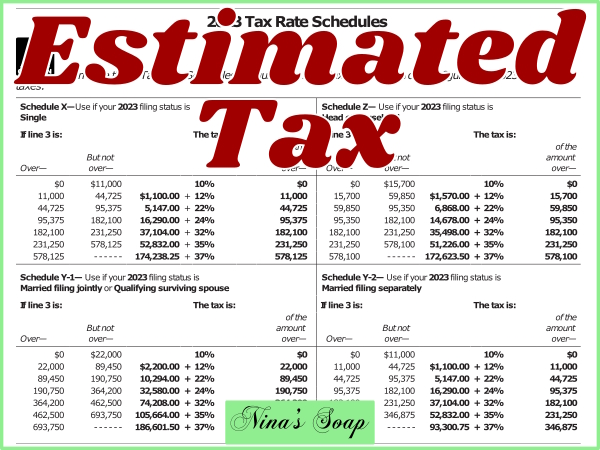

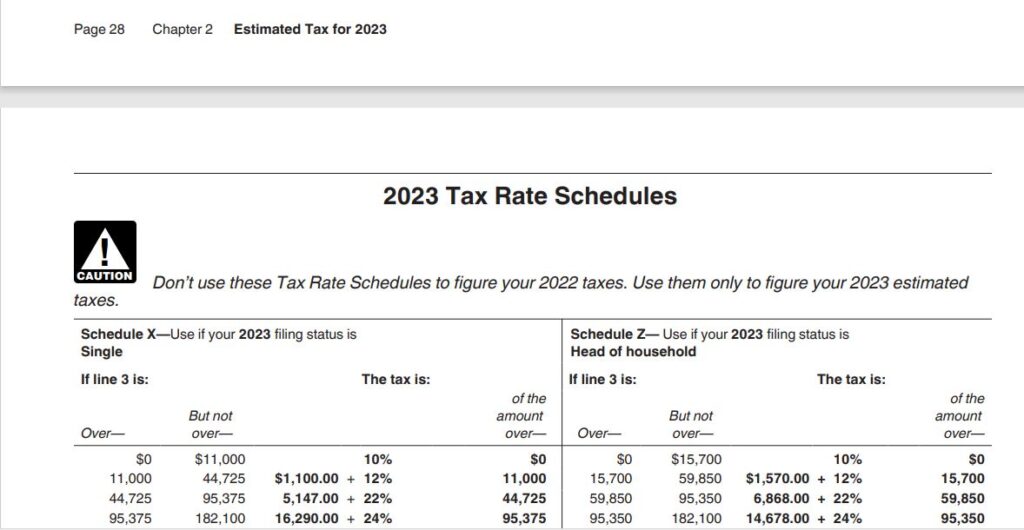

2023 Tax rates

You can find 2023 tax rate schedules in the IRS publication 505 page 29.

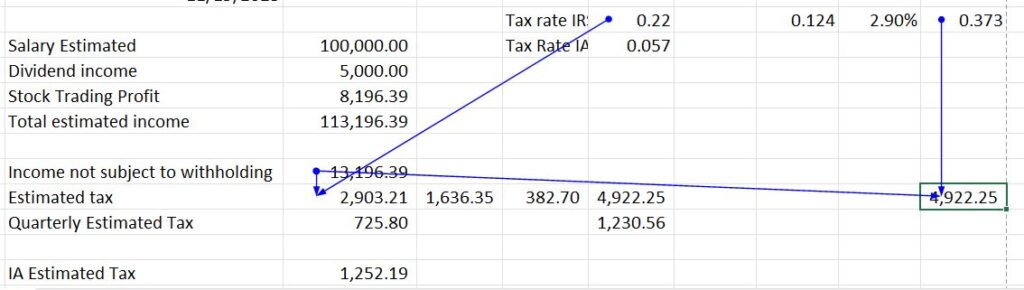

How to estimate your income tax on earned income not subject to withholding?

Open the publication 505 Tax withholding page 29 or scroll down to 2023 Tax rate schedule.

Estimate how much your income or profit will be for the year including salaries and income not subject to withholding. That is the reason you want to make estimated tax.

For your salary, you can use previous year tax return 1040-line 1 gross salary.

Then add the income that is not subject to withholding like profit from selling stocks or from stock dividend income.

That is the total income without any deductions.

Look at the 2023 tax rate schedules.

Locate your tax filing status.

If that is married filing jointly, locate that section.

Find the income bracket your total estimated income falls within. Your total income should be equal to or more than the starting bracket amount but less than the end bracket amount. Look at the tax rate in the column labelled “the rate is”. Apply that rate to the income not subject to withholding.

This will calculate the annual estimated tax on that portion of the income no tax is withheld on for you.

Divide that amount by 4. That is your quarterly estimated tax to pay.

Alternatively, every quarter, adjust the estimated amount if profit from that quarter is higher than what you previously estimated.

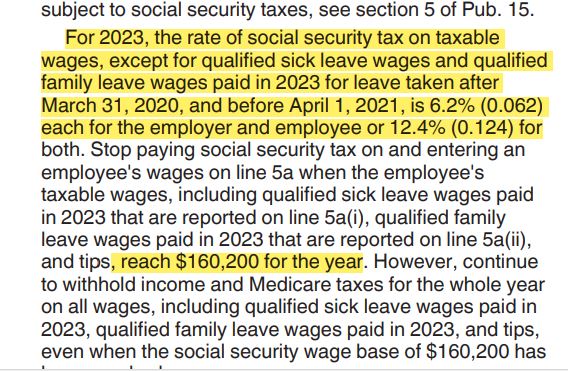

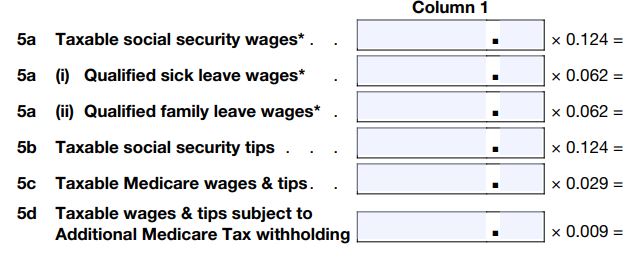

If you are self-employed and would like to apply this simple method, know that as a self- employed, you pay employer and employee total portion of Social Security of 12.4% on your profit up to $160,200.

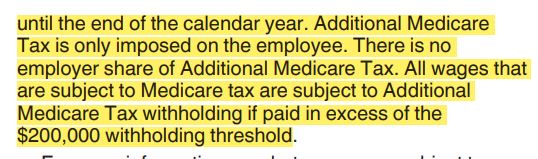

You pay employer and employee total portion of Medicare of 2.9% on your profit up to $200,000.

For profit over $200,000, you pay employer and employee total portion of Medicare tax of 2.9% and an additional Medicare tax of 0.09% on that portion of your profit that is over $200,000.

You also pay federal income tax on your profit.

You will use the 2023 tax rate schedules to find your tax filing status. Then find the bracket in which your estimated profit fits within. Look at the tax rate on that bracket row under the column “the tax rate is”.

You add that tax rate to the social security tax (12.4%) and Medicare tax (2.9%). The total of the 3 tax rates, you apply it to your estimated profit.

This is your annual estimated tax. You divide that amount by 4 to find the quarterly estimated tax to pay every quarter. By profit you take the business gross receipts minus any refunds minus the cost of goods sold.

If you are a freelancer, you use your income.

Using your gross revenues allows you to pay more estimated tax and have a refund back. But your chances to underpay taxes and get charged a penalty are nonexistent. You also save time by quickly determining the rate to apply to your profit to estimate the tax to pay.

If you want to pay less estimated tax, then you should use the estimated tax worksheets in the IRS publication 505 to calculate your estimated taxes. It will take more of your time and there is a chance you could underpay but not too much or you could overpay but not too much either.

Let your employer withhold more taxes.

If you have a job and have your side business as well, you could update the W-4 Employee’s Withholding Certificate with your employer to let them withhold more taxes from your paycheck.

You estimated your income subject to estimated tax and you added it to your annual salary. Then you use the 2023 Tax rate schedules from IRS Publication 505 Tax withholding and estimated tax, to find the filling status of yours and your income tax bracket. Then you look at the tax rate associated with that tax bracket. You take that rate and apply it to your estimated side hustle income estimated for the year. Then you divide your estimated annual side business income by the number of paychecks you receive a year. That will give you the amount to withhold extra from your paycheck.

You update W-4 with your employer and on box C Step 4 (4C), you enter the extra amount to withhold from your paycheck.

By doing so you pay more taxes through withholding and do not need to pay estimated taxes on your income from side hustle. It is more convenient.

Increase your S Corp withholding.

If you have an LLC taxed as an S Corp and you have a passive income on the side, if you collect salary from your S Corp, you could update the W-4 with your business to add the calculated extra amount (described in the paragraph above) in the W-4 step 4 box C for your business to withhold extra from each paycheck. When you let your S Corporation withhold more from your paycheck to cover your estimated tax associated to your taxable passive income, you do not need to make estimated tax payments.

How to make estimated tax payments to the IRS?

Online payment

You can use IRS Direct Pay to allow an automatic online transfer from your bank account to IRS.

You can pay by debit or with credit card and pay a fee.

You can create an online account with IRS and pay through there.

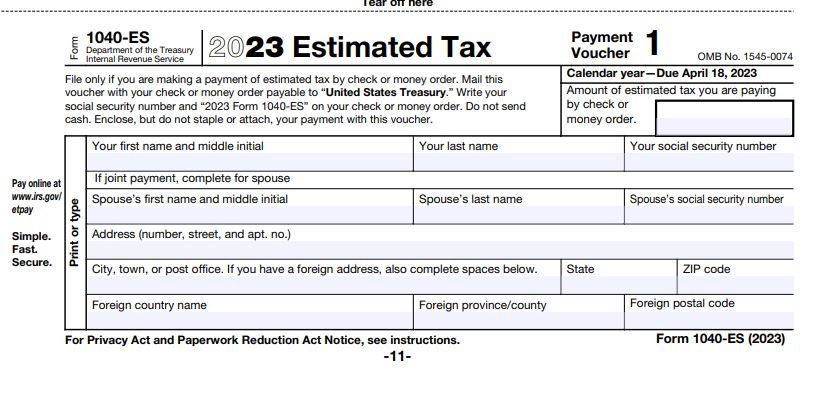

Form 1040-ES has more instructions on different payment methods on page 4.

Payment by mail

If you find online payment options too confusing, you can just complete the estimated tax payment voucher for the quarter you want to pay for and mail it with a check to IRS to the right address.

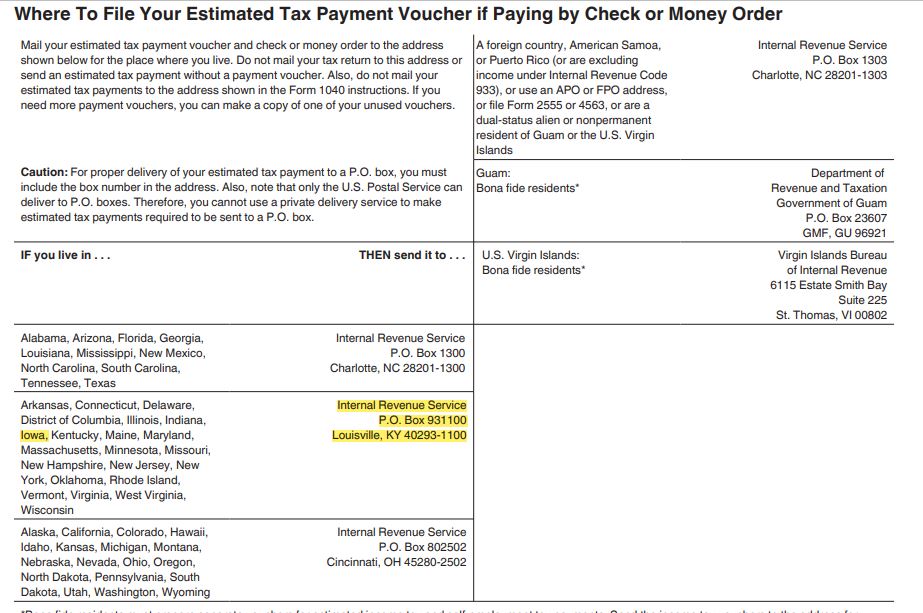

Where do I send my estimated taxes to the IRS?

If you prefer to mail your estimated tax payment, complete the appropriate quarter voucher and add a check to the voucher and mail it to the address listed on Form 1040-ES for 2023 page 5 that corresponds to the state you live in.

First, locate the state you live in, in the first column.

Then, locate the address associated to that row where your state is located.

Write that address on your envelope and include the voucher and the check.

Mail via USPS with a tracking number.

Make sure to make a copy of the voucher and check and keep for your record as well as the tracking information.

Also record the amount you pay for tax purposes later. You will need it when you file Form 1040. You will enter it on Form 1040 in section Payments.

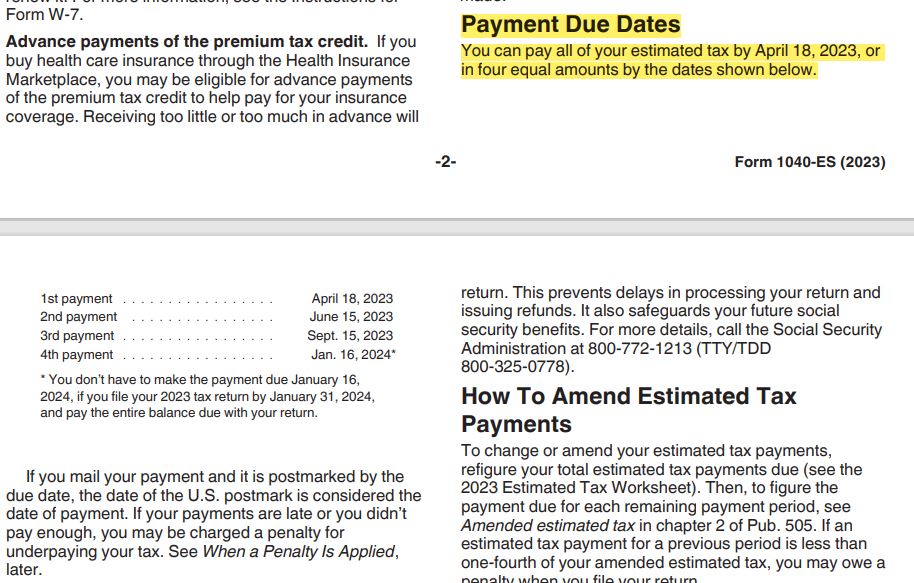

When should I pay estimated taxes?

You make your estimated tax payments each quarter of the calendar year by the following due dates:

For quarter 1 (January, February, March) revenue, you make your estimated tax payment by April 15.

For quarter 2 (April, May, June) revenue, you make your estimated tax payment by June 15.

For quarter 3 (July, August, September) revenue, you make your estimated tax payment by September 15.

For quarter 4 (October, November, December) revenue, you make your estimated tax payment by January 15.

If you are a fiscal year taxpayer meaning your tax year doesn’t end in December 31, you make your estimated tax payment by the 15th of the:

4th month of your fiscal year for Q1 payment

6th month of your fiscal year for Q2 payment

9th month of your fiscal year for Q3 payment

And 1st month of your following fiscal year for Q4 payment.

You can find more information in Form 1040-ES for 2023 page 3.

You can download IRS publication 505 Tax Withholding and Estimated Tax and Form 1040-ES in IRS website:

You could find the URL to these documents on our Tax Links page as well.

Can I pay estimated taxes all at once?

Yes, you pay your annual estimated tax all at once by April 15.

Conclusion: 1-Estimated Tax Payments 2023

Resources

Related article categories

Related articles

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Ads Disclaimer:

Ads are displayed in our contents. These ads do not influence the content we create and publish. We do not endorse them either.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Vision

Nina’s Soap was created to help you live a healthy lifestyle within your budget while increasing your net worth.

Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you will find information about living a quality life within budget and increasing your net worth. Topics covered include personal finance, investment, business management, cooking from scratch, and growing some vegetables and fruit to save money and eat healthy.

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel), https://www.pinterest.com/ninassoap/ (Pinterest), https://ninasoap.com/affiliate-products/ (Our resource page)”.