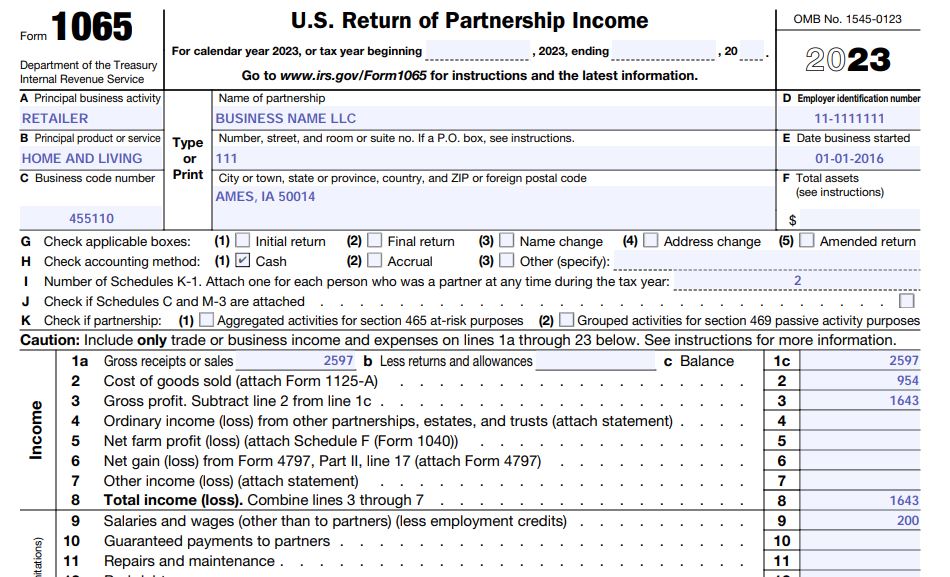

If your partnership is engaged in a trade or business activity or in a service business, income and deductible expenses are to be reported on page 1 of Form 1065.

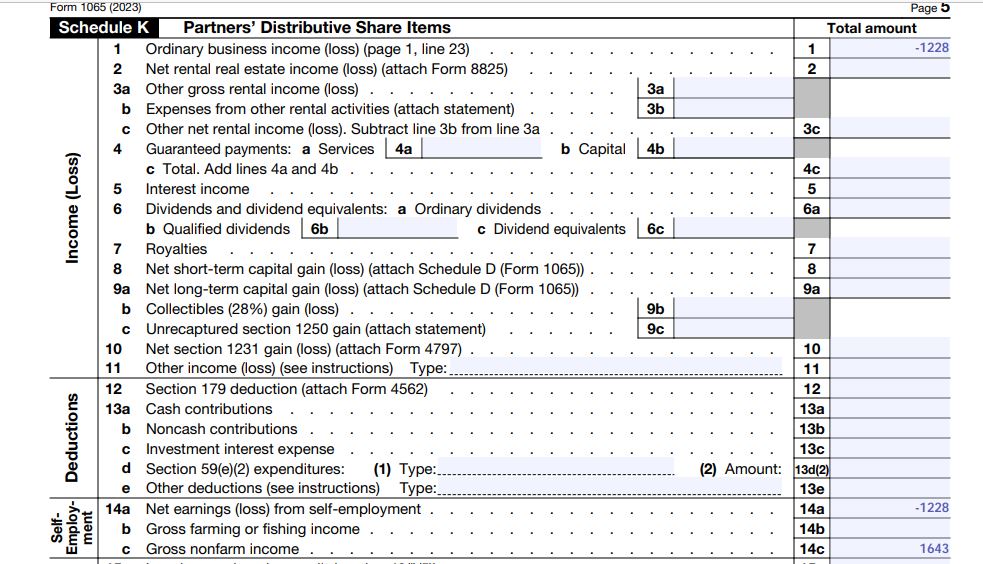

If your business is engaged in a passive activity, or generates portfolio income, or rental activity, the income and expenses will be reported on Schedule K of Form 1065 instead.

If your partnership is engaged in rental real estate activity, the income and expenses will go on Form 8825. The profit or loss from that form will be entered on Schedule K (form 1065).

The video explains how to file form 1065 for multi members LLC engaged in a trade or business activity.

Who is required to file IRS Form 1065?

If you have an LLC with multiple members or a partnership you would file Form 1065 U.S. Return of Partnership Income.

When do you file Form 1065?

You should file your Form 1065 by March 15.

What is passive activity?

If your LLC is a business or a trade and you do not materially participate in your business, the business is a passive activity for you as a partner not to the business. The passive activity is related to the partners engagement in the LLC activities. A rental real estate activity is a passive activity by default for the business and its partners.

Activities that are not passive activities to the partners

If your Company is engaged in a business or trade in which you the partner materially participate.

Your company is a rental real estate business in which you materially participated: if more than half of personal services you performed in all trades and business are related to the rental real estate business including managing, operating, leasing, or renting; and you work more than 750 hours in your rental activities. You can include services you performed as an employee if you own more than 5% of shares.

If your partnership is a trade or business, you would report income and expenses on page 1 of Form 1065.

Report rental real estate profit or loss on Schedule K.

Attach a statement to Form 1065 to show income or loss for each trade conducted under your company.

Also add an attachment to schedule K-1 to show the share of income or loss for each partner.

This allows the partners to properly classify each activity they materially participate in, and which ones are passive activities for them.

Where to report rental real estate income or loss?

Rental real properties rents income and expenses are reported on Form 8825. The profit or loss from Form 8825 is then reported on schedule K of Form 1065 NOT on page 1 of Form 1065.

Portfolio income is income from interest, dividends, and royalties unless it is your trade.

Portfolio income is reported on schedule K of Form 1065.

For instance, royalty income will go on Schedule K line 7.

Expensive related to royalty income will go on Scheule K line 13e Other Deductions if it is not included in line 13c investment interest expense.

When you line 13e for royalty expense on Schedule K, report each partner share of that expense on their Schedule K-1s box 13 with code C in the code section.

You can read more in the IRS instructions for Form 1065 page 41 or so.

How to fill out form 1065 for 2023?

It is recommended to use tax software to file your Form 1065 to save time.

Item J: Schedule M-3

You are not required to file schedule M-3 if your partnership total asset is less than $ 10 million.

Item F: Total asset: are you required to enter the total asset of your partnership?

You can leave the box blank and after you complete Schedule B on the second page of Form 1065, you can go back to add your business asset value at the of the year if it is required of you.

If you answer Yes to Schedule B of Form 1065 question 4, you are not required to enter the total asset of your business.

How to fill out IRS Form 1065 and Schedule K-1 For your LLC with no Revenue

If you started a trade or business and the first year you worked at it and didn’t generate any revenue, the cost would go on page 1. The loss would go on schedule K of Form 1065 line 1.

If you didn’t generate revenue, your income section will remain blank.

If you have expenses in the expenses section, your page 1 Form 1065 profit or loss line will be a negative number.

You report that loss on Schedule K line 1.

How to complete IRS form 1065 for a business activity you didn’t participate in?

If you have a trade or business and you didn’t materially participate in it, the expenses will go on page 1 as well as the revenue. The activity profit or loss from page 1 would go on schedule K line 1 and distributed on schedule K-1s for partners. A partner that didn’t materially participate in the trade or business conducted by the partnership, has a passive activity income or loss.

You report the profit or loss from Form 1065 page 1 to Schedule K line 1 Ordinary business income or loss and on partners Schedule K-1s box 1 whether they materially participated in the business activity or not.

How to report portfolio income on form 1065?

If you generate income that didn’t come from a trade or a business, report that income on schedule K. Income produced that is not a trade or a business include: interest, dividends, royalties. They are called portfolio income.

Where do you report expenses related to portfolio income on Form 1065?

Expenses you incurred to produce income that didn’t come from a trade or business should be reported on schedule K and schedules K-1 for the partners.

You can report them on Schedule K line 13e Other Deductions and on Schedule K-1s box 13 with code L for other types of portfolio income that is not royalty. Expenses from royalty are coded (I) and go in the same line 13e on Schedule K and box 13 in ScheduleK-1s.

How to report income and expense from a Business activity on Form 1065?

A trade or a business conducted by the partnership is a business activity for the partnership. Income and expenses from a trade or business conducted by the partnership are reported on page 1 of Form 1065 regardless of whether the partners materially participated or not. A partnership business activity could be a passive activity to its partners if they did not materially participate in it. The income and expenses of such business activities would be reported on page 1 of Form 1065 and the income or loss would go on line 1 of schedule K. The income or loss would be reported as ordinary income or loss on schedule K-1s.

However, the partners could not offset loss from passive activities with income from active activities.

If you have multiple business activities conducted by the partnership, attach a statement to Form 1065 and to Schedule K-1s to specify income or loss from each activity for the partners to accurately report them on their personal tax return.

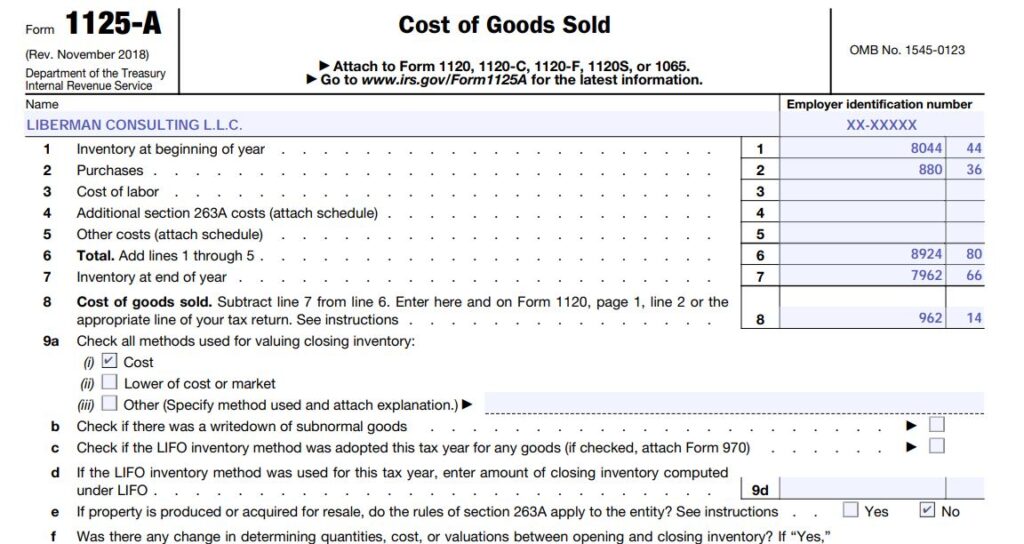

How to report cost of goods sold on tax returns using Form 1125-A?

If you carry inventory, you might have to file Form 1125-A to determine or report the value of your inventory at the start of the year, your purchases and finished value during the year, the value of your inventory at the of the year and calculate the cost of goods sold during the year.

The cost of goods sold during the year from Form 1125-A will go on Form 1065-page 1 Line 2.

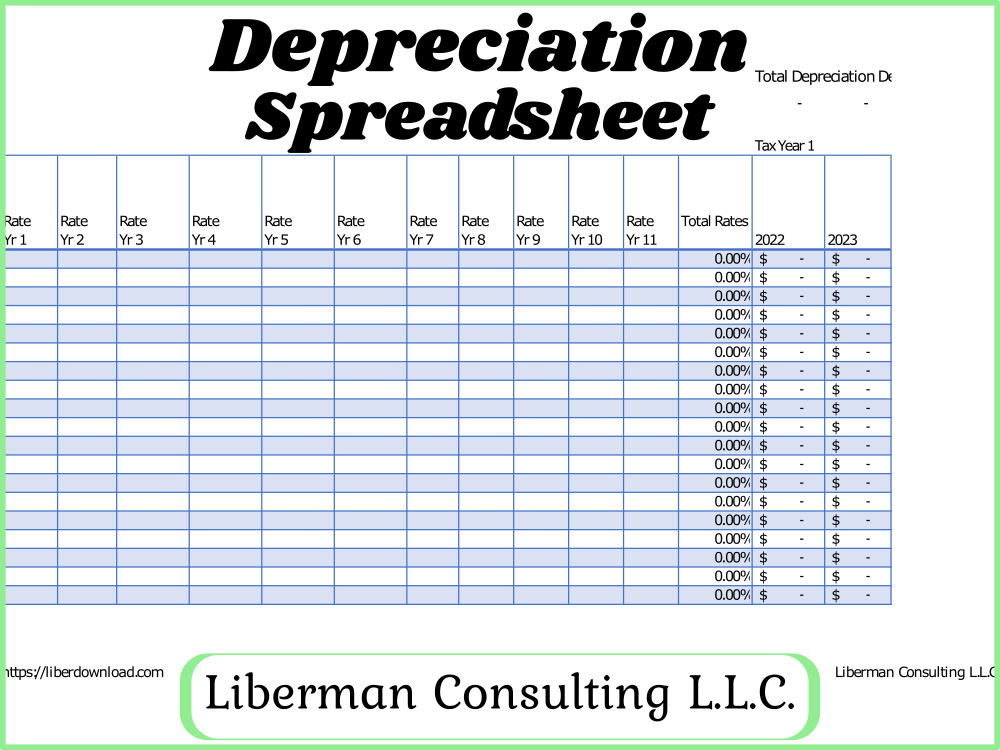

How to depreciate a business asset?

If you placed a business asset in service during the year you are filling the tax return for, you will need to complete Form 4562 Depreciation and Amortization. The total depreciation deduction from Form 4562 Part IV Summary Line 22 will go on Form 1065-page 1 Line Depreciation (Line 16a and Line 16c if Line 16b is 0).

If you are looking for an Excel workbook to track and keep a record of your purchased business assets, as well as the depreciation deduction claimed on them through the years, you can purchase one at: https://liberdownload.com/.

If you claimed Section 179 to expense the full cost of the business assets placed in service during the year, the amount from Form 4562 Part I Election to Expense Certain Property Under Section 179 Line 12 should be deducted from the total from Form 4562 Part IV Summary Line 22 and then entered on Schedule K Form 1065 Line 12 Section 179 Deductions. That Section 179 deduction amount should not be included on Page 1 of Form 1065 Line 16 Depreciation. It goes on Schedule K and flows to the partners Schedule k-1s.

If you claimed an amortization deduction, you include that amount from Form 4562 Part VI Amortization Line 44, on Form 1065 Page 1 Line 21 Other Deductions. You include that total on an attachment as well as other expenses that didn’t have their own specific lines within expenses. The total from the attachment will go on Line 21 Other Deductions Form 1065 page 1. You add the attachment to the return.

If you didn’t purchase and didn’t place a business asset in service during the year, but you have business assets placed in service in prior years and you are not done depreciating them, if you are not required to file Form 4562, you can directly enter your depreciation deduction for the year you are filling for, on Form 1065 line 16a and 16c Depreciation. You also enter the amortization deduction for the year if any on an attachment for the other expenses and all these other expenses including the amortization deduction will go on Form 1065page 1 line 21 Other Deductions.

We explained the depreciation and amortization of business assets in the video.

The Depreciation workbook used in the video is available for purchase at:

https://liberdownload.com/product/depreciation-and-amortization-worksheet-ld22d1/

Where to report income and expenses from passive activities on form 1065?

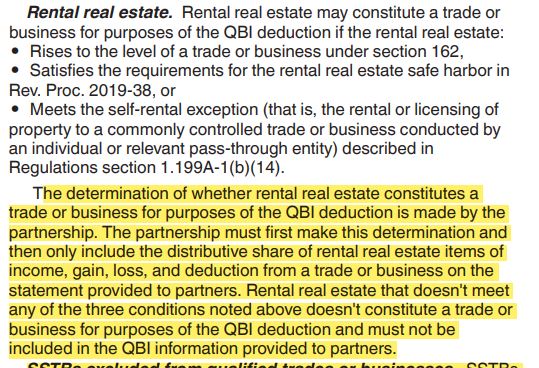

Rental real estate is a passive activity to the partnership as well as to the partners even if the partners materially participate in it.

Income or loss from rental real estate is reported on Form 8825 and on schedule K of Form 1065.

Portfolio income is a passive activity to the partnership and the partners.

Income and expenses from portfolio income are reported on schedule K of Form 1065.

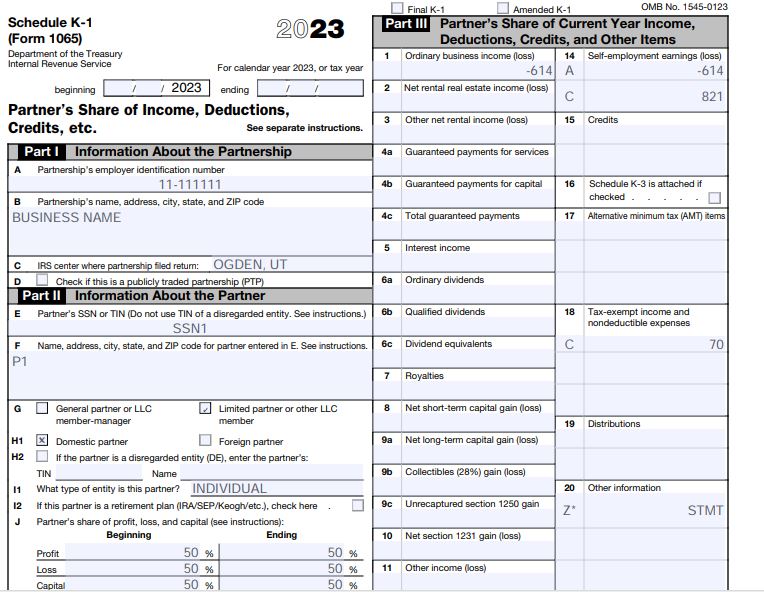

Self-Employment Net Earnings (Loss) Schedule K Line 14

If your LLC is a trade or business activity, The income or loss should be put on schedule K Line 14 self-employment net earnings or loss. Complete the self-employment worksheet in form 1065 instructions. Do not include rental income from rental properties on the worksheet. These are passive income. Enter rental income for selling rentals to customers. Enter rental income for performing substantial services to dwellers. These are active incomes. Any activity that you materially participate in would go on it. Do not include dividends, interest income. These are passive income.

Income or loss subject to self-employment tax will be the portion of the partnership profit or loss without rental real estate profit or loss or portfolio income and the portion that is associated to general partners or the LLC members that materially participated in the business activities. Because they traded their time for money, they will pay self-employment tax on the profit including social security tax and Medicare tax. That income, that will be used to calculate the self-employment tax for such partners on their individual tax return Form 1040, is being determined on Form 1065 Schedule K Line 14.

The worksheet in the instructions will help you determine the net earning or loss for self-employment allocated to general partners that should go on the general partners schedule K-1 box 14 and the portion of the net earning or loss for self-employment allocated to the limited partners that should go on the limited partners schedule K-1 box 14 with code A.

Enter the total of both allocations on Line 14a of Schedule K.

On line 14c of Schedule K enter the non-farm gross revenue.

When using a tax software to file your 1065, the software will pull data to the right lines and boxes on your behalf. You just double check them later.

More information on net earning for self-employment can be found in the IRS instructions for form 1065 around page 42-43.

Are conventions and seminar deductibles expenses?

You cannot deduct business expenses related to conventions and seminars. They are not deductible to the partners. Therefore, they are reported on Form 1065 Schedule K Line 18c non deductibles expenses. Report them on Schedule K-1 (Form 1065) in Box 18 with code C.

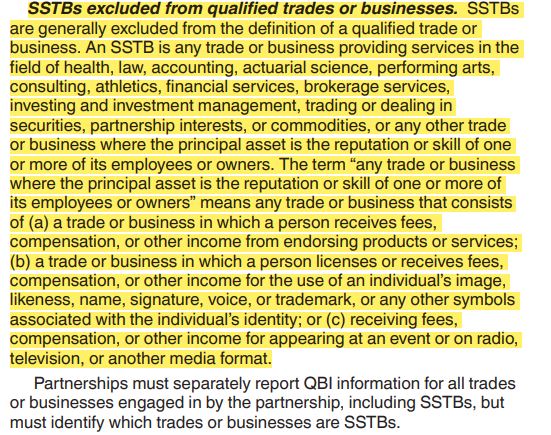

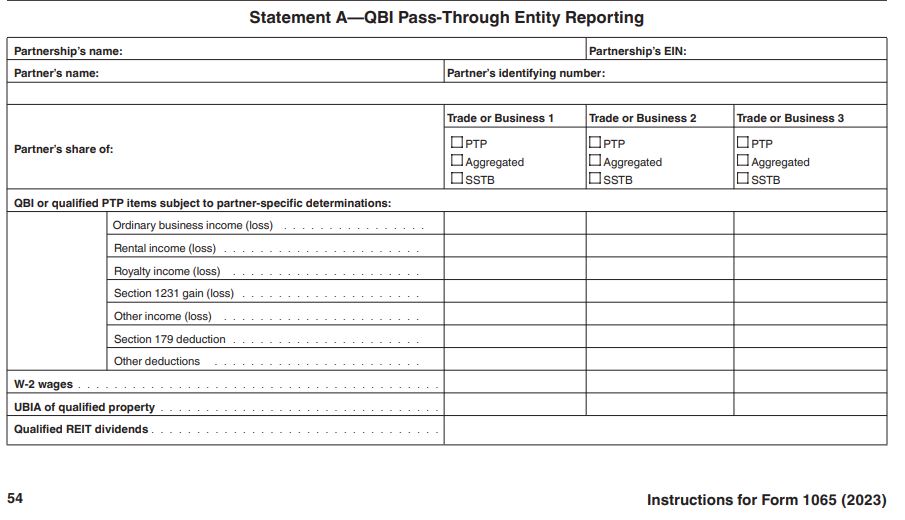

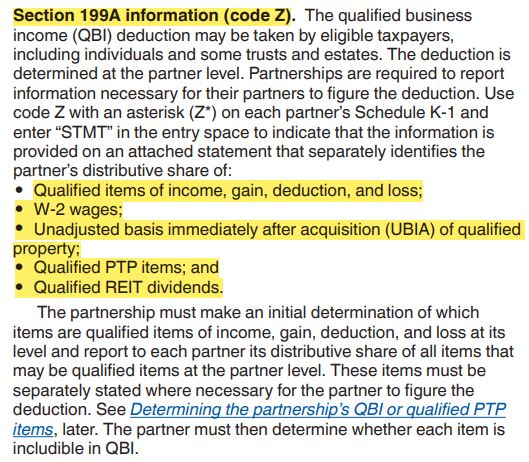

Schedule K From 1065 Line 20c Other Items and Amount-QBI (Qualified Business Income)

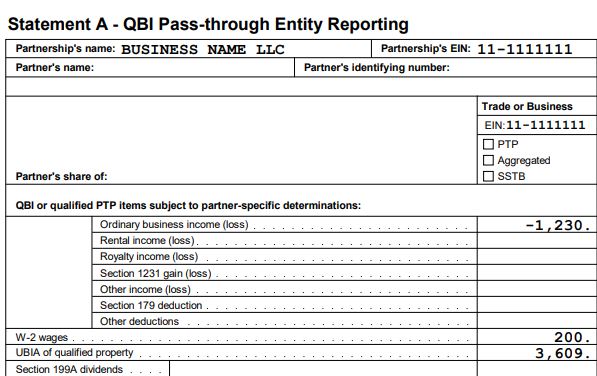

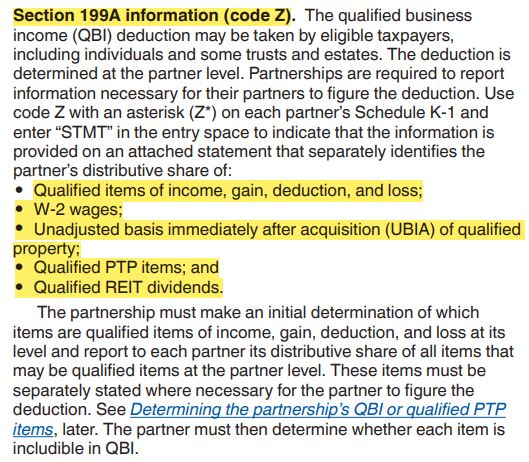

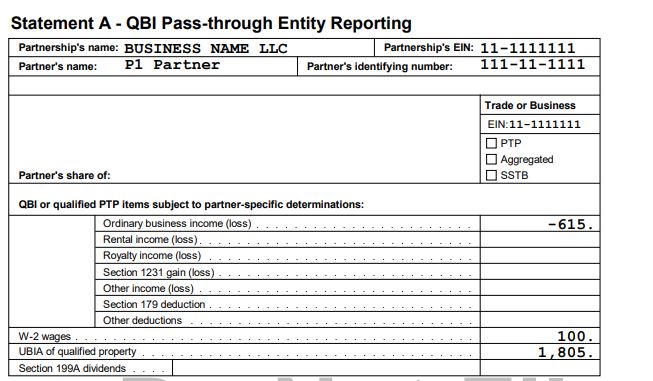

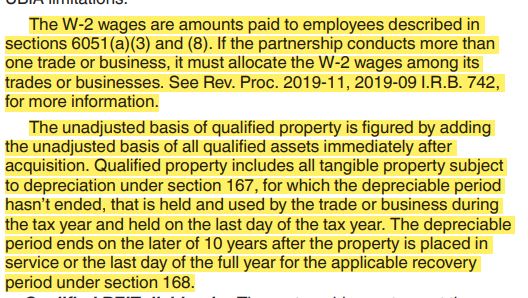

There is a worksheet Statement A QBI that can be used to select whether your business activity is SSTB (Specialized Service Trades or Businesses) or not and allows to enter the business ordinary profit or loss from Schedule K line 1 some other incomes or losses from Schedule K, W2 wages from page 1 of Form 1065, unadjusted assets basis qualified (UBIA).

The result from that worksheet will go on the partners’ schedule K-1 based on their ownership share, box 20 with code Z* in the code column, and STMT in the dollar column.

An attachment of the QBI worksheet will be draft for each partner based on their ownership percentage and attached to the tax return.

SSTBs type business includes medical field, law firms, accounting, consulting, stock trading services, brokerage services, social network influencers, …where the business depends on the expertise of the owners or their public image or influence to survive.

The QBI worksheets and what is considered SSTBs can be found in the IRS instructions for Form 1065 page 52 to 56 or so.

The instructions for form 1065 around page 58.

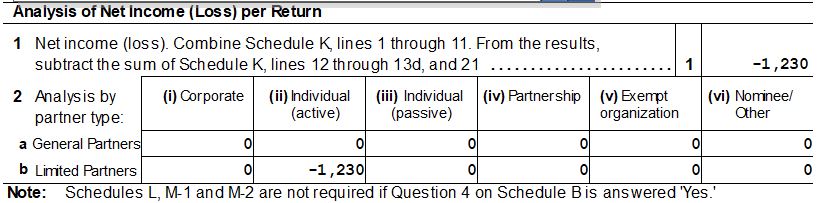

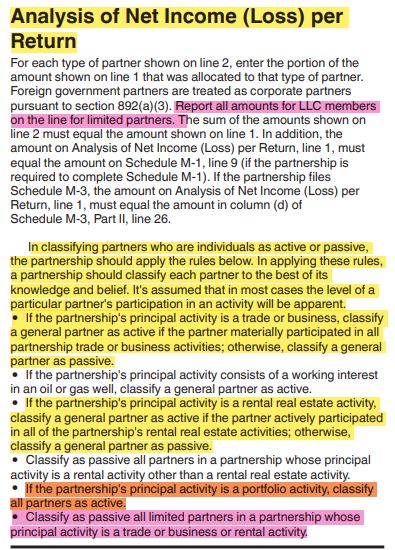

Form 1065 Page 5: Analysis of net Income

Check instructions for form 1065 around page 58 on how to report your net income or loss between the partners whether they are active or passive.

If your LLC is a member-managed LLC, consider the line of General Partners for the LLC member-managers and the line Limited partners for the LLC members that don’t work in the business. Or choose as you feel fit for your business.

In the instructions it is recommended to enter the amount on the line “Limited Partners” for LLC members.

Paid Preparer

Leave it blank if the return is completed by a partner or an employee. If you paid someone to complete form 1065, the person should complete the paid preparer section.

If you check yes for IRS to discuss the return with someone, you authorized IRS to discuss the return filed with the paid preparer that filed it not his/her firm.

How to organize Form 1065 and its forms?

After you completed form 1065, Schedule K-1 and its supplements,

Print them out.

Sign Form 1065 page 1.

Make a copy for your business record and your state tax return if your state require you include your federal Form 1065 to your state Form 1065.

Make a copy of Schedule K-1s and attachments to give to the partners. They will need it to file their individual income tax return Form 1040.

How to assemble Form 1065 before sending it to IRS?

Have Form 1065 page 1-5 together.

Put form 8825 behind it.

Followed by Form 1125A-Cost of goods Sold if you complete it

Followed by Schedule K-1s

Followed by Schedule B-1 Form 1065

Followed by supplement to Schedule K

Followed by supplement to Schedule K-1

Followed by Form 4562 Depreciation and Amortization if you are required to complete it.

If you have completed other forms not listed here, check instructions for form 1065 page 12 “Assembling the Return” for more detail.

Once all the forms are in order, you can staple them together and put them in an envelope.

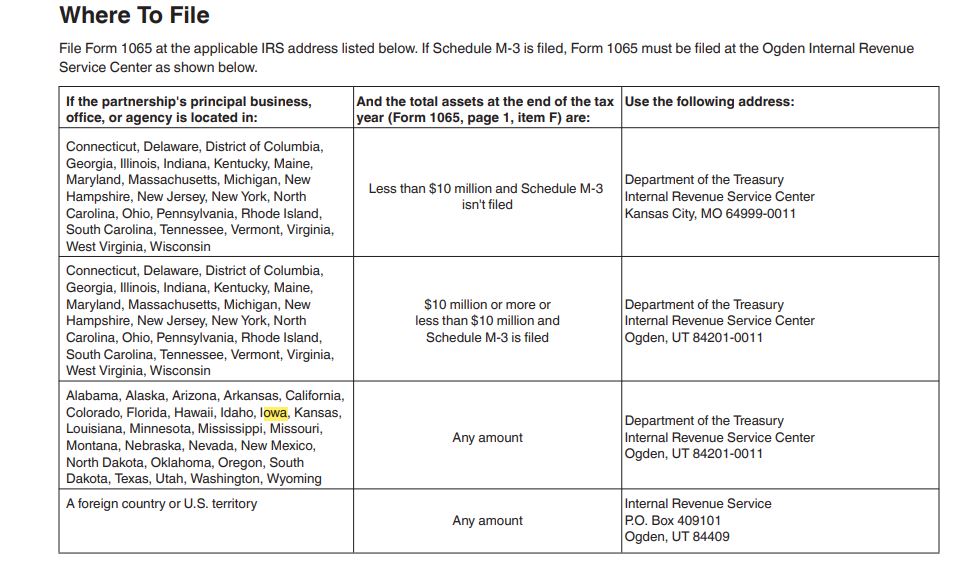

Where to mail Form 1065?

Write the address that is in the same row where your state is listed that corresponds to the total asset of the business reported on Item F of Form 1065 Page 1. The address can be found in the Instructions for Form 1065 page 7 “Where to File”.

When is the due date for Form 1065?

Mail your Form 1065 via USPS Certified by its due date March 15.

How to fill out Form 1065 and Schedule K-1 Partnership Income Tax Return for 2023?

Resources

Related article categories

Previous related articles:

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Ads Disclaimer:

Ads are displayed in our contents. These ads do not influence the content we create and publish. We do not endorse them either.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Vision

Nina’s Soap was created to help you live a healthy lifestyle within your budget while increasing your net worth.

Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.