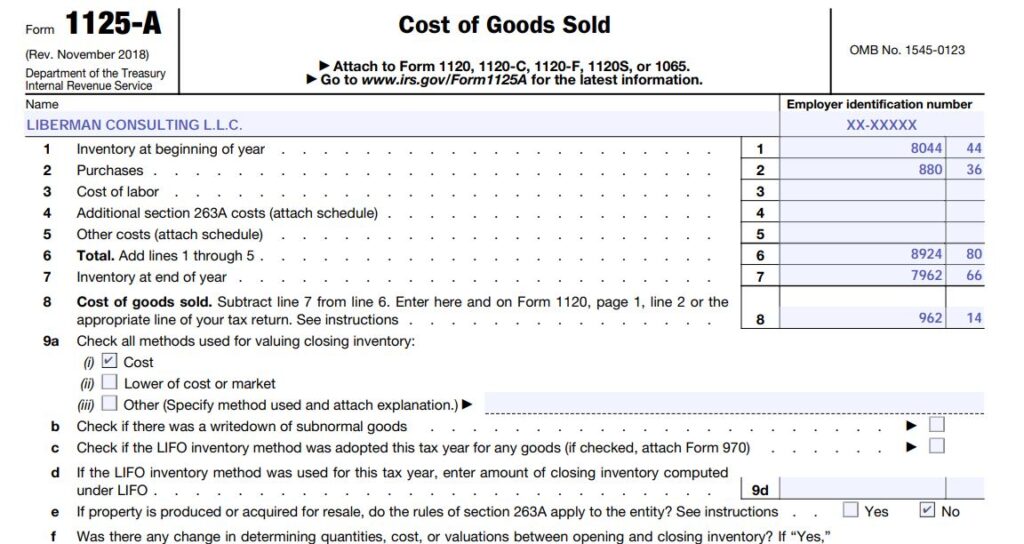

If you maintain inventories of raw materials, finished products, resale products, and or private label products, you might need to complete form 1125-A Cost of Goods Sold when filing your business tax return Form 1065 Partnership tax return or Form 1120S S Corporation tax return.

How to Fill out Form 1125-A Cost of Good?

Line 1 Inventory at the start of the year: It should match the previous year end inventory. If that is your 1st year carrying inventory, that will be $0. Leave it blank.

Line 2 Purchases: cost of raw materials purchased during the year – cost of out of inventory of raw materials used to make finished products + cost of finished products made during the year + any products purchased to resell + any products private labeled during the year to sell. These costs will include the shipping cost of the materials to you and the state sales tax you paid on them.

Line 3 Cost of Labor: If you allocated labor cost to production, that could go on this line. If it doesn’t apply to you leave that line blank.

Line 4 Additional Section 263A: You can read more about section 263A types of cost on:

If it doesn’t apply to you leave that line blank.

Line 5 Other Costs: If you included an amount on this line, you would add an attachment to form 1125-A.

Line 6 Total: Add all your numbers from line 1 to line 5.

Line 7 Inventory at year end: Look in your inventory and sales workbook to locate your inventory value at year end and enter that amount on this line.

If you need an inventory and sales spreadsheet to track your inventory and sales, you can download one for free under Free Downloads at www.ninasoap.com.

Line 8 Cost of Goods Sold: Subtract line 7 inventory at year end from the total on line 6 to find the cost of the goods you sold during the year.

On the Inventory-Sales Worksheet, you could locate your numbers on the tab or sheet COGS Summary. You must keep your inventory record up to date, for the COGS Summary tab to balance for you.

Line 9: Check the method you use to take goods out of your inventory during the year.

You can read instructions about line 9 at the end of Form 1125-A.

Form 1125-A should be attached to your business federal income tax return.

When you carry inventory for income producing purposes, you are recommended to use Accrual method for your inventory record. However, small businesses that made in average $26 million or less in revenue for the past 3 years could continue to use cash method if they are not tax shelter. To change from cash method to accrual method, you must file Form 3115 with IRS to seek their approval.

You can find links to IRS tax forms and instructions at www.ninasoap.com in the side bar.

Cash method.

Income

Record in your gross revenue, income you actually received or constructively received meaning credited to your account without restriction. Even if you are not in possession of it yet, if you authorize someone to collect the payment on your behalf, you are considered to have received it when your agent received it.

You can read more about it in IRS Publication 538 Accounting Periods and Methods Page 8 Cash Method.

For instance, if you sell on Etsy and sold a product on December 30th, under cash method, you should include that amount in your current year gross revenue. You constructively received that payment when Etsy charged and collected the payment from the buyer even if Etsy has not yet transferred it to your bank account. It is in your Etsy account without restriction.

On another hand, if you sold on Redbubble during the year and the total is less than $100, Redbubble will not transfer the payment to your bank account. It is held by Redbubble with restriction. Therefore, you do not include that payment in your gross income until Redbubble releases it. (This is just an example. You can replace Redbubble in the example, with Google AdSense or any other online platform that tends to impose a minimum income earned before they send you the money. Keep in mind that it seems if you sold on Redbubble during the year and made less than $100, they will not send you the money that month but if by the end of the year the total amount is still less than $100, they will send it to you).

Expenses

Under the cash method, you deduct expenses in the year you actually paid them.

When you prepaid expenses, you only deduct the portion of the expense that covers 12 months of service. IRS Publication 538 Accounting Periods and Methods Page 9 Cash Method.

For instance, if you renewed your website domain name and paid for 2 years of service, you only deduct half of the cost a year.

Accrual method

Income

Under the accrual method, you report income in the year you earned it, and you deduct expenses or capitalized them in the year you incurred them. In accrual method, under GAAP, you could match income to its related expenses in the correct year. IRS Publication 538 Accounting Periods and Methods Page 10 Accrual Method.

For instance, when you sell a product on Etsy on December 30th, under this method, you will include the income in your gross revenue.

Under the accrual method, you include in your gross revenue, income you actually received, or constructively received it, or it is due and payable to you.

Expenses

Under accrual method, you deduct expenses when there is a liability that can be determined with accuracy and the expense is for a physical product or service provided to you or you provided to others.

For instance, if you made online purchases in December and you received the bill in December as well as the product, under accrual method, you should report that expense that year even if you paid the bill in January the following year.

You can read more about matching expenses with income and prepaid payment on IRS Publication 538 Accounting Periods and Methods Page 12 Accrual Method.

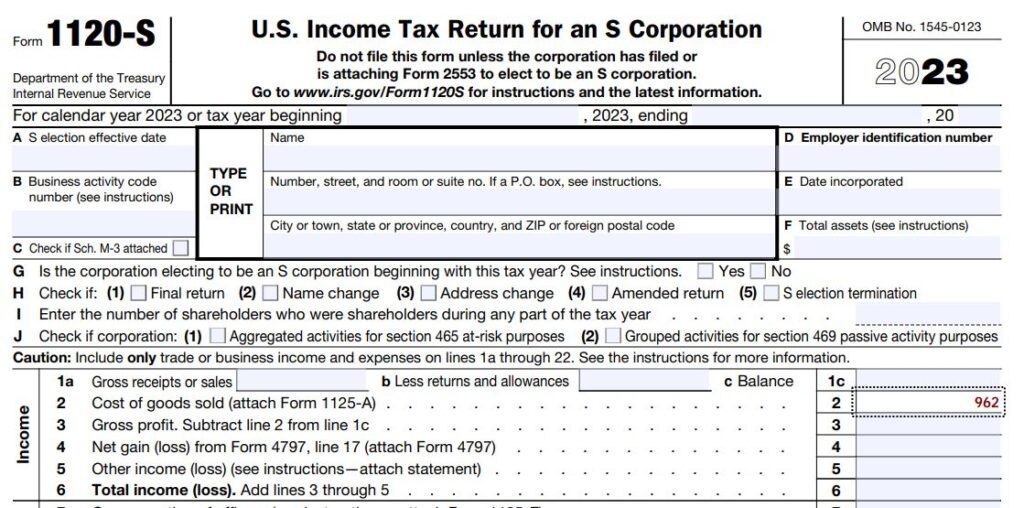

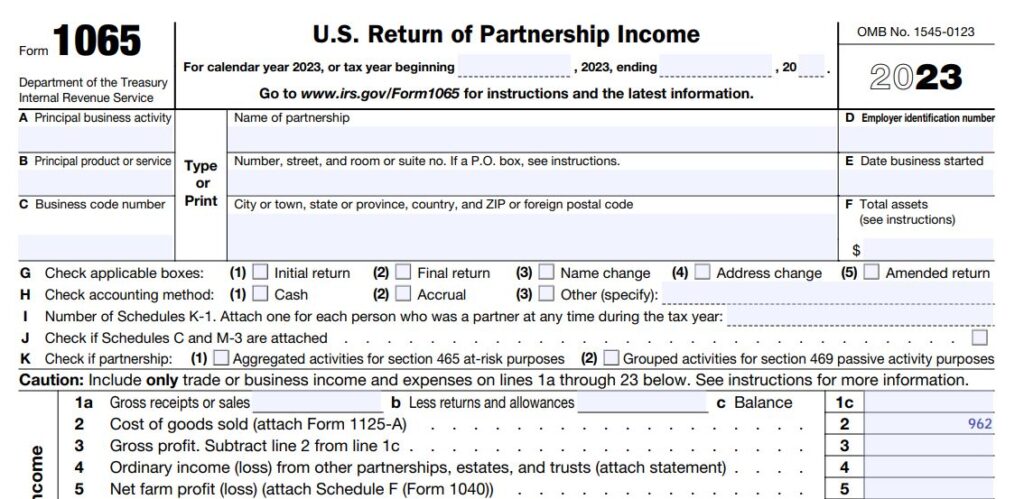

Conclusion: How to report cost of goods sold on tax returns Form 1120S Form 1065 for 2023 using Form 1125-A 7?

In the video you explain step by step to fill out form 1125-A using an example of inventory and sales spreadsheet. We also demonstrated where to record cost of goods sold on Form 1120S S Corporation Tax Return and Form 1065 Partnership Tax Return.

Resources

Related article categories

Previous related articles:

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Ads Disclaimer:

Ads are displayed in our contents. These ads do not influence the content we create and publish. We do not endorse them either.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Vision

Nina’s Soap was created to help you live a healthy lifestyle within your budget while increasing your net worth.

Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you will find information about living a quality life within budget and increasing your net worth. Topics covered include personal finance, investment, business management, cooking from scratch, and growing some vegetables and fruit to save money and eat healthy.

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel), https://www.pinterest.com/ninassoap/ (Pinterest), https://ninasoap.com/affiliate-products/ (Our resource page)”.