Where to file W2 and W3 forms?

You file W2 and W3 with Social Security Administration Not with IRS.

Can you file W-2 electronically?

Yes, the best way to file W2 and W3 with the Social Security Administration (SSA) is to file it electronically.

You cannot download W2 form from IRS website and complete it to mail. To paper file W2s you will have to request it and receive it in the mail. It is better to file W2 and W3 electronically with SSA.

Can I file 1 W2 at a time?

Yes, the Social Security Administration offers the option to manually enter W2 information one at a time up to 50 per batch.

If you have more than 50 employees, you will be issued more than one W-3.

W-3 is the sum of all W-2 you submitted for the year up to 50 employees w2 are totaled on one W3.

There is a process to upload a file instead of manually entry.

The process explained in this article and in the video is for manual entry.

How to file W2 electronically 2023?

To file W2 and W3 electronically for 2023, you need to:

- Have your payroll record up to date for 2023, or the year you are filing for.

- Register with Social Security Administration at ssa.gov/employer.

- Complete W2 for each employee on SSA website.

- W3 will generate for you to summarize all the W2s you entered.

- You review the W2s and W3.

- Save a copy of W2s and W3 to print and review.

- Submit W2s and W3 online to SSA.

- Save and print the official W2s and W3 for business record and to give to employees their copy of W2s.

It is a good idea to complete Form 944 or quarter 4 Form 941 whichever is required from your business and not submit it yet.

Both forms 944 or 4 quarters of 941 and W3 need to match in term of total taxable wages paid during the year you are filling for, as IRS will reconcile your form 944 or all 4 quarters Form 941 to Your W3 filed with Social Security Administration.

If there is an adjustment to make due to rounding, you will be able to make it and make sure your W2s and W3 match your Form 944/941 for the employees’ portion of taxes before you submit the W2s and W3 to SSA and mail either your form 944 Employer Annual Federal Tax Return or your quarter 4 Form 941 Employer Quarterly Federal Tax Return to IRS.

After you submit the W2s/W3 with SSA, then you can print your form 944/941 to sign and make copy for your business record and mail it to IRS.

Do you file W2 with IRS or SSA?

W2 is filed with SSA (Social Security Administration). 1099 is filed with IRS.

W2 due date

You are required to file W2s/W3 with SSA by January 31.

How to File W2 and W3 Electronically with SSA?

Go to:

Click on “Business Services Online”.

Scroll down to Employer.

Click on Log in.

If that is your first time, you click on Create account.

You choose between Login.gov and ID.me to register with SSA. Once you have completed the registration process and access your business account, you just click on Sign in with Login.gov or ID.me whichever you use to register with SSA.

When you enter your login information, read, and check the user certification agreement box, you click on Next under where your business user ID-business EIN is displayed in the drop-down menu.

You will access your business employer account.

From your main account, for existing employers you should have and access “Report Wages to Social Security”.

If you are a new employer and don’t see that on your main page, you might need to click on “Request a new service” in the left side bar to request it. You might need to wait for an activation code to enter for the service request to complete and for you to have the “Report wages to Social Security” displayed on your main page.

Click on “Report Wages to Social Security”.

Read the agreement and accept it.

Click “Create/Resume Forms W-2/W-3 Online”. This option allows you to manually file one W2 at a time.

Make sure the year displayed is the one you want to e-file W2 for.

On the line “For Whom are you filing”, click on the drop-down menu and select your business name.

The business information you entered during your registration will prefill and give you option to choose from.

Once you chose the business name, the line “Please enter the EIN” will fill out for you.

Double check to make sure the information is accurate.

For Line, please select the type of W-2, select Regular W-2.

Do not check a box that doesn’t apply to you.

Click continue.

Your business information will display.

Complete the contact person for this submission and contact person for this employer.

Do not complete the section Other Information if it doesn’t apply to you.

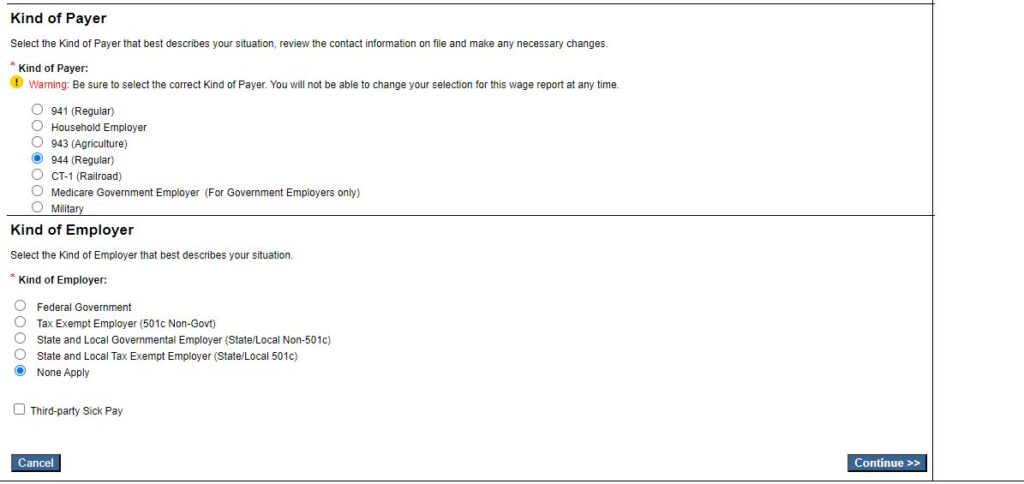

Kind of Payer

If your business is required to file Form 944 Employer’s Annual Federal Tax Return, you check the box 944 (Regular).

If your business is required to file Form 941 Employer’s Quarterly Federal Tax Return, you check 941 (Regular).

Kind of Employer

If you have your own business, check the box None Apply.

Click continue.

The prior year submission will be displayed if you filed W2/W3 with SSA electronically last year.

Click on last year WFID displayed to pull from last year entry.

Check the box next to each employee to select the employees you want to file W2 for.

Click Continue.

Click on the first employee you want to prefill the W2 with last year data.

If that is your first year of e-filing W2, you click on “Start a New W-2”. Or if the employees you want to file for were not with you the year prior to the year you are trying to file for, you click on Start a New W-2.

Once the W2 form opens, check any information that prefilled the form for accuracy and is up to date with your record. This includes the employee’s SSN, employee’s name and address, and your business EIN and address.

Complete the W2 form for the employee.

Enter the employee social security, name, and address if not yet on the form from last year.

For the employee’s name, make sure you enter the first name, the middle initial and last name where they are supposed to be.

How to fill out W2 Form?

Make sure the employer’s business name and address as well as the EIN are accurate.

Make sure the employee’s name, social security, and address are entered and accurate.

Box (Line) 1: Wages: Enter the total wages, tips, and compensation. The different types of compensation to include on Form W2 Box 1 can be found in the IRS General Instructions for Forms W2 and W3.

Wages based on calendar year.

Record wages on the W2 based on the wages you paid during the calendar year and not based on wages earned during the year but not paid out. For instance, if your employee worked the last week of December 2023 but was paid for these number of hours at the end of first week of January the following year, you will enter those wages in W2 form for 2024. They do NOT go on W2 form for 2023. The hours were worked in 2023 but paid in 2024, therefore, the amount goes in 2024 wages on W2 form for 2024. You can read more about it on the 2023 IRS General Instructions for Forms W2 and W3 around page 15 paragraph “Calendar Year Basis”.

How to report deferred retirement plans on W2 Form

If your business has SIMPLE retirement plans and your employee contributed, you do not include the employee contribution to SIMPLE retirement account in Box 1 total wages. Because SIMPLE is a tax deferred retirement plan and is not subject to federal income tax. However, it is subject to social security tax and Medicare tax. Therefore, include the employee SIMPLE contribution in Box 3 Social Security wages and Box 5 Medicare wages and tips.

You also include the employee total contribution to SIMPLE in Box 12 using the code D or S.

Do NOT include the employer’s matching contribution on the employee’s W2 form.

You can read more on the subject in the 2023 IRS General Instructions for Forms W2 and W3 page 13. The codes description for Box 12 is on page 30.

Employee business expense reimbursement accounts

It is a good practice to have an accountable plan to reimburse your employees for employee business expenses.

Under an accountable plan, you do not include employee business expense reimbursed amount on W2 for the employee.

If you have an accountable plan and you choose to pay employee business expenses reimbursements based on mileage allowance and per diem but paid more than what is set by IRS, the amount you reimbursed to the employee in excess of what is set by IRS should be included on W2 Box 1, Box 3, and Box 5 because it is subject to federal income tax, social security tax, and Medicare tax. Put the non-taxable portion or the portion that matches IRS standard allowance in Box 12 with Code L.

If you have a non-accountable plan, you include your employee business expense reimbursed amounts in Box 1, Box 3, and Box 5 of W2 because the amount is subject to federal income tax, social security tax, and Medicare tax.

Please refer to the 2023 IRS General Instructions for Forms W2 and W3 page 9 for more information.

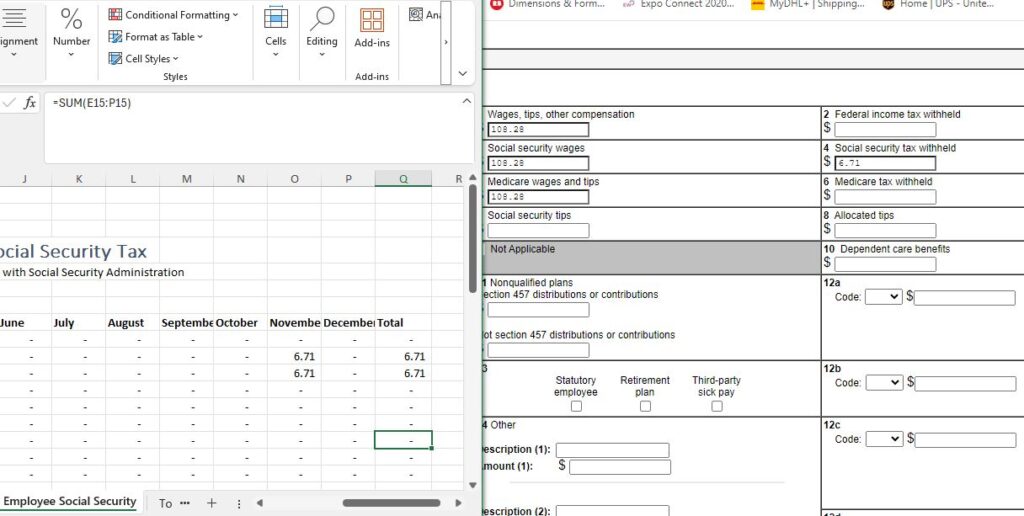

Box 2: If you withheld federal income tax, look in your payroll workbook and enter it here for the employee.

When completing social security tax withheld and Medicare tax withheld, only put the employee share to these taxes you withheld from the employee’s wages during the year, or your business didn’t withhold but decided to pay on the employee’s behalf. DO NOT enter your business portion of social security tax and Medicare tax on the employee W2 Form.

Box 3: In most cases the social Security Wages will be the same as Box 1 Total wages paid to the employee. If your employee is paid compensations that are not subject to social security tax, don’t include that compensation in Box 3. Tips are not included in Box 3, but they go in Box 7.

Box 4: Social Security Tax: Copy that from your payroll worksheet. It is the total social security tax you withheld from that employee’s wages and compensation for the year you are filing for.

Box 5 Medicare Wages and Tips: enter the total wages and tips subject to Medicare tax. You can find it on your payroll spreadsheet. In most cases, it will match Box 1 Wages.

Box 6: Medicare Tax: From your payroll workbook locate Medicare tax you withheld from that employee’s wages for the whole year and report it in Box 6 on W2.

If your employee is a statutory employee, you check the statutory employee box. You can read more on who is a statutory employee in the 2023 IRS General Instructions for Forms W2 and W3 page 22.

If you enter an amount in a box that requires a code, you can find the list of code in the 2023 IRS General Instructions for Forms W2 and W3 after page 30.

Leave the Lines (Boxes) that do not apply to your business blank and go to the state section at the bottom of the form W2.

Box 15: State: Enter your state abbreviation letters.

Employer’s ID number: enter your state employment ID # your state assigned your business. For some states, it is the Withholding permit number or withholding account number. When you file your state W2, it will have your state employment ID number. Copy it and have it in your record.

Box 16: State wages: Enter the total wages paid to the employee that is taxable by the state.

Box 17: State income tax: Enter any state income tax you withheld for the employee wages during the year.

Box 18: Local wages: Enter the total wages paid to the employee that is taxable by the state and the locality. Usually, it will match Box 16 state wages.

Box 19: Local income tax: If you withheld state income tax for the city or county related to that employee, you will enter it otherwise, leave it blank.

Box 20: Locality: Enter the city name.

Review your W2 entry.

When you agree with your entry, click “Save and Go to Next W2.

Automatically, it will open a new W2 prefilled for the next employee on the list that you checked the name.

You could also click on “Save and Go to W-2 List” instead. You will go back to the list of last year employees’ names where you would click on the next employee that you want to file W-2 for.

If that is your first time and you don’t have the employees’ names in the list from last year submission or it is for a new employee, click on “Save and Create a New W-2”.

Repeat the process above and complete the W2 form for the next employee.

If your payroll spreadsheet lacks some entries that could have made it easy for you to complete W2 form for each employee, take note to update your payroll workbook soon after you are done with the submission and your memory is still fresh on the update you want to do to your workbook. Otherwise, write your note down clearly in a way you can come back to it later and make the update to make the next year submission easier for you.

When you are done Filling out W2 forms for all your employees, click on “Save and Go to W-2 List”.

What if you took too long to gather data on an employee and you are logged out in the middle on completing the W2?

That W2 entry will not be saved.

Log back in.

Click on Edit next to the business name under unsubmitted reports.

It will take you back to the employees’ names on the W-2 List.

Click on the employee and resume or start over to complete the W-2.

When you are done with all the employees, click “Save and Go to W-2 list.

When you are done completing W2s the status in front of each employee will be checked on the W2 List page.

The total wages for all the W2s should match your payroll on your payroll spreadsheet. It should also match Form 944 Line 1 Total wages or the total of all 4 quarters of Form 941 total wages compensation line.

Click on Continue to W-3 Preview.

How to file W3?

When you file W2s electronically with SSA, W3 will be generated for you. You will review it to make sure it is accurate.

W3 is the total of all W2s filed for the year.

Review your W3 and agree with your record and the entries on your W3.

W3 on “Line b” mentions the type of employment tax return you will file with IRS whether it is Form 944 or Form 941. IRS will reconcile that employment tax return with your W2s W3 filed with SSA.

Therefore, make sure your numbers are accurate.

If there is an adjustment to make, since you have not mailed your Form 944 yet, you will be able to make the adjustment on the appropriate forms.

What you are trying to reconcile is the total wage and compensation, federal income tax withheld, social security taxable wages. Medicare taxable wages. They should match what you have on the W3 for these same things. The W3 will also have total social security tax and Medicare tax withheld from all employees’ wages. They are NOT what you are reconciling as on your Form 944 or total 4 quarters Form 941s will have employee and employer portions of these taxes. It is the total wages, taxable wages, and federal income tax withheld you are reconciling.

It is good to first fill out Form 944 or last quarter form 941 if that is what is required of your business and have it on hand. Then you file W2/W3 with SSA.

Once you agree with both, you submit W2/W3 with SSA. Then you mail Form 944/941 to IRS.

When you agree with W3, check the agree box after you read it.

Check the SSN box to display the full number.

Click Continue.

If you want to save your entries to come back to it later, Click Save and Quit. It will ask if you are sure. You click Yes.

When you are ready to continue, log back in.

You click on Create/Resume Form W2/W3 Online.

You click on Continue to W3 Preview.

Make sure the agree box is checked and the SSN box is checked.

Click continue.

It will take to a page to save a draft version of W2/W3.

Click on Print and change the printer’s name to Save as PDF and save. The download button will allow you to save it as well, but it will be in a format you may not be able to open.

Review your W2/W3.

When you agree, you can give to employees to review their own as well.

W2s W3 forms in your download

W3 copy is for your business record.

W2 Copy 1 is for the employee to file state Form 1040 with.

W2 Copy 2 is for the employee to file state Form 1040 with.

W2 Copy c is for the employee to keep for personal record.

W2 Copy B is for the employee to file Form 1040 with IRS.

W2 Copy D is for your business to keep for its own record.

When you agree with your W2/W3, go back to the SSA/employer website.

Check I agree.

Click on “Submit the Wage Report” button.

Your W2/W3 is filed with SSA.

You will receive a confirmation.

Click ok and save your confirmation receipt.

Click on Go to Save Official PDF.

Save the PDF.

Print it out and give each employee his/her W2 copy. Each copy will have 4 boxes that includes W2 copy 1, copy 2, copy B, and Copy C.

Keep W3 and W2 copy D for each employee in your business record for the year you filed for.

On the website, go back to the main page and logout.

If you want to know more about how to e file W2/W3 with SSA, when you login with SSA, look for their handbook on the right-side bar.

You can also look for IRS General Instructions for Forms W2/W3 on the IRS website www.irs.gov. You can locate the link to the instructions at www.ninasoap.com under IRS Form and Instructions here as well.

How to calculate wage for W2 line 1 if your business paid the employee’s share of taxes?

If you didn’t withhold social security and Medicare tax from your employee’s wage and decided to pay them yourself, you need to include that amount in the wages reported on W2.

For instance, if you pay $250 to your employee and decided to pay his share of social security (6.2%) and Medicare tax (1.45%), on your payroll spreadsheet you need to calculate the wages and include the taxes in the gross wages.

To figure out the amount, do $250/ (1-0.062-0.0145) =$270.71. That is the wage to include in your total wages to report of W2 line 1,3, and 5, Form 944, and Form 940 (FUTA).

You would use $270.71 to calculate the employee social security tax and Medicare withheld and report them of Form 941 or Form 944 as if you withheld them from your employee’s salary. You would report the employer’s share of taxes as well on Form 941 or Form 944 but not on W2 Form.

For more information, read 2023 IRS Publication 15-A Employer’s Supplemental Tax Guide) Section 7 Special Rules for Paying Taxes page 22 paragraph “Employee’s Portion of Taxes Paid by Employer”.

What is the difference between a W2 and a W3?

A W-2 is the total wages you paid during the year to an employee and social security and Medicare taxes you withheld from the employee’s wages.

W-3 is the total by box category of all the W-2s you filed for all your employees for the year.

Free Payroll Spreadsheet

If you don’t have a payroll software, we have free payroll spreadsheets in our Free Download you could download and track your payroll to be able to file your payroll taxes at the end of the year accurately. You can access the free download at the end of the article or in the side bar and choose the one that best fits your business. Update the form to customize it to your needs or liking. Make sure the formula is not broken. Keep in mind that you are responsible of reporting accurate numbers on your tax forms. The spreadsheets just assist you and helps you save time.

Conclusion: How to File W2 and W3 Electronically with the Social Security Administration for 2023?

The video and article explain step by step how to e file your W2s and W3 with SSA for 2023.

Resources

Related article categories

Previous related articles:

Disclaimer:

“I am not an attorney to practice law. I am not allowed to draft legal documents, give advice on legal matters including immigration, or charge a fee for these activities.” Our contents are informative and based on our knowledge and experience. Use them at your own discretion.

Ads Disclaimer:

Ads are displayed in our contents. These ads do not influence the content we create and publish. We do not endorse them either.

Affiliate links Disclaimer:

Our Videos and articles contain affiliate links. When you click on them and make a purchase, we will receive a commission. We thank you very much for your support!

Our Vision

Nina’s Soap was created to help you live a healthy lifestyle within your budget while increasing your net worth.

Liberman Consulting L.L.C.’s contents are about different ways to save money, different ways to make money to reach your financial independence where you don’t worry about money or depend on your job to provide for your family.

Our Objectives

At Nina’s Soap (Liberman Consulting L.L.C.), you will find information about living a quality life within budget and increasing your net worth. Topics covered include personal finance, investment, business management, cooking from scratch, and growing some vegetables and fruit to save money and eat healthy.

“https://ninasoap.com/membership-join/ (We welcome you to join us. Email List)

care@ninasoap.com (contact info for any questions you may have)

https://ninasoap.com (blog), https://liberdownload.com (digital products), https://ninassoap.com (natural products), https://liberlabel.com (custom apparel), https://liberoutlet.com (resale store), https://www.youtube.com/c/LibermanConsultingLLC (YouTube Channel), https://www.pinterest.com/ninassoap/ (Pinterest), https://ninasoap.com/affiliate-products/ (Our resource page)”.